Finding affordable auto insurance in Marietta, Georgia can be a challenge, as the state has some of the highest auto insurance rates in the nation. However, there are a few things you can do to find a good deal. First, shop around and compare quotes from different providers. Second, look into discounts that may be available, such as good student discounts, multi-car policies, or discounts for bundling your auto insurance with other types of insurance. Finally, make sure you have a clean driving record and a good credit score, as these factors can significantly impact your insurance rates.

| Characteristics | Values |

|---|---|

| Average monthly cost | $114 |

| Average annual cost | $1,794 |

| Average cost compared to Georgia average | $9 more expensive per month |

| Average cost compared to national average | $34 more expensive per month |

| Factors affecting cost | Age, gender, vehicle make and model, driving record, credit score, relationship status, housing situation |

| Cheapest vehicles to insure | Trucks and vans |

| Most affordable insurance companies | American Family, Progressive, Travelers Insurance, Allstate, Auto-Owners, Esurance, Nationwide, State Farm, GEICO, Georgia Farm Bureau, Liberty Mutual, USAA |

What You'll Learn

Compare quotes from different providers

Comparing quotes from different providers is a great way to find affordable auto insurance in Marietta, GA. Here are some steps to help you get started:

Step 1: Decide on the coverage you need

Different insurance companies will offer varying levels of coverage, so it's important to determine what you need before comparing quotes. Consider your state's minimum coverage requirements, your car's mileage and features, and whether you need additional coverage. For example, if you have a leased vehicle, you may be required to carry comprehensive and collision coverage.

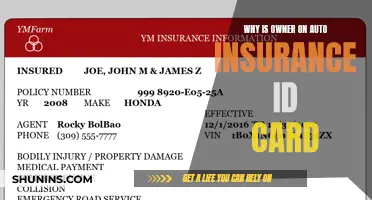

Step 2: Gather necessary information

To get accurate quotes, you'll need to provide some basic information. This includes personal details such as your age, gender, marital status, and driving history. You'll also need information about your vehicle, including the make, model, year, and mileage. Additionally, your current insurance status and address will be required, as these factors can impact your premium.

Step 3: Research and compare quotes from different providers

You can obtain quotes from multiple insurance providers in Marietta, GA, by either contacting their agents directly or using comparison websites. Comparison sites allow you to input your information once and receive quotes from multiple insurers, making it more convenient. Some sites to consider include Progressive, Compare.com, and The Zebra. Remember to compare quotes for the same types and levels of coverage to ensure an accurate comparison.

Step 4: Consider discounts and other factors

When comparing quotes, don't forget to ask about possible discounts. Many insurance companies offer discounts for safe driving records, bundling policies, or maintaining good credit. Additionally, consider the customer service, claims handling, and overall reputation of the insurance provider. You can read reviews and ratings from other customers to get an idea of their satisfaction with the company.

Step 5: Choose the best quote

After comparing quotes and considering all factors, choose the quote that offers the best value for your needs. Pay attention to the coverage, deductibles, and limits provided by each insurer. Remember, the cheapest option may not always be the best, as it could mean less coverage. Select the quote that gives you the coverage you need at a price that fits your budget.

Iranian Motorists and the Insurance Question

You may want to see also

Consider your age and gender

When it comes to auto insurance, your age and gender are two factors that can significantly impact your rates. Let's take a closer look at how these factors play out in Marietta, Georgia.

Age

In Marietta, GA, age plays a crucial role in determining auto insurance rates. Generally, older drivers tend to have lower insurance premiums compared to younger ones. As you gain driving experience, your insurance rates can decrease. For every 10-year increment in age, you can expect to see a reduction in your monthly premium. However, once you reach retirement age, your rates may start to increase again. This is because insurance companies take into account the potential decline in driving abilities and health conditions that may arise with older age.

Gender

Gender is another factor that can influence auto insurance rates in Marietta, GA. On average, female drivers tend to pay less for car insurance than male drivers. In Marietta specifically, female drivers typically pay around $8 per month less than their male counterparts. This difference in rates is based on statistical data and actuarial tables that insurance companies use to assess risk.

