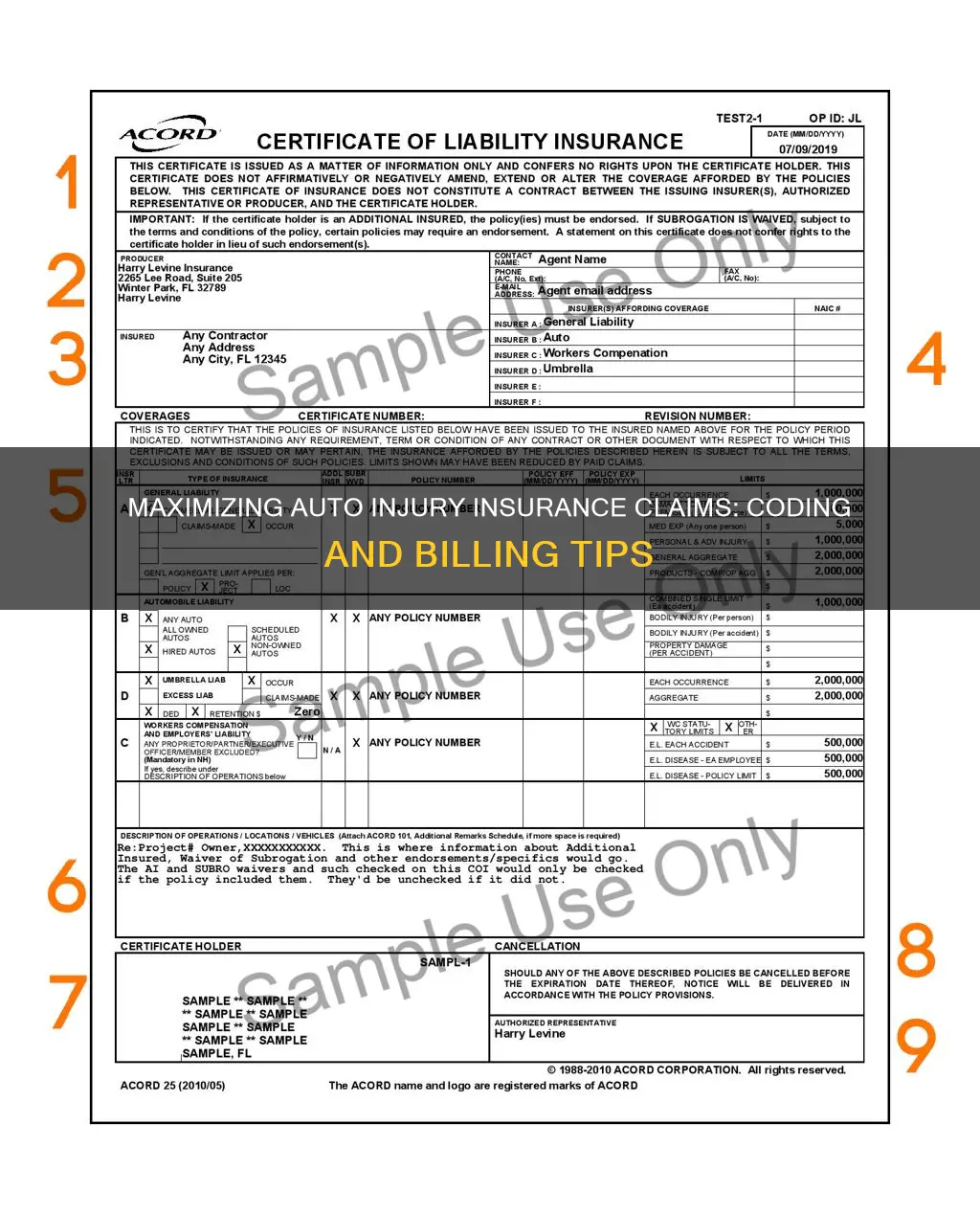

Understanding how to code and bill for auto injury insurance claims is essential for healthcare providers dealing with personal injury cases. The process can be complex, with specific requirements varying from state to state. In the US, there are three main coding systems used by health plans, medical billing companies, and healthcare providers: CPT (Current Procedural Terminology), HCPCS (Healthcare Common Procedure Coding System), and ICD (International Classification of Diseases) codes. These codes ensure consistent and reliable billing and claims processing. CPT codes, developed by the American Medical Association, describe the services provided by healthcare professionals. HCPCS codes, used by Medicare, overlap with CPT codes and include additional codes for products, supplies, and services not covered by CPT. ICD codes, maintained by the World Health Organization, identify the patient's health condition or diagnosis. Proper coding is crucial as mistakes can result in incorrect reimbursement, increased out-of-pocket expenses, or claim denials. When billing for auto injury insurance claims, it is essential to follow the correct procedures, understand state-specific laws, and accurately input the necessary codes to ensure timely and accurate reimbursement.

What You'll Learn

Understanding the different insurance codes

Current Procedural Terminology (CPT) Codes:

CPT codes are used by healthcare providers to describe the services they provide. These codes are crucial for reimbursement, as insurance companies rely on them to determine the appropriate payment for each service. CPT codes cover a wide range of medical services, from office visits and evaluations to specific procedures like electrocardiograms and blood tests. The American Medical Association (AMA) maintains and updates these codes annually, and they can be accessed through the purchase of coding books or online access from the AMA.

Healthcare Common Procedure Coding System (HCPCS) Codes:

The HCPCS is the coding system used by Medicare, which has two levels. Level I HCPCS codes are the same as CPT codes. Level II HCPCS codes, on the other hand, are unique to Medicare and cover products, supplies, and services not included in CPT codes. This includes items such as ambulance services, durable medical equipment (like wheelchairs and crutches), prosthetics, orthotics, and supplies used outside the healthcare provider's office.

International Classification of Diseases (ICD) Codes:

ICD codes, developed by the World Health Organization (WHO), identify the patient's health condition or diagnosis. These codes are often used in conjunction with CPT codes to ensure that the billed services align with the patient's diagnosis. For example, an ankle X-ray may not be reimbursed if the patient's diagnosis is bronchitis, as it is not directly related to that condition. ICD-11, the current version of these codes, took effect in 2022, replacing the previously used ICD-10 codes.

