Filling out an auto insurance application is a crucial step in obtaining auto insurance coverage. It is important to be honest and provide accurate information when filling out the application. The application process typically involves gathering relevant documentation, such as a driver's license, vehicle registration, and previous insurance policies, and contacting a reputable insurance provider to choose the appropriate coverage. The application form will require personal information, vehicle details, and driving history. Understanding the requirements and providing complete and accurate information is essential to ensure a smooth application process and obtaining the necessary auto insurance coverage.

| Characteristics | Values |

|---|---|

| Driver's Information | Driver's license number and state, social security number, date licensed, etc. |

| Vehicle Information | Vehicle ID number (VIN), vehicle make, model and year, vehicle usage, etc. |

| Current Insurance Information | Bodily injury limits, property damage limit, collision deductible, comprehensive deductible, etc. |

| Driving History | Accidents, violations, not-at-fault incidents, moving violations, etc. |

| Additional Information | Marital status, gender, date of birth, address, etc. |

What You'll Learn

Vehicle information

When applying for car insurance, you will need to provide the following vehicle information:

- Vehicle registration or title: This document proves that you are the owner of the vehicle.

- Vehicle identification number (VIN): A unique code assigned to your vehicle for identification purposes.

- Vehicle's make, model, and age: You may be asked to provide the car's registration number, make, model, and age. Alternatively, you can provide the Vehicle Identification Number (VIN), which is a unique alphanumeric code assigned to your vehicle.

- Vehicle's parking location: The location where you garage your car can impact your insurance quotes. Providing the precise address where your car is parked when not in use (e.g. at your home or business) allows for more accurate insurance quotes.

- Vehicle's annual mileage: Your insurer needs to understand how much your vehicle is driven to properly assess your coverage needs.

- Vehicle's usage: Let your insurance provider know if your personal car is used for business purposes. Failing to disclose this information could result in a lack of coverage for accidents that occur while conducting business.

- Safety features: Information about the safety features of your vehicle can also be relevant when filling out an auto insurance application.

Gap Insurance: Credit Score Impact

You may want to see also

Driver information

When filling out the driver information section of an auto insurance application, you will need to provide details about yourself and the vehicle you will be driving. This information is necessary to determine the premium and provide you with an accurate quote. Here is a comprehensive guide to help you through the process:

Personal Information:

- Full name, date of birth, and marital status.

- Your driver's license number and state of issue.

- Social Security Number (some insurers may require this for identification and risk assessment).

- Any previous driving licenses, especially if you have been licensed in other states or countries.

- Your driving history, including any accidents, moving violations, or major driving infractions within the past 3-5 years.

- Safe driving courses completed and relevant certificates.

- If you are a student driver, your grades (as good grades may qualify you for a discount).

Vehicle Information:

- Make, model, and year of the vehicle.

- Vehicle Identification Number (VIN).

- Safety and security features, such as anti-lock brakes, lane departure warning systems, or GPS trackers.

- Annual mileage and how the vehicle is used (e.g., personal or business use).

- Address where the vehicle is typically parked or garaged.

- Name of the registered owner or owners of the vehicle.

- Current or previous insurance information, including policy numbers and coverage details.

- A copy of the vehicle's title, registration, or other ownership proof.

Additional Considerations:

- If there are multiple drivers for the same vehicle, their information will also need to be provided.

- If you are a new driver or have a history of driving infractions, you may need to provide additional documentation or meet specific requirements as outlined by the insurance company or state regulations.

- Some insurance companies may also ask for proof of residence, financial information, or other personal details to assess risk and determine coverage options.

Full Coverage Auto Insurance: Does It Cover Medical Bills?

You may want to see also

Insurance history

When filling out the auto insurance application, you will need to provide your insurance history. This will include details of any previous insurance policies you have held. You can obtain a copy of your auto insurance history by contacting your previous insurance company or companies. They can provide a printout of your insurance coverages and claims, often called a letter of experience. Alternatively, you can try contacting your state's Department of Motor Vehicles, which may have information on your previous insurance policies.

