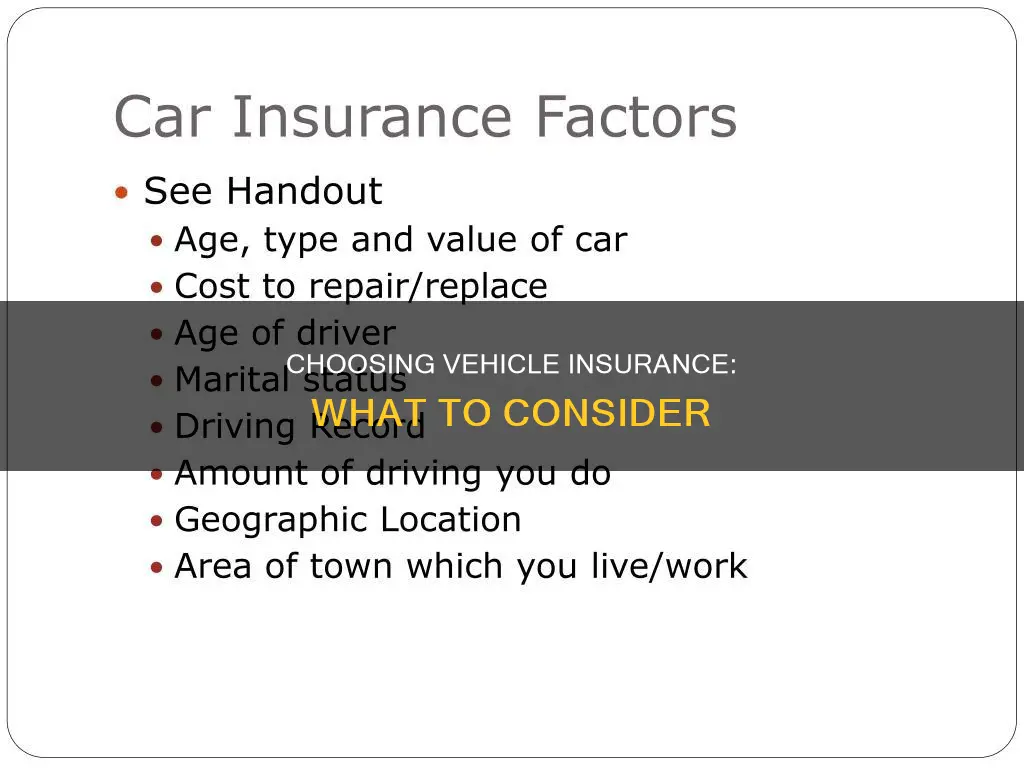

Choosing the right vehicle insurance can be a challenging task, with so many companies and policies to choose from. It's important to do your research and understand your objectives when shopping for insurance. You should consider your financial situation, the level of coverage you need, the reputation of the insurance company, and the cost of the policy. Understanding the different types of insurance coverage available and what each one does is essential. You should also be aware of your state's minimum insurance requirements and any additional coverage you may need, such as collision or comprehensive insurance. When choosing a policy, it's crucial to get multiple quotes, compare prices and coverage options, and ask about discounts.

| Characteristics | Values |

|---|---|

| Medical or Personal Injury Protection | Covers medical expenses for you and your passengers |

| Uninsured/Underinsured Motorist | Covers damage costs when the other driver has no insurance or not enough insurance |

| Collision | Covers damage to your own vehicle in an accident |

| Comprehensive | Covers damage to your vehicle not caused by an accident, e.g. theft, weather damage |

| Liability | Covers personal injury or damage to others when you are responsible for an accident |

| Deductibles | The amount you pay out-of-pocket before insurance covers the rest; higher deductibles lead to lower premiums |

| Premium | The amount you pay to the insurance company to buy the policy |

| Quotes | Estimates of your premium cost; get multiple quotes to compare |

| Discounts | Ask about discounts for teens with good grades, low mileage, driver education classes, anti-theft devices, etc. |

| Coverage Limits | Ensure you have optimal protection by understanding your state's minimum requirements and your lender's requirements |

What You'll Learn

Understanding the types of insurance coverage

Liability Coverage

Liability coverage is a legal requirement in most US states and is needed to drive a car. This type of insurance covers injuries and property damage caused to others in an accident where you are at fault. It is important to note that liability coverage does not cover any expenses for the policyholder or their passengers, except for legal fees if sued due to the accident.

Collision Coverage

Collision insurance covers repairs or replacement of the policyholder's car after an accident, regardless of fault. It is not required by state law but is mandatory for leased or financed vehicles. Collision coverage only applies to damage to the policyholder's vehicle and does not include medical bills.

