The cost of auto insurance varies depending on factors such as location, driving history, age, and vehicle type. In the US, the average monthly cost of a full-coverage car insurance policy is $158, while a state minimum policy costs $42 per month. In California, the average monthly cost for state minimum coverage is $50, while full coverage costs $122 per month. The cheapest car insurance in California is offered by Geico, with rates starting at $31 per month. Factors such as age, gender, driving record, and credit score can also impact insurance rates, with younger and less experienced drivers often paying higher premiums.

| Characteristics | Values |

|---|---|

| Average monthly cost of full coverage car insurance in the U.S. | $158 |

| Average monthly cost of state minimum coverage auto insurance in California | $50 |

| Average monthly cost of full coverage auto insurance in California | $122 |

| Average monthly cost of full coverage car insurance in the U.S. for a 20-year-old driver | $3,576 |

| Average monthly cost of full coverage car insurance in the U.S. for a 35-year-old driver | $143 |

| Average monthly cost of full coverage car insurance in the U.S. for a 40-year-old driver | $158 |

| Average monthly cost of full coverage car insurance in the U.S. for a driver with a recent DUI | $291 |

| Average monthly cost of full coverage car insurance in the U.S. for a driver with a speeding ticket | $173 |

| Average monthly cost of full coverage car insurance in the U.S. for a driver with an at-fault accident | $196 |

What You'll Learn

How much is car insurance per month for a 16-year-old?

The cost of car insurance for a 16-year-old varies depending on a range of factors, including the driver's gender, location, insurance provider, and the type of insurance coverage.

Average Costs

According to Bankrate, a married couple with a 16-year-old driver on their policy will pay an additional $2,705 annually, or $225 per month, for a full-coverage policy. Forbes Advisor's analysis places this figure slightly higher, at $2,735 a year, or $230 extra per month.

The Zebra reports that the average 16-year-old driver in 2020 paid an annual premium of $5,744, or $479 per month, for insurance. This is compared to the national average of $1,483 across all ages.

CarInsurance.com places the average cost of car insurance for a 16-year-old at $7,625 a year, or $635 per month, for full coverage.

Insurance Coverage

The cost of car insurance for a 16-year-old also depends on the type of insurance coverage. For example, the average cost of state minimum coverage is $2,511 per year, while liability-only coverage (50/100/50) costs $3,008 per year.

Gender

Gender is another factor that influences the cost of car insurance for 16-year-olds. Male drivers typically pay more than female drivers due to a higher rate of car accidents. According to Forbes Advisor, insuring a 16-year-old male driver costs 25% more than insuring a female of the same age when added to a parent's policy.

Insurance Provider

The choice of insurance provider also affects the cost. For example, Erie is identified by Forbes as the cheapest car insurance company for adding a 16-year-old driver to a parent's policy, while Nationwide is the second cheapest.

Location

A 16-year-old driver's location will also impact the cost of car insurance. States with high numbers of bodily injury claims or states with no-fault laws, such as Michigan or Florida, will have higher insurance rates. Additionally, states with a higher population density and more drivers will result in increased insurance rates.

Auto Insurance Industry: How Many Employees Does It Have?

You may want to see also

How much is car insurance per month for a 17-year-old?

The cost of car insurance for a 17-year-old varies depending on factors such as gender, location, and the insurance company. On average, a 17-year-old can expect to pay around $523 to $737 per month for car insurance. However, it is important to note that these rates can vary widely by company and location.

For example, Erie, which is available in 13 states, offers insurance for 17-year-olds at $275 per month. In contrast, USAA, which is only available to military members and their families, offers rates at $360 per month. Geico, a widely available company, offers rates at $423 per month for 17-year-olds.

Adding a 17-year-old driver to a parent's insurance plan can be significantly cheaper than getting a separate policy. The average cost of adding a 17-year-old to a parent's policy is around $323 per month, which is much lower than the cost of a separate policy.

There are several ways that 17-year-olds can save on car insurance. One way is to be added to a parent's policy instead of getting separate insurance. Additionally, shopping around for quotes, exploring discounts, and adjusting coverage levels can also help lower rates. Good student discounts, driver's education discounts, and distant student discounts are common ways to reduce insurance costs for young drivers.

It is worth noting that male drivers tend to pay more for car insurance than female drivers, as they are statistically more likely to be involved in accidents. The difference in rates between male and female drivers decreases as they gain more driving experience.

