Comparing home insurance quotes is the best way to find the right policy for you. While standard home insurance policies generally contain the same types of coverage, the coverage limits won't always be similar. Your policy should have the right amount of coverage to rebuild your home and replace your personal property in case of a covered loss. You don't want to be left without enough coverage, but you also don't want to pay for more coverage than you need.

The first step is to get the quotes themselves. You can visit several insurance company websites to gather quotes or save time by using a quote comparison website that provides quotes from multiple companies.

The cost is probably the first thing that will grab your attention. While it's important to fit your homeowners insurance into your budget, remember that the cheapest policy isn't necessarily the best one. If a quote is exceedingly low, make sure that it actually provides the coverage that you need.

One of the most important parts of shopping for home insurance is finding a policy that fully covers you, your home and your belongings. This includes both coverage types as well as your coverage limits.

| Characteristics | Values |

|---|---|

| Average Annual Cost | $1,678 |

| Average Monthly Premium | $140 |

| Average Annual Cost for $350,000 in Coverage | $1,344 |

| Average Annual Cost for $500,000 in Coverage | $1,298 |

| Average Annual Cost for $750,000 in Coverage | $1,810 |

| Average Annual Cost for $200,000 in Coverage | $729 |

| Average Cost by State | Hawaii: $330; Oklahoma: $4,025 |

What You'll Learn

How to get a quote

Getting a quote for house insurance is a straightforward process. Here's a step-by-step guide on how to get a quote:

- Provide Basic Information: To get started, you will need to provide some basic information about yourself and your property. This includes personal details such as your name, date of birth, marital status, and how long you have lived in the home. You will also need to provide information about the property, including the address, year of construction, and any relevant features like the age of the roof or the presence of a burglar alarm.

- Choose Your Coverage Options: Different insurance companies offer different coverage options, so it is important to understand what is included in each quote. Standard home insurance policies typically cover damage to your home and belongings, as well as provide liability coverage. However, you may want to consider additional coverage options, such as flood insurance or umbrella insurance, depending on your specific needs.

- Compare Quotes from Multiple Companies: It is recommended to get quotes from multiple insurance companies to find the best rates and coverage options for your needs. You can use online tools like HomeQuote Explorer to easily compare quotes from multiple companies at once.

- Review the Quotes: Once you have received quotes from different insurance companies, take the time to review them carefully. Pay attention to the coverage limits, deductibles, and whether your belongings are insured on an actual cash value or replacement cost value basis. These details can significantly impact your overall costs.

- Select the Best Policy for You: Consider your budget and the level of coverage you need when selecting a policy. It is important to choose a reputable company with strong financial stability, high customer satisfaction ratings, and robust coverage offerings. You can use resources like Bankrate Scores to compare companies based on these factors.

- Finalize the Quote: After you have selected the best policy for your needs, work with the insurance company to finalize the quote and purchase the policy. This may involve providing additional information or making adjustments to your coverage options.

By following these steps, you can get a house insurance quote that is tailored to your specific needs and budget. Remember to review your insurance coverage periodically and compare quotes from different companies to ensure you are getting the best rates and coverage.

Navigating the Mail: Mailing Your Farmers Insurance Payment

You may want to see also

What to consider when comparing quotes

When comparing quotes, it's important to consider more than just the cost. Here are some key things to keep in mind:

Coverage Amounts

Review the coverage amounts offered by each insurer and ensure they meet your needs. This includes checking the dwelling coverage, which should be enough to rebuild your home in case of a total loss. You should also consider additional coverage options, such as extended or guaranteed replacement cost coverage, which can provide extra protection if the cost of rebuilding your home exceeds your policy limits.

Deductibles

The deductible is the amount you will have to pay out of pocket before your insurance coverage kicks in. A lower deductible usually means higher monthly payments, so consider your ability to pay the deductible when comparing quotes. Also, look out for separate deductibles for specific perils, such as hurricanes or windstorms.

Companies' Reputation

The reputation and financial stability of the insurance company are important factors to consider. Choose a trusted insurer with a good track record of resolving claims in a timely and positive manner. Check reviews, third-party ratings, and customer satisfaction surveys to get an idea of the company's reputation.

Discounts

Insurers often offer a range of discounts that can help lower your premium. Look for companies that offer discounts that match your profile, such as multi-policy discounts, claims-free discounts, or discounts for security systems or home renovations.

Additional Coverage Options

In addition to the standard coverage types, some insurers offer add-ons or endorsements to enhance your policy. These can include coverage for water backup, identity theft, equipment breakdown, or high-value items. Consider your specific needs and compare the additional coverage options offered by each insurer.

Customer Service

Consider the level of customer service and support you expect from your insurer. Evaluate the ease of communication, the availability of online tools or apps, and the overall responsiveness of the company when you have questions or need to file a claim.

