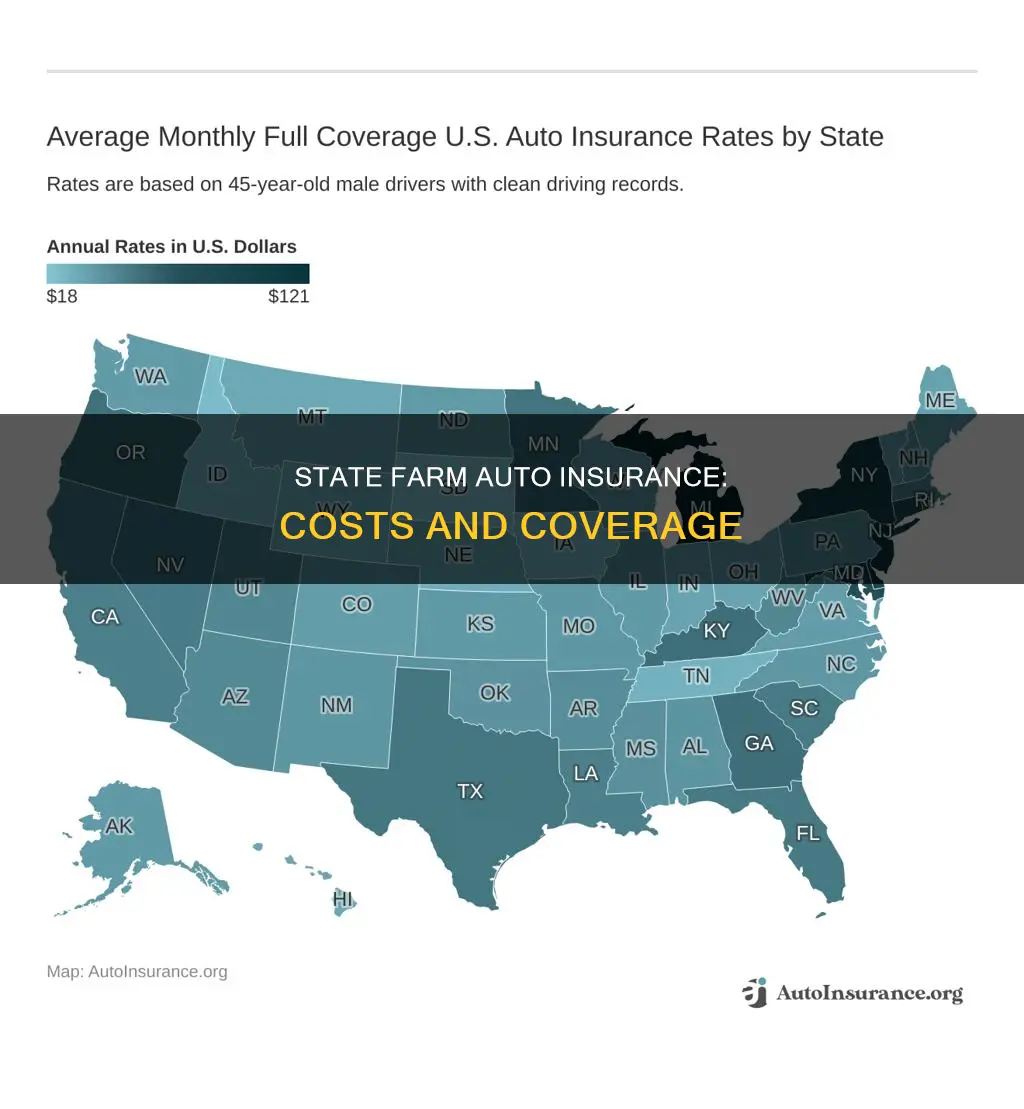

State Farm is the largest auto insurance provider in the US, offering some of the most affordable average rates to many types of drivers across the nation. The company provides full-coverage car insurance at an average of $1,647 per year or $138 per month, which is 21% cheaper than the national average. Its minimum-coverage insurance is also among the most affordable, with an average rate of $523 annually or $44 monthly. State Farm customers can take advantage of usage-based insurance programs and several types of discounts to further lower their rates.

