Group term life insurance is a type of insurance that covers multiple people under a single contract. It is typically offered by an employer as part of an employee benefits package, providing financial security at an affordable price. While the specific economic benefit of group term life insurance can vary depending on several factors, it generally offers a cost-effective way to provide financial protection for employees and their families.

The economic benefit of group term life insurance can be calculated by considering factors such as the number of employees covered, the amount of coverage provided, the cost of premiums, and any applicable tax implications. Employers can also offer additional coverage options, such as supplemental insurance, which may impact the overall economic benefit.

It's important to note that group term life insurance is typically temporary and may not provide permanent coverage. Additionally, the availability and specifics of group term life insurance can vary based on the employer and the insurance provider.

| Characteristics | Values |

|---|---|

| Type of insurance | Temporary |

| Who is it for? | A group of people, usually employees of a company |

| Who provides it? | An employer or a group (e.g. a union) |

| How long does it last? | A certain amount of time, in contrast to permanent insurance |

| Payout | A lump sum to the deceased's beneficiaries |

| Cost | Relatively inexpensive compared to individual life insurance |

| Coverage | Typically tied to the covered employee's annual salary |

| Tax implications | Up to $50,000 of coverage per employee is tax-free; additional coverage is taxable |

| Enrollment | Employees are typically automatically enrolled in the base coverage |

| Medical exam | Not usually required |

What You'll Learn

Calculating the taxable benefit of group term life insurance

Group term life insurance is a type of temporary life insurance where one contract is issued to cover multiple people. It is usually provided by an employer to their employees as part of a benefits package. This type of insurance is relatively inexpensive compared to individual life insurance, and participation rates tend to be high.

In the United States, the Internal Revenue Code (IRC) Section 79 provides an exclusion for the first $50,000 of group-term life insurance coverage provided by an employer. This means that there are no tax consequences if the total amount of coverage does not exceed $50,000. However, if the coverage exceeds this amount, the imputed cost of coverage must be included in the employee's income and is subject to Social Security and Medicare taxes. This is known as a taxable fringe benefit.

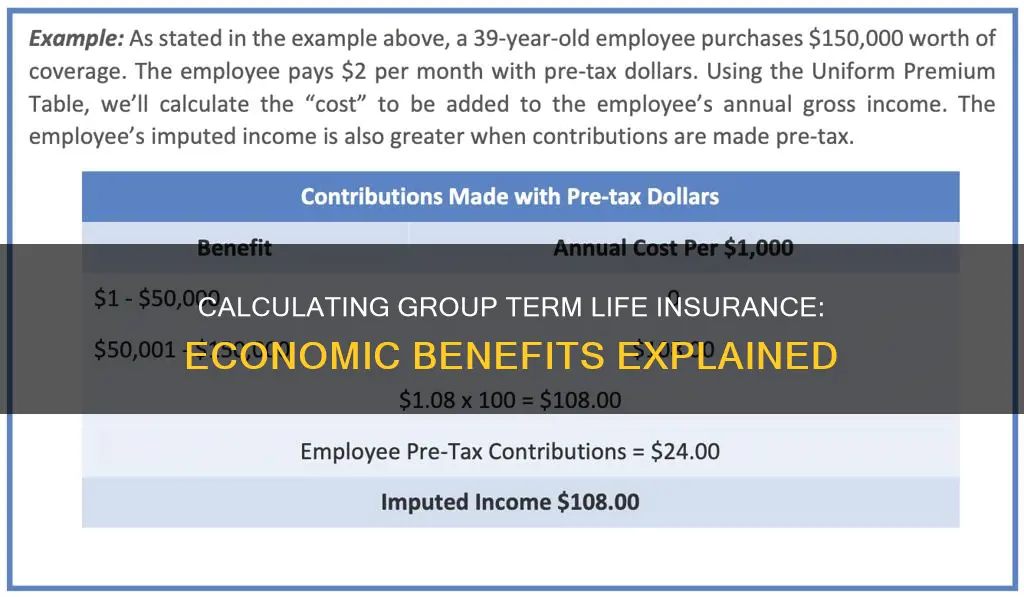

To calculate the taxable benefit of group term life insurance, you need to determine the cost of coverage that exceeds $50,000. This can be done by referring to the IRS Premium Table, which provides rates based on age groups. The taxable portion of the premiums for coverage above $50,000 must be calculated and included in the employee's gross income for federal income tax and Federal Insurance Contributions Act (FICA) purposes.

