Collision and comprehensive insurance are optional add-ons to your auto insurance policy. Collision insurance covers damage to your car resulting from a collision with an object (e.g. a telephone pole, a guard rail, a mailbox), or as a result of flipping over. The average cost is about $290 per year. Comprehensive insurance covers damage to your car caused by disasters other than collisions, such as natural disasters, theft, and fallen objects. The average cost of comprehensive insurance is about $134 per year.

| Characteristics | Values |

|---|---|

| Average annual collision insurance cost | $814 |

| Average annual comprehensive insurance cost | $367 |

| Average collision claim | $4,822 |

| Average comprehensive claim | $1,284 |

| Average cost of collision insurance coverage | $596 |

| Average cost of comprehensive insurance coverage | $136 |

What You'll Learn

- Collision insurance covers damage to your car from collisions with objects or other cars

- Comprehensive insurance covers non-collision damage, such as weather damage, theft, and vandalism

- Collision insurance is more expensive than comprehensive insurance

- You may not need comprehensive and collision coverage if your car is old or has low value

- Collision and comprehensive coverage is often sold together as a package

Collision insurance covers damage to your car from collisions with objects or other cars

Collision insurance is particularly useful if you would have difficulty paying for repairs or a replacement car out of pocket. While it is not required by law, nearly four out of five drivers choose to purchase collision coverage. It is worth noting that collision insurance does not cover damage to another person's car or your own car-related weather damage. If you want coverage for problems like weather damage, theft, or animal collisions, you will need to purchase comprehensive insurance in addition to collision insurance.

Comprehensive insurance covers damage to your car from non-collision events, such as theft, fire, vandalism, and natural disasters. The average cost of comprehensive coverage is significantly lower than collision insurance, at around $134 per year. When deciding whether to purchase collision insurance, it is important to consider the age and value of your car. Collision coverage becomes less valuable over time, as it will never pay out more than the car's value. For older cars with low market value, collision insurance may not be worth the cost.

To reduce auto insurance expenditures, you may consider taking a higher deductible. The deductible is the amount you must pay out of pocket before the insurance coverage kicks in. By choosing a higher deductible, you can usually get a lower premium. However, it is important to ensure that you can cover the out-of-pocket costs if you need to file a claim.

In summary, collision insurance provides valuable coverage for damage to your car resulting from collisions with objects or other vehicles. It is optional but highly recommended, especially if you have a loan or lease, or if you cannot afford repairs or a replacement car on your own. Collision insurance provides peace of mind and financial protection in the event of a crash.

People's Trust Insurance: Exploring Their Auto Insurance Offerings

You may want to see also

Comprehensive insurance covers non-collision damage, such as weather damage, theft, and vandalism

Comprehensive insurance is an optional coverage that protects your vehicle from damage caused by non-collision events, including weather damage, theft, and vandalism. It is often referred to as "other than collision" coverage, as it covers losses that are outside of your control and are not caused by a collision with another vehicle or object.

Weather damage includes a range of natural disasters, such as earthquakes, floods, hurricanes, tornadoes, and volcanic eruptions. It also includes damage caused by falling objects, such as trees, branches, ice, or hail. Comprehensive insurance covers damage to your vehicle caused by these natural events.

Theft is another key component of comprehensive insurance. It covers the theft of the entire vehicle or just parts of it, such as airbags. If your car is stolen or broken into, comprehensive insurance will help cover the cost of repairs or replacement.

Vandalism is also covered by comprehensive insurance. For example, if your car is spray-painted or its windows are broken by vandals, comprehensive insurance will help pay for the repairs.

The average cost of comprehensive insurance is approximately $134 per year but can vary depending on factors such as the state where you live and the value of your vehicle. It is worth noting that comprehensive insurance does not cover damage to personal items inside your vehicle or any repairs caused by a collision.

Comprehensive insurance is a valuable option for those seeking protection against non-collision events. It provides peace of mind and financial protection in the event of weather damage, theft, or vandalism.

