Chiropractic care is often sought after a car accident, especially for back and neck injuries. The cost of this treatment is usually covered by insurance, but it's important to understand how billing and insurance coverage work in this situation. The first step is to determine whether your car insurance or medical insurance covers chiropractic treatment, and then to understand the specific coverage and limitations of your insurance plan. This can include deductibles, co-pays, and co-insurance, which influence your out-of-pocket expenses. It's also crucial to seek immediate medical attention and consult with a chiropractor to assess and document any injuries, as this documentation is essential for insurance reimbursement.

| Characteristics | Values |

|---|---|

| When to seek chiropractic treatment | As soon as possible after the accident |

| Who pays for chiropractic treatment | The person at fault for the accident, or their insurance company |

| What to do first | Call local law enforcement, then your car insurance company |

| What to ask your insurance company | Whether your policy covers chiropractic care, and how much coverage you have in "Med Pay" |

| What to do if your insurance company doesn't cover chiropractic care | Check if your regular medical insurance does |

| How to get reimbursed | File a medical claim, not just an accident claim |

| What to do if the insurance company disputes your claim | Consult a personal injury attorney |

| What to do if you can't afford the treatment | Some chiropractors will work on a medical lien, meaning they will wait for payment until your injury case is settled |

What You'll Learn

Personal Injury Protection (PIP) insurance

PIP insurance covers the financial costs of recovering from an auto accident, including hospitalization and other medical bills, lost wages if you are unable to work, accidental death and funeral expenses, transportation costs for medical appointments, and childcare or house cleaning services. It is important to note that PIP does not cover physical damage to vehicles, damage to someone else's property, vehicle theft, or injuries to other vehicles or their passengers.

The recommended coverage and minimum limits for PIP insurance vary by state, typically ranging from $2,500 to $50,000. In some states, such as Delaware, Florida, and Hawaii, PIP insurance is required, while in others, such as Arkansas, Maryland, and Texas, it is optional. Even when it is not required, purchasing PIP insurance is advisable, especially if you have limited or no health coverage.

When dealing with insurance companies, it is important to remember that your health insurance company may be entitled to reimbursement for their contribution to your medical bills. It is also crucial to avoid conversations with the at-fault party's insurance company, as they may try to prove that your injuries were not related to the crash. Consulting with a personal injury attorney can be beneficial to guide you through the complex process and ensure your medical bills are considered in the settlement negotiations.