It is important to note that the determination of whether the premium charges are affected by the employer's subsidizing or redistributing role is based on the IRS Premium Table rates, not the actual cost. This calculation ensures that employees are taxed appropriately on the benefit they receive from their employer-provided group term life insurance coverage.

Life Insurance Options for the Over 80s

You may want to see also

Tax benefits for employers

Group term life insurance is a type of temporary life insurance that covers multiple people under one contract. It is usually offered by employers as part of a benefits package. While group term life insurance is often provided at no cost to employees, it can also be offered as an optional extra that employees can purchase for themselves and their families.

Group term life insurance is a tax-efficient way for employers to provide a valuable benefit to their employees. Under IRC section 79, the first $50,000 of group-term life insurance coverage provided by an employer is excluded from taxation. This means that there are no tax consequences for the employer or the employee if the total amount of coverage does not exceed $50,000.

If the coverage exceeds $50,000, a taxable fringe benefit arises, and the imputed cost of coverage must be included in the employee's income, using the IRS Premium Table. This excess coverage is subject to Social Security and Medicare taxes.

It is important to note that a policy is considered "carried" by the employer if they pay any cost of the insurance or arrange premium payments, even if employees pay the full cost charged. Therefore, employers should be mindful that providing group term life insurance coverage over $50,000 will likely result in tax consequences for their employees.

Additionally, if an employer provides group-term life insurance coverage for an employee's spouse or dependent, the cost is not taxable to the employee if the face amount of the coverage does not exceed $2,000. This is considered a de minimis fringe benefit.

By taking advantage of the tax exclusion for the first $50,000 of coverage, employers can offer a valuable benefit to their employees at a relatively low cost. Group term life insurance is generally inexpensive, especially for younger employees, and can be a great way to attract and retain talent.

Whole Life Insurance: Guaranteed Protection for Your Loved Ones

You may want to see also

Calculating the economic benefit of a split-dollar policy

Split-dollar life insurance is a strategy that allows the sharing of the cost of a premium for a permanent life insurance policy. It is often a key part of an executive compensation package and can benefit both the employer and employee. A split-dollar plan is a contract that details how the premium, cash value, and death benefit of a life insurance policy will be split between the two parties.

There are two types of split-dollar life insurance plans: economic benefit arrangements and loan arrangements. In this response, I will focus on the economic benefit arrangement and how to calculate its economic benefit.

Economic Benefit Arrangement

Under the economic benefit arrangement, the employer owns the policy, pays the premium, and assigns certain rights and benefits to the employee. The employee can designate beneficiaries who will receive a portion of the policy's death benefit. The value of the economic benefit the employee receives is calculated each year. This calculation is done by determining the value of the life insurance provided, which is based on the IRS Premium Table or the insurance company's rates.

Taxation

The premium payments made by the employer are considered taxable benefits to the employee. The employee must pay taxes on the value of their portion of the death benefit, insurance coverage, and any accrued cash value. The IRS has specific rules governing the taxation of split-dollar plans, ensuring that both parties understand their tax obligations.

Termination

Split-dollar plans are typically terminated in two ways: at the employee's death or at a future date included in the agreement, often retirement. Upon the employee's death, the employer recovers their costs, and the remaining balance is paid to the employee's beneficiaries as a tax-free death benefit.

Benefits

The economic benefit arrangement offers benefits to both employers and employees. Employers can choose the recipient of the benefit and the amount, as well as when the benefit is given. They can also recoup their costs when the employee leaves or passes away. Employees benefit from reduced costs, as the employer pays the bulk of the premiums. Depending on the plan structure, the employee may also end up with full ownership of the policy, allowing them to make tax-efficient loans and withdrawals.

Calculating the Economic Benefit

To calculate the economic benefit of a split-dollar policy, several factors need to be considered:

- The value of the life insurance provided: This is determined by the IRS Premium Table or the insurance company's rates and is based on factors such as age, health, and policy features.