E Codes:

E codes are specifically mentioned in the context of auto injury insurance claims. They are used to specify the external cause of the injury, such as auto accident codes V40-V49. These codes help insurance companies understand the nature of the accident and determine liability.

Occurrence Codes:

Occurrence codes provide additional information about the circumstances of the injury. For example, there are specific codes to indicate whether the injury is related to an accident with no-fault or liability laws, a third-party accident that may involve civil court action, or an accident with no medical or liability coverage. These codes help insurance companies assess their responsibility for payment and process claims accordingly.

Understanding and correctly applying these insurance codes are vital for accurate billing and reimbursement of auto injury insurance claims. It ensures that healthcare providers receive appropriate compensation for their services and that patients are not burdened with incorrect charges.

Texas Auto Insurance in Louisiana: What You Need to Know

You may want to see also

Knowing when to bill auto insurance vs. health insurance

Knowing when to bill auto insurance versus health insurance can be a tricky proposition, especially if multiple insurance policies are involved. Here are some key considerations:

Understanding Coverage Options:

Firstly, it is essential to understand the different coverage options available. Auto insurance policies typically include liability, comprehensive, and collision coverage, which primarily focus on vehicle repairs and do not cover medical expenses. However, additional coverages like Medical Payments (MedPay), Personal Injury Protection (PIP), and Uninsured/Underinsured Motorist Bodily Injury coverage can help with medical bills resulting from car accidents. On the other hand, health insurance covers medical expenses regardless of the cause of injury or illness.

Primary and Secondary Insurance:

When both auto and health insurance policies are involved, determining which insurance is primary and secondary is crucial. In most cases, auto insurance is considered primary for car accident injuries, and health insurance becomes secondary. This means auto insurance will pay for treatment until its coverage limits are reached, after which health insurance kicks in. However, some health insurance plans may explicitly state that they are secondary in the event of a car accident, in which case auto insurance would be billed first.

