Direct billing is a service offered by some healthcare providers, where they bill the insurance company directly for the services rendered to a policyholder, instead of the patient having to do all the paperwork themselves. This saves the patient time and hassle, allowing them to focus on their recovery rather than dealing with insurance paperwork and payment processing. It also benefits the healthcare provider, who receives payment sooner, and the insurance company, who does not have to wait for the policyholder to complete the paperwork.

| Characteristics | Values |

|---|---|

| Definition | Direct billing is an insurance industry term that refers to a service provider directly billing the customer. |

| Process | The service provider (e.g. hospital, doctor) sends the itemized bill directly to the insurance company, bypassing the customer. |

| Benefits | Direct billing saves the customer time and hassle by removing the need for them to file a claim and await reimbursement. |

| Application | Direct billing is commonly used in health insurance due to the high frequency of claims. It is also used in property and casualty insurance. |

| Payment | The insurance company pays the service provider directly. |

| Commission | Insurance agencies may find it difficult to reconcile the commission earned from direct billing due to the high volume of transactions. |

What You'll Learn

Direct billing saves time and effort for the insured

Direct billing saves the insured time and effort by streamlining the billing process. When an individual seeks medical treatment, the healthcare provider can choose to direct bill, which means sending the itemized bill directly to the insurance company, bypassing the patient. This saves the patient from having to file an insurance claim and handle the initial interaction with the insurance company.

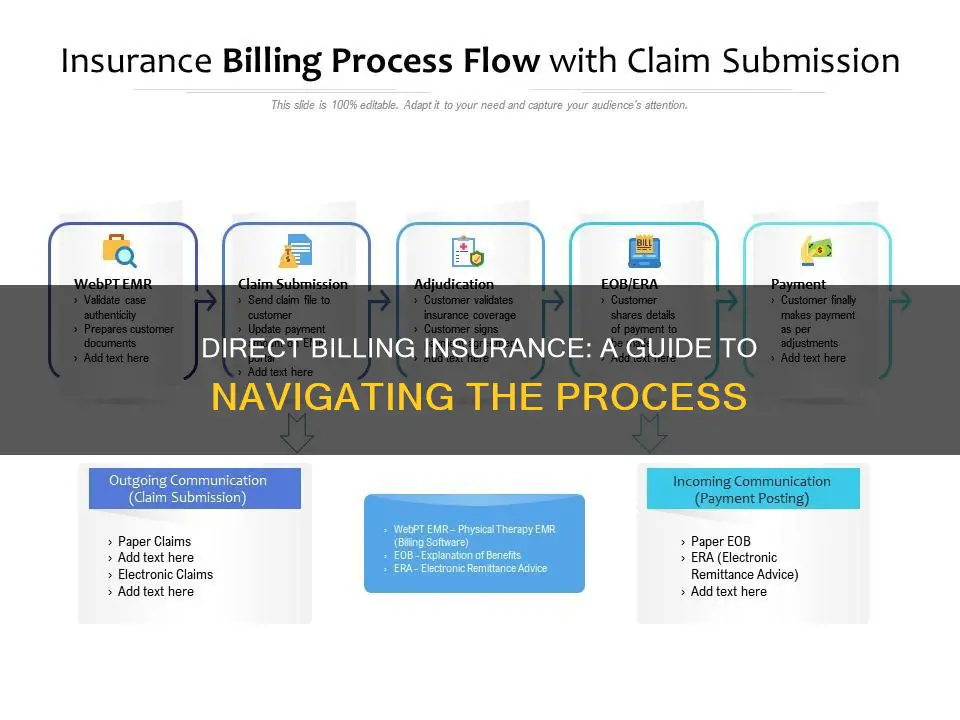

The direct billing process primarily involves the healthcare provider and the insurance company. However, it is the patient's responsibility to initiate the claim after receiving treatment. The patient files a claim for the medical services received, along with supporting documents, such as a copy of the bill and passport. The insurance company then reviews and verifies the claim before making the payment directly to the healthcare provider.

Direct billing offers several benefits to both the patient and the healthcare provider. The patient is spared the hassle of dealing with insurance paperwork and reimbursement claims, allowing them to focus on their recovery. They also avoid the financial burden of paying upfront for medical services and waiting for reimbursement.

Direct billing also benefits the healthcare provider by expediting the payment process. They can bill the insurance company directly and receive payment by the invoice payable date, rather than waiting for the patient to complete the paperwork. This improves the provider's cash flow and reduces administrative costs associated with billing and collection.

Overall, direct billing simplifies the billing process, reducing the time and effort required from the insured while also benefiting the healthcare provider and insurance company.

The Complexities of Abortion Coverage: Unraveling Privacy Concerns and Insurance Trails

You may want to see also

The insured must still initiate the claim

While direct billing can save you time and the hassle of dealing with insurance paperwork and payment processing, it is important to remember that the insured still has a role to play in the process. Even if your healthcare provider offers direct billing, as the insured, you are responsible for initiating the claim to ensure that the travel insurance company pays the bill. This is a mandatory step and applies regardless of the billing method requested by the healthcare provider.

After receiving medical treatment, you must file a claim for the services you received. This claim, along with a copy of the itemized bill, your passport copy, completed Form I-94, and any other supporting documents required by the travel insurance company, should be sent to the insurance company. Filing a claim is an essential step in the verification process. It allows the insurance company to review and verify the information provided before approving the claim and paying the medical service provider directly.

It is important to understand the terms and conditions of your insurance policy to avoid confusion and ensure timely reimbursement. Familiarize yourself with the insurance company's claim submission process and required documentation. Don't hesitate to reach out to your insurance provider if you have any questions or concerns about medical billing. By understanding your responsibilities and the insurance company's requirements, you can help ensure that your eligible medical expenses are covered.

