Getting competitive auto insurance quotes is a great way to save money on your car insurance. Here are some tips to help you get started:

- Know your policy coverage: Understand the details of your current policy, including deductibles, liability, collision, and comprehensive coverage. This will help you compare apples to apples when reviewing new quotes.

- Know your state's requirements: Familiarize yourself with the minimum coverage limits and legal obligations in your state. This will ensure that the quotes you receive meet your state's insurance requirements.

- Know your cancellation policy: Review your current policy's cancellation notice requirements to avoid being billed for the following month and having a lapse in coverage reported to credit agencies.

- Know your vehicle information: Have your make, model, year, and vehicle identification number (VIN) ready. Also, be aware of any safety features your car has, as these may qualify you for discounts.

- Request a copy of your driving record: Obtain a copy of your driving record from the DMV to provide accurate information to insurance companies. This will include any driving infractions from the past ten years, which can impact your premium.

- Know your credit score: Insurance companies use your credit score to calculate rate estimates, so knowing your score beforehand can help you receive a more accurate quote.

- Research reputable companies: Focus on companies with good financial ratings and stable backgrounds. Read reviews, check their financial ratings with organizations like A.M. Best, and look for companies that provide quotes online or through other channels.

- Provide accurate information: Online car insurance quotes are estimates generated based on the information you provide. Inaccurate information will result in an incorrect estimate. Be prepared to speak to a representative to finalize coverage and go over the details of your current policy.

- Compare quotes and adjust coverage: Take notes on how premiums change when you adjust your coverage. Review the changes to find the most cost-effective option, but don't make a decision right away. Ask about the validity period of the quoted price to avoid impulsive choices.

- Contact your current insurance agent: Discuss your options with your current agent and see if they can match the quotes you've received from other companies.

| Characteristics | Values |

|---|---|

| Excellent driving history | No tickets |

| Excellent credit score | N/A |

| Avoid switching insurance providers too often | N/A |

| Avoid living in big cities | N/A |

| Avoid buying highly-rated vehicles | N/A |

| Shop around for quotes | N/A |

| Compare similar coverage types | N/A |

| Research insurance companies | N/A |

| Know your state's insurance requirements | N/A |

| Know your cancellation policy | N/A |

| Know your vehicle information | N/A |

| Know your credit score | N/A |

What You'll Learn

Know your policy coverage

Knowing your policy coverage is a crucial aspect of getting competitive auto insurance. Here are some detailed paragraphs to help you understand this concept better:

Understanding the Basics of Auto Insurance Coverage:

It's important to know the basics of auto insurance coverage before diving into the specifics. Auto insurance provides financial protection in case you or another driver operating your car cause an accident that results in damage to someone else's property, injuries, or both. This basic personal auto insurance is mandated by most states in the US and helps cover the costs associated with these incidents. However, it's essential to recognize that state-required minimums might not be sufficient in the event of a severe accident. As a result, purchasing higher levels of coverage is a wise decision.

Types of Auto Insurance Coverage:

There are several types of auto insurance coverage, some of which are required by law, while others are optional. The mandatory coverages typically include bodily injury liability and property damage liability. Bodily injury liability covers the costs associated with injuries or death caused by you or another driver operating your vehicle. On the other hand, property damage liability reimburses others for any damage caused to their vehicle or other property, such as fences, buildings, or utility poles. Additionally, many states also require medical payments or personal injury protection (PIP) coverage, which reimburses medical expenses and lost wages for you and your passengers.

Optional Coverages:

In addition to the mandatory coverages, there are optional coverages that you can add to your policy for enhanced financial protection. Collision coverage, for instance, reimburses you for damage to your car resulting from a collision with another vehicle or object, such as a tree or guardrail. Comprehensive coverage protects your vehicle against theft and damage caused by incidents other than collisions, including fire, flood, vandalism, and natural hazards. Glass coverage is also available to cover the cost of repairing or replacing your windshield and other windows.

Understanding Coverage Amounts and Exclusions:

When considering your policy coverage, it's not just about the types of coverage but also the amounts. Ensure that you understand the limits of your coverage and whether it aligns with your needs. Additionally, be aware of any exclusions or situations that are not covered by your policy. For example, normal wear and tear, intentional damage, or accidents caused while performing illegal activities may not be covered.

