Liability car insurance is a type of insurance that covers expenses when you are at fault in a crash. It covers the costs of damage to another person's property and bodily injury expenses. Liability insurance is required by law in nearly every state, with the exception of Virginia and rural parts of Alaska.

Liability insurance is typically broken down into two categories: bodily injury liability coverage and property damage liability coverage. Bodily injury liability coverage helps pay for bodily injuries for which you are legally liable, while property damage liability coverage helps pay for damage done to another person's or company's property.

The cost of liability insurance varies depending on factors such as your driving history, the amount of coverage you select, and other factors that can vary by state and company. When choosing a liability insurance policy, it is important to consider your specific needs and choose a policy that provides adequate coverage.

| Characteristics | Values |

|---|---|

| What is liability car insurance? | A type of insurance that covers expenses when you are at fault in a crash. |

| What does it cover? | Property damage and/or injuries to another person caused by an accident in which you're at fault. |

| What are the two categories of liability insurance? | Bodily Injury liability coverage and Property Damage liability coverage |

| What does BI cover? | Defence and court costs if you are sued, and medical bills and lost wages for people in another vehicle if you are at fault for the crash. |

| What does PD cover? | Removal of a damaged tree, repairs to a building wall you crashed through, and defence and court costs if you are sued. |

| What doesn't liability insurance cover? | Repairs to your vehicle, or injuries that you personally sustained. |

| How much does liability insurance cost? | The cost depends on several factors, including your driving history, the amount of coverage you buy, gender, marital status, occupation and credit. |

What You'll Learn

Bodily injury liability coverage

The amount of bodily injury liability coverage you need will depend on your state's minimum requirements and your personal financial situation. Most states have minimum Bodily Injury Liability requirements, but it's important to note that these limits may not be sufficient. When shopping for insurance, it's essential to ensure you have adequate protection. You can use an online coverage calculator to help determine how much coverage you may need.

The cost of bodily injury liability insurance will depend on various factors, including your driving history, the amount of coverage you choose, and other factors that may vary by state and insurance company. In states where it is required, bodily injury liability coverage is typically included in the overall price of your policy. However, if you choose to increase your coverage limits for extra protection, this will likely result in a higher premium.

Auto Insurance: Pothole Damage Covered?

You may want to see also

Property damage liability coverage

The amount of property damage liability coverage you need depends on several factors. Firstly, it's important to note that each state sets its own minimum coverage requirements, so you should check the specific requirements for your state. However, the state minimums may not be sufficient to protect you adequately in the event of a crash. It's recommended to assess your personal situation and consider factors such as whether you own a home or other expensive items, whether you travel in high-traffic areas, and whether there are a lot of expensive vehicles in your area.

When determining how much coverage you need, a general rule of thumb is to ensure that your liability coverage is sufficient to cover your net worth. This includes the value of your assets, such as your home, cars, savings, and investments, minus your debts. By evaluating your net worth, you can make an informed decision about the level of property damage liability coverage that best suits your needs.

Additionally, it's worth considering the potential consequences if the cost of damages exceeds your coverage limits. In such cases, you may be held personally responsible for any amount above your liability limits, and the affected individuals could sue you for the remaining costs. Therefore, it's generally advisable to err on the side of having higher coverage limits to protect yourself financially.

To increase your liability coverage, you can either opt for higher limits or consider purchasing an umbrella insurance policy. Umbrella insurance provides additional liability coverage, typically starting at $1 million, and kicks in when your primary liability coverage is exhausted. This can be especially useful if you have a significant amount of assets or a higher risk of encountering situations that may result in costly repairs and medical bills.

Martial Status and Auto Insurance: Unraveling the Connection

You may want to see also

How liability insurance works

Liability insurance is a type of insurance coverage that protects you financially if you are found to be responsible for someone else's injuries or property damage. This type of insurance is required in most states and usually comes standard with vehicle and property insurance policies, including auto and homeowners insurance.

Liability insurance consists of two types of auto coverage: bodily injury liability protection and property damage liability protection. Bodily injury liability protection covers the medical expenses of the other party if you are at fault in an accident, as well as lost wages and legal fees if the injured party files a lawsuit. Property damage liability protection covers damages to property, including the other party's vehicle and other types of property, such as fences, structures, and phone poles.

When purchasing liability insurance, you will need to choose a coverage limit, which is the maximum amount your policy will pay for injuries or property damage you cause to others. It is recommended to choose a liability limit that matches or exceeds your total net worth to adequately protect your assets.

Liability insurance is typically shown as a series of three numbers, such as 25/50/25, representing the maximum amounts covered for bodily injury per person, bodily injury per accident, and property damage per accident, respectively.

In addition to liability insurance, you may also need to purchase additional types of insurance, such as collision coverage and comprehensive coverage, to protect your own vehicle and personal injuries.

