Michigan has some of the most expensive car insurance rates in the US, with the average annual cost of full coverage car insurance in the state being $3,643, or $304 per month. The average annual cost of state minimum coverage is $856, or $71 per month. However, the cheapest car insurance in Michigan is offered by USAA, at $1,918 per year for full coverage and $383 per year for minimum liability. The cost of car insurance in Michigan is influenced by factors such as age, location, driving record, and credit score.

| Characteristics | Values |

|---|---|

| Average cost of full coverage auto insurance in Michigan | $2,887 per year |

| Average cost of minimum coverage auto insurance in Michigan | $872 per year |

| Average monthly rate of full coverage auto insurance in Michigan | $241 |

| Average monthly rate of minimum coverage auto insurance in Michigan | $73 |

| Average annual premium for state minimum coverage auto insurance in Michigan | $856 |

| Average monthly premium for state minimum coverage auto insurance in Michigan | $71 |

| Average annual premium for full coverage auto insurance in Michigan | $1,924 |

| Average monthly premium for full coverage auto insurance in Michigan | $160 |

| Cheapest full coverage auto insurance in Michigan | USAA ($1,918 per year) |

| Cheapest minimum coverage auto insurance in Michigan | Auto-Owners ($369 per year) |

What You'll Learn

- Full coverage insurance includes comprehensive and collision coverages, which raise premiums

- Michigan drivers pay an average of $1,924 per year for full coverage car insurance

- The cheapest car insurance in Michigan is from USAA at $1,918 per year for full-coverage protection

- The cheapest car insurance in Michigan for minimum coverage is Auto-Owners

- The average cost of full coverage auto insurance in Michigan is $3,643 per year or $304 per month

Full coverage insurance includes comprehensive and collision coverages, which raise premiums

Full coverage insurance is an umbrella term for comprehensive and collision insurance, which are two types of optional coverage that protect your vehicle from damage. While comprehensive insurance covers damage to your vehicle from unexpected non-collision incidents like theft, animal damage, falling trees, and weather damage, collision insurance covers damage to your vehicle that's the result of a collision with another vehicle or object.

In Michigan, the average monthly cost for a state minimum coverage car insurance policy is about $71, while a full coverage policy averages around $160 per month. The average annual cost for full coverage car insurance in Michigan is $1,924, with the cheapest option being GEICO, at $1,027 per year.

Full coverage insurance is more expensive because it includes both comprehensive and collision insurance, which are typically required for a car loan or lease. The cost of comprehensive and collision insurance varies based on factors such as the insurer, your location, the value of your vehicle, and your chosen deductible.

When selecting your comprehensive and collision deductibles, you should consider how much you'd be willing to pay out of pocket if your car was damaged. The higher you're able to set your deductibles, the lower your premium will be. However, it's generally easier to have the same deductible amount for both coverages so you always know roughly how much you'd pay for repairs.

It's important to note that coverage limits for comprehensive and collision insurance are determined by the value of your vehicle and the deductible amounts you select. In the event that your vehicle is totaled, the maximum payout you can expect will be equal to the actual cash value of your vehicle, minus your deductible.

Auto Insurance: Filling Prescriptions

You may want to see also

Michigan drivers pay an average of $1,924 per year for full coverage car insurance

Michigan's car insurance rates are among the highest in the country, with the average annual cost of full coverage car insurance in the state reaching $3,643, or $304 per month. This is about 81% more than the national average of $2,008 per year. The average annual cost of state minimum coverage in Michigan is $856, or $71 per month, which is also higher than the national average of $595 per year ($50 per month).

The high insurance rates in Michigan can be attributed to various factors, including the state's no-fault insurance laws, which mandate that drivers carry personal injury protection (PIP) coverage. Additionally, high collision rates and auto theft statistics also contribute to the elevated insurance premiums in the state.

