Property damage liability insurance is a type of car insurance that covers the cost of damage to another person's property, such as their car or home, in the event of an accident. This type of insurance is required by law in most states and is meant to ensure that drivers can assume financial responsibility for damage caused in an accident where they are deemed at fault. The amount of property damage liability insurance that drivers need to purchase depends on various factors, including state requirements, the value of their car, and their budget.

| Characteristics | Values |

|---|---|

| What type of insurance is it? | Property damage liability insurance |

| What does it cover? | Damage to another person's property, such as their car or home, as a result of an accident |

| What does it not cover? | Damage to the policyholder's own vehicle or property |

| How much does it cost? | Depends on how much you purchase; higher limits = more expensive coverage |

| What are the typical liability limits? | $5,000 to $100,000 |

| What is the average cost of liability insurance? | $1,407 per year for a minimum coverage policy |

| What is the recommended coverage? | As much as you can comfortably afford, ideally enough to cover your assets |

What You'll Learn

- Property damage liability insurance covers damage to other people's property

- Collision coverage is for damage to your own car

- Comprehensive coverage protects against risks like theft or fire

- Uninsured motorist coverage protects you if an uninsured driver hits you

- Personal injury protection covers medical costs

Property damage liability insurance covers damage to other people's property

Property damage liability insurance is a type of car insurance coverage that pays for damage caused to another person's property, such as their car, home, or other personal property, as a result of an accident. It is one of the major coverage types that drivers are required to have by law in most states.

Property damage liability insurance covers the cost of repairs or replacement of the other vehicles involved in an accident, as well as other related property damage. This includes damage to fences, housing, lampposts, and other stationary objects. It also covers the cost of losses incurred by a business that had to close due to damage, legal fees for a lawsuit filed for property damage, and any other recurring costs resulting from accident damage.

It is important to note that property damage liability insurance does not cover damage to the policyholder's own vehicle or property. To cover their own vehicle repairs, the policyholder would need to purchase separate comprehensive and collision coverage.

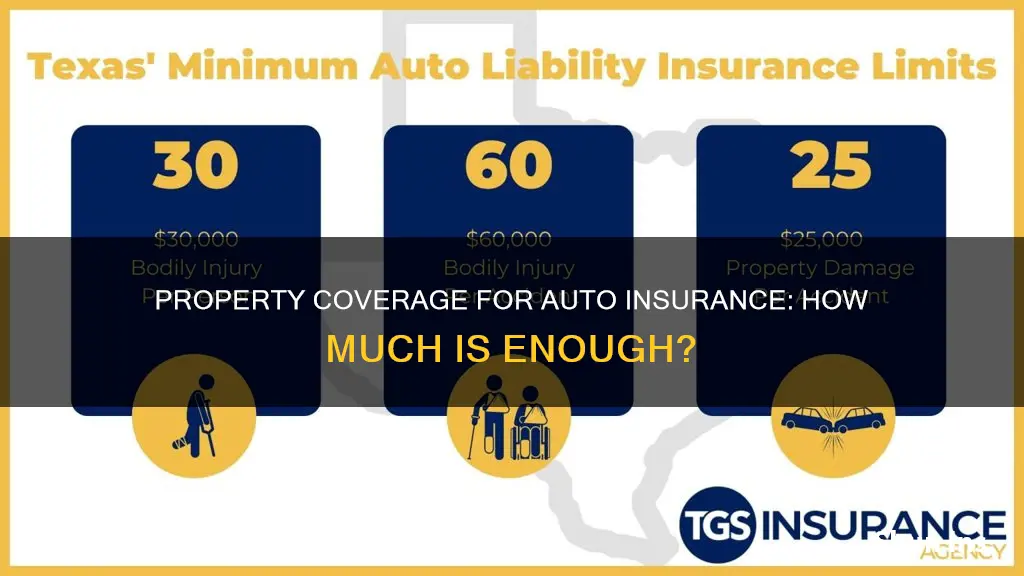

The cost of property damage liability insurance depends on the coverage limits selected. The higher the coverage limits, the higher the premium amounts will be. The minimum coverage requirements vary by state, ranging from $5,000 to $25,000. However, it is recommended to purchase higher coverage limits to ensure sufficient protection in the event of an accident.

Property damage liability insurance typically has a "per accident" limit, meaning it will only pay out up to the amount stated in the policy for each accident. If the damage caused exceeds the coverage limit, the person making the claim can pursue legal action against the policyholder to recover the excess amount.

Switching Auto Insurance: A Quick Guide

You may want to see also

Collision coverage is for damage to your own car

Collision coverage is a type of auto insurance that covers the cost of repairing or replacing your car if it collides with another object, such as a car, guardrail, pole, or tree. It is important to note that collision coverage is separate from property damage liability insurance, which covers the cost of damage to another person's property caused by the policyholder.

Collision coverage allows you to file a claim with your own insurance company to pay for repairs to your vehicle, regardless of who was at fault for the accident. This means that even if you are to blame for the accident, you can still get your damaged car repaired or replaced. However, it's important to remember that you can't collect compensation from both your collision coverage and the other driver's liability coverage for the same losses. Once you settle a claim under your collision coverage, you give up your right to collect compensation from the other driver's insurance for the same property damage.

The main advantage of using your collision coverage is that your own insurer will likely pay your vehicle damage claim quicker. Collision coverage pays regardless of fault, whereas third-party claims involve an investigation to determine who was at fault, which can take time. Additionally, if you also have a third-party personal injury claim, using your collision coverage won't impact your injury claim.