Marriage and Auto Insurance: Staying on Parents' Policy

You may want to see also

How much is car insurance per month for an 18-year-old?

The cost of car insurance for an 18-year-old varies depending on several factors, including gender, location, insurance provider, and the type of policy. On average, 18-year-olds can expect to pay between $210 and $230 per month for car insurance. This age group is considered high-risk due to their limited driving experience, which results in higher insurance rates.

Cost of Car Insurance for 18-Year-Olds by Gender

According to one source, the average cost of full coverage car insurance for an 18-year-old female on a family policy is $2,526 per year or $210 per month. In comparison, the average cost for an 18-year-old male is $2,756 per year or $230 per month. However, it is important to note that some states, such as Michigan, Massachusetts, California, Hawaii, North Carolina, and Pennsylvania, prohibit insurers from using gender as a factor in determining rates.

Cost of Car Insurance for 18-Year-Olds by Insurance Provider

The cost of car insurance for 18-year-olds also varies depending on the insurance provider. Here are the average annual costs for full coverage policies from some of the cheapest insurance companies:

- GEICO: $2,431

- Nationwide: $2,476

- Erie: $2,673

- Travelers: $2,716

- State Farm: $2,829

- USAA: $3,062

Cost of Car Insurance for 18-Year-Olds by Type of Policy

The type of policy also impacts the cost of car insurance for 18-year-olds. Here are the average annual costs for different types of policies:

- Full coverage policy: $2,641

- State minimum liability policy: $515

- Liability-only policy: $485 to $515

Ways to Save on Car Insurance for 18-Year-Olds

- Stay on a parent's policy: Teens can often get lower rates by staying on their parents' policy until they move out permanently.

- Choose a safe and affordable car: Selecting a car with a good safety rating and a lower price can reduce insurance costs.

- Seek good student discounts: Many insurance companies offer discounts for students who maintain good grades, usually a B average or higher.

- Complete a driver's education course: Insurance companies may offer discounts to young drivers who complete certified driving courses.

- Opt for higher deductibles: Choosing a higher deductible can lower insurance premiums, but ensure the deductible is still affordable if you need to file a claim.

- Limit coverage on older vehicles: Consider reducing coverage to liability only for older, less valuable cars as the cost of full coverage may not be worth it.

Leased Cars: Higher Insurance?

You may want to see also

How much is car insurance per month for a 19-year-old?

The cost of car insurance for a 19-year-old varies depending on several factors, including gender, location, insurance provider, and the level of coverage. Here is an overview of the average monthly and annual costs for car insurance for 19-year-olds in the United States:

Monthly Costs:

According to ValuePenguin, the average monthly cost of car insurance for 19-year-olds with their own full-coverage policy is around $365. For males, the average is $383, while for females, it is $346. However, the costs can vary by state and insurance provider. For example, in North Carolina, Farm Bureau offers full coverage for $89 per month, while in Florida, State Farm's cheapest full-coverage rate is $315 per month. Geico, available across the US, offers full coverage for $310 per month.

On the other hand, if a 19-year-old is added to their parents' policy, the average monthly cost decreases significantly. Bankrate estimates the average monthly cost of full coverage for 19-year-olds on their parents' policy to be $311, while minimum coverage costs around $91 per month.

Annual Costs:

According to CarInsurance.com, the average annual cost of full coverage for a 19-year-old on their own policy is $4,132. This breaks down to about $344 per month. Male drivers pay slightly more, with an average annual cost of $4,132, while female drivers pay around $3,615 per year.

Bankrate provides a higher estimate, placing the average annual cost of full coverage for 19-year-olds on their own policy at $5,289. For minimum coverage, they estimate the average annual cost to be $1,512.

Factors Affecting Costs:

The cost of car insurance for 19-year-olds can be influenced by various factors:

- Gender: In states that allow gender to be considered in insurance rates, males typically pay more than females due to higher accident rates.

- Location: Car insurance rates can vary significantly by state and even by ZIP code. For example, Hawaii has the cheapest average rates for 19-year-olds, while Rhode Island is the most expensive.

- Insurance Provider: Different insurance companies offer varying rates, and it's essential to shop around and compare quotes to find the best deal.

- Driving Record: A clean driving record can help lower insurance costs, while accidents, speeding tickets, or DUIs will increase rates.