Additionally, if the healthcare provider requests upfront payment, it is crucial to obtain an itemized bill listing all the medical procedures you received. This bill will be necessary when filing a claim for reimbursement at a later stage. Understanding your responsibilities in the direct billing process will help ensure a smooth and efficient claims procedure.

The Surprising Link Between Cavities and Insurance: Understanding the Unexpected Connection

You may want to see also

The healthcare provider decides the billing method

Direct billing, also known as direct pay, is when the hospital or doctor sends the itemized bill directly to the insurance company. This approach can save the patient time and hassle, as they don't have to do all the paperwork themselves. It also benefits the healthcare provider, as they receive payment for services rendered sooner. The patient also benefits as they don't have to pay upfront and wait for reimbursement from the insurance company. Direct billing is particularly useful for health insurance claims, which are often filed more frequently than other types of insurance claims.

On the other hand, agency billing is when the insurance agency acts as the middleman, collecting the entire premium from the insured and then paying the insurance premium to the insurance company, minus the commission due to the agency. Agency billing may be preferred if the agency wants to maintain a direct relationship with the customer, as cross-selling other insurance products may be easier. Additionally, with agency billing, the agency receives its commission upfront, upon receiving payment from the client.

There are several factors to consider when choosing between direct billing and agency billing. The size and volume of transactions can impact the reconciliation process for direct billing, as a large number of transactions can make it difficult to track commissions. The availability of personnel to perform the reconciliation process and the level of trust in the insurance company's technology to ensure accurate commission payments are also important considerations. For agency billing, the ability to handle the accounting and administrative tasks, as well as the impact on cash flow by receiving commissions upfront, should be taken into account.

Ultimately, the decision on the billing method is at the discretion of the healthcare provider, and there is no one-size-fits-all solution. Each option has its own advantages and disadvantages, and the best choice will depend on the specific circumstances and needs of the provider.

Term Insurance Takeover: Navigating the Transition When Your Carrier is Sold

You may want to see also

Direct billing is also used in property and casualty insurance

There are several advantages to direct billing for property and casualty insurance. Firstly, direct billing can save the policyholder time and hassle by eliminating the need for intermediaries. Direct billing also benefits the insurance company, as they receive payment directly from the policyholder without having to wait for an intermediary to process the payment. This can result in faster settlement of claims.

Another advantage of direct billing is that it can reduce administrative costs for insurance companies and brokerages. With direct billing, there is no need to issue invoices, process payments, send receipts, or pay credit card processing fees. These costs can be significant, especially for smaller policies where the brokerage is not earning a high commission.

However, there are also some drawbacks to direct billing in property and casualty insurance. One disadvantage is that the policyholder may lose the opportunity to interact with the brokerage or agency and strengthen their relationship. Additionally, direct billing can make it more difficult for insurance agencies to reconcile the commission earned on a monthly basis due to the high volume of transactions.

Ultimately, the decision to use direct billing or agency billing depends on various factors, including the size of the premiums involved and the volume of policies being managed. For larger premiums or important clients, agency billing may be preferred, while direct billing may be more suitable for smaller policies to reduce administrative costs.

Understanding Loss Assessment: Unraveling the Intricacies of Shared Property Insurance Coverage

You may want to see also

Direct billing is the most common billing method for personal lines

Direct billing is chosen for personal lines because these are highly transactional, and it is more efficient for the insurance carrier to bill the policyholder directly. With direct billing, carriers handle all the payment collections, meaning there is no need to deal with accepting cheques, card or wire payments, or to manage a trust account to split commissions and pay carriers.

However, direct billing can cause issues for insurance agencies when it comes to receiving their commission. Agencies are paid by the insurance company, and with direct billing, this can take up to a quarter, causing a delay in receiving commissions which can affect cash flow. With agency billing, the agency collects the premium first and pays the insurance company, minus their commission.

Direct billing is also very common in the healthcare industry, where it is used to save time and resources. The healthcare provider can bill the insurance company directly, and be paid by the invoice payable date, without needing to wait for the policyholder to complete any paperwork. The policyholder also benefits as they don't need to file any paperwork or pay for the costs upfront and wait for reimbursement.

Nurse Practitioners: Navigating the Insurance Billing Maze

You may want to see also

Frequently asked questions

Direct billing is an insurance industry term that refers to a service provider directly billing the customer. In a health insurance context, direct billing is when a healthcare provider bills an insurance company directly for services rendered to a policyholder, saving the patient from paperwork. In a property and casualty insurance context, direct billing refers to a policyholder paying premiums to the insurance company directly instead of to a brokerage or agency.

Direct billing has benefits for both the healthcare provider and the policyholder. The healthcare provider generally receives payment for services rendered sooner, as they can bill the insurance company directly and be paid by the invoice payable date. The policyholder does not need to file any paperwork or pay for the costs upfront and wait for reimbursement.

After receiving medical treatment, it is the patient's responsibility to initiate the claim. The hospital or physician sends the bill directly to the travel insurance company and provides the patient with a copy of the bill. The patient then needs to file a claim for the medical services received, sending it along with a copy of the bill, their passport copy, completed Form I-94, and any other supporting documents required by the travel insurance company. The travel insurance company then reviews the claim and verifies the information provided. If the claim is approved, the company pays the medical service provider directly.

Direct billing is when the insurance carrier bills the policyholder, and the policyholder pays the carrier directly. Agency billing is when the agency bills the insured, collects the premium payment(s), and pays the MGA or the carrier.