| Characteristics | Values |

|---|---|

| Average annual rate for full coverage | $1,657 |

| Average annual rate for minimum coverage | $523 |

| Average monthly rate for full coverage | $138 |

| Average monthly rate for minimum coverage | $44 |

| Average annual savings for new policyholders | $649 |

| Maximum possible saving when bundling insurance | $1,273 |

| Maximum possible saving for safe driving | 30% |

| Maximum possible saving for drivers under 25 with no at-fault accidents or moving violations | 20% |

| Number of policies served | 87.7 million |

What You'll Learn

State Farm's average insurance rates

State Farm is the largest auto insurance provider in the US, and its rates are generally affordable compared to other insurance companies. The company's sample annual rate is $2,150 per year, slightly higher than the national average rate of $2,068. State Farm's sample rate for minimum coverage is $2,042 per year, and its high-coverage rate is $2,275 per year, both of which are also higher than the national average.

State Farm's average annual rates for full coverage are $1,657, and $523 for minimum coverage. These rates are about 21% and 20% cheaper than the national average, respectively.

State Farm offers many ways for customers to save money and lower their rates, including:

- Usage-based insurance programs

- Multi-policy discount: Bundling auto insurance with renter's insurance, homeowner's insurance, or life insurance.

- Multi-car discount: Insuring multiple vehicles on the same policy.

- Good driver discount: Rewarding accident-free drivers who avoid speeding tickets and other traffic violations.

- Good student discount: Full-time students with good grades can get up to a 25% discount.

- Student away at school discount: For students under 25 who are away at school and not using their car.

- Vehicle safety discount: For modern cars with updated safety features such as anti-theft devices.

- Drive Safe & Save™ Program: Customers can save up to 30% on their current insurance premiums by allowing State Farm to track their driving behaviour.

- Steer Clear® training program: Teens and young adult drivers can receive discounts by participating in safe driving lessons, watching videos, and taking quizzes in the Steer Clear app.

State Farm also offers discounts for:

- Accident-free driving

- Defensive driving courses

- Insuring multiple vehicles

- Safe driving

Additionally, State Farm provides competitive rates for drivers with less-than-perfect driving records. Those with speeding tickets, DUIs, or accidents on their record may find that State Farm's rates are lower than the national average for these categories.

Other factors that influence car insurance rates include:

- Coverage options

- Deductibles

- Discounts

- Driving history

- Credit score (where permitted by law)

- Third-party reports

- Age, gender, and marital status

- Annual mileage

- Vehicle type and safety features

- Location and traffic congestion

Farm Vehicle Insurance: What You Need to Know

You may want to see also

Factors influencing State Farm's insurance rates

State Farm is the largest auto insurance provider in the US, offering some of the most affordable average rates to many types of drivers nationwide. The company's average annual rate is $2,150, slightly higher than the national average of $2,068. State Farm's sample rate for minimum coverage is $2,042 per year, and its high-coverage rate is $2,275 per year, both of which are also higher than the national average.

Age, Gender, and Marital Status

Drivers between the ages of 25 and 65 tend to have fewer accidents than those who are younger or older. Accident rates are often higher for drivers under the age of 25, especially single males. Married drivers generally pay slightly less for car insurance than single drivers.

Driving History

Those with clean driving records receive the best auto insurance rates. DUIs, speeding tickets, and other moving violations can significantly raise your premiums. Drivers who have been accident-free for a long period may qualify for an accident-free savings discount.

Vehicle Type

Vehicles with more powerful engines or fewer safety features often lead to higher insurance rates. Some vehicles are safer and cost less to repair than others. Insurance companies collect data about each make and model and use it to determine insurance rates. Driving vehicles that rate highly in terms of driver and passenger protection may result in insurance savings.

