State Farm is one of the best-known car insurance companies, but there are many reasons why you might want to cancel your policy and switch to another insurer. Fortunately, State Farm makes it easy to cancel your auto insurance policy, and you can do so at any time, for any reason. In this article, we'll take you through the steps to cancel your State Farm car insurance, as well as some considerations to keep in mind before making the switch.

| Characteristics | Values |

|---|---|

| Cancellation methods | Phone, mail, in person |

| Cancellation time | Immediate or specified date |

| Information required | Name, date of birth, policy number, address, phone number, new insurer's name, policy number, policy start date, proof of vehicle sale/plate forfeiture |

| Cancellation confirmation | Yes |

| Cancellation fee | No |

| Refund | Pro-rated refund if prepaid |

| Auto policy cancellation number | 800-STATEFARM |

| Mailing address | Corporate Headquarters, State Farm Insurance, One State Farm Plaza, Bloomington, IL 61710 |

What You'll Learn

Cancelling by phone

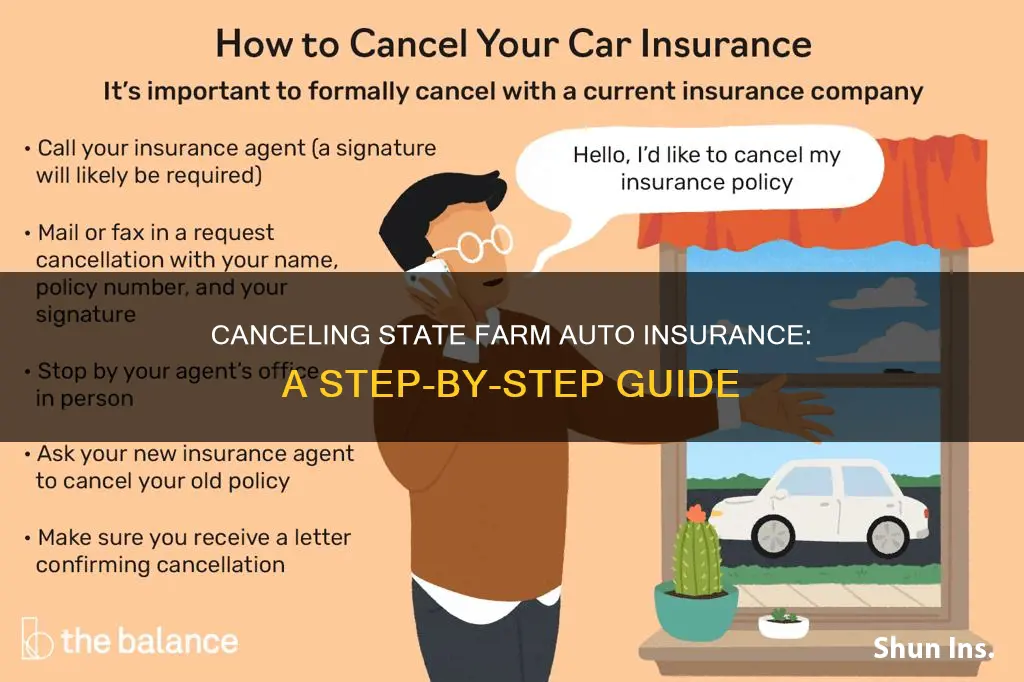

To cancel your State Farm auto insurance by phone, you can follow these steps:

Step 1: Find the contact details of your local State Farm agent.

You can use State Farm's website to find a local agent's contact information. If you have an auto insurance policy, you can also call 800-STATEFARM (800-782-8332).

Step 2: Provide the necessary details to look up your policy.

Be prepared to provide your full name, date of birth, and policy number. If you are cancelling because you sold your car, you may also need to provide a bill of sale or proof that you turned in your license plate.

Step 3: Specify the date of cancellation.

You can choose to cancel your policy immediately or select a future date. If you are switching to a new insurer, you may need to provide the name of the new insurance company, the start date of the new policy, and the new policy number.

Step 4: Notify the Department of Motor Vehicles (DMV) if required.

In some states, you are mandated to inform the DMV of any changes to your car insurance policy. Your insurance agent should be able to tell you whether this is necessary.

Step 5: Confirm your cancellation.

Make sure you receive a confirmation of your cancellation, which may come in the form of an email or printout from your insurance agent. This confirmation should include details about which policy was cancelled, as well as the effective date of the cancellation. Remember to also stop any automatic payments you may have set up.

Add Your Vehicle to Direct Auto Insurance

You may want to see also

Cancelling by mail

To cancel your State Farm auto insurance by mail, you need to follow several steps to ensure that your policy is cancelled as expected. Firstly, you must decide on a date when you want your policy to end. You must then mail your cancellation letter at least two weeks before that date. This will allow enough time for delivery and processing.