State-Specific Regulations:

It is important to understand that regulations vary from state to state. Certain "no-fault" states have specific rules governing the relationship between health and auto insurance after a car accident. In these states, each driver is required to cover their own medical payments through MedPay or PIP. Additionally, state laws may dictate whether MedPay, PIP, or Uninsured Motorist coverage is mandatory or optional.

Deductibles and Out-of-Pocket Costs:

When deciding which insurance to bill, consider the deductibles and out-of-pocket expenses associated with each policy. Health insurance often comes with deductibles, which can be substantial, and may also require co-pays. In contrast, MedPay and PIP coverage typically have no deductibles and lower short-term costs. Therefore, using auto insurance coverage for medical bills might be more advantageous financially.

Timing of Payment:

Another factor to consider is the timing of payment. Auto insurance coverage, such as MedPay and PIP, often provide faster payment for medical bills compared to health insurance. Health insurance might be subject to delays, especially if there are disputes or denials of claims.

In conclusion, when deciding whether to bill auto insurance or health insurance, it is essential to understand the specifics of each policy involved, the applicable state regulations, and the financial implications for the patient. It is also crucial to remember that communication and coordination between the patient, auto carriers, and attorneys are vital to ensuring a smooth claims process and avoiding potential reimbursement issues.

Unlicensed and Uninsured: Understanding Auto Insurance Coverage for Unlicensed Drivers

You may want to see also

What to do if a patient doesn't disclose the cause of their injury

When a patient doesn't disclose the cause of their injury, it's important to remember that you, as the healthcare provider, are legally obligated to protect the patient's privacy and confidentiality. Here are some steps to take in this situation:

- Maintain Confidentiality: Do not discuss the patient's condition with anyone except authorized personnel who need to know. This includes not disclosing information to family members or friends without the patient's consent.

- Document the Interaction: Make detailed notes about the patient's injury, including any information they choose to share about the cause. Note that the patient did not disclose the full details of the injury.

- Seek Additional Information: If possible and appropriate, try to obtain more information about the injury from the patient or other sources, such as police reports or accident reports, with the patient's consent.

- Inquire about Insurance: Ask the patient about their insurance coverage, as this may provide some insight into the nature of the injury and the appropriate billing procedures.

- Use Appropriate Coding: When coding and billing for the patient's treatment, use standard codes for procedures (CPT) and diagnoses (ICD). You may also use "E" codes in the diagnoses section to specify external causes of injury, such as auto accidents.

- Communicate with the Patient: Explain to the patient the importance of disclosing the cause of their injury for insurance and billing purposes. Emphasize that their information will remain confidential.

- Consider Involving a Lawyer: If the patient continues to withhold information about the cause of their injury and it is impacting the billing process, consult with a lawyer to discuss your legal options and ensure compliance with state laws.

Remember, it is crucial to respect the patient's privacy and only collect the information necessary for their treatment and billing purposes. Always follow state and federal laws regarding patient confidentiality, such as HIPAA in the US.

GEICO: Salvage Vehicle Insurance

You may want to see also

How to handle a patient's request to submit to auto insurance after billing health insurance

If a patient requests that you submit their medical bills to their auto insurance after billing their health insurance, there are a few important steps to follow. Firstly, it is crucial to understand the patient's reasoning behind this request. There may be concerns about using their personal health insurance for injuries caused by someone else, or they might worry about the financial implications. Reassure the patient that using their health insurance is the smartest option to ensure timely and necessary medical care. Explain that their health insurance coverage is meant for such situations and that their health should be the top priority.

Secondly, inform the patient about the billing process and how their health insurance will be reimbursed. Explain that their health insurance company will need to be involved in the process, and they might have specific requirements or forms that need to be completed. Provide the patient with clear instructions on how to contact their health insurance company and initiate the reimbursement process.