Farmers Insurance Umbrella: Comprehensive Protection for Your Assets

You may want to see also

How to compare quotes

Comparing quotes is the best way to find the right home insurance policy. Here is a step-by-step guide on how to compare quotes:

Step 1: Think about your coverage needs

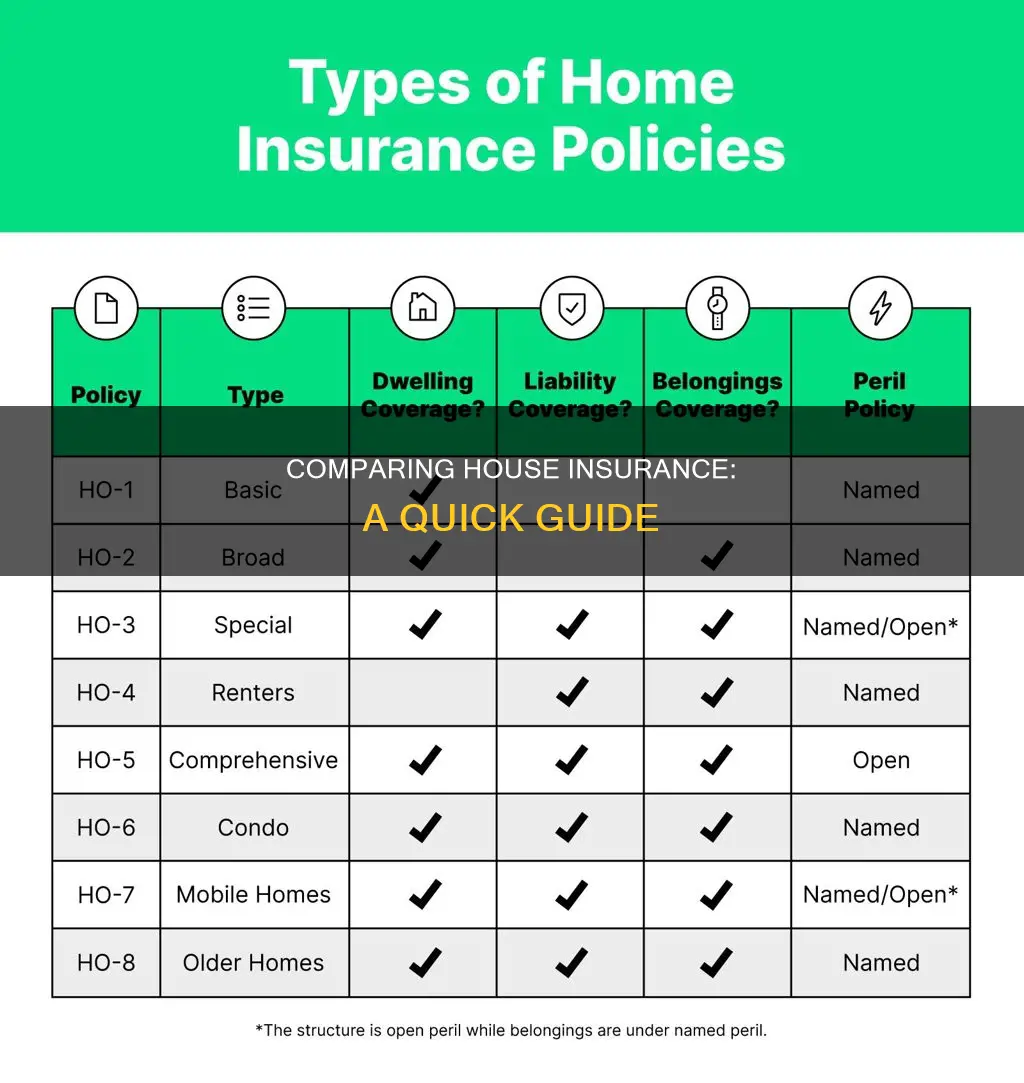

First, you need to understand what a typical home insurance policy includes and excludes. Home insurance policies are divided into coverage types, and each type is subject to its own limit. The coverage types found in a standard home insurance policy are:

- Dwelling coverage: This covers the estimated cost to rebuild your home and your home's physical structure if it is damaged in a covered loss.

- Other structures: Covers up to 10% of dwelling coverage for non-attached structures like a gazebo, fence or shed if they are damaged in a covered loss.

- Personal property: Covers between 50% and 70% of dwelling coverage for your personal belongings in your home, plus limited coverage for your belongings housed in other locations (like a storage unit).

- Additional living expenses: Covers between 20% and 30% of dwelling coverage for expenses, like a hotel room and restaurant bills, if you are displaced from your home due to a covered loss.

- Personal liability: Covers between $100,000 and $500,000 for legal expenses if you or a member of your household is found negligent for someone else's injuries or property damage.

- Medical payments: Covers between $1,000 and $5,000 for guests' medical bills if they are injured on your property.

Step 2: Get quotes from several home insurance companies

Once you know what you are looking for in a company, it is recommended to request quotes from several home insurance providers that might fit your needs. You can request quotes in multiple ways:

- Online: Getting a quote online is a great place to start. Some carriers may allow you to purchase your policy entirely online, while others will put you in contact with an agent to complete the process.

- Captive insurance agent: A captive agent works for one insurance provider. Working with a captive agent is best if you've already chosen a company but need help building or finalizing your policy.

- Independent agent or broker: If you prefer personalized service and want help gathering quotes, working with an independent insurance agent or broker is a good choice. Unlike captive agents, independent agents can provide you with home insurance quotes from multiple companies.

