Getting auto insurance in one sitting is possible, and many insurance companies offer this option to their customers. This is known as same-day car insurance, and it is a great option for those who need car insurance immediately. The process is simple and can be done online. All you need is your personal information, such as your name, date of birth, and driver's license number, as well as information about your vehicle, including the make, model, year, and vehicle identification number. It is also important to determine your coverage needs and get quotes from multiple companies to ensure you are getting the best rate. Once you have chosen a policy, you can purchase it and print off your proof of insurance.

| Characteristics | Values |

|---|---|

| How to get auto insurance in one sitting | Gather all necessary information, including personal information and vehicle information. Determine your coverage needs. Get more than one quote. Buy your policy. Get proof of insurance. |

| Who qualifies for one-day auto insurance | People between 21 and 75 years old with a relatively clean driving record. |

| How to get one-day auto insurance | Step 1) Gather your information. Step 2) Compare insurance quotes online. Step 3) Call local insurance agents. Step 4) Pay your rate. Step 5) Get proof of insurance. |

What You'll Learn

What you need to get same-day auto insurance

Getting auto insurance in one sitting is possible, and many major insurance companies offer this option. Here's what you need to get same-day auto insurance:

Personal Information

You will need to provide your full name, date of birth, driver's license number, and Social Security number. It is also helpful to know how many miles you plan on driving and have other vehicle information readily available, such as the make, model, year, and vehicle identification number (VIN).

Coverage Needs

When getting same-day auto insurance, it is essential to determine your coverage needs. While you may be tempted to get the minimum amount of coverage required by your state, it is important to ensure you have adequate protection. Once you have your policy, you can always go back to your insurer to discuss additional coverages and discounts.

Payment Method

To purchase your policy, you will need a payment method, such as a credit or debit card. Most insurance companies require payment before your coverage can start.

Proof of Insurance

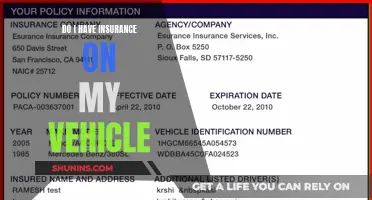

After purchasing your policy, you will need to obtain proof of insurance or a digital insurance card. This is because most states require you to carry proof of insurance in your vehicle at all times, and dealerships will also require this before you can drive your new car off the lot. Many companies offering same-day insurance allow you to print a temporary hard copy or access your proof of insurance cards online while waiting for your physical cards to arrive.

Compare Quotes

Although you may be in a rush, it is beneficial to get multiple quotes from trusted companies offering same-day auto insurance. This will allow you to compare coverage and rates to ensure you get the best deal. Most major insurance companies can provide a quote within minutes.

By gathering the necessary information, determining your coverage needs, having a payment method ready, obtaining proof of insurance, and comparing quotes, you can successfully obtain same-day auto insurance.

Apply for Cure Auto Insurance: A Step-by-Step Guide

You may want to see also

How to get proof of insurance

Getting proof of insurance is a straightforward process. Once you've purchased a policy, your insurance company will provide you with proof of insurance. This can be done via fax or email immediately after making your first premium payment. You may also receive this document electronically, as 49 states and the District of Columbia allow digital copies of insurance cards. However, it's worth noting that New Mexico does not recognize electronic copies during traffic stops, and Massachusetts doesn't require drivers to carry proof of insurance.

- By Mail: Your insurance company will often mail you multiple paper insurance cards when you start a new policy.

- Print-Out: You can request an electronic copy of your insurance card and print it out yourself.

- Mobile App: Many insurance companies, including Allstate, Geico, Progressive, and State Farm, allow you to access your digital insurance card through their mobile app.

It's important to always carry your proof of insurance with you, as you may need it when pulled over by the police, in an accident, leasing a vehicle, or during other situations. The proof of insurance will typically include your policy number, effective dates, vehicle information, and other relevant details.

Canceling a USAA Auto Insurance Claim

You may want to see also

Who qualifies for one-day auto insurance

It is important to note that car insurance companies do not typically offer one-day car insurance. If you encounter a provider that says they do, be cautious, as it may be an insurance scam. However, there are a few ways to get insured for a day, and some situations where you may qualify for one-day insurance.

Firstly, if you are driving a borrowed car, you can call the car owner's insurer and ask to be included in their policy for the day. Most providers will cover you since the insurance policy is for the car, not the driver. Secondly, if you are renting a car, you can contact the rental car company to confirm whether their insurance policy covers you. If not, you can buy a temporary policy for the day through the rental car company.