While age and gender are important factors, it's essential to remember that they are not the only considerations. Other factors, such as driving record, vehicle type, credit score, and location, also come into play when determining auto insurance rates. By comparing quotes from multiple insurance providers and considering various factors, you can find the most affordable coverage for your needs in Marietta, GA.

Auto Insurance Costs for a G35: What to Expect

You may want to see also

Assess your driving record

When it comes to finding affordable auto insurance in Marietta, GA, assessing your driving record is crucial. Your driving record plays a significant role in determining your insurance rates, and a clean driving record can help you secure cheaper premiums. Here's what you need to know about assessing your driving record:

Understanding Your Driving Record

Your driving record, also known as your motor vehicle record (MVR), contains a wealth of information about your history as a driver. This includes various types of incidents and violations, such as accidents, speeding tickets, traffic violations, and even arrests for more serious offences like driving under the influence (DUI). These records are maintained by the Department of Motor Vehicles (DMV) in your state, and you can request a copy of your driving record from them, usually for a fee. Keep in mind that the information included and the retention period for these records can vary depending on your state's laws.

Impact of Your Driving Record on Insurance Rates

Insurance companies use your driving record to assess the risk of insuring you. They consider the frequency and severity of accidents, violations, and convictions on your record. The more incidents on your record, the higher the risk you pose to the insurer, which can result in higher insurance rates. For example, a single accident on your record can increase your insurance rates by an average of $80 per month, while a speeding ticket can raise your rates by $45 per month. DUI convictions carry even higher penalties, with drivers paying an average of $272 per month for full coverage.

Improving Your Driving Record

If your driving record isn't spotless, don't despair. You can take steps to improve it over time. Firstly, focus on driving carefully and maintaining a clean record by avoiding accidents, tickets, and violations. Additionally, consider taking defensive driving classes, which can help reduce your insurance rates. Remember that incidents on your record typically only impact your insurance rates for a certain period, usually between three and five years, depending on your state's laws. So, if you have older incidents on your record, they may no longer affect your rates.

Shopping for Affordable Insurance

When looking for affordable auto insurance in Marietta, GA, it's essential to compare quotes from multiple insurance companies. Some insurers, like State Farm and Progressive, offer more competitive rates for drivers with less-than-perfect records. By shopping around and getting quotes from different providers, you can find the best rates and coverage options for your specific situation. Additionally, consider using comparison websites or working with an independent insurance agent who can help you find the most suitable policy for your needs.

Comprehensive Auto Insurance: Mold Protection Included?

You may want to see also

Evaluate your vehicle

When evaluating your vehicle, it's important to consider the make and model, as well as the age of your car. Generally, newer vehicles are more expensive to insure than older ones. However, in Marietta, GA, the most expensive vehicles to insure are four to five years old. Trucks and vans tend to be the cheapest to insure, with cars and SUVs being more costly.

The type of insurance coverage you choose will also depend on your vehicle. If you have a newer car, you may want to consider full coverage, which includes collision and comprehensive insurance, to protect against any unforeseen circumstances. Collision insurance covers repairs when your car hits another vehicle or object, while comprehensive insurance covers non-accident-related damages such as floods, fires, theft, or vandalism. If you have an older car, liability insurance, which covers the other driver's expenses if you are at fault in an accident, may be sufficient.

Additionally, consider your vehicle's safety features and ratings. A car with good safety ratings may be eligible for discounts on insurance premiums. You can also install additional safety features, such as anti-theft devices, which can help lower your insurance rates, especially for senior drivers in Marietta.

Finally, if you are financing your vehicle, your lender may require you to have full coverage insurance to protect their investment. Make sure to review the requirements of your loan agreement to ensure you have the necessary insurance coverage for your vehicle.

By evaluating your vehicle's characteristics, age, and safety features, as well as your own needs and preferences, you can make an informed decision about the type of insurance coverage that is best suited for your car.

Auto Insurance Deductible: High or Low?