Comprehensive Coverage

Comprehensive insurance covers damage to the policyholder's vehicle caused by something other than an accident, such as vandalism, natural disasters, theft, or collisions with animals. Like collision coverage, comprehensive insurance is not required by state law but is usually mandated for leased or financed cars.

Uninsured/Underinsured Motorist Coverage

This type of insurance covers vehicle damage and medical expenses incurred after an accident with an uninsured or underinsured driver. Uninsured motorist coverage is often split into three parts: bodily injury coverage, property damage coverage, and underinsured motorist coverage. It is important to check your state's requirements, as this coverage is not mandatory in all states.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, covers the policyholder's direct medical expenses and funeral costs after an accident, regardless of fault. This type of coverage may also extend to family members or passengers in the car. While it is only required in a few states, it can be a valuable addition to your policy if available and affordable.

Personal Injury Protection (PIP)

Personal injury protection (PIP) covers medical expenses and lost income resulting from an accident, regardless of fault. PIP offers broader coverage than medical payments coverage and may include costs not typically covered by health insurance. While PIP is only required in certain states, it is a valuable protection against unexpected medical bills.

Additional Coverages

Other types of vehicle insurance coverages include gap insurance, rental reimbursement, roadside assistance, and classic car insurance. Gap insurance covers the difference between your car's value and the amount owed on a loan or lease if the vehicle is stolen or totaled. Rental reimbursement provides coverage for a rental car while your vehicle is being repaired after an accident. Roadside assistance covers services like towing, jump-starts, and flat tire changes. Classic car insurance offers specialized coverage for vintage and classic vehicles.

Vehicle Insurance: Mexico's Mandatory Law

You may want to see also

Determining the level of coverage you need

When determining the level of coverage you need, it's important to consider your state's minimum requirements, your financial situation, and the value of your assets. Here are some key factors to help you decide:

- State Minimum Requirements: Almost every state in the US mandates a minimum amount of car insurance, with liability insurance being the main coverage required. This covers injuries and damage caused to others in an accident. However, these minimum requirements may not be sufficient to protect you financially in the event of a serious accident. It's important to check your state's specific requirements and consider opting for higher coverage limits if needed.

- Your Financial Situation: Evaluate your financial situation to determine how much coverage you can comfortably afford. Consider your income, savings, and any assets you want to protect. Remember that insufficient coverage could leave you financially vulnerable if you're involved in an expensive accident.

- Value of Your Assets: Consider the value of your assets, including your car, home, savings, and investment funds. If you're underinsured and found responsible for an accident, you may be ordered by a court to pay for damages that exceed your coverage limits. The cost of additional insurance can be minimal compared to the potential financial impact of a major accident.

- Type of Vehicle: The type of vehicle you drive can impact the level of coverage you need. If you own a brand-new or relatively new vehicle, collision coverage is essential to protect against repair costs or total loss. Comprehensive coverage is also important if you want protection against non-accident-related damage, such as theft, vandalism, or natural disasters.

- Driving History: If you have a history of accidents or speeding tickets, you may want to consider higher coverage limits to protect yourself financially. A clean driving record may qualify you for discounts on your policy.

- Personal Needs: Think about your personal needs and preferences. If you're leasing or financing a vehicle, you may be required to carry collision and comprehensive coverage. Additionally, consider whether you want optional coverages like rental reimbursement, roadside assistance, or gap insurance.

- Liability Coverage: Opt for the highest amount of liability coverage you can reasonably afford. The most common recommendation is a policy with limits of $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $100,000 for property damage. This will provide better financial protection in the event of a serious accident.

Insurance Companies: Vehicle Value Determinants

You may want to see also

Reviewing the financial health of car insurers

When choosing a car insurance company, it's essential to consider their financial health and stability. This ensures that they will be able to pay out claims if needed. Here are some detailed instructions on reviewing the financial health of car insurance companies:

Firstly, refer to independent ratings companies such as A.M. Best, Fitch, Moody's, and Standard & Poor's. These agencies provide insights into the financial health of insurance companies. Each agency has its own rating scale and standards, so it's beneficial to consult multiple sources to get a comprehensive view. It's also important to note that these agencies update their ratings periodically, so checking annually is prudent.

When reviewing these ratings, pay attention to the "secure" and "vulnerable" mega-categories. This distinction can give you a quick indication of the financial stability of an insurance company. Additionally, be cautious when insurance companies selectively highlight higher ratings from certain agencies while ignoring lower ones.

Another aspect to consider is understanding the differences in rating codes between agencies. For example, an A+ rating from A.M. Best is different from an A+ rating from Fitch, Kroll, or S&P, as they have different ranking categories. Therefore, it's essential to familiarize yourself with each agency's rating system to make an informed decision.

In addition to the ratings, you can also look at other financial indicators, such as the company's financial reports, market performance, and investment portfolios. These sources can provide valuable information about their financial health and stability.

