Michigan's auto insurance law requires drivers to have no-fault insurance, which covers injuries and damages without the need to determine fault in an accident. The mandatory unlimited Personal Injury Protection (PIP) medical benefits proved too expensive for many Michigan families, so a new law was passed in 2019 to provide insurance coverage options and lower rates while maintaining the highest benefits in the country. This means drivers can now choose from six PIP medical coverage levels based on their needs and budget. The monthly premium for state minimum coverage in Michigan is around $77, while the average cost of car insurance in the state is $872 for minimum coverage and $2,887 for full coverage.

| Characteristics | Values |

|---|---|

| Average cost of minimum coverage car insurance in Michigan | $872 per year |

| Average cost of full coverage car insurance in Michigan | $2,887 per year |

| Average monthly premium for minimum coverage car insurance in Michigan | $73 |

| Average monthly premium for full coverage car insurance in Michigan | $241 |

| Average monthly premium for state minimum coverage in Michigan | $77 |

| Minimum coverage requirements | Bodily injury liability of $50,000 per person and $100,000 per accident, property damage liability of $10,000 per accident, and unlimited personal injury protection (PIP) |

What You'll Learn

Michigan's auto insurance law changes

On May 30, 2019, Michigan's governor signed a new bipartisan no-fault auto insurance reform law to provide insurance coverage options, lower rates for Michigan drivers, maintain the highest benefits in the country, and strengthen consumer protections. The new law applies to auto insurance policies issued or renewed after July 1, 2020.

Michigan previously had the highest auto insurance benefits and the highest costs. Mandatory unlimited Personal Injury Protection (PIP) medical benefits proved too expensive for many Michigan families, with some drivers who could not afford the costly unlimited coverage choosing to drive uninsured.

The new law implemented the following cost reduction measures:

- Personal Injury Protection (PIP) Choice: Drivers can now choose a coverage level that is appropriate based on their needs and budget.

- Rate Reduction: Each insurance company is required to reduce PIP statewide average medical premiums. The premium will depend on individual circumstances and the coverage selected.

- Fee Schedule: A required cost control measure between auto insurance companies and healthcare providers to make PIP medical coverage more affordable.

The new law established the following consumer protections:

- Elimination of Some Non-Driving Factors: The new law prohibits auto insurance companies from using sex, marital status, home ownership, credit score, educational level, occupation, and zip codes when setting auto insurance rates.

- Fraud Investigation Unit: The newly established unit investigates criminal and fraudulent activity related to the insurance and financial markets.

- Michigan Catastrophic Claims Association (MCCA) Transparency: The MCCA is now required to provide an annual report to the Legislature, post an annual consumer statement on their website, and is subject to an audit by the Michigan Department of Insurance and Financial Services (DIFS) every three years.

- Prior Approval: Auto insurance rates and policies must now be filed with and approved by DIFS before being offered to consumers.

- Fines and Penalties: The new law allows for increased fines for insurance companies, agencies, and licensed agents for certain violations of the law.

MOT and Insurance: Are You Legal to Drive?

You may want to see also

Mandatory insurance coverage

Michigan operates under a no-fault system, which means that motorists are required to carry no-fault insurance to cover injuries and damages without needing to determine fault in an accident. To drive legally in Michigan, state law requires the purchase of no-fault automobile insurance. Driving without insurance is punishable by a fine of up to $500 and up to one year in jail. The court may also order a license suspension for 30 days or until the driver can provide proof of valid insurance.

Michigan's new auto insurance law, which came into effect for policies issued or renewed after July 1, 2020, provides insurance coverage options and lowers rates for Michigan drivers while maintaining the highest benefits in the country and strengthening consumer protections. The new law allows drivers to choose their PIP medical limit on their auto policy. Personal Injury Protection (PIP) medical coverage pays for allowable expenses for medical care, recovery, and rehabilitation if injuries are sustained in an auto accident. The PIP medical coverage options are:

- $500,000 per person per accident

- $250,000 per person per accident

- $250,000 per person per accident with exclusions—to select this option, one or both of the following must be met: the named insured who is excluding PIP medical has qualified health coverage that is not Medicare, and/or any resident relative or spouse who is excluding PIP medical has qualified health coverage

- $50,000 per person per accident—to select this option, both of the following must be met: the applicant or named insured is enrolled in Medicaid, and any spouse and all resident relatives have qualified health coverage, are enrolled in Medicaid, or are covered under another auto policy with PIP medical coverage

- No PIP medical coverage—to select this option, both of the following must be met: the applicant or named insured has coverage under both Medicare Parts A and B, and any spouse and all resident relatives have qualified health coverage or are covered under another auto policy with PIP medical coverage

If a PIP medical option is not chosen by the insured, the unlimited PIP medical option is selected by default.

In addition to the PIP medical coverage, there are two other mandatory basic coverages in a Michigan auto insurance policy: Property Protection Insurance (PPI) and Residual Bodily Injury and Property Damage Liability (BI/PD).

PPI pays up to $1 million for damage your car does in Michigan to other people's property, such as buildings and fences. It will also pay for damage your car does to another person's properly parked vehicle. It does not pay for any other damage to cars.

