The cost of car insurance varies depending on a number of factors, including the driver's age, gender, location, driving history, and the type of car they drive. The national average cost of car insurance in the United States is $1,718 per year for full coverage and $488 per year for minimum coverage, according to a June 2024 analysis by NerdWallet. However, these rates can differ significantly by state, with Wyoming having the cheapest full coverage rates at $972 per year, and Florida having the most expensive rates at $3,067 per year.

In addition to location, other factors that influence car insurance rates include age, gender, credit score, marital status, vehicle type, and driving history. For example, younger and older drivers tend to have higher insurance premiums due to their higher risk of accidents. Similarly, drivers with a history of accidents, speeding tickets, or DUIs will typically pay more for car insurance.

When determining how much car insurance is needed, it is essential to consider the state's minimum requirements, the value of the car, and the driver's financial situation. While minimum coverage may be sufficient to comply with the law, it may not provide adequate protection in the event of an accident. Full coverage insurance, which includes liability, collision, and comprehensive insurance, offers more comprehensive protection but at a higher cost.

| Characteristics | Values |

|---|---|

| Average cost of car insurance | $1,718 per year for full coverage and $488 for minimum coverage |

| Average cost of car insurance for young drivers | $3,576 for full coverage and $1,023 for minimum coverage |

| Average cost of car insurance for drivers with a DUI | $2,986 for full coverage and $901 for minimum coverage |

| Average cost of car insurance for drivers with a speeding ticket | $2,024 for full coverage and $621 for minimum coverage |

| Average cost of car insurance for drivers with poor credit | $2,741 for full coverage and $756 for minimum coverage |

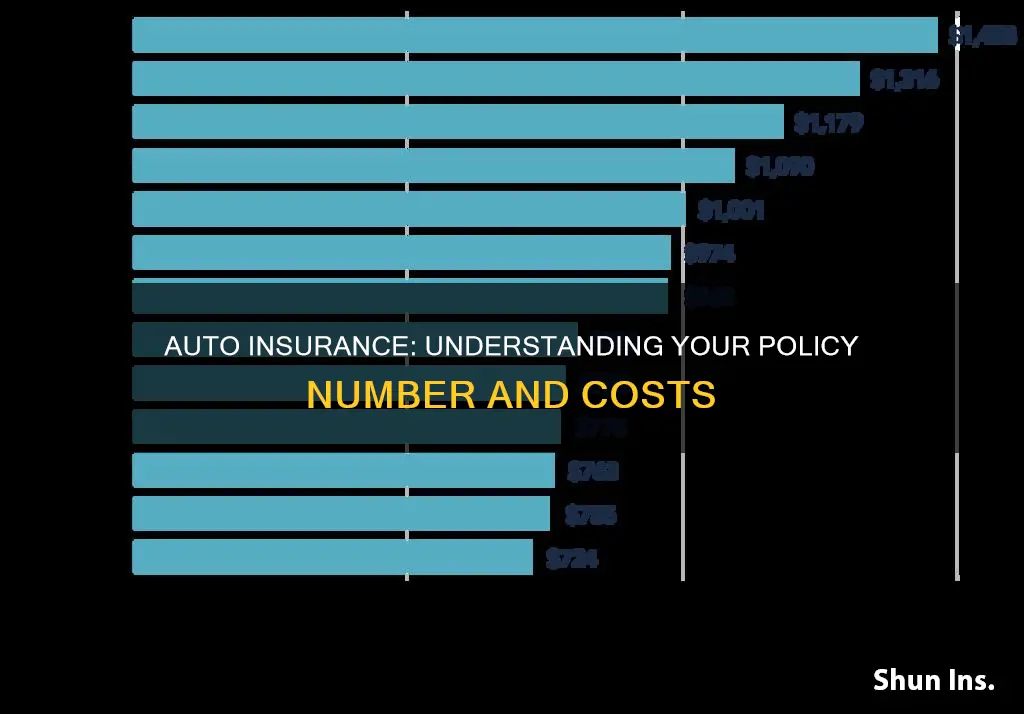

| Average cost of car insurance by state | Wyoming: $972 per year; Vermont: $1,082 per year; New Hampshire: $1,119 per year; Idaho: $1,162 per year; Ohio: $1,209 per year |

| Average cost of car insurance by company | GEICO: $1,531 per year; State Farm: $1,508 per year; Progressive: $1,677 per year; Allstate: $2,006 per year; Farmers: $2,052 per year; USAA: $1,201 per year |

What You'll Learn

How much is car insurance per month?

