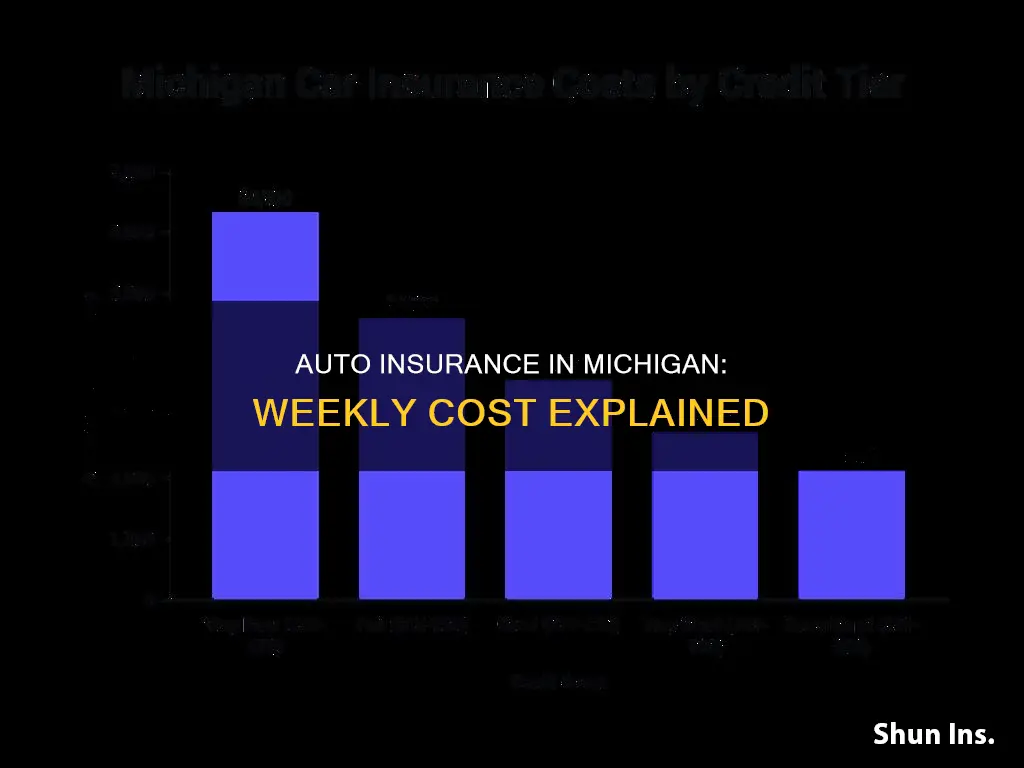

Michigan drivers pay an average of $1,360 per year or $113 per month for minimum coverage and $3,643 a year or $304 a month for full-coverage car insurance. These rates are as much as 81% to 117% higher than the national average.

The average cost of car insurance in Michigan varies depending on factors such as age, driving record, and vehicle type. For example, the average cost of full-coverage car insurance for a 16-year-old driver in Michigan is $12,921 per year, while the average cost for a 30-year-old driver is $2,176 per year.

Additionally, drivers with a clean driving record will typically pay lower insurance rates than those with a history of accidents, speeding tickets, or DUIs.

It is important to note that Michigan is a no-fault state, which requires drivers to carry personal injury protection (PIP) coverage. This may contribute to the higher insurance rates in the state.

| Characteristics | Values |

|---|---|

| Average monthly cost of minimum coverage | $71-$73 |

| Average monthly cost of full coverage | $160-$304 |

| Average annual cost of minimum coverage | $856-$872 |

| Average annual cost of full coverage | $1,924-$3,643 |

| Average annual cost of full coverage for 16-year-old drivers | $7,581 |

| Average annual cost of full coverage for 19-year-old drivers | $3,762 |

| Average annual cost of full coverage for 22-year-old drivers | $2,203 |

| Average annual cost of full coverage for 30-39-year-old drivers | $1,924 |

| Average annual cost of full coverage for 60+-year-old drivers | $1,763 |

| Average annual cost of full coverage with one speeding ticket | $2,508 |

| Average annual cost of full coverage with one accident | $2,919 |

| Average annual cost of full coverage with one DUI | $4,061 |

What You'll Learn

Average monthly cost

The average monthly cost of car insurance in Michigan varies depending on the level of coverage, age, driving record, and other factors. Here is an overview of the average monthly costs for different coverage levels and driver profiles:

Minimum Coverage:

For state minimum liability-only coverage, the average monthly cost is around $71 to $73. This option provides basic protection and is the most affordable.

Full Coverage:

For full coverage car insurance, the average monthly cost in Michigan ranges from around $154 to $162, depending on the chosen deductible and coverage limits. Full coverage includes comprehensive and collision insurance, providing more extensive protection.

Age-Based Costs:

Age is a significant factor, with younger drivers paying higher rates. For example, 16-year-old drivers may pay an average of around $500 to $600 per month for full coverage, while drivers aged 30-60 can expect rates around $160 to $190 per month. Seniors aged 60 and above benefit from the lowest rates, averaging around $147 to $170 per month.