Annual Mileage

Policyholders who drive only a few miles a week will likely pay less for auto insurance than those who drive longer distances. People who use their car for business and drive more miles in a year pay more than those who drive less. The more miles you drive, the higher the chances of a collision, regardless of how safe a driver you are.

Credit History

In many states, having a low credit score can raise your car insurance rates. Certain credit information can be predictive of future insurance claims, so many insurance companies use "Credit-Based Insurance Scores" to help determine rates. Maintaining good credit may positively impact your car insurance costs.

Coverage Options, Deductibles, and Discounts

Coverage options, deductibles, and discounts affect your policy cost. Generally, choosing a higher deductible means a lower monthly payment, while choosing a lower deductible means a higher monthly payment. State Farm offers various discounts, including multi-policy, multi-car, good driver, good student, vehicle safety, and more.

Maximizing National Insurance: Filling Gaps, Securing Benefits

You may want to see also

State Farm's insurance coverage options

State Farm offers a wide range of insurance coverage options to suit different needs. Here is a detailed overview of the coverage options available:

Vehicle Insurance Coverage:

- Motorcycle insurance: Coverage for motorcycles, offering protection for riders and their vehicles.

- Boat insurance: Coverage for boats and marine vessels, providing protection against accidents, damage, and liability.

- Motorhome insurance: Insurance for motorhomes, covering liabilities and risks associated with recreational vehicles.

- Off-road vehicle insurance: Off-road enthusiasts can insure their vehicles against accidents and damage.

- Classic and antique car insurance: Coverage specifically designed for classic and antique cars, which may have different risk factors and values compared to modern vehicles.

- Rideshare insurance: Designed for rideshare drivers, this insurance extends coverage to driving for companies like Uber or Lyft.

- Car insurance: State Farm offers various options for car insurance, including collision coverage, comprehensive coverage, liability coverage, uninsured and underinsured motorist coverage, medical payments coverage, rental car reimbursement, and emergency road service coverage. Collision coverage helps repair or replace your vehicle in case of a collision or overturning. Comprehensive coverage includes protection from theft, fire, vandalism, and animal collisions. Liability coverage pays for the other party's expenses if you are at fault in an accident. Medical payments coverage assists with medical and funeral costs for insured individuals in an accident. Rental car reimbursement covers the cost of a rental vehicle during repairs. Emergency road service provides fast assistance for issues like towing or flat tires.

Home & Property Insurance:

- Homeowners insurance: Coverage for homeowners, protecting their property and belongings.

- Condominium unit owners insurance: Designed for condo owners, this insurance covers their specific needs and risks.

- Renters insurance: Renters can protect their belongings and themselves from liability with this coverage.

- Rental property insurance: For landlords, this insurance covers rental properties and associated risks.

- Personal articles insurance: This coverage protects valuable personal belongings and items.

- Manufactured home insurance: Insurance designed for manufactured homes, providing coverage for these unique dwellings.

- Farm and ranch insurance: Farms and ranches have specific insurance needs, including coverage for equipment, crops, and livestock.

- Identity restoration insurance: This coverage assists individuals in restoring their identity in case of identity theft.

Life & Health Insurance:

State Farm offers life insurance, personal liability insurance, health insurance, and disability insurance. Life insurance provides financial security for loved ones, while health insurance covers medical expenses. Disability insurance replaces lost income due to injury or illness, and personal liability insurance protects against legal claims.

Small Business Insurance:

- Small business insurance: Tailored for small businesses, this coverage protects against risks such as property damage, liability, and business interruption.

- Business owners insurance: This coverage is designed for business owners, offering protection for their investments and liabilities.

- Professional liability insurance: Professionals can safeguard themselves against claims of malpractice or negligence with this insurance.

- Commercial business insurance: Coverage for commercial ventures, protecting against risks associated with running a business.

- Workers' compensation insurance: This insurance covers medical costs and lost wages for employees who are injured or become ill due to work-related causes.

- Contract insurance: Designed for contractors, this insurance covers risks associated with construction and renovation projects.

