If you want to check that your auto insurance is effective with the DMV, you will need to provide some information about yourself and your vehicle. This includes your basic contact information, driver's license number, insurance company (if applicable), license plate number, and vehicle identification number (VIN). You can then use a reputable site to perform an insurance check, or contact the DMV directly. In some states, you can check your insurance status online, but you will need a letter or order from the DMV relating to your auto liability insurance. In other states, you can log into an online portal to check your registration and insurance status.

| Characteristics | Values |

|---|---|

| How to check auto insurance | Contact the insurance company or sign into your online account |

| What to do if your insurance has lapsed | Check out a list of the best auto insurance companies that don't penalize for a lapse in coverage |

| What to do if you've been in an accident with another driver | Call the police to collect information and check if the other driver's car is insured |

| What to do if you're borrowing someone else's vehicle | Check the vehicle has the required auto insurance coverages |

| What to do if you're a business owner with company cars | Ensure your employees have car insurance coverage |

| What to do if you're divorcing | Keep an auto insurance policy on whichever car you get |

| What to do if you're driving students | Check that they have auto insurance coverage |

| How to verify auto insurance coverage | Collect relevant driver and vehicle information, then contact a reputable source like the insurance company, the police, or the DMV |

| Information required to verify auto insurance coverage | Basic contact information of the driver, driver's license number, insurance company, license plate number, and vehicle identification number (VIN) |

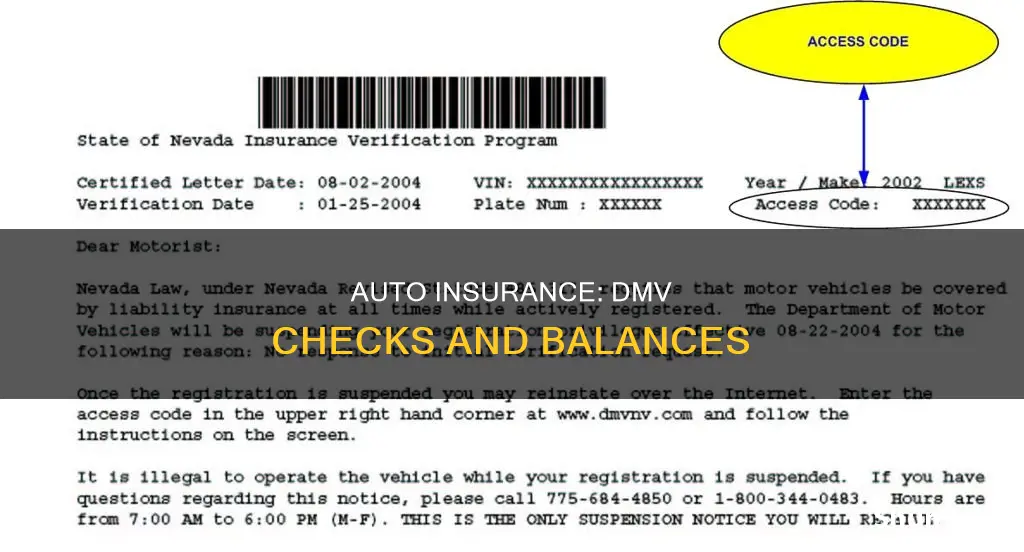

| How to check insurance status online | You will need a letter or order from the DMV related to your auto liability insurance, including the 10-digit document number and your vehicle plate number |

| How often to check insurance coverage | When borrowing a car, when you're a business owner with company cars, when divorcing, when driving students, when in an accident with another driver, or when worried your coverage has lapsed |

What You'll Learn

Contact the insurance company

If you want to check that your auto insurance is effective, you can contact your insurance company. This is a simple process, and you can either call your insurance company or log in to your online account to verify that your insurance coverage is still active. If you are calling, you will need your basic information, such as your name, address, and policy number. If you are logging in, you will just need your login information.

You can also contact your insurance company to check if another driver has valid insurance. If you have been in an accident with another driver, you will need to collect relevant driver and vehicle information. This includes the basic contact information of the driver, their driver's license number, their insurance company (if applicable), the license plate number of the car, and the vehicle identification number (VIN). Once you have this information, you can call the insurance company and provide them with the vehicle's details to verify the insurance coverage.

It is important to note that insurance information is not public record, and you usually need to show that you are requesting this information in relation to a collision involving the vehicle. If you are checking the insurance of another driver, you may need to provide a police report of the crash to prove you have a valid reason for the request.

Finance Firm Auto-Insurance Fees

You may want to see also

Ask the vehicle owner for proof of insurance

If you are checking whether another driver has insurance, you should ask them for proof of insurance. This could be in the form of an insurance card, which is often stored in the driver's glove compartment, or a copy of the declarations page (known as the "dec page"), which is usually received at the same time as the insurance card. Other options include a copy of the insurance binder signed by the licensed insurance agent or broker, a copy of the application for a state-specific insurance program, a copy of a letter from the insurance company, or an electronic view of the driver's information.