Thirdly, assist the patient in gathering the necessary information and documentation. This includes obtaining an itemized bill from the medical provider, detailing every service provided, laboratory tests, medications dispensed, and any other relevant expenses. Additionally, the patient will need their auto insurance information, including policy details and claim procedures. Help the patient compile all the required documents and guide them through the process of submitting the claim to their auto insurance company.

Finally, advise the patient to keep detailed records of all communication and documentation related to the claim. This includes saving copies of emails, letters, and forms, as well as taking notes on phone conversations, including dates, times, and the names of individuals they speak with. This comprehensive record-keeping will be invaluable if there are any disputes or discrepancies regarding the claim.

By following these steps, you can effectively handle a patient's request to submit their medical bills to their auto insurance after initially billing their health insurance. It is important to provide clear guidance, address any concerns, and support the patient throughout the process to ensure a smooth and efficient resolution.

Credit Card Auto Insurance: AAA's Stance on Using Plastic for Protection

You may want to see also

How to code for a sprained ankle

When coding and billing for auto injury insurance claims, it is important to follow the correct procedures to ensure proper reimbursement. In the case of a sprained ankle, there are specific steps that should be taken to ensure accurate coding and billing. Here is a detailed guide on how to code for a sprained ankle in the context of auto injury insurance claims:

Understanding Sprained Ankles

A sprained ankle is a common injury that occurs when the ligaments in the ankle are torn or stretched beyond their limits. It is often the result of falling, rolling, or twisting the ankle. Sprains are graded based on the severity of ligament damage, ranging from mild (Grade 1) to moderate (Grade 2) to severe (Grade 3) sprains. Symptoms of a sprained ankle include pain, swelling, bruising, and tenderness, which can vary depending on the grade of the sprain.

Initial Assessment and Diagnosis

When a patient presents with a suspected sprained ankle, it is crucial to conduct a thorough physical examination. Evaluate the patient's range of motion and identify which ligaments are affected. In addition to the physical exam, further imaging tests, such as an X-ray, may be necessary to confirm the diagnosis and rule out other injuries, such as a broken ankle.

Treatment and Coding

The treatment approach for a sprained ankle will depend on the severity of the injury. For the initial 24-48 hours after the injury, the PRICE method is commonly recommended:

- Protection: Use crutches, a boot, or a brace/splint to limit the use of the injured ankle and provide support and stability.

- Rest: Avoid physical activities that may cause stress to the sprain, such as running, jumping, or exercising.

- Ice: Apply ice or a cold pack wrapped in a towel to the ankle for 20-minute increments to reduce swelling.

- Compression: Gently wrap the ankle with an elastic bandage to help decrease swelling and provide support.

- Elevation: Keep the ankle elevated above the heart level while sitting or lying down to reduce swelling.

For severe sprains, anti-inflammatory medications like ibuprofen can be used to manage pain and swelling. In some cases, crutches may be recommended to improve balance and mobility while allowing the ankle to rest.

Billing and Insurance Considerations

When billing for a sprained ankle in the context of auto injury insurance claims, it is important to follow the appropriate billing procedures. Obtain all the necessary information, including the patient's auto insurance details and claim number. Verify the patient's coverage and understand the billing requirements of their specific insurance carrier.

In some cases, billing the patient's health insurance first and then submitting the claim to their auto insurance may be an option. However, it is crucial to check with both carriers to determine which is primary and secondary. Additionally, be mindful of the patient's out-of-pocket expenses and ensure proper reimbursement.

Long-Term Management and Prevention

After the initial treatment phase, focus on rebuilding flexibility and strength in the ankle through physical therapy exercises. These exercises should aim to improve the range of motion, strengthen the muscles and tendons, and enhance balance to prevent future sprains.

It is important to provide patients with guidance on preventing sprained ankles, such as maintaining good muscle strength through regular exercise, warming up and stretching before physical activities, and paying attention to uneven surfaces while walking or running.

Creating Fake Auto Insurance Cards

You may want to see also