Florida Auto Insurance: Cracked Windshield Conundrum

You may want to see also

Medical claims

Understanding Medical Claims for Chiropractic Care

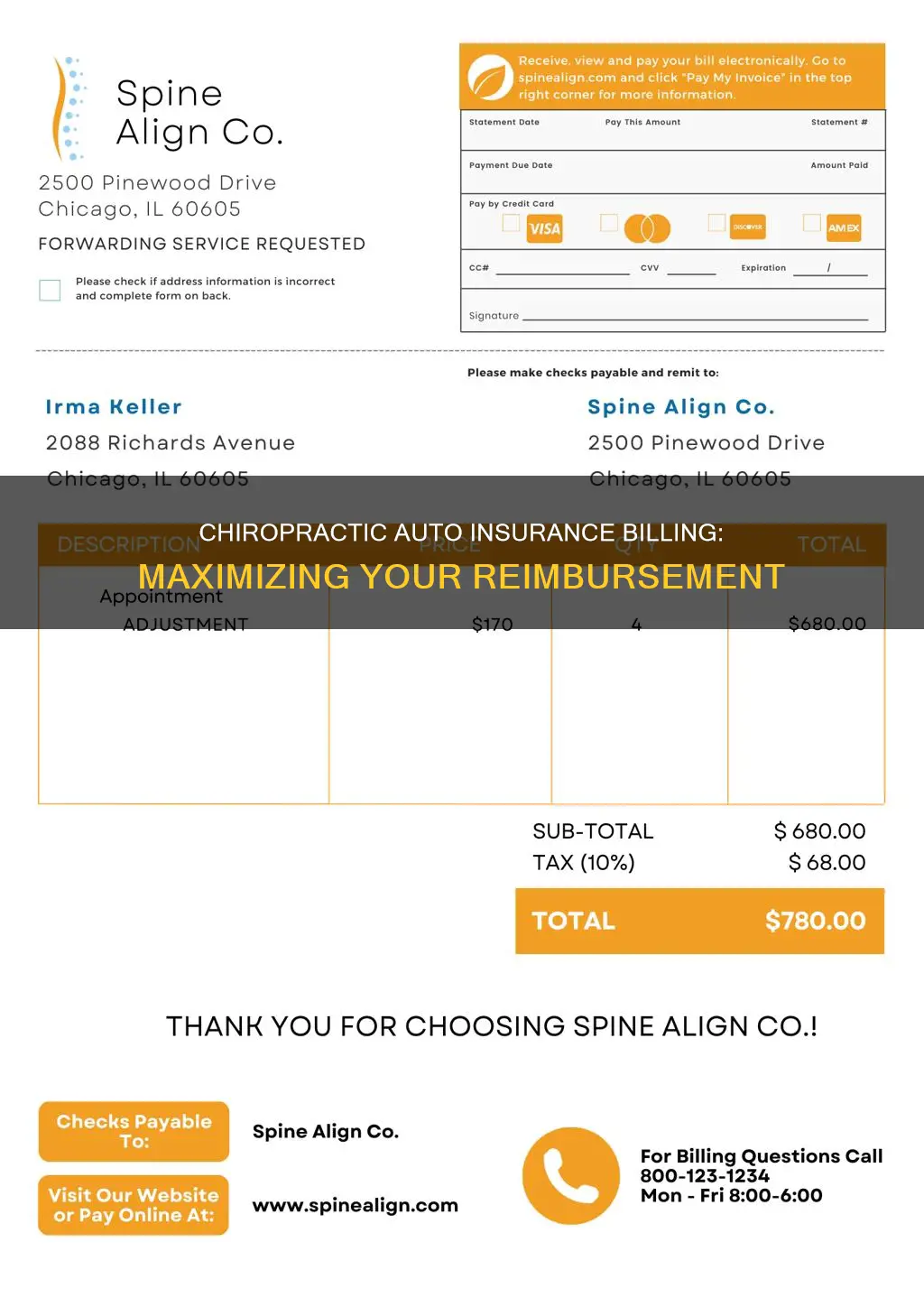

Chiropractic care is often sought after a car accident, especially for neck and back injuries. To ensure coverage, it's important to file a medical claim with the auto insurance company. This is separate from an accident claim, which deals solely with damage to the vehicles. When interacting with the insurance company, inquire about their "Med Pay" coverage, which is specifically designated for medical bills following an accident. Understanding their payment structure is also crucial; some companies pay as you receive treatment, while others wait until the end of your treatment.

Proving Medical Expenses

To ensure that your chiropractic expenses are covered, it's important to prove that your medical expenses were necessary for your recovery. Proper documentation is key in this process. Detailed narratives and daily reports that outline your specific symptoms, treatments provided, and costs incurred for each treatment will strengthen your claim. It's also important to seek medical attention promptly after an accident, as delays in care can make it more challenging to establish a direct link between your injuries and the accident.

Dealing with Insurance Companies

When dealing with insurance companies, it's important to recognize that they may dispute charges or deny coverage. They may argue that chiropractic visits were not necessary, leaving you responsible for the bills. In such cases, having a personal injury attorney can be beneficial. An attorney can fight for your rights and ensure you receive compensation for all necessary medical treatments, including chiropractic care.