If you are the owner of the vehicle in question, you can verify your auto insurance coverage by calling your insurance company or logging into your online account. You will need your basic information and your policy number if calling, or just your login information if logging in online.

Leasing a Vehicle in Florida: Insurance Laws

You may want to see also

Check online

Checking your auto insurance status online is a straightforward process. However, the procedure may vary depending on your location. Here is a general guide on how to check your auto insurance online:

Gather the Necessary Information:

Before beginning the process, ensure you have the relevant driver and vehicle information. This includes basic contact information, the driver's license number, insurance company details (if applicable), the license plate number, and the Vehicle Identification Number (VIN).

Visit the Official DMV Website:

Go to the official website of your local DMV. Look for an option to check insurance status or verification. For example, in Nevada, you can log in to your MyDMV account to check your registration and insurance status.

Input Your Information:

Enter the information you gathered in the first step into the relevant fields on the DMV website. This may include your license plate number, VIN, and other personal details.

Review the Results:

After submitting your information, review the details provided by the DMV website. This should give you an up-to-date status of your insurance, including any lapses or issues.

Take Necessary Actions:

If there are no issues with your insurance, you're done! However, if there is a lapse in coverage or other problems, the DMV website should provide instructions on the next steps to take. This may include contacting your insurance company, updating your policy, or responding to any notices or letters sent by the DMV.

Remember that the specific steps and requirements may vary depending on your location, so it's always a good idea to refer to your local DMV's website or contact them directly for the most accurate and up-to-date information.

Dual Auto Insurance: Double the Coverage?

You may want to see also

Contact the DMV

If you want to check that your auto insurance is effective, one option is to contact the DMV. The Department of Motor Vehicles can verify insurance coverage, but you will need a police report of a crash to prove you have a valid reason to check another driver's coverage.

If you have received an order from the DMV about a lapse of liability insurance, you can check the status of your insurance online. You will need the letter or order from the DMV, which will include a 10-digit document number and your vehicle plate number. This cannot be done by mail, phone, or in a DMV office.

If you are in Nevada, you can check your insurance and registration status by logging into MyDMV. You can also update your policy information and address if necessary. If you have received a Verification Request or a Certified Letter regarding a lapse in coverage, you must respond within 15 days. If you have continuous coverage, the process ends. If not, your vehicle registration will be suspended, and you may not drive the vehicle on any public street.

If your registration is suspended, you may need to follow Reinstatement procedures. This may involve reinstating your registration in person at a DMV office, especially if you need a new license plate or a movement permit to drive the vehicle. You may also be required to maintain an SR-22 insurance policy.

Iranian Motorists and the Insurance Question

You may want to see also

Contact the police

If you want to check that a vehicle has auto insurance coverage, you can contact the police. This is especially important if you've been in an accident with another driver, or if the other driver isn't willingly offering their information. The police can check the validity of insurance using an electronic system connected to the DMV. They can also help to collect information and check insurance coverage in the event of an accident.

To verify auto insurance coverage for another driver, you will need to collect relevant driver and vehicle information. This includes the basic contact information of the driver, their driver's license number, their insurance company (if known), the license plate number of the car, and the vehicle identification number (VIN). If you are unable to collect this information, for example, in the case of a hit-and-run, it is best to call the police and file a crash report. This will help to ensure your claim is approved by adding validity to your claim, even without the other driver's information.

If you are checking the insurance coverage of your own vehicle, the process is much simpler. You can call your insurance company or sign into your online account to verify that your insurance coverage is still active. If you are calling, you will need your basic information, as well as your policy number. If you are logging in, you will just need your login information.

It is important to carry proof of insurance with you whenever you are driving. If you are stopped by the police, they will request your driver's license and proof of insurance. If you fail to provide proof of insurance, you will be issued a ticket for driving uninsured. If you are unable to provide proof of insurance, you may be able to provide the necessary documentation to the police department within a specified timeframe to avoid penalties. However, it is important to check the specific laws and regulations in your area.

In some states, the police can use equipment to verify if your car insurance policy is valid when you are stopped for a violation. For example, in California, insurance companies must electronically report all private-use vehicle liability policies to the DMV when a policy is issued or cancelled. Law enforcement can then electronically verify if a car is insured. Similarly, in Texas, insurance companies are required to submit policy information to a database called TexasSure, which includes vehicle registration information and insurance policy details. Law enforcement can then use this system to confirm whether a vehicle is insured by entering the license plate number.

Auto Insurance Subrogation: How Long Does It Take?

You may want to see also

Frequently asked questions

You can check if your auto insurance is effective by calling your insurance company or signing into your online account.

You will need your basic information and your policy number.

If you can't find your policy number, you can use your login information to sign into your online account.

If you don't have an online account, you can create one on your insurance company's website.

Yes, you can ask the DMV to verify insurance coverage, but you will need a police report of any crash to prove you have a valid reason for checking.