You may want to see also

Explore discounts

When it comes to finding affordable auto insurance in Marietta, Georgia, there are a few things you can do to keep costs down. One of the best ways to save money on car insurance is to explore the various discounts that may be available to you. Here are some common types of auto insurance discounts to look out for:

Multi-Policy or Bundling Discounts

If you take out multiple policies with the same company, such as combining auto insurance with home, renters, condo, life, motorcycle, RV, or boat insurance, you can often get a significant discount. This is known as "bundling" and can save you between 5% and 25% on your auto insurance. For example, Progressive offers a 7% average discount when you combine auto and home insurance.

Vehicle Safety Discounts

If your car is equipped with safety features like anti-lock brakes, airbags, and daytime running lights, you may be eligible for a discount. Airbag discounts can be substantial, offering up to a 40% discount on medical-related coverage. Cars that are less than three years old may also qualify for a new car discount, which is typically between 10% and 15%.

Anti-Theft Device Discounts

If your car has anti-theft features, you can usually get a discount on your comprehensive coverage. This can range from 5% to 25% off. Examples of anti-theft devices include GPS-based systems, stolen vehicle recovery systems, and VIN etching, which permanently engraves the vehicle identification number on the windshield and windows.

Good Driver Discounts

Insurance companies often reward safe drivers with discounts. For instance, if you've had no accidents in five years, GEICO offers up to a 26% discount. Good driver discounts typically range from 10% to 40%. Some companies may also offer accident forgiveness, where your rate won't increase if you have a claim, provided you meet certain conditions.

Defensive Driver Discounts

Taking an approved defensive driving course can sometimes lead to a discount on your insurance. This discount usually applies to qualified drivers over the age of 50, and the typical discount is between 5% and 10%. In some states, this discount is mandated for mature drivers.

Good Student Discounts

If you or your student driver is a full-time student with good grades (usually a B average or above), you may be eligible for a discount. This discount often applies to students aged 16 to 25 and can range from 8% to 25%.

Student Away at School Discount

If your student is away at school and doesn't have regular access to your car, you may qualify for a discount. The requirements vary, but typically the student must be under 25 years old and more than 100 miles from home, only using the car during school vacations and holidays.

Payment Method Discounts

Insurance companies often offer discounts if you pay your policy in full upfront. Additionally, you may be able to get a small discount for setting up automatic payments or using electronic funds transfer (EFT). Going paperless and opting for electronic billing and documents can also lead to a small discount.

Online Quote and Advance Purchase Discounts

Some companies offer a discount if you get an online quote and sign up for a policy, ranging from 4% to 12%. You may also get a discount if you purchase a policy in advance of your current one expiring, typically around seven to 14 days in advance. This discount can range from 2% to 15%.

Occupational Discounts

Your occupation may also qualify you for a discount. For example, Liberty Mutual offers special policy features for educators, and GEICO offers up to a 15% discount for military personnel. It's worth asking your insurance agent if your occupation qualifies for any discounts.

Usage-Based Insurance (UBI) Discounts

Some insurance companies offer UBI programs that adjust rates based on your driving habits. These programs typically offer a discount for enrolling (5% to 10%) and then an additional discount based on your actual driving, which can be anywhere from 5% to 40%.

Remember that not all discounts are automatic, and it's always a good idea to regularly review the available discounts with your insurance agent. Discounts can also vary by state and insurance company, so be sure to check what's applicable in your area.

Canceling MetLife Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The average cost of auto insurance in Marietta, GA, is about \$114 per month, which is higher than the national average.

Factors such as age, gender, vehicle type, driving record, credit score, marital status, and address can affect car insurance quotes in Marietta.

To find affordable auto insurance in Marietta, GA, you can compare quotes from different providers, look for discounts, and consider your coverage needs. Websites like Compare.com allow you to compare quotes from multiple companies.

Yes, companies like Freedom National, Action Auto Insurance Agency, and GEICO are known for offering affordable auto insurance in Marietta, GA.

In Marietta, GA, drivers are required to carry a minimum of \$25,000 in bodily injury liability per person, \$50,000 per accident, and \$25,000 in property damage liability per accident.