Customizing Your Coverage:

Auto insurance policies can be customized to suit your specific needs and budget. You can choose the types of coverage that are most relevant to your situation and decide on the coverage amounts that provide adequate protection. By understanding the different types of coverage, their limits, and any exclusions, you can make informed decisions about your auto insurance policy.

In conclusion, knowing your policy coverage involves understanding the basics of auto insurance, the types of coverage available, the coverage amounts, and any exclusions. This knowledge empowers you to make informed decisions about your policy and ensure that you have the financial protection you need in the event of an accident or incident.

Auto Insurance Complaints: Your Rights and How to File

You may want to see also

Know your state's requirements

Each state has its own minimum car insurance requirements. It is important to be aware of the requirements of the state in which you live, as failing to meet these requirements can result in fines, license suspension, and other penalties.

Liability Coverage

Liability coverage is required in almost every state. This includes bodily injury liability, which covers medical bills if you injure someone in an accident, and property damage liability, which covers the cost of property damage you cause in an accident. The specific minimum amount of liability coverage you need depends on your state. For example, in California, the minimum requirements are $25,000 per person and $50,000 per accident for bodily injury liability, and $15,000 for property damage liability. On the other hand, in Florida, the minimum requirements are $10,000 for property damage coverage and $10,000 per person and $10,000 per accident for medical payments coverage.

Uninsured/Underinsured Motorist Coverage

About half of all states require uninsured/underinsured motorist (UM/UIM) coverage, which helps cover the cost of injuries and damage to your car if you are hit by a driver with little or no insurance. In some states, this coverage is only required for bodily injury.

Personal Injury Protection (PIP)

PIP is required in no-fault states, which include Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. In these states, drivers are required to file bodily injury claims with their own insurance through their PIP coverage. However, some no-fault states allow drivers to opt out of PIP coverage. PIP is also required in a few at-fault states.

Medical Payments Coverage

Maine is the only state that requires medical payments coverage, which goes toward medical expenses due to injuries from a car accident. It covers you, your family, or your passengers, but it does not cover lost wages or any additional benefits.

Comprehensive and Collision Coverage

While no state requires comprehensive and collision coverage, these types of coverage are important for protecting your vehicle. Comprehensive coverage covers damage to your car from events other than collisions, such as fire, theft, vandalism, animal strikes, and acts of nature. Collision coverage pays for damage to your car after a collision, regardless of who was at fault.

