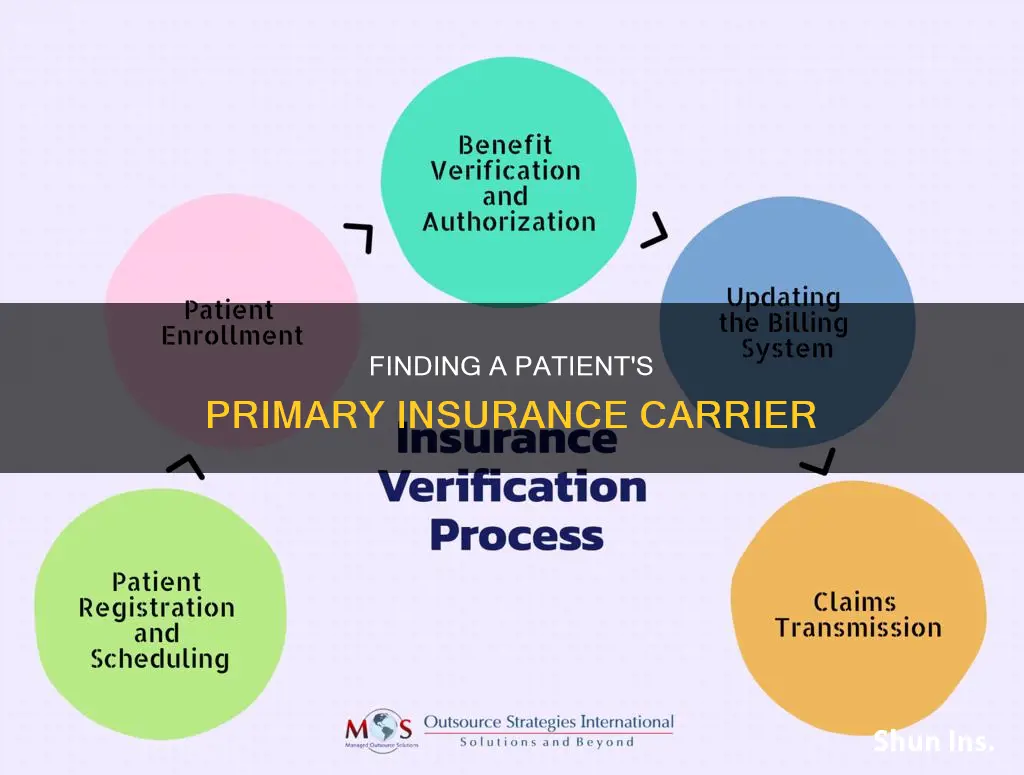

Determining a patient's primary insurance carrier is a crucial step in ensuring proper billing and reimbursement for healthcare services. In cases where a patient has multiple insurance plans, it is essential to identify which plan is primary and which is secondary. This process, known as coordination of benefits, involves understanding the patient's coverage under each plan and designating the order of payment responsibility. The primary insurance plan is typically billed first and pays according to the patient's benefits. Any remaining balance is then sent to the secondary insurance carrier for additional payment consideration.

| Characteristics | Values |

|---|---|

| Name of insurance company | Carrier, insurer, insurance company, or provider |

| Number of insurance plans | Patients can have primary and secondary insurance plans, or even tertiary (third) or quaternary (fourth) insurance plans |

| Determining primary insurance | The primary insurance plan should be designated by a Coordination of Benefits form, which can be filled out by the patient or the patient's guardian |

| Determining secondary insurance | If the patient has multiple insurance plans, ask them to identify which one is primary and which is secondary. If the patient is unable to do so, call each insurance company to verify |

| For minors and young adults | The birthday rule determines which plan is primary and which is secondary. The parent whose birthday falls first in the year has the primary insurance plan |

| For divorced parents | There may be a court order to determine which insurance plan is primary. If there is no court order, the birthday rule applies |

| For young adults with a spouse's insurance plan | The plan that has been effective longer will be primary. If the plans started on the same day, the birthday rule will apply |

| For young adults with their own employer insurance plan | The patient's own employer insurance plan is primary, and the parent's plan is secondary |

| For Medicare and a private health plan | Medicare is primary if the worker is 65 or older and their employer has less than 20 employees. A private insurer is primary if the employer has 20 or more employees |