By following these steps, you can make a more informed decision when choosing a car insurance company, ensuring that they have the financial stability to honour their commitments and pay out claims when needed. Remember to consider multiple sources and seek out recent information to make the most informed decision.

Update Your Vehicle Insurance Name

You may want to see also

Comparing several car insurance quotes

- Determine your coverage needs: Understand the different types of insurance coverage available, such as liability coverage, collision coverage, comprehensive coverage, personal injury protection, uninsured/underinsured motorist coverage, etc. Decide on the level of coverage you need based on factors such as your vehicle's value, your financial situation, and the requirements in your state.

- Get quotes from multiple insurers: Shop around and get quotes from multiple insurance companies. This is because rates can vary significantly from one insurer to another, even for the same driver. By comparing quotes, you can find the best price and coverage for your needs.

- Consider the insurer's reputation and financial health: Look into the financial stability and customer service reputation of the insurance companies you are considering. Check independent ratings, customer reviews, and complaint records to assess their reliability and responsiveness in handling claims.

- Ask about discounts: Many insurance companies offer discounts, so be sure to inquire about any that you may be eligible for. These could include good driver discounts, student discounts, low-mileage discounts, or discounts for safety features in your vehicle.

- Compare the same types and amounts of coverage: When gathering quotes, ensure that you are comparing the same levels of liability, deductibles, and optional coverages across different insurers. This will allow you to make an accurate comparison and find the best value for your money.

- Protect your personal information: When using online insurance comparison sites, be cautious about providing your personal information. Some sites may sell your data to insurance agencies or lead-generation sites, resulting in unwanted spam and solicitations. Look for reputable sites that provide real-time quotes without selling your information.

Virginia Farm Vehicle Insurance: What's Required?

You may want to see also

Asking about discounts

Discounts are a great way to save on your auto insurance. While insurance companies will apply discounts based on the information you give them, it's always worth asking about them to make sure you're getting the best deal. Companies don't always offer the same discounts, but there are some common types to look out for.

Good driver discount

If you haven't filed an insurance claim and have a good driving record, you're likely to be eligible for a good driver discount. Companies see good drivers as less of a risk, so be sure to ask about this one if you think you qualify.

Multi-car and multi-policy discounts

If you have more than one car on your policy, you'll probably be offered a discount. You may also get a discount for having multiple policies with the same company, such as home or renters insurance.

Low-mileage discount

If you don't drive much, your chances of staying accident-free are better. Let your insurance company know if you work from home or only drive for pleasure, as you may be eligible for a low-mileage discount.

Good student discount

If you have high school or college students in your household who get good grades, be sure to let your insurance company know. Many companies offer discounts to reward good students.

Safety equipment discounts

Owning a car with safety features like an anti-theft system or crash protection technology could result in a discount. If you have anti-theft devices or add them after purchasing your policy, be sure to tell your insurance company.

Association discounts

Being a member of certain clubs, an employee of certain companies, or a student or alumni of certain universities can lead to a discount from some insurers.

Safe driving discount

Most insurance companies will offer a discount to drivers who take a driver's education course or who have a history of safe driving.

Paid-in-full discount

You can often get a discount by paying a year's worth of premiums upfront when you start your policy.

Bundling discount

You can usually save by buying your auto insurance and home, renters, or condo insurance from the same company.

New driver training discount

New drivers who take a driver training course can often get a discount. For experienced drivers, refresher courses or defensive driving training can also lead to a discount.

Senior/mature driver discount

Senior or mature driver discounts are usually state-mandated and apply to drivers over a certain age, typically 65.

Student away from home discount

If your child is on your auto insurance but lives away from home, you could be eligible for a discount.

Towing Uninsured Vehicles: Is It Legal?

You may want to see also

Frequently asked questions

There are several factors to consider when choosing vehicle insurance, including the level of coverage you need, the financial health of the insurer, and the cost of the premium. It's also important to compare quotes from multiple insurers and ask about any available discounts.

The main types of vehicle insurance coverage include liability, collision, comprehensive, uninsured/underinsured motorist, and medical or personal injury protection. Liability coverage pays for injuries or damage caused to others, while collision coverage pays for damage to your own vehicle in an accident. Comprehensive coverage pays for damage to your vehicle not caused by an accident, such as theft or weather damage. Uninsured/underinsured motorist coverage protects you if you're in an accident with a driver who doesn't have insurance or has insufficient coverage. Medical or personal injury protection covers medical expenses for you and your passengers.

When choosing the right amount of coverage and deductible, consider your financial situation and assets. If you have a lot of assets, you may want higher liability limits to protect yourself from lawsuits. Additionally, think about your liquidity and how much you can comfortably afford to pay for a deductible. A higher deductible can lower your premium, but it's important to ensure you can cover the cost in the event of an accident.