SBI Life Insurance is one of India's most trusted insurance providers, offering a wide range of products, including term plans, savings, health, pension, and child insurance solutions. Established in 2001, the company has built a strong reputation for its commitment to customer satisfaction, as reflected in its impressive Claim Settlement Ratio (CSR) of 99.02% in FY 2023-24. With its comprehensive insurance products, SBI Life caters to the unique needs of individuals and groups, providing financial security and peace of mind.

In this article, we will explore the process of applying for SBI Life Insurance, including the different plans available, eligibility requirements, and the necessary steps to secure this important financial protection for yourself and your loved ones.

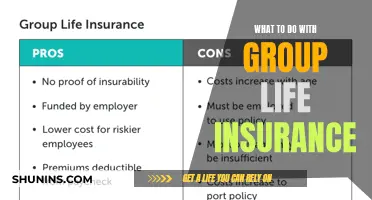

| Characteristics | Values |

|---|---|

| Year Established | 2001 |

| Company Type | Private life insurance company |

| Insurance Types | Term insurance, savings, pension, child, health, protection, retirement, wealth creation, money-back, corporate solutions, group loan protection, group micro insurance |

| Customer Support | 24/7 through website and toll-free helpline |

| Mobile App | SBI Life Smart Care App |

| Claim Settlement Ratio (2023-24) | 99.02% |

| Awards | Life Insurance Company of the Year 2019 (FICCI), Customer Orientation in Life Insurance 2021 (Outlook Money Awards), India CSR Leadership Award 2024 |

| Premium Payment Options | Online, SBI Life Easy Access mobile app, State Bank Group ATMs, NACH, ECS, direct remittance at SBI Life branches, Point of Sale (POS) terminals at select branches |

| Grace Period for Premium Payment | 30 days for quarterly, half-yearly, and yearly payments; 15 days for monthly payments |

What You'll Learn

Online application process

SBI Life Insurance offers a range of insurance products that can be purchased online, including term insurance, savings, pension, and child insurance plans. Here is a step-by-step guide to the online application process:

Step 1: Visit the SBI Life Insurance Website

Go to the official website of SBI Life Insurance. On the homepage, you will find various insurance plans offered by the company. You can browse through the different types of insurance, such as protection plans, savings plans, retirement plans, and child plans. Each plan will have detailed information about the coverage, benefits, eligibility, and premium range.

Step 2: Choose Your Desired Insurance Plan

Select the insurance plan that best suits your needs and requirements. Carefully review the terms and conditions, benefits, and premium payment options before making your choice. SBI Life Insurance offers a wide range of plans, including:

- Term Life Insurance Plans: These provide coverage for a specific period and offer financial protection to your loved ones in case of any unforeseen circumstances.

- Savings Plans: SBI Life offers savings plans that help you secure your short-term and long-term financial goals, providing both protection and savings options.

- Retirement/Pension Plans: These plans are designed to secure your financial independence during retirement, ensuring you can meet your financial needs even without a regular income.

- Child Plans: SBI Life's child plans help secure your child's future by providing funds for their education, milestone events, or other aspirations.

Step 3: Provide Personal and Payment Information

Once you have selected your desired insurance plan, you will need to provide personal information, such as your name, date of birth, address, and contact details. You will also need to choose your preferred premium payment option, including the frequency of payments (monthly, quarterly, half-yearly, or yearly) and the duration of the payments.

Step 4: Review and Confirm Your Application

Before submitting your application, carefully review all the information you have provided, including your personal details and payment preferences. Ensure that you understand the terms and conditions of the insurance plan and any additional benefits or riders you have selected.

Step 5: Complete the Purchase

Finally, complete the purchase by following the online payment process. SBI Life Insurance offers multiple payment options, including online payments through their website, the SBI Life Easy Access mobile app, state bank group ATMs, direct remittance at SBI Life branches, and more.

It is important to note that SBI Life Insurance offers a free look period of 30 days for online policies. During this period, you can review the policy terms and conditions and cancel or return the policy if you are dissatisfied. Additionally, SBI Life provides 24/7 customer support through its website and a toll-free helpline to assist you with any queries or concerns you may have during the application process.

Fidelity Life Insurance: Physical Exam Requirements and Details

You may want to see also

Required documents

When applying for an SBI Life Insurance plan, you will need to submit several documents to the insurance company. Here is a detailed list of the required documents:

- Job card allotted by NREGA (National Rural Employment Guarantee Act) and completely signed by the State Government. This document helps to verify your employment status and income details.

- The letter allotted by the Unique Identification Authority of India (UIAI) or the National Population Register, which contains personal information such as your address, name, and Aadhar number. This is necessary for identity verification.

