Auto insurance records are important for drivers to keep track of, as they can impact insurance rates and coverage options. These records include details such as claims history, driving record, and personal information. There are a few ways to obtain auto insurance records, including contacting previous insurance companies, requesting a CLUE report, or checking with the state's Department of Motor Vehicles. It is recommended to periodically check auto insurance records to ensure accuracy and understand how it may affect insurance rates.

| Characteristics | Values |

|---|---|

| How to get auto insurance records | Contact your insurance company or request a CLUE report from LexisNexis |

| How far back do insurance companies check records? | 3-10 years |

| How long do claims stay on your record? | 7 years |

| How to dispute errors | Contact your insurer or LexisNexis |

What You'll Learn

Ask your previous insurance company for a letter of experience

A letter of experience is a document that contains all the information about your auto insurance policy. It is written by an insurance company that has covered you in the past and details your record with them. It is much like a letter of recommendation.

You can request a letter of experience directly from your auto insurance company. It is a good idea to keep updated versions from all the providers you deal with. If you ever go shopping for a new provider, especially in a new province, the letter of experience will tell the provider what kind of policyholder you are, and this could result in considerable savings on your premiums.

The letter will include the following information:

- The names of the insured on the policy

- The current status of the policy

- The policy's start and end dates

- All claims made against the policy

- Claim details like the type of claim and the date it was filed

- Any fault determination

- Any injuries claimed

- Information on why the policy ended (if applicable)

A letter of experience must be printed on the company's letterhead and signed by an authorized representative to be considered valid.

Medicare and Auto Insurance: Understanding Primary Coverage for Medical Expenses

You may want to see also

Request a CLUE report from LexisNexis

To request a CLUE report from LexisNexis, you can contact the company directly by phone or online. The CLUE report, or Comprehensive Loss Underwriting Exchange report, contains your claims history for the past seven years. It is free, and you are entitled to one copy every 12 months.

To request your report online, you need to fill out an Online Request Form. After your request has been submitted, you will receive a letter via U.S. Mail with details explaining how to access your report online.

If you prefer to mail in your request, you can download a Printable Request Form (PDF) and send it to LexisNexis via U.S. Mail. The address is:

LexisNexis Risk Solutions Consumer Center

P.O. Box 105108

Atlanta, GA 30348-5108

You can also request your CLUE report by calling LexisNexis at 866-312-8076 or 1-866-897-8126. After your request is submitted, you will receive a letter via U.S. Mail with details explaining how to access your report online.

LexisNexis will verify the information you provide with the information in their records. They may not be able to comply with your request if they cannot confirm your identity or connect the information in your request with the personal information in their possession.

Gap Insurance: CarMax Coverage?

You may want to see also

Contact your state's Department of Motor Vehicles

If you're unsure which insurance company you've used in the past and need a record of your auto insurance history, you can try contacting your state's Department of Motor Vehicles (DMV). The DMV may be able to provide information on your previous insurance policies and can also give you a copy of your motor vehicle record (MVR), which can clarify any queries about tickets or accidents.

The process for checking your driving record can vary depending on the state you live in. Generally, you will need to determine which type of driving record you want, complete the relevant application, provide proof of identification, and pay any necessary fees. For example, in South Carolina, you can access your driving record points summary online for free. However, to view your three-year or ten-year driving record, you will need to pay a fee. In North Carolina, the fee is $5 for a three-year record and $7 for a seven-year record, which is the type typically used by insurance companies and employers.

You can find out the specific requirements for obtaining a driving record in your state by contacting your local DMV or Department of Public Safety. Many states allow you to request a driving record online, while others may require an in-person application. It's important to note that different types of driving records may be used for different purposes, such as background checks or court appearances. These records can include a history of minor and major traffic violations, accidents, and arrests for serious violations like driving under the influence.

Your driving record plays a significant role in determining your car insurance premiums. Insurance companies use your driving history to assess the risk associated with insuring you. They consider the frequency and severity of recent driving violations and collisions to estimate your insurance risk level. Therefore, a history of accidents or serious traffic violations will likely result in higher insurance premiums as you are considered a higher-risk driver.

Auto Insurance: Hail Damage Covered?

You may want to see also

Check your online account with your insurance company

Many insurance companies now offer online accounts for their customers, which can be a convenient way to access your insurance records. Here are some detailed instructions on how to check your auto insurance records through your online account with your insurance company:

Logging In to Your Online Account

Firstly, you will need to log in to your online account. Visit the website of your insurance company and locate the customer login or sign-in page. You will likely need to enter your login credentials, such as your email address or username, and password. If you have forgotten your login details, most websites will have an option to reset your password or retrieve your username.

Navigating the Online Portal

Once you have successfully logged in, you will be able to access your account information. The layout of the online portal will vary depending on the insurance company, but you should be able to find your policy information by navigating through the available options. Look for sections labelled "My Account", "Policy Information", or something similar.