Utilizing Chiropractic Billing Software

To streamline the billing process and reduce manual errors, consider utilizing chiropractic billing software. This software can automate various tasks, such as linking SOAP note macros to charge codes, securely billing and posting insurance payments, and staying up to date with industry regulations. It also helps to ensure timely payment by verifying patients' coverage and identifying the correct billing and CPT (Current Procedural Terminology) codes.

Billing the Insurance Company

Billing the insurance company involves several critical steps. Firstly, check the patient's eligibility and coverage for your chiropractic services. Then, ensure accurate and comprehensive patient documentation, as even a small mistake can lead to a claim denial. Utilizing managed billing services can provide expert assistance in this area. Finally, it's crucial to file claims on time to avoid denials and receive reimbursements promptly.

Auto Insurance: Removing Exclusions

You may want to see also

In-network vs out-of-network providers

Chiropractic care offers a holistic approach to health, focusing on the body's natural ability to heal and function optimally. While chiropractic services are not considered an "essential health benefit" under the Affordable Care Act, some individuals may still seek coverage for such treatments under their health insurance plans. When considering in-network versus out-of-network providers for chiropractic care, there are several key factors to keep in mind.

In-network providers have contracted with your insurance company to accept negotiated rates for their services. These rates are typically discounted, resulting in lower out-of-pocket costs for individuals seeking treatment. To become an in-network provider, doctors and facilities must meet certain credentialing requirements and agree to the discounted rates set by the insurance company. This means that when you visit an in-network chiropractor, you can expect to pay less, as the insurance company has already negotiated the rates on your behalf.

On the other hand, out-of-network providers have not agreed to any discounted rates with your insurance company. This means that they can charge you the full price for their services, which is usually much higher than the in-network discounted rate. When you visit an out-of-network chiropractor, you may be responsible for paying the difference between what your insurance plan covers and the provider's full charge. Additionally, out-of-network providers may work with out-of-network labs and facilities, which can further increase the overall cost of your treatment.

When deciding between in-network and out-of-network chiropractic care, it is important to consider the potential impact on your finances. Out-of-network costs can add up quickly, even for routine care. If you have a preferred chiropractor, it is worth consulting them about their participation in your insurance network. Additionally, reviewing your insurance policy and contacting your insurance provider can help you understand the specifics of your coverage and identify in-network chiropractors.

While in-network providers typically offer more affordable options, there may be instances where individuals prefer to seek out-of-network care. For example, an out-of-network chiropractor may offer a flat fee for services, making it a more affordable option than the co-payments associated with in-network care. Additionally, out-of-network chiropractors are not restricted by the insurance company's dictated number of visits, allowing them to provide care based on individual patient needs.

BMO's Auto Insurance: What You Need to Know

You may want to see also

Deductibles, co-pays, and co-insurance

When it comes to billing auto insurance for chiropractic care, understanding deductibles, co-pays, and co-insurance is crucial. Here's a comprehensive guide:

Deductibles

A deductible is a specific amount of money that you must pay out-of-pocket before your insurance company starts covering your medical expenses. In the context of chiropractic care, you usually need to meet your deductible before receiving coverage for these services. Different types of insurance plans have different deductibles. Generally, the higher your monthly premium, the lower your annual deductible. If you opt for a high-deductible health plan, consider enrolling in a gap health insurance plan to receive coverage for chiropractic visits before reaching your deductible.

Co-pays and Co-insurance

Co-pays and co-insurance are important components of understanding the billing process for chiropractic care. A co-pay, or copayment, is a fixed amount you pay per visit, while co-insurance is a percentage of the cost of your care that you are responsible for paying. These out-of-pocket expenses can vary depending on your insurance plan and the specifics of your coverage. It's important to review your insurance policy to understand your financial responsibility when seeking chiropractic treatment.

Maximizing Your Benefits

To make the most of your insurance coverage for chiropractic care, there are several strategies you can employ:

- Review your policy annually: Insurance plans and benefits can change from year to year. Stay up-to-date on what's covered and any changes that may impact your chiropractic care.