- Property tax or Municipal receipt as proof of residence. This document should be recent and include your name and current address.

- Utility bills such as water, electricity, piped gas, or a post-paid mobile phone bill. These should be from the last two months and display your name and address.

- Bank account or post office savings statement. This document helps verify your financial status and ability to pay premiums.

- Allotment letter of accommodation from your employer, issued by a state or central government body. This provides additional proof of your employment and residence.

- Orders of pension payment or family pensions allotted to retired persons by government departments or public sector undertakings. This is only necessary if you are retired and receiving a pension.

Make sure you have these documents readily available when applying for SBI Life Insurance to ensure a smooth application process.

Beneficiary Life Insurance: Taxable or Not?

You may want to see also

Payment methods

SBI Life Insurance offers a range of payment methods for customers to choose from when paying their premiums. These methods include:

- Online payments through the SBI Life website

- SBI Life Easy Access mobile app

- State Bank Group ATMs

- NACH (National Automated Clearing House)

- ECS (Electronic Clearing Service)

- Direct remittance at SBI Life branches

- Point of Sale (POS) terminals at select branches

Each of these payment options provides convenience and flexibility for customers to manage their premium payments. It is worth noting that the NACH service requires registration and the completion of a form before it can be used.

Health and Life Insurance Exam: Challenging or Easy?

You may want to see also

Premium payment frequency

SBI Life Insurance offers flexible premium payment frequencies, allowing customers to choose the option that best suits their financial situation and preferences. Here are the details of the premium payment frequencies available:

Monthly Premium Payments

SBI Life Insurance provides the option of paying premiums on a monthly basis. This can be a convenient choice for individuals who want to spread out their payments over the year. It offers a more manageable way to pay for insurance, especially for those who prefer regular, smaller payments.

Quarterly Premium Payments

For those who want to pay their premiums at regular intervals but less frequently than monthly, SBI Life Insurance offers quarterly premium payments. This option allows customers to make payments every three months, which can be a more convenient and budget-friendly alternative to monthly payments.

Bi-Annual Premium Payments

The bi-annual premium payment option enables customers to pay their premiums twice a year. This semi-annual payment schedule can be a good middle ground between monthly and annual payments, providing a balance between payment frequency and convenience.

Annual Premium Payments

SBI Life Insurance also gives customers the choice to pay their premiums on a yearly basis. This option may appeal to those who prefer to make a single payment for the entire year, reducing the number of transactions and providing a clear overview of their annual insurance expenditure.

It is important to note that SBI Life Insurance offers a grace period for premium payments. This grace period is typically 15 days for monthly premiums and 30 days for quarterly, half-yearly, and yearly premium payments. No interest is charged during this grace period; however, late payments beyond this time may result in penalties or cause the policy to lapse.

Additionally, SBI Life Insurance provides multiple payment methods, including online payments through their website, the SBI Life Easy Access mobile app, State Bank Group ATMs, direct remittance at branches, and more, ensuring convenience and flexibility for their customers.

Drug Addiction and Life Insurance: What's the Verdict?

You may want to see also

Claim settlement

SBI Life Insurance has a quick and hassle-free claim settlement process. Here is a detailed breakdown of the steps involved:

Step 1: Claim Intimation

The first step is to inform SBI Life Insurance about the claim. This can be done online by visiting the 'Claims and Maturity' section of the SBI Life Insurance website, or by submitting the filled claim form along with the required documents at the nearest SBI Life branch. You can also intimate your claim via email.

Step 2: Document Submission

After reporting the claim, the policyholder needs to submit the relevant documents. These can be sent to the SBI life insurance email address or submitted at a nearby branch. The required documents include:

- Original policy document

- Original or attested death certificate issued by the local authority

- Claimant's current address proof

- Claimant's photo ID proof

- Claimant's bank statement or cancelled cheque with a pre-printed name and account number

Additional documents may be requested, such as a medical attendant's certificate, hospital treatment certificate, employer's certificate (for salaried individuals), and a copy of the FIR/panchnama report/post-mortem report.

Step 3: Decision and Settlement

Once the documents are submitted, the claim is assessed based on the information provided. If the claim is approved, the settlement amount will be released as per the terms and conditions of the policy. The entire claim settlement process is designed to be quick, with a turnaround time of 30 working days from receiving the valid documents.

SBI Life Insurance also provides dedicated customer support throughout the process. Their team can be reached via email or by visiting the nearest branch for any queries or assistance.

Life Insurance: Millions of Americans Are Underinsured

You may want to see also