Gap Insurance: New Car Essential?

You may want to see also

Collision insurance is more expensive than comprehensive insurance

Collision insurance and comprehensive insurance are two types of car insurance that cover physical damage to your vehicle. However, they differ in the types of damage they cover. Collision insurance covers damage to your car resulting from a collision with an object or another car. On the other hand, comprehensive insurance covers non-collision incidents such as theft, fire, natural disasters, and vandalism. While neither type of insurance is legally required, your lender will likely require both if you have a loan or lease on your car.

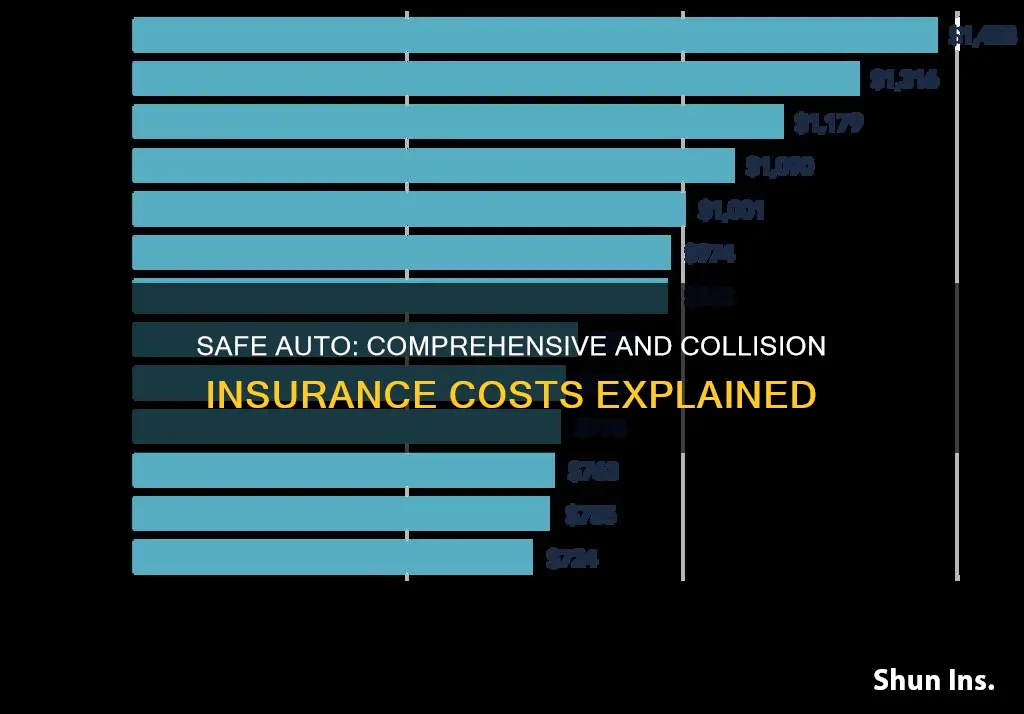

Although both types of insurance are important, collision insurance is generally more expensive than comprehensive insurance. According to the most recent rate analysis by Insurance.com, the average cost of collision insurance in the United States is $723 per year, while the average cost of comprehensive insurance is significantly lower at $263 per year. This difference in cost can be attributed to several factors, including the age, gender, location, driving record, credit score, and type of car of the driver.

One reason collision insurance is more expensive is that it covers damage caused by accidents, which are typically more costly to repair than non-collision incidents. Collision insurance also covers a wider range of accident scenarios, such as single-vehicle crashes and rollovers, regardless of who is at fault. Additionally, collision claims are usually the driver's fault, which leads to an increase in insurance rates.

Comprehensive insurance, on the other hand, covers a narrower range of incidents, such as weather damage, theft, and vandalism. These incidents are generally less costly to repair and are often beyond the driver's control, which is reflected in the lower insurance rates. Comprehensive insurance also covers incidents such as contact with animals and damage caused by fallen objects, which are typically less severe and less frequent than collisions.