Understanding the True Cost of Full Auto Insurance Coverage

You may want to see also

Research and compare quotes from reputable companies

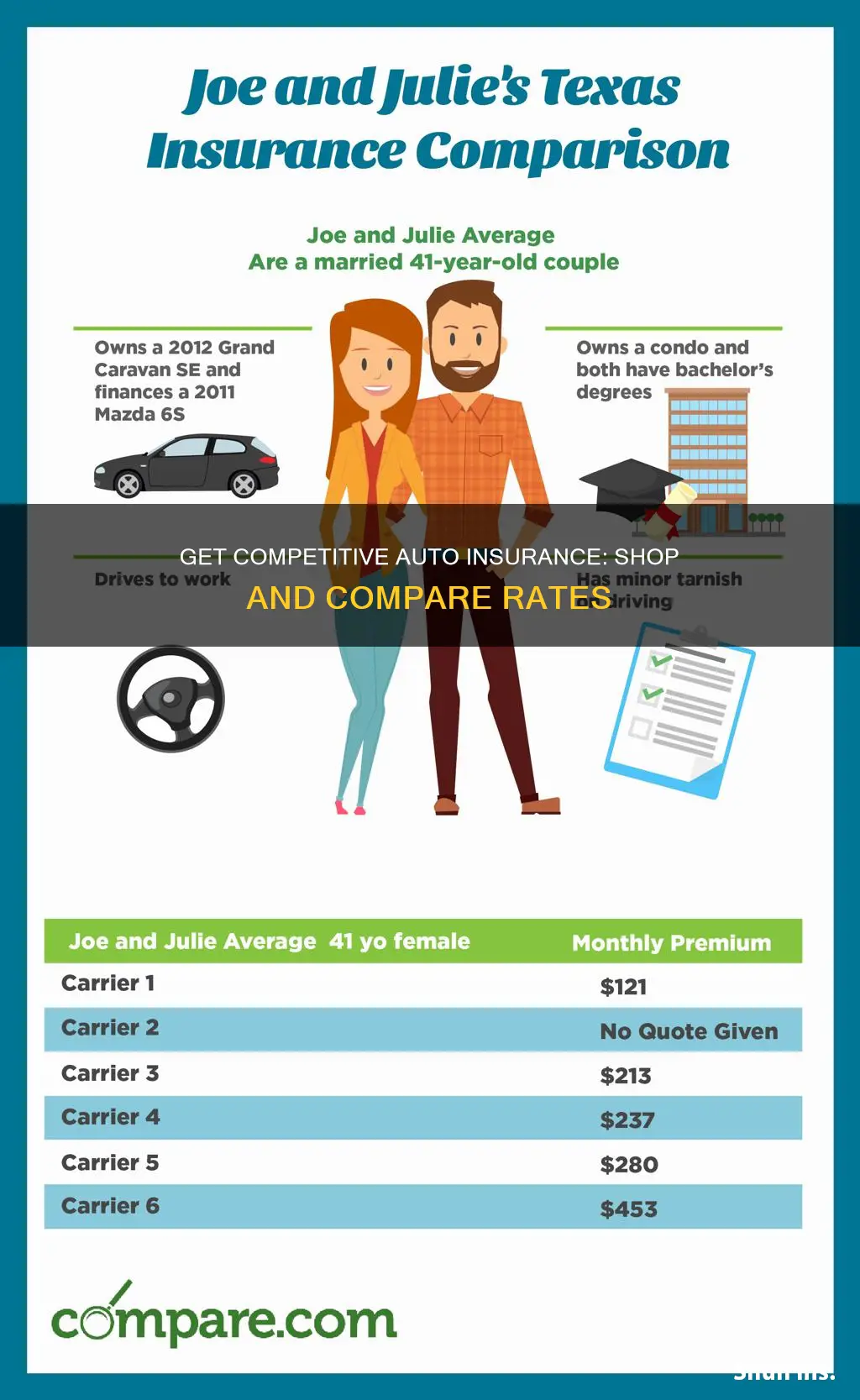

Researching and comparing quotes from reputable companies is a crucial step in getting competitive auto insurance. Here are some detailed tips to help you through the process:

Understand the Factors Affecting Your Premium

Before you start comparing quotes, it's essential to understand the factors that influence your auto insurance premium. These include your personal information, such as age, gender, driving history, credit history, vehicle type, and location. Knowing these factors will help you make more informed decisions when comparing quotes.

Gather Quotes from Multiple Reputable Companies

Obtain quotes from multiple reputable insurance companies. You can do this by visiting their websites, using insurance comparison sites, or contacting their agents directly. Aim for a minimum of three quotes to have a good basis for comparison.

Compare Coverage Options and Limits

When reviewing the quotes, pay close attention to the coverage options and limits offered by each company. Make sure you're comparing apples to apples by keeping the coverage limits the same across the quotes. This will help you identify which company offers the most comprehensive coverage at a competitive price.

Consider Additional Discounts and Benefits

In addition to the base premium, explore the discounts and benefits offered by each company. For example, many insurers provide discounts for bundling multiple policies (e.g., home and auto), having a clean driving record, or being a good student. These discounts can significantly reduce your overall premium.

Read Reviews and Assess Customer Satisfaction

Don't just focus on the price; consider the quality of service as well. Read reviews and assess customer satisfaction ratings from independent sources, such as J.D. Power or AM Best. Choosing a company with high customer satisfaction scores can enhance your overall experience and make the claims process smoother.

Analyze Complaint Data

Examine complaint data for each insurance company you're considering. This information is usually available from state insurance departments or consumer advocacy organizations. A company with a lower-than-average complaint ratio indicates better customer satisfaction and fewer issues with claims handling.