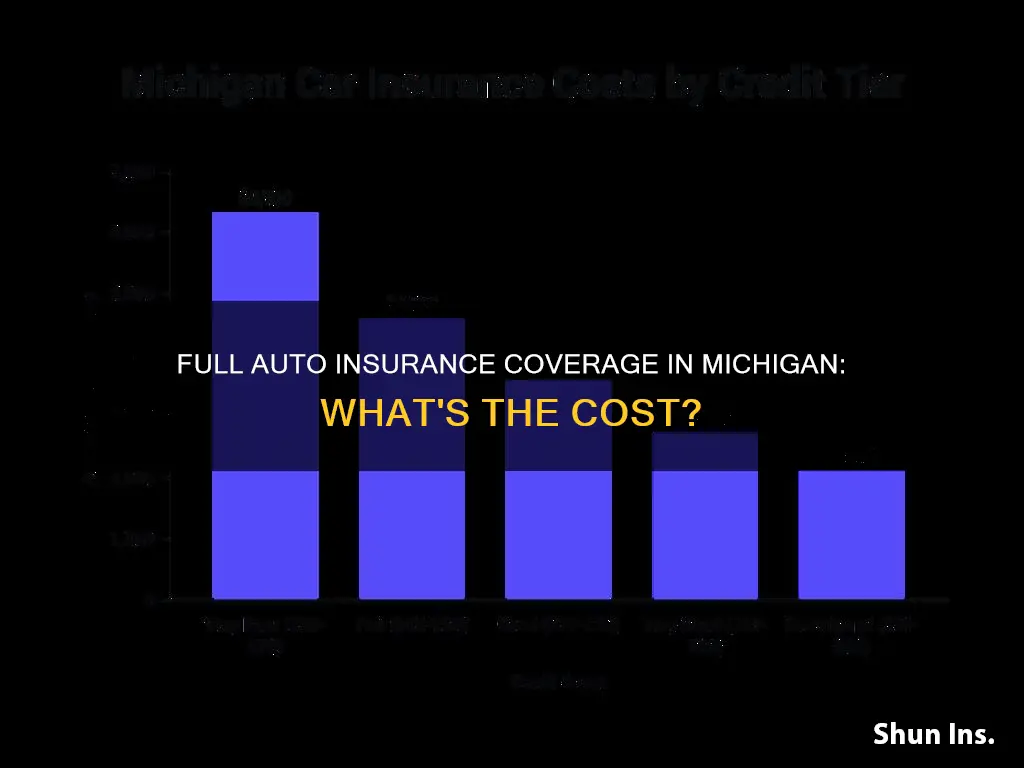

The cost of car insurance in Michigan is influenced by several factors, such as age, chosen coverage, location, driving record, and credit history. Younger drivers, especially those aged 22 to 29, tend to pay higher premiums, with rates decreasing as drivers age. Urban areas with higher traffic congestion and theft rates also lead to pricier car insurance.

When it comes to specific insurance providers, GEICO offers the cheapest full coverage at $1,027 per year, while Hanover provides the most expensive average annual premium at $4,586. USAA, which caters to military members and their families, offers the cheapest minimum-liability car insurance coverage in the state, with an annual premium of $383.

To find affordable car insurance in Michigan, it is recommended to compare rates from different companies, maintain a good driving record, and look for available discounts, such as those for safe driving or having a car alarm.

AAA Auto Insurance Grace Period: What You Need to Know

You may want to see also

The cheapest car insurance in Michigan is from USAA at $1,918 per year for full-coverage protection

The Cheapest Car Insurance in Michigan

The cheapest car insurance in Michigan is from USAA, which offers full-coverage protection for $1,918 per year, or $160 per month. This is significantly lower than the state average of $2,691 per year for full-coverage car insurance. USAA also offers the cheapest minimum-liability car insurance coverage in Michigan, at $383 per year, or $32 per month.

USAA is only available to current and former military members and their families. For those who aren't eligible for USAA coverage, Progressive offers the next cheapest full-coverage insurance in Michigan, at $2,209 per year, or $184 per month.

Factors Affecting Car Insurance Rates in Michigan

Several factors influence car insurance rates in Michigan, including:

- Location: Urban areas with higher traffic congestion and theft rates typically lead to pricier car insurance due to the increased risk of accidents and claims.

- Age and Gender: Younger drivers often face higher rates due to inexperience, while gender can impact premiums based on historical accident data.

- Driving Record: A clean driving record can lead to lower car insurance rates, while accidents, tickets, and violations suggest higher risk and result in increased costs.

- Credit Score: In Michigan, credit scores are used to determine car insurance rates, with higher scores generally leading to more favorable premiums.

- Vehicle Type: Cars that are more expensive to repair or frequent targets for theft may have higher insurance costs.

- Coverage Level: Opting for higher coverage limits or additional policies, such as collision insurance and comprehensive insurance, will impact your rate.

- Insurance History: Gaps in insurance coverage or a history of claims can increase insurance premiums.

- Annual Mileage: The more you drive, the higher the chance of an incident, which can potentially increase your insurance rates.

- Marital Status: Married individuals may receive lower rates as they are statistically less likely to file claims than single drivers.

Tips for Saving Money on Car Insurance in Michigan

- Shop Around: Compare rates from multiple insurers to find the best deal.

- Maintain a Good Driving Record: A clean driving record can significantly lower your insurance rates.