On the other hand, there are a few potential disadvantages to using your collision coverage. Your options will depend on your coverage limits, and you may have to pay a deductible when making a claim, which can range from $500 to $2,000. The rules set by your insurance policy for processing a claim under your collision coverage may also be more restrictive than those for a third-party claim.

In terms of cost, the average cost of collision coverage is $814 annually or $68 per month. However, this can vary depending on factors such as the insurer, your location, and the vehicle you drive. It is also worth noting that collision coverage is generally required if you have a car loan or lease, but it is optional if you own your car outright.

MassHealth Insurance and Auto Accidents: Understanding Medical Bill Coverage

You may want to see also

Comprehensive coverage protects against risks like theft or fire

Comprehensive coverage is an optional add-on to your auto insurance policy that protects your vehicle from damage caused by events outside of your control, excluding collisions. This includes theft, vandalism, fire, and accidents with animals. It is often required by lenders if you are leasing or financing your vehicle.

Comprehensive coverage is particularly useful if you live in an area with a high risk of animal collisions, harsh weather, or a high crime rate. For example, if you live in an area with frequent hailstorms, comprehensive coverage can protect your vehicle from hail damage. Similarly, if you live in an area with a high crime rate, comprehensive coverage can provide peace of mind in the event of a break-in or theft.

It's important to note that comprehensive coverage does not cover damage caused by colliding with another vehicle or object. In these cases, you would need collision coverage. Additionally, comprehensive coverage does not cover normal wear and tear on your vehicle.

The cost of comprehensive coverage can vary depending on factors such as the value of your vehicle, your location, and your driving record. It is typically more expensive for vehicles with a higher cash value. You can also choose a higher deductible to lower your premiums.

When deciding whether to add comprehensive coverage to your auto insurance, consider the value of your vehicle, your financial circumstances, and your personal preferences. If your vehicle has a high cash value or you cannot afford to repair or replace it out of pocket, comprehensive coverage can be a wise investment.

Does Auto Insurance Cover Door Dings?

You may want to see also

Uninsured motorist coverage protects you if an uninsured driver hits you

Property damage liability insurance is a type of car insurance that covers the cost of damage to another person's property, such as their car or home, in an accident where you are at fault. This type of insurance is required by law in most states, with minimum coverage limits ranging from $5,000 to $25,000. It is important to note that property damage liability insurance does not cover damage to the policyholder's own vehicle or property; separate collision or comprehensive coverage is needed for that.

Now, what happens if you are hit by an uninsured driver? This is where uninsured motorist coverage comes into play. Uninsured motorist coverage protects you financially if you are in an accident with a driver who does not have auto insurance. Underinsured motorist coverage, which is often offered alongside it, safeguards you if the other driver doesn't have adequate coverage for the damages or injuries they caused.

Uninsured motorist coverage typically includes:

- Uninsured motorist bodily injury (UMBI): Covers medical bills for you and your passengers.

- Uninsured motorist property damage (UMPD): Covers damage to your vehicle and, in some states, other property.

Underinsured motorist coverage usually consists of:

- Underinsured motorist bodily injury (UIMBI): Covers medical expenses for you and your passengers.

- Underinsured motorist property damage (UIMPD): Pays for damage to your car and, in certain states, other property.

It's worth noting that uninsured and underinsured motorist coverage is mandatory in several states and highly recommended for all drivers. Without it, you could be left footing the bill for repairs and medical expenses. In some cases, you might have to resort to legal action against the at-fault driver, which can be a lengthy and costly process.

Business Auto Insurance: How Much Coverage Do You Need?

You may want to see also

Personal injury protection covers medical costs

Personal injury protection (PIP), also known as "no-fault insurance," is a type of car insurance that covers medical expenses and related costs resulting from an accident, regardless of who caused it. PIP covers the policyholder, their passengers, and anyone in their vehicle at the time of the incident. This includes medical expenses for those without health insurance.

PIP covers medical expenses such as ambulance services, medical and surgical treatment, hospital stays, nursing, medication, medical supplies, rehabilitation, prostheses, dental care, optical treatment, and chiropractic services. In addition to medical care, PIP often provides payments for lost income, childcare, and funeral expenses related to the accident.

PIP is required in 12 to 16 states, including Delaware, Florida, Hawaii, Kansas, Kentucky, Maryland, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Oregon, Pennsylvania, Utah, and Puerto Rico. In states where PIP is not mandatory, it is often offered as an optional coverage.

While health insurance typically covers medical expenses, it may not cover non-medical expenses such as lost wages, childcare, or house cleaning services that may arise due to an accident. PIP can fill these gaps and provide a wider range of benefits.

It is important to note that PIP does not cover damage to vehicles or property. For coverage of property damage, a separate property damage liability insurance policy is required. Property damage liability insurance covers the cost of repairs or replacement of damaged property, such as vehicles or stationary objects, resulting from an accident caused by the policyholder.

Business Auto Insurance: More Expensive?

You may want to see also

Frequently asked questions

Property damage liability insurance is a type of car insurance that covers the cost of damage to another person's property, such as their car or home, in the event of an accident. It is one of the major coverage types that drivers are required to have by law in most states.

Property damage liability insurance covers the cost of repairs to the other party's vehicle, damage to businesses, houses, fences, and other structures, legal fees, and other recurring costs resulting from accident damage.

The amount of property damage liability insurance you need depends on your state's minimum requirements and your personal financial situation. It is recommended to have as much coverage as you can comfortably afford to protect your assets in case of an accident.

The cost of property damage liability insurance depends on the coverage limits you choose. Higher coverage limits will result in higher premiums. Typical liability limits range from $5,000 to $100,000.