The cost of car insurance per month depends on a variety of factors, including age, location, driving record, vehicle type, and more. The national average cost of car insurance in the US is $158 per month for a full-coverage policy and $42 per month for a state minimum policy. However, rates can vary significantly from state to state and between different insurance providers. For example, in California, the average monthly cost of full coverage car insurance is $122, while in Louisiana, the average monthly cost is $240.

Age is also a significant factor, with younger and less experienced drivers often paying higher insurance premiums. The cost of car insurance for a 20-year-old male, for instance, is around $328 per month, while it is $294 per month for a 20-year-old female. Additionally, the type of vehicle you drive can affect your insurance rates, with luxury cars and sports cars typically being more expensive to insure.

It is important to shop around and compare quotes from multiple insurance companies to find the most affordable coverage for your needs. Discounts and bundling policies can also help lower your monthly insurance costs.

State Farm Auto Insurance: Is Massachusetts Covered?

You may want to see also

How much is minimum car insurance compared to full coverage car insurance?

The cost of car insurance varies depending on the type of coverage you choose. The national average for full coverage auto insurance is $1,718 per year, or about $143 a month, according to NerdWallet's June 2024 analysis. In contrast, the national average for minimum coverage auto insurance is $488 per year, or about $41 per month. Full coverage insurance typically includes liability, collision, and comprehensive insurance, while minimum coverage only includes the state-mandated minimum amount of liability insurance.

Full coverage insurance offers more comprehensive protection in the event of an accident or damage to your vehicle. It covers repairs or replacement of your car, regardless of who is at fault. It also includes liability insurance, which pays for the injuries and property damage you cause to others in an accident. On the other hand, minimum coverage only covers the damages and injuries you cause to others and does not include coverage for your own vehicle.

The cost of car insurance also depends on various factors such as your age, driving record, location, and the insurance company you choose. Additionally, each state has different minimum coverage requirements, which can affect the cost of insurance. It is important to shop around and compare quotes from multiple companies to find the best rate for the coverage you need.

Vehicle Insurance: Protection Essential

You may want to see also

Who pays the most for car insurance?

There are several factors that determine the cost of car insurance, and who pays the most for car insurance can vary depending on these factors. Here are some of the factors that can affect the cost of car insurance:

- Age and driving experience: Younger and less experienced drivers are often considered higher-risk and may pay higher premiums.

- Gender: In some states, gender can influence rates, with men typically paying more than women due to a higher risk of accidents.

- Driving record: A clean driving record can result in lower rates, while accidents, speeding tickets, or DUIs can increase premiums.

- Location: Insurance rates can vary by state and city, with higher rates in areas with higher accident rates, theft, or congested traffic.

- Vehicle make and model: The cost of insurance may be higher for vehicles with expensive parts or those that are commonly stolen.

- Credit score: In most states, a poor credit score can lead to higher insurance rates.

Based on these factors, here are some groups that may pay higher car insurance rates:

- Young drivers: Drivers under 25, especially males, often pay higher rates due to their higher risk of accidents.

- Drivers with a poor driving record: Accidents, speeding tickets, and DUIs can significantly increase insurance costs.

- Drivers with poor credit: A low credit score can result in higher insurance premiums in most states.

- High-risk drivers: Those with multiple infractions or a history of claims may be considered high-risk and face higher rates.

- Location-specific rates: Certain states, such as Florida, Louisiana, and Texas, have higher average insurance rates.

It's important to note that insurance rates are highly individualized, and the best way to determine your specific rates is to compare quotes from multiple insurance providers.

Teacher Credit Gap Insurance: Refundable?

You may want to see also

How much auto insurance should I have?

The amount of auto insurance you should have depends on your state's requirements, your net worth, and your ability to pay for damages out of pocket.