- Surety and fidelity bonds: These financial instruments guarantee the performance of a contract or the honesty of employees.

- Commercial vehicle insurance: Insurance for commercial vehicles, offering protection against accidents, damage, and liability.

State Farm's coverage options are extensive and tailored to meet diverse customer needs. The company also offers various discounts and savings opportunities to make their insurance products more affordable.

CNAC: Gap Insurance Included?

You may want to see also

Discounts and savings opportunities

State Farm offers a variety of discounts and savings opportunities to its auto insurance customers. Here are some of the ways you can save on your State Farm auto insurance:

Multi-Policy Discount

You can save money by bundling your auto insurance with other types of insurance policies offered by State Farm, such as renter's insurance, homeowner's insurance, or life insurance. By combining these policies, you can take advantage of the multi-policy discount and lower your overall insurance premiums.

Multi-Car Discount

If you have more than one vehicle, you can insure them all on the same policy with State Farm and receive a discount. This is a great way to save money on your total insurance costs, especially if you have a family with multiple cars.

Good Driver Discount

Safe driving habits can help you reduce your insurance premiums. By staying accident-free and avoiding speeding tickets or other traffic violations, you can qualify for the good driver discount. State Farm's Drive Safe & Save™ program rewards customers for their safe driving habits, offering discounts of up to 30% on their current insurance premiums.

Good Student Discount

Full-time students who maintain good grades can benefit from State Farm's good student discount, which can lower their insurance premiums by up to 25%. This discount is a great incentive for students to focus on their academics and maintain a good driving record.

Student Away at School Discount

If you have a student under 25 who is away at school and not using their car regularly, you may be eligible for the student away at school discount. This discount helps you save money while your student is away from home and not driving their vehicle.

Vehicle Safety Discount

Modern cars with advanced safety features, such as anti-theft devices and autonomous braking, may qualify for discounted insurance premiums. These safety features not only protect you on the road but can also help you save on your insurance costs.

Steer Clear® Training Program

State Farm offers a training program called Steer Clear® for teens and young adult drivers. This program includes lessons, educational videos, and quizzes on safe driving habits. Participants are also required to complete five hours of practice driving. Upon completion of the program, drivers receive a certificate of completion and are eligible for a discount on their State Farm auto insurance policy.

It's important to note that discounts and savings opportunities may vary by state and eligibility requirements. Be sure to check with a State Farm agent to find out which discounts you may qualify for and how you can take advantage of these opportunities to lower your auto insurance costs.

Gap Insurance: Automatic or Not?

You may want to see also

State Farm's insurance availability

State Farm is the largest auto insurance provider in the US, serving 87.7 million policies and growing. It is available in 48 states and Washington, D.C.

State Farm is not available in Massachusetts and Rhode Island.

State Farm offers a wide range of insurance products, including auto insurance for teen drivers, rental cars, commercial vehicles, motorcycles, antique cars, and more. They also offer RV insurance, which protects recreational vehicles, motorhomes, truck or van campers, and travel trailers.

In addition to auto insurance, State Farm provides homeowners, renters, condo, life, health, and long-term care insurance. They also offer pet medical insurance through Trupanion.

State Farm has approximately 19,000 agents available to help customers across the US.

BMW Gap Insurance: What You Need to Know

You may want to see also

Frequently asked questions

State Farm offers competitive rates for all auto insurance products. The company's full-coverage car insurance premiums are 14% below the national average, making State Farm an affordable choice for most drivers. State Farm also offers some of the most affordable minimum-coverage rates, which are about 20% below the national average.

Several factors influence State Farm auto insurance rates, including age, driving history, vehicle type, marital status, and credit history. Young drivers and those with a history of DUIs, speeding tickets, or other violations can expect to pay higher premiums.

State Farm offers various discounts and savings opportunities to its customers. These include multi-policy discounts, multi-car discounts, good driver discounts, good student discounts, and vehicle safety discounts. Customers can also save up to $1,273 by bundling their auto insurance with a homeowners, renters, condo, or life insurance policy.