- Bundle Insurance Policies: Combining car insurance with other policies like homeowners insurance can unlock discounts.

- Increase Your Deductibles: Opting for higher deductibles can lower your premiums, but ensure you can afford the deductible if you need to make a claim.

- Ask About Discounts: Insurers offer various discounts, such as for safe driving, good students, or anti-theft devices. Always ask what discounts are available to you.

- Choose Your Vehicle Wisely: Driving a car that is cheap to insure, such as models with good safety ratings, can lead to lower insurance premiums.

- Consider Usage-Based Insurance: If you're a low-mileage driver, usage-based insurance programs can offer lower rates by tracking your driving habits.

Hard Inquiry: What Auto Insurance Companies Really See

You may want to see also

The cheapest car insurance in Michigan for minimum coverage is Auto-Owners

Auto insurance rates in Michigan are among the highest in the country, with the average annual premium for state minimum coverage at $856, or $71 per month. However, Auto-Owners Insurance Co. offers the cheapest minimum coverage in the state at $149 per year, or $12 per month. This rate is significantly lower than the state average and provides essential financial protection for Michigan drivers.

Factors Affecting Car Insurance Rates in Michigan

Several factors influence car insurance rates in Michigan, including age, gender, driving record, credit score, vehicle type, coverage level, insurance history, and marital status. Age is a significant factor, with younger drivers often facing higher rates due to their lack of experience. Additionally, Michigan's no-fault insurance laws, which require drivers to carry personal injury protection (PIP) coverage, contribute to the state's high insurance premiums.

Benefits of Minimum Coverage Car Insurance

While minimum coverage car insurance in Michigan may not offer the most comprehensive protection, it can provide basic financial protection in the event of an accident. It includes bodily injury liability coverage of $50,000 per person and $100,000 per accident, as well as property damage liability coverage of $10,000 per accident. This ensures that drivers can cover the costs of damages or injuries they may cause to others in an accident, as required by Michigan law.

Drawbacks of Minimum Coverage Car Insurance

However, minimum coverage car insurance in Michigan has its limitations. It does not include collision or comprehensive coverage, which means that damage to your own vehicle may not be covered. If you finance or lease your vehicle, lenders may require you to purchase additional coverage, such as collision or comprehensive insurance, to protect their investment. Additionally, minimum coverage may not be sufficient if you are involved in a severe accident or cause extensive property damage. In such cases, you may be held financially liable for amounts exceeding your coverage limits.

Alternative Insurance Options in Michigan

While Auto-Owners Insurance Co. offers the cheapest minimum coverage, other insurance providers in Michigan, such as Westfield and Travelers, also offer competitive rates. It is essential to compare quotes from multiple insurers and consider your specific needs, such as additional coverage options and discounts, to find the best car insurance policy for your situation.

United Auto Workers Health Insurance: A Comprehensive Review

You may want to see also

The average cost of full coverage auto insurance in Michigan is $3,643 per year or $304 per month

The average cost of full-coverage auto insurance in Michigan is $3,643 per year or $304 per month. This is about 81% more than the national average of $2,008 per year. Michigan has some of the most expensive car insurance rates in the nation. The state's average annual premium for state minimum coverage is $856 ($71 per month), which is higher than the national average cost of car insurance for minimum coverage at $595 per year ($50 per month).

The high insurance rates in Michigan can be attributed to various factors, including the state's no-fault insurance laws, which mandate drivers to carry personal injury protection (PIP) coverage. Additionally, high collision rates and auto theft statistics also contribute to the elevated insurance premiums in the state.

The cost of car insurance in Michigan can vary depending on factors such as age, chosen coverage, location, driving record, and credit history. The more severe the driving violation, the higher the premiums tend to be.

It is worth noting that Michigan has banned the use of certain factors, such as ZIP code, gender, and credit score, in determining car insurance rates. This was implemented to protect consumers from potentially discriminatory rating practices.

Health Insurance and Auto Injuries: Understanding South Carolina's Unique Coverage

You may want to see also

Frequently asked questions

The average cost of full coverage auto insurance in Michigan is around $2,887 per year, or around $241 per month.

The cheapest car insurance in Michigan is from USAA, at $1,918 per year for full coverage and $383 per year for minimum liability.

The average cost of car insurance in Michigan is $2,887 per year for full coverage and $872 per year for minimum coverage.

The best car insurance company in Michigan depends on your personal situation. Progressive is generally the cheapest option, while USAA is the best choice for military members, veterans and their families.

Auto-Owners Insurance offers the cheapest rates for young drivers in Michigan, with an average rate of $4,614 per year for 16-year-olds.