What You'll Learn

Ask the patient to clarify which insurance is primary and which is secondary

As a mental health clinician, you may encounter patients with two insurance plans. In such cases, it is crucial to determine which insurance is primary and which is secondary to ensure proper billing and timely payment processing. Here are some detailed steps and scenarios to help you ask the patient to clarify their primary and secondary insurance coverage:

Understanding Primary and Secondary Insurance:

Explain to the patient that the primary insurance is responsible for paying first on any claims. Clarify that the secondary insurance comes into play only if the primary insurance policy cannot cover the entire claim. Emphasize that having a clear understanding of their primary and secondary insurance will help ensure their claims are processed efficiently.

Ask the Patient to Identify Their Primary and Secondary Insurance:

- Request the patient to confirm which of their insurance plans is designated as the primary payer and which is the secondary payer.

- If the patient is unsure, offer to help by suggesting that you can verify this information by contacting each insurance company directly.

- Obtain the necessary details from the patient, such as insurance company names, policy numbers, and contact information, to facilitate the verification process.

Coordination of Benefits:

Explain the concept of "Coordination of Benefits" to the patient. This is the process that helps determine which insurance is primary and which is secondary. Mention that they can use a Coordination of Benefits form to designate their preferred order of insurance coverage.

Scenarios for Primary and Secondary Insurance Determination:

Minors and Young Adults:

If the patient is a minor or young adult covered under their parent's insurance plans, explain the "birthday rule." The parent whose birthday falls earlier in the year (considering only the month and day) typically has the primary insurance, while the other parent's insurance is secondary.

Divorced or Separated Parents:

In cases of divorced or separated parents, inform the patient that a court order may determine the primary insurance plan. If there is no court order, the birthday rule still applies.

Young Adults with Spousal Coverage:

For young adults (under 26) who are married and covered by both a parent and a spouse, explain that the plan that has been in effect longer will usually be the primary insurance. If both plans started on the same day, the birthday rule can be applied.

Coverage through Employment:

If the young adult has their own coverage through their employer, clarify that their employer-provided insurance is typically considered the primary coverage, and the parent's or spouse's insurance becomes secondary.

Multiple Insurance Plans:

Inform the patient that having a secondary insurance plan is not uncommon, especially for children covered by both parents' plans or elderly patients with supplemental plans to Medicare and Medicaid. Reassure them that you can handle the billing process for multiple plans, but emphasize the importance of having accurate information to avoid delays in payment.

Eligibility Checks:

Explain to the patient that insurance companies have varying policies regarding secondary insurance payments. Recommend performing eligibility checks with each insurance company to understand how their claims will be paid and to prevent issues with coordination of benefits.

Remember, effective communication with your patient is key to clarifying their primary and secondary insurance coverage. By providing clear explanations and walking them through different scenarios, you can help ensure that their insurance claims are processed correctly and promptly.

Bodily Injury Insurance: Florida's Law

You may want to see also

Contact insurance companies to verify which is primary

When a patient has two insurance plans, it is important to determine which is the primary insurance and which is the secondary insurance. The primary insurance is responsible for paying first on any claims, and the secondary insurance only comes into play if the primary insurance policy is unable to cover the entire claim.

If a patient has multiple insurance plans, you can ask them if they know which one is primary and which is secondary. If the patient is unable to tell you, you can contact each insurance company to verify.

In cases involving minors and young adults who are covered under their parent's insurance plans, there is a rule called the "birthday rule" that determines which plan is primary and which is secondary. The parent whose birthday falls first in the year (month and day only) has the primary insurance plan, and the other parent's insurance provides secondary coverage. If the parents share a birthday, the plan that has been active for longer is the primary plan.