Driving Record Impact:

The driving record also significantly affects costs. For example, a speeding ticket can increase rates by up to 39%, while an at-fault accident can result in a 44% increase in premiums. A DUI conviction will lead to the most significant increase, with rates more than doubling in some cases.

Other Factors:

Other factors that can influence the average monthly cost in Michigan include the chosen insurance provider, the vehicle make and model, credit score, and location. Comparing quotes from multiple insurers and customizing coverage options can help drivers find the most affordable rates.

Dashcam Discounts: Auto Insurance Savings

You may want to see also

Michigan minimum coverage average

Michigan has some of the highest auto insurance costs in the country. The average annual cost for state minimum car insurance in Michigan is $919, which equates to around $77 per month. However, other sources state that the average cost of car insurance in Michigan for 2024 is $872 for minimum coverage. This equates to a monthly rate of $73 for minimum coverage.

Michigan operates under a no-fault system, which means that your insurer pays for your injuries or property damage after an accident, regardless of who is at fault, up to your coverage limit. Michigan drivers are required to carry no-fault insurance to cover injuries and damages without the need to determine fault in an accident.

The minimum liability limits in Michigan are 50/100/10. This means that the minimum coverage includes $50,000 for bodily injury per person, $100,000 for bodily injury per accident, and $10,000 for property damage per accident. Michigan also requires Personal Injury Protection (PIP) with unlimited coverage.

The cost of car insurance in Michigan can vary depending on factors such as age, vehicle type, and driving record. For example, drivers aged between 22 and 29 typically face higher premiums due to insurers viewing them as higher-risk. Additionally, vehicle type can play a significant role in insurance rates, with the make and model of a car influencing the cost of coverage.

American Integrity Auto Insurance: What You Need to Know

You may want to see also

National minimum coverage average

The national minimum coverage average for car insurance in the US is $595 per year or $50 per month. In Michigan, the average monthly cost for a state minimum coverage policy is about $71, or $856 per year. This is higher than the national average, with Michigan drivers paying 40% more for minimum coverage.

The average cost of car insurance varies across the US, with Michigan being one of the most expensive states. The national average for full coverage is $1,296 per year or $108 per month, while Michigan residents pay $1,924 per year or $160 per month, which is 48% more than the national average.

The high insurance rates in Michigan can be attributed to several factors, including the state's no-fault insurance laws, which mandate personal injury protection (PIP) coverage. Additionally, factors such as high collision rates and auto theft statistics contribute to the elevated insurance premiums in the state.

When compared to other states, Michigan's insurance rates are significantly higher. For example, the average cost of minimum coverage in California is $201 per month, while Mississippi residents pay an average of $167 per month.

The Mechanics of General Auto Insurance: Understanding the Basics

You may want to see also

Michigan full coverage average

The average cost of full-coverage car insurance in Michigan is around $160 per month or $1,924 per year. This is significantly more expensive than the national average, which is $108 per month or $1,296 per year.

The cost of car insurance in Michigan varies depending on factors such as age, chosen coverage, location, driving record, and credit history. For example, drivers aged 22-29 tend to pay the most for car insurance, while rates decrease for older drivers, with those over 60 benefiting from the lowest premiums.

The level of coverage also affects the cost, with minimum coverage in Michigan costing around $71 per month, while full coverage with a $1,000 deductible is about $160 per month.

Additionally, the city in which one lives can impact car insurance rates. For instance, Hamtramck is the most expensive city in Michigan for car insurance, with an average annual rate of $3,114, while Grand Haven is the cheapest, with an average rate of $1,868 per year.

It's important to compare rates from different insurance providers and consider factors such as discounts, driving record, and coverage options to find the best value for car insurance in Michigan.

Rebuilt Rides: Does NJ Auto Insurance Cover Rebuilt Title Cars?

You may want to see also

National full coverage average

The national average cost for full-coverage car insurance is $2,150 per year, according to Forbes Advisor's analysis. This rate is for full-coverage car insurance, which includes optional coverage for theft and damage to your own vehicle.

The national average cost for car insurance is $1,718 for full coverage and $488 for state minimum coverage, according to NerdWallet's June 2024 rate analysis.

MarketWatch, on the other hand, puts the national average cost of full-coverage car insurance at $2,681 per year or $223 per month.

According to Bankrate, the average car insurance cost in Michigan is $872 for state-mandated minimum coverage, while full coverage car insurance rates average $2,887 a year.

CarInsurance.com puts the average car insurance cost in Michigan at $2,266 per year or $189 per month.

Auto Insurance Costs in the Philippines: What to Expect

You may want to see also

Frequently asked questions

The average cost of car insurance in Michigan is between $872 and $3,643 for minimum coverage and full coverage.

The minimum car insurance requirements in Michigan include $50,000 for bodily injury per person, $100,000 for bodily injury per accident, $10,000 for property damage and unlimited personal injury protection (PIP) per person.

Michigan drivers pay an average of $1,924 per year for full coverage car insurance with a $1,000 deductible. For state minimum coverage, the average annual cost is about $856.

The average annual cost of car insurance for a 22-year-old in Michigan with 100/300/100 full coverage and a $1,000 deductible is $2,203 or $184 per month.