Step 3: Review each home insurance quote for accuracy

Once you have your quotes, it's time to go over them with a fine-toothed comb for accuracy. Review the documentation you receive and ensure that each home insurance quote is in line with the information you provided. Your coverage amounts may vary based on each insurance company's valuation tool, but as long as your quotes are in the same ballpark, you should be able to compare them. Aside from coverage amounts, you will also want to take a close look at the deductible, the policy type, and whether your belongings are insured on an actual cash value or replacement cost value basis.

Step 4: Choose your home insurance policy

Your budget is an important consideration when searching for the perfect home insurance policy. However, it is not the only thing to think about. Hopefully, you will never need to file a home insurance claim, but if disaster strikes, you'll want to know that your insurance company will be there for you when you need it. As such, experts recommend choosing a company that has a strong financial history, high rates of customer satisfaction, and robust coverage offerings.

Farmers Insurance: The Reliable Choice for Customized Coverage

You may want to see also

How to choose a policy

When choosing a home insurance policy, it's important to consider your specific needs and compare policies from multiple providers. Here are some key steps to help you select the right policy:

- Assess your coverage needs: Determine the amount of coverage you require by considering factors such as the cost to rebuild your home, the value of your personal belongings, and the level of liability protection needed.

- Get quotes from multiple companies: Obtain quotes from several home insurance providers to compare rates, coverage options, and discounts offered. You can use online tools, captive agents, or independent agents to gather these quotes.

- Evaluate the coverage details: When comparing quotes, pay attention to the coverage limits, deductible amounts, and whether your belongings are insured on an actual cash value or replacement cost basis.

- Consider the company's reputation: Research the reputation and financial strength of the insurance companies you're considering. Look for companies with high customer satisfaction ratings and responsive claims handling processes.

- Review additional benefits: Some insurance companies offer unique benefits, such as equipment breakdown coverage, identity theft protection, or coverage for specific risks like floods or earthquakes. Consider which benefits are important to you.

- Ask about discounts: Inquire about potential discounts you may be eligible for, such as bundling home and auto insurance, installing security systems, or having a claims-free history.

- Read the fine print: Carefully review the terms and conditions of each policy to understand any exclusions, limitations, and conditions that may apply.

- Seek recommendations: Ask friends, family, or trusted sources for recommendations or referrals to reputable insurance providers.

- Consider your budget: While budget is important, don't base your decision solely on price. Opt for a policy that offers the coverage you need at a price that fits within your financial plan.

- Choose a reputable company: Select a company with a strong financial history, high customer satisfaction ratings, and robust coverage offerings.

The Complex Web of Farmers Insurance: Unraveling the Oligopoly's Reach and Impact

You may want to see also

How to determine how much insurance you need

Determining the right amount of home insurance coverage can be challenging. However, the following steps can help you make an informed decision:

Understand the factors that impact rebuilding costs:

Consider the size, age, and features of your home, as well as local construction costs. The price you paid for your home may not reflect the cost of rebuilding it due to factors such as location, construction materials, and labour.

Assess your possessions:

Create a detailed inventory of your personal belongings, including electronics, jewellery, and other valuables. This will help you estimate the replacement cost and determine if you need additional coverage for specific items.

Evaluate your liability and living expenses:

Consider your personal liability risks, such as owning a dog or hosting frequent gatherings. Calculate the potential cost of temporary living arrangements if your home becomes uninhabitable due to covered damage.

Choose your coverage type:

Understand the difference between actual cash value (ACV) and replacement cost coverage. ACV considers depreciation, while replacement cost covers the full cost of replacing items without deducting for depreciation.

Research additional coverage options:

Explore endorsements or riders that can fill gaps in your policy, such as flood insurance, earthquake insurance, or identity theft coverage. These add-ons will increase your premium but provide extra protection.

Consult with professionals:

Work with your insurance company or agent to estimate the rebuilding cost of your home and recommend appropriate coverage levels. They can guide you in choosing the right coverage types and amounts based on your specific circumstances.

Review and adjust your policy annually:

Personal circumstances, local construction costs, and other factors can change over time. Regularly review and update your policy to ensure it remains aligned with your needs.

The Friendly Face of Farmers Insurance: Unveiling the Man Behind the Company's Success

You may want to see also

Frequently asked questions

You can compare home insurance quotes by getting them from multiple companies and looking at the cost and the coverage being offered. You can get quotes by visiting a local home insurance agent, contacting an insurer directly online or over the phone, or going through an online marketplace. While the cost is important, remember that the cheapest policy isn't necessarily the best one.

Comparing home insurance quotes is a great way to save money. You can also save money by comparing quotes before the end of every policy period and switching insurers if you find a better rate. You can also save money by taking advantage of discounts, such as multi-policy discounts, new roof discounts, and home security system discounts.

The amount of home insurance you need will depend on the replacement cost of your home and the value of your personal assets. You can determine the replacement cost of your home by calculating the cost to rebuild it with current labour and material costs. For your personal assets, you should consider purchasing enough liability insurance to cover your net worth.