Your insurance history may also include details of any claims you have made. In the US, this information can be found in your CLUE (Comprehensive Loss Underwriting Exchange) report, which is maintained by LexisNexis. You can request a copy of your CLUE report by contacting LexisNexis directly by phone or online. The CLUE database allows insurance companies to access information about past claims and inquiries, even if a claim was never submitted or paid.

If you need proof of insurance for a specific period, you will need to contact the insurance company that covered you during that time. They can provide you with the necessary documentation. It is important to keep in mind that proof of insurance does not provide a claims history, but only coverage dates.

When filling out the application, be sure to provide complete and accurate information about your insurance history, including any relevant documents. This will help ensure that your application is processed smoothly and that you obtain the appropriate insurance coverage for your needs.

Exclude Drivers from Auto Insurance?

You may want to see also

Personal details

When filling out an auto insurance application, you will need to provide various personal details. This includes information about yourself, your vehicle, and your driving history. Here are some key points to keep in mind:

- Basic Information: Start by providing your full name, date of birth, age, gender, and marital status. You will also need to input your address, contact information (phone number, email address), and driver's license details (license number, type of license, date of issue, etc.). If you have multiple drivers in your household, make sure to gather their information as well.

- Vehicle Information: For each vehicle you own, you will need to provide the year, make, model, vehicle identification number (VIN), and safety features. Additionally, you may be asked about your vehicle's usage (personal, business, commute, etc.), annual mileage, and parking location. If your car is financed or leased, you will also need to provide the name and address of the loss payee or lessor.

- Driving History: Be prepared to disclose your driving record and any accidents, traffic violations, or claims within the past 3 to 5 years. This information is crucial for assessing your risk profile.

- Insurance History: If you have previously held insurance, provide details of your current or previous insurance policies, including the insurance company, policy number, and coverage dates. You may also need to submit a copy of your current declarations page, which outlines your existing coverage and loss payee clause.

- Additional Information: Depending on the insurance company and your specific circumstances, you may be asked for further details. This could include your occupation, professional affiliations, student status (for young drivers), property ownership, and social security number.

Remember to review the application form thoroughly and ensure you understand all the instructions and requirements. Provide accurate and complete information to the best of your knowledge. Once you have filled out the application, double-check all the details for correctness before submitting it.