- The portion of the premium paid by the employer: This is the amount the employer contributes towards the premium, which reduces the cost for the employee.

- The death benefit and cash value split: The agreement should specify how the death benefit and cash value will be divided between the employer and employee.

- The period of coverage and termination: The agreement should outline how long the plan will be in effect and under what circumstances it can be terminated.

- Tax implications: The premium payments made by the employer are taxable benefits for the employee, so the taxes on these benefits need to be calculated and considered.

By considering these factors and calculating the value of the benefits provided to the employee each year, the economic benefit of a split-dollar policy can be determined. This calculation is essential for both parties to understand the value exchanged and the tax obligations associated with the plan.

Get a Life Insurance License: Texas Requirements Guide

You may want to see also

Tax consequences of group term life insurance

Group term life insurance is a type of temporary life insurance that covers multiple people under a single contract. It is often provided by employers as part of a benefits package. While the first $50,000 of group term life insurance coverage provided by an employer is excluded from taxable income, any amount exceeding this threshold becomes taxable. This is known as a "taxable fringe benefit" and must be included in the employee's income, subject to Social Security and Medicare taxes. This is true even if the employees are paying the full cost of the insurance.

The taxable amount is determined using the IRS Premium Table, which sets rates based on age groups, rather than the actual cost of the insurance. This can result in a higher tax burden for older employees, as the amount of taxable income attributed to them may be higher than the premium they would pay for comparable coverage under an individual policy.

If you have group term life insurance as part of your benefits package and the coverage exceeds $50,000, you will be taxed on the excess amount. This will be included in your taxable wages reported on Form W-2, specifically in Box 12 with the code "C". You are responsible for paying federal, state, and local taxes on this amount, as well as the associated Social Security and Medicare taxes.

To avoid being taxed on the excess coverage, some employers may offer a "carve-out" plan, where they provide $50,000 of group term insurance (which is tax-free) and then offer an individual policy or a cash bonus to cover the remaining balance.

Life Insurance: Managing Risk, Securing Future

You may want to see also

Group term life insurance as a retention benefit

Group term life insurance is an important type of employee benefit that provides financial security at an affordable price. It is a type of temporary life insurance in which one contract is issued to cover multiple people. Typically, this is offered by an employer as part of a benefits package. Group term life insurance is usually inexpensive, and participants are automatically enrolled without needing to go through an underwriting process.

Group term life insurance can be a powerful retention benefit, as it provides employees with important coverage that they might not otherwise be able to afford. According to a survey, 44% of workers said that a life insurance benefit was very or extremely important to them or their families. This makes group term life insurance an attractive benefit that can help recruit and retain top talent.

The standard amount of coverage is usually tied to the covered employee's annual salary, with premiums primarily based on the insured's age. Employers typically pay most or all of the premiums for basic coverage, and additional coverage can be purchased by the employee for an extra premium.

Group term life insurance is a fantastic benefit for employees, as it provides financial protection for their families in the event of their death. It is also beneficial for employers, who can use it as a tool to attract and retain talented employees without significantly increasing their expenses.

However, it is important to note that group term life insurance is temporary and may not provide sufficient coverage for all employees' needs. It is often recommended to combine group term life insurance with an individual life insurance policy to ensure adequate protection.

Group Life Insurance: Annual Renewal Options Explained

You may want to see also

Frequently asked questions

Group term life insurance is a type of temporary life insurance in which one contract is issued to cover multiple people. It is often provided by an employer as part of a benefits package, but it can also be sold by associations and professional organisations.

Group term life insurance is a cost-effective way for employers to provide financial security to employees and their families. It is also a good way to attract and retain talent, as it is a highly valued benefit. For employees, it provides access to financial protection at an affordable price, without the need for a medical exam or underwriting.

The first $50,000 of group-term life insurance coverage provided by an employer is tax-free. Any amount above this must be recognised as a taxable benefit and included on the employee's W-2 form.

The economic benefit amount is the value of the life insurance protection. It is measured using a number of factors, including the type of split-dollar arrangement, the date the arrangement was entered into, the type of life insurance policy, and the rate table used. You can use the IRS Premium Table to calculate the taxable portion of the premiums for coverage that exceeds $50,000.