Your letter should include your name, address, phone number, and insurance policy number. You should also specify the date you want your policy to end. If you are switching to a new insurer, include that company's name, the date your new policy will begin, and the new policy number. If you are cancelling because you sold your vehicle, you may also need to include a bill of sale or proof of plate forfeiture. Be sure to sign and date your letter.

Mail your letter to the following address:

Corporate Headquarters

State Farm Insurance

One State Farm Plaza

Bloomington, IL 61710

It is important to note that you cannot cancel your State Farm auto insurance policy online. You can, however, also cancel your policy by phone or in person.

Canceling Gainsco Auto Insurance: A Step-by-Step Guide

You may want to see also

Cancelling in person

To cancel your State Farm auto insurance in person, you will need to follow a few steps.

Firstly, find your local State Farm agent. You can use State Farm's online tool to find agents in your area if you are unsure of whom to contact.

Secondly, gather all the information you will need, including your contact details, policy number, and the date you want your coverage to end. If you are switching to a new insurer, you will also need to provide the name of the new company, your new policy number, and the start date of the new policy. If you have sold your car and no longer need coverage, you may also be required to provide a bill of sale or proof that you have turned in your license plate.

Thirdly, visit your local State Farm office and inform them of your cancellation. It is a good idea to contact your agent in advance to set up a time to come in.

Your cancellation can be effective immediately, or you can schedule it for a future date. Remember that if you have bundled policies with State Farm, such as home and car insurance, cancelling one of them may result in higher costs for the remaining policy. This is because you will lose the multi-policy discount.

Additionally, before cancelling your State Farm auto insurance, ensure that you have a new policy in place, as most states require drivers to have car insurance. Not having insurance can result in legal and financial troubles.

CSAA Auto Insurance: Understanding Motorhome Coverage

You may want to see also

What to do if you have bundled policies

If you have a home and car insurance bundle with State Farm and you cancel one of the policies, you may lose any discounts that come with having multiple policies with the same carrier. This could make your remaining policies more expensive.

If you are switching all your bundled policies to a new insurer, be sure to inform State Farm of all the types of coverage you are cancelling. However, if you are only switching one policy, consider the total costs of all your insurance coverage before making the switch. If another insurance provider offers you savings on your auto policy, but switching would make your homeowners or renters insurance more expensive, then it may not be the right move.

Auto Insurance Scoring: Unlocking the Calculation Mystery

You may want to see also

What to do if you've sold your car

If you've sold your car, there are a few important steps you should take to finalise the sale and ensure you're not liable for any future issues. Here's what to do:

Firstly, do a final check of the vehicle to ensure you haven't left any personal belongings behind. It's also a good idea to give the car a clean so the buyer receives it in good condition.

Next, obtain a bill of sale. This serves as proof that you've sold the car and includes details such as the vehicle's description, Vehicle Identification Number (VIN), sale date, purchase price, and the signatures of both the buyer and seller. While some states may not require a bill of sale, it's still a good idea to have one for your records in case any disputes arise in the future.

After this, you should obtain a "release of liability" from the DMV. This is an important step as it officially transfers legal responsibility for the car from you to the buyer. Most states require this to be done within 5 to 10 days of the sale, and failing to do so could result in a fine.

Once you've completed the above steps, you can proceed to cancel your auto insurance. Before doing so, ask your insurer about your options, as cancelling too soon could create risks. When cancelling your insurance, you may be required to provide certain documentation, such as a bill of sale or proof that you've cancelled your license plate. It's also important to note that if you have bundled policies with your insurance provider, cancelling your auto insurance could make your other policies more expensive.

Finally, remember to transfer or cancel any additional services associated with the car, such as electronic toll collection.

Bundling Home and Auto Insurance: The Progressive Advantage

You may want to see also

Frequently asked questions

You can cancel your State Farm auto insurance by phone, mail, or in person.

By phone: Call 800-STATEFARM and provide your name, date of birth, policy number, and cancellation date.

By mail: Send a letter with your name, address, phone number, policy number, and cancellation date to State Farm Insurance, One State Farm Plaza, Bloomington, IL 61710.

In person: Visit your local State Farm agent and provide your name, date of birth, policy number, and cancellation date.

In addition to the information above, you may need to provide proof of your vehicle's plate forfeiture or a bill of sale if you are cancelling because you have sold your vehicle.

The best time to cancel is on your policy renewal date to avoid any additional charges or fees.

No, State Farm does not allow you to cancel your insurance policy online.