Understanding the Auto Insurance Claim Process: A Step-by-Step Guide

You may want to see also

How much liability insurance costs

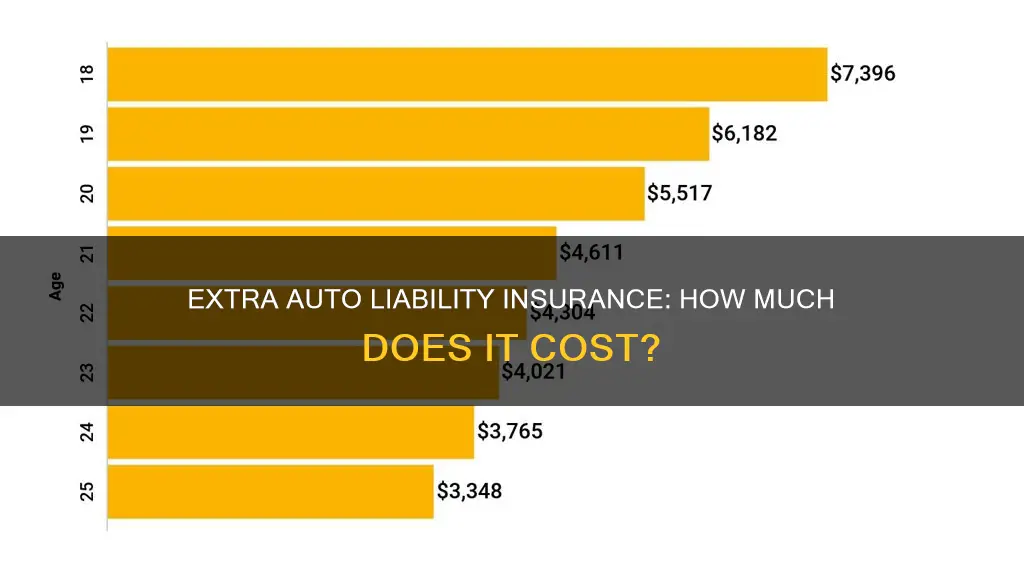

The cost of liability insurance varies depending on several factors, including the type of insurance, the level of risk associated with the policyholder's business or vehicle, and the state in which they live.

Liability Car Insurance Costs

Liability car insurance is required in most states and is typically the most expensive portion of a policy. The national average cost of minimum car insurance, which usually includes liability insurance and other state-mandated coverage, is $493 per year, according to NerdWallet's June 2024 rate analysis. This rate increases to $738 per year, on average, for drivers with an at-fault accident on their record. For those with a recent DUI or DWI, the average cost is $919 per year.

The cost of liability car insurance also depends on factors such as age, driving history, the make and model of the car, and, in some states, credit score. However, California, Hawaii, and Massachusetts do not allow insurers to use credit scores when determining car insurance rates.

Farm Bureau offers the cheapest liability car insurance for most drivers, with rates as low as $31 per month or $368 per year on average. USAA, Auto-Owners, and Country Financial are also among the most affordable providers.

General Liability Insurance Costs

General liability insurance (GLI) or commercial general liability insurance is essential for protecting small businesses from claims that may arise during normal business operations, such as bodily injury or property damage claims. The cost of GLI varies, but on average, small businesses pay about $805 annually or $67 per month. However, the total cost will depend on the unique risks faced by each business.

Factors that influence the cost of GLI include the industry and level of risk associated with the business, the location and population of the business, the business's claims history, and the policy limit amount and deductible chosen.

While GLI is essential for many small businesses, most states require small business owners to carry workers' compensation insurance if they have employees and commercial auto insurance if they have company-owned vehicles.

Travelers Auto Insurance: Rated and Reviewed

You may want to see also

When liability insurance is required

Liability insurance is required in most states in the US, except for Virginia and specific parts of Alaska. In Virginia, residents can choose to pay the state a $500 annual fee to waive the liability insurance requirement. In Alaska, only those living in rural areas are exempt from the requirement.

Even in states where liability insurance is not mandatory, it is still a good idea to have it. Liability insurance covers the costs of damages to others' property and injuries to others that you cause while driving. Without it, you will be personally liable for these costs, which can be substantial.

Each state that requires liability insurance sets its own minimum coverage requirements. However, these minimums are often not enough to cover all the costs of a serious accident. Therefore, it is recommended that you purchase enough liability insurance to cover your net worth. This can be calculated by adding up the value of your home, cars, savings, and investments, and then subtracting your debts.

You can increase your liability coverage in increments of $50,000 up to $500,000. If you need more coverage than that, you can purchase an umbrella policy, which provides additional liability coverage starting at $1 million.

When purchasing liability insurance, you will typically see the coverage limits displayed as a series of three numbers, such as 100/300/100. These numbers indicate the maximum amount of coverage for bodily injury per person, bodily injury per accident, and property damage per accident, respectively. For example, 100/300/100 means:

- $100,000 for bodily injury to one person per accident

- $300,000 for bodily injury to more than one person per accident

- $100,000 for property damage per accident

Unraveling the Auto Insurance Settlement Process: A Comprehensive Guide

You may want to see also

Frequently asked questions

Liability insurance covers the expenses of others when you are at fault for a car accident that causes bodily injury or property damage. It also covers legal-related costs if you are sued due to a car accident.

Liability insurance does not cover the cost of repairing or replacing your own vehicle, nor does it cover your own injuries. You will need separate coverages for these exposures, such as collision coverage, comprehensive coverage, and medical payments coverage.

The amount of liability insurance you need depends on your specific circumstances. It is recommended to have enough liability insurance to cover your net worth, which includes the value of your home, cars, savings, and investments minus your debts.

The cost of liability insurance varies depending on several factors, including your driving history, the amount of coverage you choose, your age, and your state. According to NerdWallet's rate analysis, the national average cost of minimum liability insurance for a good driver with good credit is $549 per year.