Viewing Your Policy Information

Within your account, you should be able to view the details of your current insurance policy. This includes important information such as the type of coverage you have, the start and end dates of your policy, and any additional benefits or riders attached to your policy. You may also be able to view previous policies and their details.

Accessing Claims Information

In addition to policy details, your online account may also provide access to your claims history. This section will show any claims you have made, their status, and any relevant claim documents. You may also be able to initiate a new claim through this section. If you are unable to locate your claims information, try using the search function within the portal or refer to the help or support section of the website.

Downloading or Requesting Documents

Through your online account, you may have the option to download or print certain documents, such as your policy certificate or proof of insurance. This can be useful if you need to provide evidence of your insurance coverage to a third party. If there are specific documents that you require but cannot find, you may be able to submit a request through your online account. Alternatively, you can contact your insurance company directly to request these documents.

Updating Your Policy Details

Your online account may also allow you to make changes or updates to your policy. For example, you may be able to add or remove coverage options, change your payment details, or update your personal information. If you need to make changes to your policy, be sure to review the process outlined by your insurance company, as there may be limitations or restrictions.

Remember to keep your login credentials secure and confidential to protect your personal information. If you suspect any unauthorized access to your account, be sure to notify your insurance company immediately.

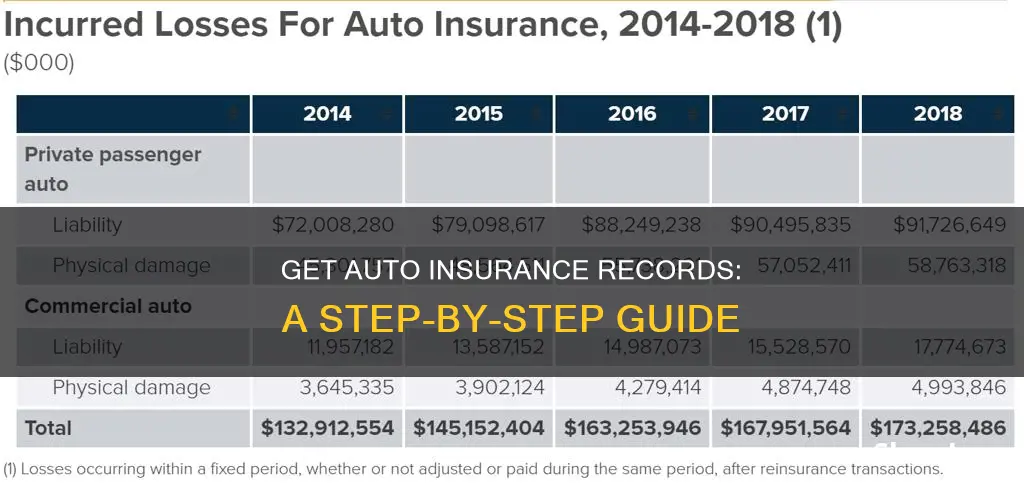

Auto Insurance Companies: Billions Made, but How?

You may want to see also

Request a claims history report

Requesting a claims history report is a straightforward process. There are a few ways to go about it, depending on the type of insurance and the information you need.

Auto Insurance Claims History Report

If you need an auto insurance claims history report, you can request a CLUE report from LexisNexis. This report will contain a seven-year history of claims filed for any vehicle, even if you weren't the owner at the time. The CLUE report is free, and you are entitled to one copy every 12 months. You can request it online, by mail, or by contacting LexisNexis directly.

Alternatively, you can ask your previous or current auto insurance provider for a letter of experience, which will detail your policy information, including any claims made.

Home Insurance Claims History Report

If you are looking for a home insurance claims history report, you can also request a CLUE report from LexisNexis. This report will contain a seven-year history of claims filed for any property and is provided by the insurance companies. Similar to the auto insurance CLUE report, you can request it online, by mail, or by contacting LexisNexis directly. You are entitled to one free copy per year.

If you are specifically looking for claims filed on your current home, you can request a copy of the claims history from your current home insurance company. However, if you want information on claims filed by previous owners, the CLUE report is the best option.

Florida: Mandatory Auto Insurance Coverage

You may want to see also

Frequently asked questions

You can get a copy of your auto insurance records by contacting your previous insurance company and requesting a letter of experience, which details your policy and claims history. You can also request your CLUE report from LexisNexis, which contains up to seven years of claims history.

If your insurance company is no longer operational, you can order your Claims Loss Underwriting Exchange (CLUE) report directly from LexisNexis. This is a free service and can be requested online or over the phone.

It is recommended to check your auto insurance records periodically, especially when renewing your policy or considering a new provider. Checking once a year or when any major changes occur is a good practice.

When checking your auto insurance records, you will typically need to provide the following information:

- Policyholder's full name

- Vehicle information (make, model, year)

- Date of birth of the policyholder

- Date range for the claims history you want to access