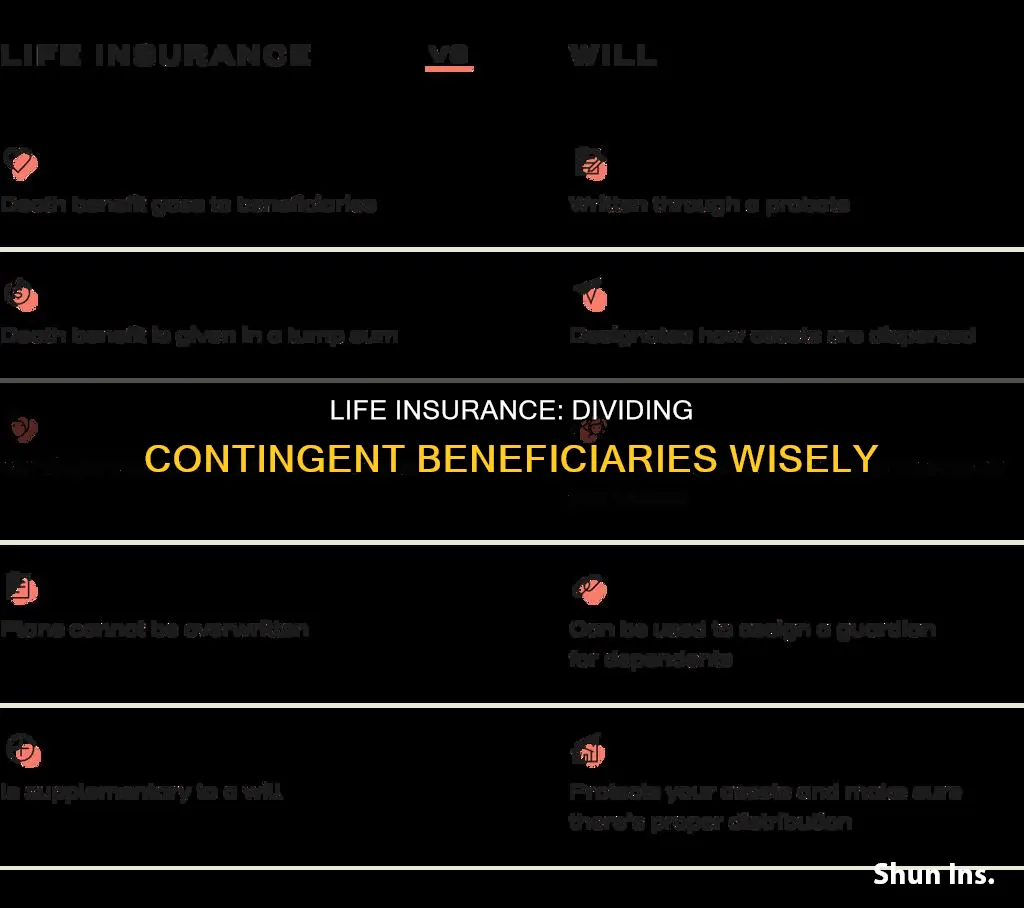

When you take out a life insurance policy, you can name multiple beneficiaries and decide how you want the money to be split between them. This is important because if you don't name a beneficiary, the death benefit typically becomes part of your estate and may be subject to probate, a legal process that can delay the disbursement of funds to your loved ones.

There are two types of beneficiaries: primary and contingent (also known as secondary or remainder beneficiaries). Primary beneficiaries are the first in line to receive the payout from your policy. Contingent beneficiaries only receive the payout if the primary beneficiary is unable to do so, for example, if they are deceased, cannot be located, or refuse the payout.

When designating multiple beneficiaries, you need to decide how you want the money to be split between them. Usually, this is done by percentage (e.g. 50%/50%, 65%/35%, etc.). You can also choose to divide the payout per stirpes or per capita. Per stirpes means the payout is divided by rank in the family, while per capita means it is divided by the number of people.

It's important to regularly review and update your beneficiary designations to reflect any major life changes, such as marriage, divorce, or the birth of a child.

| Characteristics | Values |

|---|---|

| Number of beneficiaries | There is no limit to the number of beneficiaries you can have. |

| Primary beneficiary | The first recipient of the policy assets. |

| Contingent beneficiary | The secondary recipient of the policy assets, if the primary beneficiary is deceased or otherwise unable to receive the benefit. |

| Distribution of proceeds | Proceeds can be distributed per stirpes (by rank in the family) or per capita (by the number of people). |

| Age of beneficiary | Minors can be beneficiaries, but they cannot receive the benefit directly. |

What You'll Learn

Primary and contingent beneficiaries

When you take out a life insurance policy, you will need to designate a beneficiary or beneficiaries. While it is not strictly necessary to name a beneficiary, it is highly recommended. If you do not, the death benefit will typically become part of your estate and may be subject to probate, which can delay the disbursement of funds to your loved ones.

There are two main types of beneficiaries: primary and contingent. Primary beneficiaries are the first in line to receive the death benefit from your policy. Contingent beneficiaries are the backup and will only receive the benefit if the primary beneficiary is unable to. This could be because the primary beneficiary has died, or because they cannot be found or have declined to accept the payout.

You can name multiple primary beneficiaries and decide what percentage of the death benefit each will receive. For example, you might name your spouse as a primary beneficiary and your children as contingent beneficiaries. If your spouse predeceases you, your children will each receive a portion of your estate following your death.

It is a good idea to name at least one contingent beneficiary as a backup in case your primary beneficiary is unavailable. Without one, your assets could enter probate if your primary beneficiary is unable to claim them. You can name any person or organisation as your contingent beneficiary, although if the designated beneficiary is a minor, the assets would first go to a legal guardian. You can also have multiple contingent beneficiaries and divide your estate among them.