- Keep records: Maintain detailed records of your chiropractic visits, treatments, and communications with your insurance company. This documentation can be crucial for resolving billing issues or disputes.

- Pre-authorization: Some insurance plans require pre-authorization for chiropractic care. Ensure you have all the necessary approvals in place before starting treatment to avoid unexpected costs.

- Utilize preventive care: Take advantage of preventive care visits if your insurance plan covers them. Regular chiropractic check-ups can help maintain your health and prevent more serious issues, often falling under preventive benefits.

- Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs): If you have an FSA or HSA, use these pre-tax funds to pay for chiropractic care. This can reduce your overall healthcare costs and make your treatment more affordable.

By understanding deductibles, co-pays, and co-insurance, as well as maximizing your benefits, you can effectively navigate the billing process for chiropractic care and ensure you receive the treatment you need without unexpected financial burdens.

Hippo: Your One-Stop Shop for Auto Insurance?

You may want to see also

Insurance company payment structures

When it comes to billing auto insurance for chiropractic care, understanding the insurance company's payment structure is crucial. These structures can vary, and knowing what to expect can help you navigate the claims process effectively. Here is an overview of the different payment structures you may encounter:

Payment During Treatment:

Some insurance companies will pay for your chiropractic treatment as you receive it. This means that they will cover the costs of each visit to the chiropractor as you undergo treatment. This can be helpful as it ensures that you don't have to bear the financial burden of the full treatment cost upfront. However, it's important to note that not all insurance companies operate this way.

Payment Upon Discharge:

Alternatively, some insurance companies will wait until the end of your treatment to make a payment. This means that they will cover the costs only after you have completed your treatment and are "discharged" from the auto case. Discharge typically occurs when you have reached your pre-accident status or achieved the point of "maximum medical improvement," which is the best condition you can attain given the injuries sustained. This payment structure can result in out-of-pocket expenses during treatment, but it ensures that the insurance company covers the costs once your treatment is concluded.

Med Pay Coverage:

Med Pay, or Medical Payments Coverage, is a feature offered by many car insurance companies. It is essentially a small health insurance policy that covers a portion of your medical bills, including co-pays and deductibles, following an accident. Med Pay can be extremely useful in covering chiropractic treatment costs, and it is often recommended by attorneys. However, it is important to note that Med Pay does not replace normal health insurance and is specifically intended for accident-related expenses.

Health Insurance Reimbursement:

In some cases, your health insurance company may pay for all or part of your chiropractic treatment costs. However, they may be entitled to reimbursement for their contribution. It is crucial to carefully review your health insurance policy to understand if and when reimbursement is expected. This can help you avoid unexpected expenses down the line.

Liability Insurance Coverage:

If another party is found to be at fault for the accident, their liability insurance may cover your chiropractic treatment costs. The coverage provided will depend on the policy limits, deductibles, and the severity of your injuries. In such cases, a skilled attorney can be invaluable in negotiating with the insurance company to ensure you receive adequate compensation.

Understanding the insurance company's payment structure is essential to navigating the financial aspects of your chiropractic treatment after a car accident. Each company's structure may vary, so be sure to review your policy carefully and consult with professionals, such as experienced personal injury attorneys, to explore the best options for your specific situation.

Auto Insurance: Protecting Your Assets

You may want to see also

Frequently asked questions

One of the first things you should do after a car accident is to call your car insurance company. They will ask if you have been injured and you can let them know that you would like to be evaluated by a chiropractor. Ask about their coverage for this and they should be able to go over your benefits with you. If your car insurance does not cover chiropractic care, most medical insurance plans do.

If you have personal injury protection (PIP) or medical payments coverage (MedPay) on your insurance, it may cover chiropractic treatment. This coverage applies regardless of fault. If the other driver is at fault and has liability insurance, their insurance may also cover your chiropractic treatment.

You will need to provide your insurance card and information about your insurance coverage and benefits. This includes your car insurance declaration page, health insurance information, and proof of residency.