If the parents are divorced, there may be a court order that determines which insurance plan is primary. If there is no court order, the birthday rule applies. If one parent is covered under COBRA, the other parent's insurance plan will always be the primary plan.

For young adults under the age of 26 who are married and covered by both a parent and a spouse, the plan that has been in effect longer is the primary plan. If the plans started on the same day, the birthday rule will apply. However, if the young adult has their own health plan through their employer, that coverage is considered the primary insurance, and the parent/spouse's coverage is secondary.

It is important to have the correct information about the patient's insurance coverage to ensure that claims are processed properly and payments are made in a timely manner.

Insurance Requirements for Plow Carriers

You may want to see also

Understand the birthday rule

The birthday rule is a method used by many insurance companies to determine which insurance plan is primary and which is secondary for a dependent child covered by both parents' insurance plans. It is not a law, but a widely accepted insurance claims practice endorsed by many states.

According to the birthday rule, the parent whose birthday comes first in a calendar year has the primary coverage for the child. The day and month of a parent's birthday determine the coverage, not the birth year. For example, if one parent's birthday is in April and the other's is in October, the parent with the April birthday will be responsible for primary insurance.

The birthday rule falls under coordination of benefits (COB) rules, which resolve coverage order when individuals have multiple insurance plans. COB rules ensure that insurers pay their share without overpaying for services.

The birthday rule is applicable only to dependent children and doesn't apply to adults. It also doesn't apply to step-parents or children who live in a blended family.

The birthday rule has some exceptions. If both parents share the same birthday, the parent who has been covered by their plan for a longer period provides primary coverage for the children. In cases of divorce or separation, the plan of the parent with custody generally provides primary coverage, unless specified otherwise by a court. If one parent is currently employed and has health insurance through their current employer, while the other parent has coverage through a former employer, the plan belonging to the currently employed parent is considered primary for the children.

The birthday rule helps determine the order in which insurance companies will pay benefits when a dependent child is covered by two health insurance plans. The primary insurance plan pays first, acting as if it is the sole insurer of the dependent child. The secondary insurance company then pays towards the balance of the bill that the primary insurer did not cover, reducing or sometimes eliminating out-of-pocket costs for covered services.

It is important to note that neither insurance plan will pay for medical care it does not cover, and each plan will apply its benefits and benefit restrictions. The birthday rule simply establishes the order of insurers' benefit payments on behalf of a dependent child with dual insurance coverage.

Country Insurance: Concealed Carry Coverage

You may want to see also

Identify if there is a court order

When determining a patient's primary insurance carrier, it is important to identify if there is a court order in place, especially in cases involving divorced or separated parents with dependent children. Here are some key considerations regarding court orders and their impact on insurance coverage:

- Custodial Parent's Insurance as Primary: In situations where divorced or separated parents share custody of their children, the custodial parent's health plan typically takes precedence as the primary insurance carrier. This means that the custodial parent's insurance will be responsible for covering the majority of the child's medical expenses. However, it is important to review the specific court decree or custody agreement to confirm this arrangement.

- Court Order Supersedes the Birthday Rule: The "birthday rule" is commonly used to determine primary insurance when children are covered by both parents' insurance plans. This rule dictates that the parent whose birthday falls earlier in the year will have their insurance designated as the primary carrier. However, in cases of divorced or separated parents, a court order or decree will take precedence over the birthday rule. The court order will specify which parent is responsible for providing health insurance for the children.

- Impact on Coordination of Benefits: When a court order is in place, it is crucial to consider the coordination of benefits between the parents' insurance plans. The primary insurance carrier will pay for covered medical services first, according to the benefits provided by their plan. The secondary insurance carrier, which is typically the plan of the non-custodial parent, will then pay the remaining balance, depending on the benefits provided by their plan.