In addition, if you need to show proof of insurance but do not own a car, you can purchase non-owner car insurance, which provides liability coverage at cheaper rates than standard insurance. If you only drive your car occasionally, you may also want to consider usage-based insurance, where you are only charged for the days you drive.

Finally, if you are test-driving a car at a dealership, you are covered by their insurance. Dealerships are required by law to have full coverage for their vehicle inventory.

Auto Insurance: Scratches Covered?

You may want to see also

How to get insurance for a parked car

Getting insurance for a parked car is a great way to save money if you don't plan on driving for a while. Here's a step-by-step guide on how to get insurance for your parked car:

Step 1: Understand the concept of parked car insurance

Parked car insurance, also known as "storage coverage," is an interim solution offered by insurance companies for vehicles that won't be in use for an extended period. This type of insurance typically includes only comprehensive coverage, excluding liability and collision coverages. It's designed to keep your vehicle parked in one place, ideally in a locked garage off the street, and can lower your premium by up to 80%.

Step 2: Check state and insurer requirements

Each state and insurer has different regulations regarding parked car coverage. Before making any changes to your insurance policy, be sure to research and understand the specific requirements of your state and insurance provider. Some states may require you to cancel your vehicle registration and remove it from public roads. Additionally, your insurance company might mandate that you insure another vehicle to meet the state's minimum liability requirements.

Step 3: Contact your insurance company

Call your insurance company to inquire about their parked car insurance options. Many companies require that your car is in storage for a minimum of 30 days to qualify. They will guide you through the process and let you know if there are any additional steps or requirements.

Step 4: Ensure you meet the eligibility criteria

To be eligible for parked car insurance, you usually need to have an established policy with a "fully" insured vehicle, meaning it is insured to at least your state's liability limits. Additionally, you must own the vehicle outright. If you are leasing or financing the car, you typically cannot reduce the coverage to "storage" or "non-use" as it would violate your lease or finance agreement.

Step 5: Compare rates and make a decision

If your current insurance company does not offer parked car insurance, take the opportunity to shop around and compare rates from different providers. Obtaining quotes from multiple companies will help you find the best coverage and price for your needs. Remember to consider not only the cost but also the reputation and reliability of the insurer.

Step 6: Purchase the policy and obtain proof of insurance

Once you've decided on an insurance company and policy, go ahead and purchase the parked car insurance. Make sure to review the coverage and rates carefully before finalizing the transaction. After purchasing, obtain proof of insurance, as most states require you to carry this with you in your vehicle.

By following these steps, you can obtain insurance for your parked car, ensuring that your vehicle remains protected while also saving you money on your insurance premiums.

Switching Auto Insurance: Is It Possible?

You may want to see also

The pros and cons of storage coverage

While it is not a legal requirement to insure a car that is not being driven and is in storage, it is still a good idea to keep it insured, even if it is to a lesser degree. This will protect your car against theft, vandalism, or damage caused by accidents or weather events.

Pros of Storage Coverage

Storage coverage, also known as parked car insurance, is an interim solution for a car that won't be in use for an extended period. It is a way to "suspend" your auto policy if you won't be driving or using your vehicle for a period of time, such as during winter or summer.

Storage coverage can lower your premium significantly, sometimes by as much as 80%. It is a cost-saving option if you won't be driving for a while and is much better than canceling your coverage altogether.

Cons of Storage Coverage

The potential downside of storage coverage relates to state vehicle registration laws. Excluding New Hampshire, all states require drivers to carry at least minimum liability insurance as part of their car insurance policies. If you drop this coverage, you risk license and registration suspension.

To avoid this, you will need to cancel your registration, remove the vehicle from public roads, and follow the necessary protocols required by your state and Department of Motor Vehicles (DMV). Your insurance company might also require you to insure another vehicle to meet your state's minimum liability requirements.

Gap Insurance: Negotiating With Dealers

You may want to see also

Frequently asked questions

You can get auto insurance in one sitting by buying a policy online. Many major insurance companies offer the option to buy car insurance online instantly, where you can get a quote, pay, and print proof of insurance in minutes.

At the very least, you should have your personal information (full name, date of birth, driver's license, and Social Security number) and vehicle information (make, model, year, vehicle identification number, and mileage).

Getting auto insurance in one sitting can be convenient if you need coverage immediately. It can also be a cost-effective option if you don't drive a lot, as you can pay for just the days you need coverage.