In conclusion, while both collision and comprehensive insurance are important for protecting your vehicle, collision insurance is more expensive due to the higher costs associated with accident repairs and the likelihood of claims being the driver's fault. Comprehensive insurance offers a more affordable option by covering a narrower range of incidents that are typically beyond the driver's control and result in less costly repairs.

Auto Insurance Competition: Strategies for Staying Ahead in a Crowded Market

You may want to see also

You may not need comprehensive and collision coverage if your car is old or has low value

Collision and comprehensive insurance are optional, but they are generally required if you have a car loan or lease. They are valuable insurance types that protect you financially in the event of an accident. However, as your car gets older and loses value, you may want to reconsider whether these coverages are worth the cost.

Collision insurance covers repairs or replacement of your car if you collide with something or someone. It also covers damage caused by potholes. The average cost of collision coverage is $290 per year, but this can vary depending on factors such as the age and value of your car, repair and replacement costs, and your credit score.

Comprehensive insurance covers damage to your car caused by disasters other than collisions, such as natural disasters, theft, and fallen objects. It is significantly cheaper than collision coverage, with an average cost of $134 per year.

When deciding whether to keep collision and comprehensive coverage for an older car, consider the value of your car and the potential insurance payout. If the cost of insurance and the deductible exceeds the value of your car, it may not be worth keeping these coverages. For example, if your car is worth $5,000 and you have a $2,000 deductible, the maximum payout you could receive is $3,000, which may not justify the cost of insurance over time.

In general, when a car reaches 10 years of age, it is often more cost-effective to switch from full coverage to liability-only insurance. At this point, the cost of insurance may represent a significant proportion of the car's value, and the potential insurance payout may not be worth the cost of coverage.

Additionally, consider your financial situation. If you have the resources to replace your car or make repairs without insurance, you may decide that collision and comprehensive coverage are unnecessary.

Ultimately, the decision to keep or drop collision and comprehensive coverage depends on your individual circumstances, including the age and value of your car, your financial situation, and your comfort level with the potential risks.

Auto Insurance Incidentals: What's Covered and What's Not?

You may want to see also

Collision and comprehensive coverage is often sold together as a package

Collision and comprehensive coverage are often sold together as a package, despite being two separate forms of first-party insurance. This is because they are considered important supplements to liability insurance. While liability insurance is required in nearly all states, it does not cover damage to your own car when you are at fault for a crash. This is where collision and comprehensive coverage come in.

Collision coverage pays for your vehicle's damage if you hit an object or another car. This includes accidents where you are at fault, as well as single-vehicle crashes and rollovers. It also covers damage caused by potholes.

On the other hand, comprehensive insurance covers non-crash damage, such as weather and fire damage, as well as theft or vandalism. It also covers damage from collisions with animals and falling objects, such as trees or branches.

In the US, about 80% of drivers buy comprehensive coverage, while 76% buy collision coverage. This is because collision and comprehensive coverage are usually required by lenders if you have a loan or lease on your car. They are also crucial if you have a new or high-value vehicle.

While collision and comprehensive coverage are often sold together, they can also be purchased separately. The cost of each depends on the current market value of the covered vehicle and the deductible you choose. A higher deductible will result in lower insurance costs.

Auto Insurance and Mileage: The Tracking Technology Twist

You may want to see also

Frequently asked questions

Comprehensive insurance covers damage to your car caused by disasters other than collisions. This includes damage from natural disasters, theft of the car or parts of the car, and contact with animals.

The average cost of comprehensive insurance is around $134 per year.

Collision insurance covers damage to your car resulting from a collision with an object or as a result of flipping over. It reimburses you for the cost of repairing your car, minus the deductible.

The average cost of collision insurance is about $290 per year.

Comprehensive and collision insurance are not required by law, except when you are leasing or financing your vehicle. Whether you need them depends on factors such as where you live, the value of your car, and your financial situation.