State Requirements

Every state has a minimum amount of car insurance you must buy to satisfy financial responsibility laws. Liability insurance is the main mandated coverage. It covers damage and injuries you cause to others in an accident. The most common minimum limits for liability are $25,000 per person and $50,000 per accident for bodily injury and $25,000 for property damage. However, your state’s requirements may be higher or lower.

Net Worth

You should have enough liability insurance to cover what you could lose in a lawsuit against you if you cause a car accident. A good rule of thumb is to buy enough liability insurance to cover your net worth. If you don't have enough insurance to cover all the damage you caused in an accident, you could be sued and have to pay out of pocket for any remaining amount.

Out-of-Pocket Expenses

If you can afford to pay for repairs or a new car out of pocket, you might not need collision and comprehensive insurance. Collision insurance covers the cost to repair or replace your car if it’s damaged in an accident with another vehicle or object. Comprehensive insurance protects your vehicle from things outside your control, such as theft, vandalism, fire, collisions with animals, glass breakage, and damage from weather. If you have a high deductible, your insurance company will see you as a lower risk and reward you with a lower premium.

Optional Coverage

There are several types of optional coverage you can add to your auto insurance policy, including:

- Guaranteed Asset Protection (GAP)

- Temporary Car Insurance

- Mechanical Breakdown

- Rental Reimbursement

- Pay-per-Mile Coverage

- Roadside Assistance Coverage

- Umbrella Liability Policy

- Custom Equipment Coverage

- Original Equipment Manufacturer (OEM) Endorsement

- Forgiveness Coverage

- Glass Coverage

- Classic Car Insurance

- Rideshare Insurance

- Uninsured Motorist (UM) and Underinsured Motorist (UIM)

- Medical Payments Coverage (MedPay)

- Personal Injury Protection (PIP)

Bundling Auto and Motorcycle Insurance with Progressive

You may want to see also

How much liability insurance do I need?

The amount of liability insurance you need depends on your state's requirements and your personal financial situation.

State Requirements

Nearly every state requires a minimum amount of liability insurance, except for Virginia and some remote parts of Alaska. The most common minimum liability limits are $25,000 per person and $50,000 per accident for bodily injury, and $25,000 for property damage. However, these limits vary by state, so it's important to check your state's specific requirements.

Personal Financial Situation

When deciding how much liability insurance to purchase, consider your net worth, which includes the value of your assets (such as your home, vehicles, savings, and investments) minus any debt. You should aim to have enough liability insurance to cover your net worth in case you are found at-fault in an accident. This will help protect your assets from potential lawsuits.

If you don't have many assets, you may be okay with purchasing minimal liability coverage. However, if you have a high net worth, consider purchasing an umbrella insurance policy to provide additional liability coverage beyond what your auto insurer offers.

Full Coverage

In addition to liability insurance, you may want to consider full coverage, which includes collision and comprehensive insurance. Collision insurance covers damage to your vehicle in an accident, while comprehensive insurance covers damage from events outside your control, such as theft, vandalism, or natural disasters. Full coverage is usually required if you lease or finance your vehicle.

When choosing your coverage limits and deductibles, consider how much you can afford to pay for repairs or a new vehicle if needed.

Optional Coverage

There are also several types of optional coverage you may want to add to your policy, such as uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection. These coverages can provide additional protection in case of an accident, especially if you live in a state with a high percentage of uninsured drivers.

In summary, the amount of liability insurance you need depends on your state's requirements and your personal financial situation. It's important to review your state's minimum requirements and assess your own financial needs to determine the right amount of coverage for you.

Insurance Policy Pitfalls: When No-Fault Accidents Lead to Cancellation

You may want to see also

Frequently asked questions

The car insurance rate will vary depending on factors such as where you live, the vehicle you drive, and your driving history. The national average cost of insurance is $64 per month for minimum coverage or $164 per month for full coverage.

The cheapest major insurance companies are Auto-Owners, Erie, State Farm, and USAA. State Farm is widely available and a good choice for most people. Auto-Owners and Erie are only available in certain states. USAA is often the cheapest but is only available to those in the military and their families.

An 18-year-old driver pays an average of $481 per month for full coverage for their own policy. Young drivers who are on their parents' insurance will pay less than that.