BI/PD coverage limits are as follows:

- Up to $250,000 for a person who is hurt or killed in an accident

- Up to $500,000 for each accident if several people are hurt or killed

- Up to $10,000 for property damage in another state

You have the option of purchasing other BI/PD coverage limits under the new law. The lowest coverage limits you may purchase are:

- $50,000 for a person who is hurt or killed in an accident

- $100,000 for each accident if several people are hurt or killed

- $10,000 for property damage in another state

It is important to carefully consider the coverage limits you choose, as this choice will have financial consequences. If you are responsible for injuries to another person, you may be liable for damages beyond your coverage limit.

CSL Auto Insurance: Understanding Combined Single Limit

You may want to see also

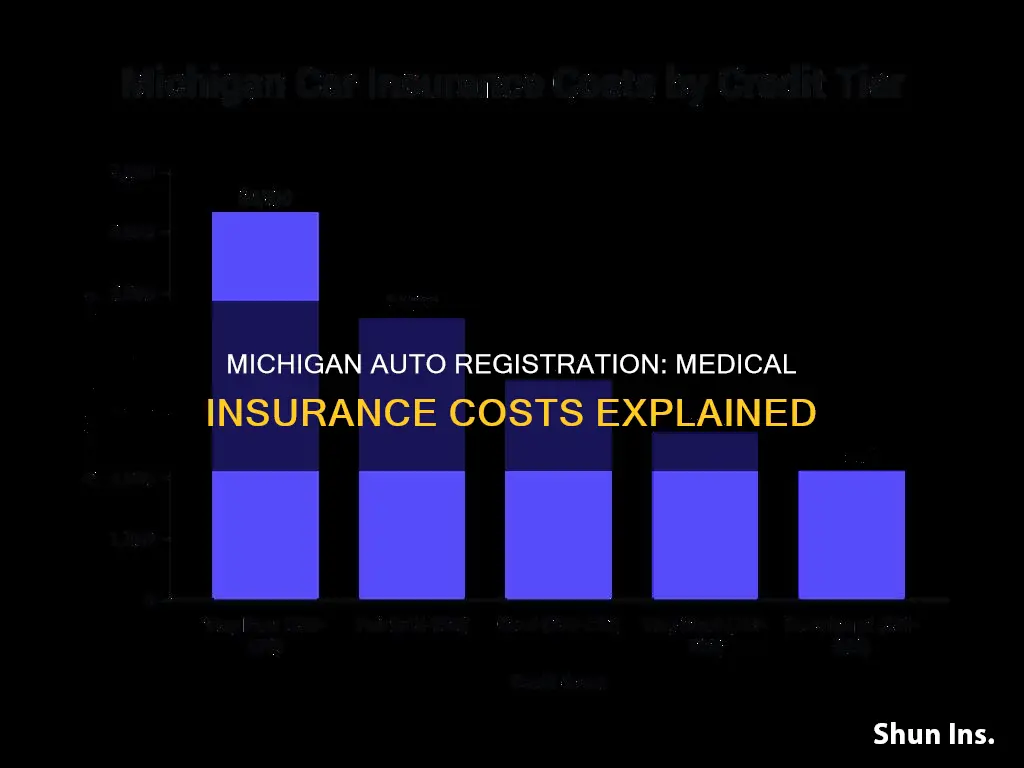

Average insurance costs

The cost of car insurance in Michigan depends on several factors, including the type of coverage, age, driving record, and vehicle type. Let's take a closer look at the average insurance costs in Michigan.

Minimum Coverage

The state of Michigan requires drivers to have minimum liability insurance and unlimited personal injury protection (PIP). The minimum liability limits are $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $10,000 for property damage per accident. The average annual cost for minimum coverage in Michigan is around $919, which breaks down to approximately $77 per month. However, the cost can vary depending on age, with drivers between 22 and 29 often facing higher premiums due to being considered higher-risk.

Full Coverage

Full coverage car insurance in Michigan includes additional protections beyond the state's minimum requirements. The average annual cost for full coverage is significantly higher at $2,887, or about $241 per month. This cost is influenced by various factors and can vary depending on the driver's specific circumstances.

PIP Medical Coverage Options

Under Michigan's auto insurance law, drivers have several options for PIP medical coverage levels:

- Up to $500,000 in coverage

- Up to $250,000 in coverage

- Up to $250,000 in coverage with PIP medical exclusions

- Up to $50,000 in coverage (available if the named insured has Medicaid and household members have other insurance coverage)

- PIP medical opt-out (available if the named insured has Medicare Parts A and B, and household members have other insurance coverage)

If a driver does not select a PIP medical option, the unlimited PIP medical option is selected by default. Each auto insurance company in Michigan is required to reduce statewide average PIP medical premiums for eight years. The specific premium a driver pays will depend on their individual circumstances and the coverage they choose.

Impact of Driving Record

A driver's record can significantly impact their insurance costs. For example, drivers with an at-fault accident on their record may pay about 51% more than the state average for full coverage insurance.