- Communication with Insurance Providers: It is important to notify both insurance providers about the court order and the existence of dual insurance coverage. This helps initiate the coordination process and ensures that each provider is aware of their respective responsibilities. Providing documentation, such as the court order and insurance policies, facilitates a smooth coordination process.

- Review Court Order for Specifics: Court orders or decrees can vary, and it is essential to carefully review the document to identify any specific instructions or requirements regarding insurance coverage. In some cases, the court order may outline the allocation of financial responsibilities for the child's medical care, including which parent's insurance will serve as the primary carrier and the extent of coverage provided.

- Addressing Discrepancies: In the event of discrepancies or disputes between the insurance providers regarding coverage, it is important to refer back to the court order. The court order should provide clarity on the designated primary and secondary insurance carriers, as well as any cost-sharing arrangements. If necessary, seek legal advice or consult with a healthcare advocate to ensure compliance with the court's directives.

LA Skyscrapers: Earthquake Insurance Essential?

You may want to see also

Complete a Coordination of Benefits form

Completing a Coordination of Benefits (COB) form is a crucial step in determining a patient's primary insurance carrier when they have multiple insurance plans. This form allows the patient or their guardian to designate their preferred primary and secondary insurance coverage. Here's a step-by-step guide on completing the COB form and ensuring accurate coordination of benefits:

Understanding the Coordination of Benefits Process:

Before filling out the form, it's important to understand how coordination of benefits works. When an individual has multiple insurance policies, the insurance carriers need to coordinate to determine which plan is primary and which is secondary. This coordination ensures that claims are paid correctly and that the patient receives the appropriate coverage without overpaying or underpaying.

Identify All Insurance Plans:

Start by identifying all the insurance plans that the patient has. This includes plans from both employers in a married couple's scenario, parental plans for children under 26, or supplemental plans for elderly patients with Medicare or Medicaid. It's important to list all applicable plans to ensure comprehensive coordination.

Obtain and Fill Out the COB Form:

You can usually obtain a Coordination of Benefits form from the insurance companies involved or your healthcare provider. Once you have the form, carefully fill out the patient's information, including their name, date of birth, and policy details for each insurance plan they have.

Designate Primary and Secondary Insurance:

On the COB form, clearly indicate which insurance plan the patient or their guardian wants to be the primary carrier. This is typically the plan that will receive and process claims first. Then, indicate the secondary insurance plan, which will come into play if the primary insurance doesn't cover the entire claim.

Submit the Completed Form:

Submit the completed COB form to the relevant insurance companies and ensure they have all the necessary information. It's important to provide this information to each insurance carrier involved to initiate the coordination process effectively.

Verify and Confirm with Insurance Companies:

After submitting the COB form, take the time to verify the information with each insurance company. Contact them to confirm that they have received the form and that they understand the designated primary and secondary insurance plans. This proactive step can help prevent delays or discrepancies in the coordination process.

Keep Records and Monitor Updates:

Maintain organized records of all communications, forms, and responses from the insurance companies. It's crucial to keep track of any updates or changes to the patient's insurance coverage. If there are any changes, be sure to notify all relevant parties, including the insurance companies and healthcare providers.

By following these steps and completing the Coordination of Benefits form accurately, you can effectively determine a patient's primary insurance carrier and ensure that their insurance coverage is coordinated smoothly. This process helps protect the patient from unnecessary costs and ensures they receive the full benefits of their insurance plans.

Malpractice Insurance: A Must-Have for Physician Assistants

You may want to see also

Frequently asked questions

A carrier is another name for an insurance company. The terms insurer, carrier, and insurance company are generally used interchangeably.

The primary insurance is responsible for paying first on any claims. The "birthday rule" is often used to determine which insurance is primary. The primary insurance is held by the person whose birthday falls earlier in the year.

Coordination of Benefits is the process that insurance companies use to decide which plan will pay first for covered medical services or prescription drugs and what the second plan will pay after the first plan has paid.