- Credit Score: In most states, a good credit score can lead to lower insurance rates, while poor credit can result in higher premiums.

- Coverage Level: Full coverage costs more than minimum coverage but provides more comprehensive protection in the event of an accident.

Rethinking Fault: How Insurance Companies Reconsider Accident Responsibility

You may want to see also

How much is car insurance per month for a 20-year-old?

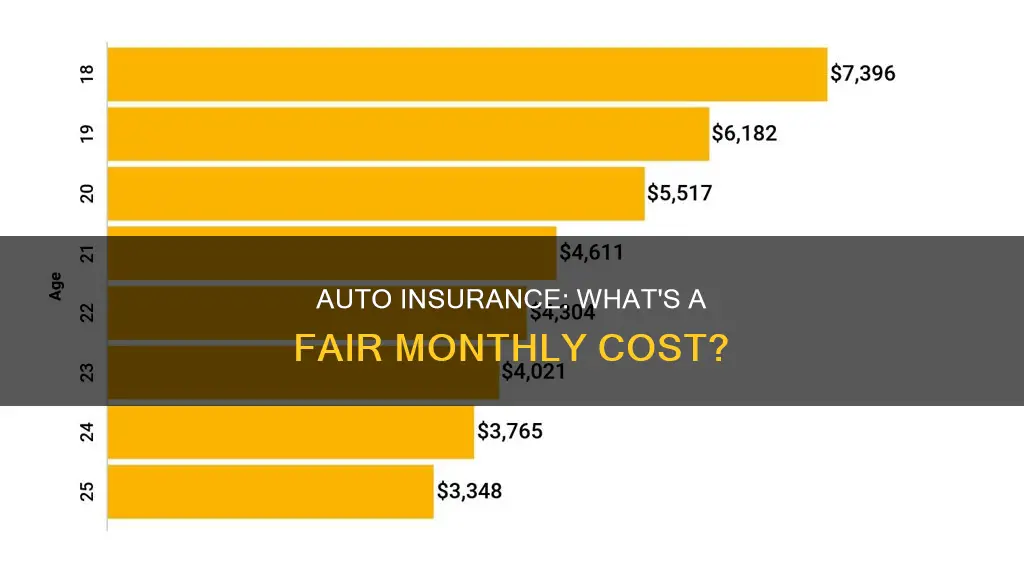

The cost of car insurance for a 20-year-old varies depending on factors such as gender, location, and the insurance company. On average, a 20-year-old driver will pay $3,329 a year for full coverage car insurance, more than double the national average of $1,150 for all drivers.

The Zebra reports that the average cost of car insurance for a 20-year-old driver is $300 per month or over $3,600 per year. This is substantially more than the national average across all age brackets. 20-year-old drivers pay $1,366 more every year compared to other young adult drivers in their 20s.

According to ValuePenguin, the average cost of car insurance for a 20-year-old with their own policy is $329 per month for a full-coverage policy. The cheapest rates for 20-year-olds come from Farm Bureau, at $198 per month. For parents who keep a 20-year-old driver on their policy, the average cost of full coverage insurance is $3,535 per year, while minimum coverage costs just $1,019 per year.

Insurance.com reports that the average cost of full coverage car insurance for a 20-year-old driver is $3,739 a year, which is $1,844 more than the national average. Auto-Owners offers the cheapest average car insurance rates for 20-year-old drivers at about $247 per month or around $2,958 per year.

NerdWallet reports that the average annual car insurance costs for a 20-year-old driver are $3,576 for full coverage and $1,023 for minimum required coverage.

Car and Driver reports that Erie Insurance, Auto-Owners, American Family, and Progressive are some of the insurance companies with the lowest average annual rates for 20-year-old drivers, at $1,119, $1,208, $1,488, and $1,854, respectively.

Bundling Home and Auto Insurance: The Progressive Advantage

You may want to see also

Frequently asked questions

The monthly average cost of a full-coverage car insurance policy in the U.S. is $158. The rate for a state minimum policy is $42 per month.

Car insurance for a 20-year-old male costs $328 per month or $3,935 per year. Car insurance for a 20-year-old female costs $294 per month or $3,527 per year.

The average cost of car insurance for a 22-year-old in California for state minimum coverage is $734 annually, which is about $61 monthly.

Car insurance for an 18-year-old male costs $461 per month or $5,533 per year.