Incorporating Life Insurance in Your Net Worth Calculation

You may want to see also

Revocable vs. irrevocable beneficiaries

When choosing a life insurance beneficiary, you can select either a revocable or an irrevocable beneficiary. Here is a detailed overview of the two types:

Revocable Beneficiary

A revocable beneficiary is the policy owner's choice and can be changed at any time without the consent of the beneficiary. The person or entity chosen as a revocable beneficiary has no legal interest in the death benefit during the insured person's lifetime. The policy owner has full control and can make changes without any approval. This flexibility is beneficial when there are changes in your life, such as marriage, divorce, or the birth of a child.

Irrevocable Beneficiary

An irrevocable beneficiary is designated to receive the assets from your life insurance policy and cannot be changed or removed without their consent. They have certain rights regarding the death benefit, and if you wish to change the beneficiary, the current irrevocable beneficiary must agree and sign off on the changes. Irrevocable beneficiaries provide a layer of certainty but limit flexibility. This type of beneficiary is often chosen in cases of divorce, second marriages, or blended families to ensure the benefit goes to the intended individual(s).

Convert Term Life Insurance: Is It Possible?

You may want to see also

Per stirpes vs. per capita

When it comes to dividing assets, the terms 'per stirpes' and 'per capita' are often used. They are both Latin terms, with 'per stirpes' meaning 'by branch' and 'per capita' meaning 'by the heads'. These terms are used to describe different methods of dividing assets among beneficiaries.

Per Stirpes

Per stirpes is used when a beneficiary passes away before the testator (the person who created the will). In this case, the inheritance will go to the deceased beneficiary's heirs, or the closest person under their branch of the family tree. This is often the beneficiary's children or grandchildren. Per stirpes is a good way to ensure that the descendants of the original beneficiaries are protected.

Per Capita

Per capita is used to describe an arrangement in which, if a beneficiary passes away before the testator, the estate is distributed evenly among the surviving beneficiaries. Their share of the estate is not set aside but is divided among the other beneficiaries.

Per Stirpes vs Per Capita

The main difference between per stirpes and per capita is that per stirpes passes the inheritance down the family tree, while per capita results in a more even split among surviving beneficiaries. Per stirpes is more common than per capita, but neither is better than the other. The testator's feelings for their family dynamic should guide their decision on which method to use.

Full Denture Insurance Coverage: MetLife's Offerings and Limits

You may want to see also

Minors as beneficiaries

While it is possible to name a minor as a life insurance beneficiary, it is not recommended. Here are some reasons why:

- Minors cannot receive the death benefit directly. A court-appointed adult custodian will be responsible for managing the funds until the minor reaches adulthood. This process can be time-consuming and expensive, reducing the amount of money available to the child.

- The transfer process does not come cheap and can further reduce the funds available to the minor.

- You lose control over who handles the funds, as the court will appoint the custodian.

Instead of naming a minor as a direct beneficiary, consider these alternatives:

- Establish a life insurance trust: By setting up a trust, you can specify how you want your death benefit to be distributed. For example, you can state that a portion of the funds be distributed for your child's college education when they turn 18, and then the remainder be given to them at age 25 to use as they wish. The trust is listed as the beneficiary, and a trustee of your choice routes the money to your child per your wishes.

- Designate your partner or spouse as a beneficiary: If you have a partner or spouse, consider making them the primary beneficiary. They can continue to manage your household finances and save money for your child's future. If both you and your partner pass away, the life insurance trust can take over.

- Create a UTMA account: The Uniform Transfers to Minors Act (UTMA) requires you to name a custodian to manage your child's assets until they become an adult, at which point the assets will be transferred to them.

Pru Life: Comprehensive Health Insurance Coverage?

You may want to see also

Charities and organisations as beneficiaries

Charities and organisations can be beneficiaries of life insurance policies. This is a good option if you want to leave a legacy gift and provide financial support to organisations you believe in.

You can name a charity as a primary or contingent beneficiary. If you are confident that your loved ones will be financially secure after you pass away, you may want to consider naming a charity as your primary beneficiary. If you are unsure about your loved ones' financial security, you can name a charity as a contingent beneficiary, who will receive the payout if your primary beneficiary is no longer alive when you pass away.

You can also allocate a percentage of your life insurance benefit to a charity, while the remaining amount goes to a loved one. It is important to know the business of the nonprofit beneficiary to ensure that the money will be used in a way that you support.

You can also choose to make a charitable gift of your life insurance policy. This can be done by donating an existing permanent policy to a nonprofit. To qualify for a charitable deduction, the donor must relinquish all rights to the policy. The donor will not receive a charitable income tax deduction for this future gift because they have not made an irrevocable charitable contribution. However, the donor's estate will be entitled to a charitable estate tax deduction for the amount transferred to the nonprofit.

Another option is to purchase a new policy in the name of the charity, with the charity owning the policy and paying the premiums. The donor will receive a charitable deduction for the donated cash or assets but not for the policy itself.

Cheap Life Insurance: Smart Ways to Save on Coverage

You may want to see also

Frequently asked questions

A contingent beneficiary is a secondary recipient of your life insurance policy payout. They will receive the benefit if your primary beneficiary is unable to, ensuring the proceeds are distributed as intended.

You can name almost anyone as your contingent beneficiary. However, you cannot name children under the age of 18 or pets.

You can choose multiple contingent beneficiaries, so if the first is unable to accept the benefit, another can take their place. It is recommended that you name at least a secondary beneficiary in case your primary dies before you do.

You can leave 100% of the life insurance death benefit to one person or split the proceeds between multiple beneficiaries. You can assign proceeds to be distributed per stirpes (by rank in the family) or per capita (by the number of people).