Switching Auto Insurance in Massachusetts: A Step-by-Step Guide

You may want to see also

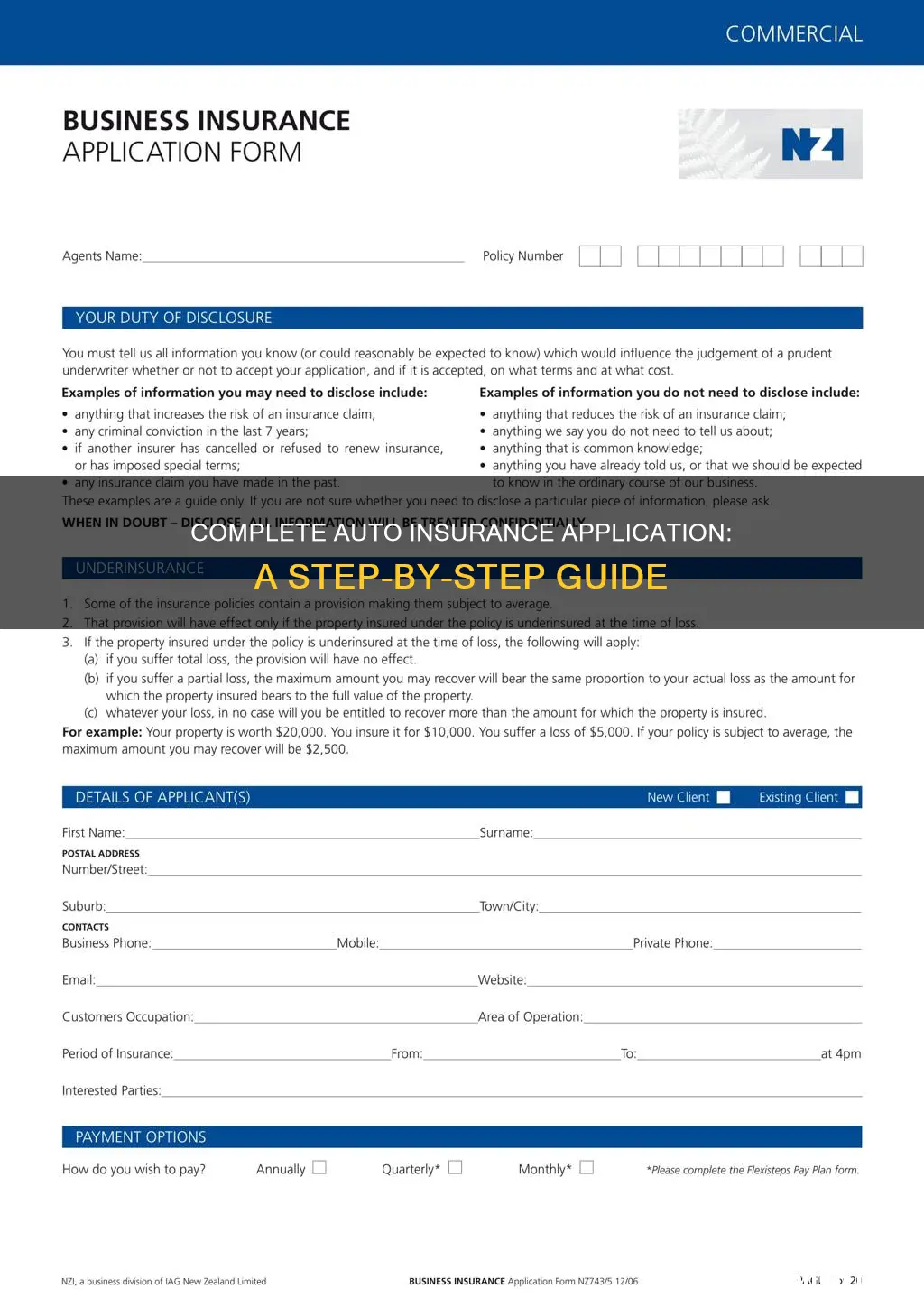

Payment details

When it comes to payment details, you will need to provide information about your preferred payment method and, in some cases, details about your financial situation. Here are some key points to consider:

- Payment Method: Decide how you would like to pay for your auto insurance policy. Common payment methods include paying in full annually or opting for a monthly or quarterly payment plan. Some insurance companies may offer additional flexibility, such as paying in semi-annual instalments or setting up automatic payments from your bank account or credit card.

- Payment Information: Depending on your chosen payment method, you may need to provide specific payment details. For example, if you choose to pay by credit card, you will need to share your card number, expiration date, security code, and billing address. If paying by bank transfer, you may need to provide your bank account number and routing number.

- Financial Details: In some cases, the insurance company may request additional financial information, especially if you are applying for financing or payment plans. This could include details about your income, employment, and credit history. Be prepared to provide documentation such as pay stubs, tax returns, or bank statements if necessary.

- Payment Frequency and Amount: Find out from your insurance provider how often payments need to be made and the exact amount for each instalment. This information should be outlined clearly in your application to avoid confusion or missed payments.

- Payment Schedule and Due Dates: Understand the payment schedule and due dates associated with your auto insurance policy. Ask about any grace periods, late fees, or penalties that may apply if payments are not made on time. Knowing these details will help you stay on top of your payments and maintain your coverage without interruption.

Remember to review the payment terms and conditions carefully before finalising your application. It is important to understand the financial commitments and payment options associated with your auto insurance policy to ensure a smooth and stress-free experience.

Texas Comprehensive Claims: Higher Auto Insurance?

You may want to see also

Frequently asked questions

You will need to provide personal details, contact information, and relevant documents. This includes your driver's license, vehicle registration, and any previous insurance policies.

The type of coverage you choose will depend on your specific needs. Common types include liability insurance and comprehensive coverage.

You will need to provide details such as the vehicle's make, model, and year and Vehicle Identification Number (VIN). You will also need to disclose the main use of the vehicle and the expected mileage.

You will need to disclose any accidents, tickets, or claims within the last 36 months. Be honest about your driving record, as inaccuracies can result in increased rates or a void policy.

Once your application is processed and approved, you will receive proof of insurance, such as an insurance card or digital document. Keep this in your vehicle at all times.