Evaluate Claims Processes and Repair Quality

Look into the claims processes and repair quality of the insurance companies. Some companies may have streamlined claims procedures, making it easier and faster to get your vehicle repaired or replaced. Additionally, consider the collision repair grades assigned by auto body professionals, as this reflects the insurers' handling of collision claims.

Understand the Quote's Validity Period

Be aware that insurance quotes may have different validity periods. Some quotes may be valid for up to 60 days, while others can change at any time. This is important to keep in mind, especially if you're not ready to make a decision immediately.

Contact Their Agents and Assess Their Support

Before finalizing your decision, contact the agents of the insurance companies you're considering. Assess their level of support, responsiveness, and knowledge. Choosing a company with helpful and accessible agents can make a significant difference in your overall experience, especially when you need to file a claim.

Remember, while price is an important factor, it shouldn't be the sole criterion for choosing an auto insurance company. By following these steps, you'll be able to make a well-informed decision and select a reputable company that offers competitive rates, comprehensive coverage, and excellent customer service.

Auto Insurance Payments: Covering the Oncoming Month and Beyond

You may want to see also

Know your credit score and driving history

Knowing your credit score and driving history is essential for getting competitive auto insurance rates. These two factors are critical variables that insurance companies use to calculate your insurance premium. While you might not have much control over your driving history, you can take steps to improve your credit score and, consequently, get more competitive insurance rates.

Your credit score is a numerical value that indicates your creditworthiness and is calculated based on your credit report, which includes information such as your payment history, outstanding debt, length of credit history, pursuit of new credit, and mix of credit experience. A higher credit score is generally associated with lower insurance rates, as insurance companies consider individuals with good credit scores to be less risky. Improving your credit score can lead to significant savings on your insurance premium. For example, improving your credit score from the "poor" to the "average" tier can save you up to 19% per credit tier each year.

Insurance companies also consider your driving history when determining your insurance rates. They will look at factors such as your driving record, age, vehicle type, and location to assess the likelihood of you filing an insurance claim. If you are a new, young driver or have a history of accidents, speeding tickets, or other violations, you will likely be considered a high-risk driver and face higher insurance rates. However, you can improve your driving record over time by driving safely and avoiding violations, which will help lower your insurance premium.

Additionally, it's important to note that not all insurance companies weigh these factors equally. Different insurance providers have their own methodologies for calculating insurance scores and determining rates. Therefore, it's advisable to shop around and compare quotes from multiple insurance companies to find the most competitive rates, especially if you have a poor credit score or a less-than-perfect driving history.

Understanding Auto Collision Insurance: What You Need to Know

You may want to see also

Only pursue reputable companies

When shopping for car insurance, it's important to only pursue reputable companies. This means doing your research and choosing a company that is financially stable, has a history of providing good customer service, and has a low number of customer complaints relative to its size.

You can check a company's financial stability by looking at its financial strength rating from independent agencies like AM Best, Moody's, and Fitch. A company with strong financial backing is more likely to be able to pay out your claim.

To get a sense of a company's customer service and complaint history, you can read reviews on third-party sites and check its complaint index with the National Association of Insurance Commissioners (NAIC). Keep in mind that even the most reputable companies will have some negative reviews, so look for overall trends rather than individual complaints.

In addition to financial stability and customer satisfaction, you'll also want to consider the cost of coverage. The best car insurance companies offer competitive rates and a variety of discounts to help you save money. You can usually get a quote online or by contacting the company directly.

- Amica

- Geico

- Progressive

- Auto-Owners

- Nationwide

- Safeco

- Travelers

- USAA

- State Farm

- Liberty Mutual

Finding In-Network Auto Insurance: What You Need to Know

You may want to see also

Frequently asked questions

The first step is to know your coverage needs and your state's insurance requirements. You can then start comparing quotes from reputable companies with an online presence. It's important to research any company you're considering and to be aware of factors that can affect your quote, such as your credit score and driving history.

Auto insurance rates are influenced by a variety of factors, including your driving record, age, location, vehicle type, and credit score. Other factors include the coverage limits you choose, your eligibility for discounts, and your deductibles.

It's recommended to compare auto insurance quotes at least once a year or whenever there are significant changes in your life, such as moving to a new state or buying a new car. Comparing quotes regularly can help you ensure you're getting the best coverage and rate available.