Vehicle Type

The type of vehicle being insured also influences insurance costs in Michigan. For instance, a driver of a BMW 330i may pay 43% more for insurance annually than someone driving a Ford F-150.

Understanding Liberty Mutual's Auto Insurance Billing: A Comprehensive Guide

You may want to see also

Choosing Personal Injury Protection (PIP) and Bodily Injury (BI) coverage limits

Choosing the right Personal Injury Protection (PIP) and Bodily Injury (BI) coverage limits is essential to ensure you have adequate financial protection in the event of a car accident. Here are some things to consider when selecting your PIP and BI coverage limits in Michigan:

Understanding PIP and BI Coverage:

Personal Injury Protection (PIP) coverage is a mandatory component of auto insurance in Michigan. It covers your medical expenses and lost wages after a car accident, regardless of who is at fault. PIP is designed to provide you with the necessary financial support to help you recover from your injuries and rebuild your life. On the other hand, Bodily Injury (BI) coverage is meant to protect you financially if you are found legally responsible for causing injuries to another person in an automobile accident. It covers the costs of their medical care, treatment, and other related expenses.

Assessing Your Financial Situation:

When selecting your PIP and BI coverage limits, carefully consider your financial situation. Evaluate your income, savings, and ability to cover potential out-of-pocket expenses in the event of an accident. If you have sufficient financial resources, you may opt for lower coverage limits. However, if you want more comprehensive protection, consider choosing higher coverage limits or even unlimited PIP coverage.

Analyzing Your Health Insurance Coverage:

If you have comprehensive health insurance that covers car accident injuries, you may be able to lower your PIP coverage limits. Review your health insurance policy to understand what it includes and exclude, as well as any deductibles or limitations. This information will help you make an informed decision about your PIP coverage limits.

Understanding the Risks and Potential Costs:

Consider the potential costs associated with car accidents, including medical bills, lost wages, and replacement services. Evaluate the likelihood of being involved in an accident and the potential financial impact. If you have a higher risk profile or want more peace of mind, consider selecting higher coverage limits.

Exploring the Available Coverage Options:

In Michigan, you have several PIP coverage options to choose from. These options include $50,000, $250,000, and $500,000 coverage limits, as well as an unlimited option. Additionally, if you meet certain requirements, you may be able to opt out of PIP coverage altogether. For BI coverage, you can choose from different coverage limits, with the lowest option being $50,000 for a person who is hurt or killed in an accident and $100,000 for each accident if multiple people are injured or killed.

Seeking Professional Guidance:

If you are unsure about the right coverage limits, consider consulting with a licensed insurance agent, a financial advisor, or a lawyer specializing in personal injury protection. They can help you assess your individual needs, explain the implications of different coverage limits, and guide you in making an informed decision.

Remember, selecting the appropriate PIP and BI coverage limits is crucial to ensure you have the financial protection you need in the event of an unforeseen automobile accident. Carefully weigh your options, consider your personal circumstances, and don't hesitate to seek professional advice to make the right choice for your situation.

Alamo Auto Rental Insurance: What UK Drivers Need to Know

You may want to see also

Penalties for driving without insurance

Michigan has some of the harshest penalties for driving without insurance in the United States. Driving without insurance in Michigan is considered a misdemeanor, and if convicted, you may have to pay a fine of up to $500, face up to one year in jail, and surrender your driver's license for 30 days or until you can provide proof of insurance, whichever is later. You will also have to pay a service fee of at least $125 to reinstate your license.

If your license is suspended, you may need to have your insurer submit proof of financial responsibility to the Secretary of State, showing that you have the required minimum insurance coverage. This is known as an SR-22 form, and it proves that you have the minimum required auto insurance.

If you are caught driving without insurance in Michigan, your vehicle may be impounded, and you will have to pay fees to get it back. The state may also suspend your vehicle's registration, and you will be unable to renew your plates until you can provide proof of insurance and pay a $50 fee.

If you are caught driving without insurance multiple times, the penalties will be more severe. For example, you may be required to perform community service in addition to the other penalties.

In addition to the legal penalties, driving without insurance in Michigan can leave you financially vulnerable in the event of an accident. If you cause an accident while uninsured, you will be responsible for all the medical costs and car repair bills for yourself and the other driver. You will also lose out on compensation for pain and suffering, vehicle damage, and lost wages if the accident was not your fault. As an uninsured driver, you might even have to pay for the other driver's lost income, medical costs, pain and suffering, and vehicle damage.

Canceling Progressive Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

In Michigan, the minimum car insurance coverage includes $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $10,000 for property damage per accident. Michigan also requires Personal Injury Protection (PIP) with unlimited coverage.

The average car insurance cost in Michigan is $872 for state-mandated minimum coverage, while full coverage car insurance rates average $2,887 a year.

The monthly premium for state minimum coverage in Michigan is around $77.

Driving uninsured in Michigan results in significant penalties, including fines of up to $500, driver’s license suspension, and possible vehicle impoundment. Repeat offenses can lead to even harsher consequences, like community service.

Personal Injury Protection (PIP) Choice allows you to choose a coverage level that is appropriate based on your needs and budget.