If you need to repair or replace your vehicle's glass, you may be able to claim it on your insurance. Many insurance companies offer auto glass coverage, which can be added to your car insurance for a small fee. If you have comprehensive insurance, you may also be able to include auto glass coverage within that policy. In either case, you will likely have to pay an excess or deductible before your coverage begins. To initiate the claim process, you will need to contact your insurance company and provide basic information, such as the size and location of the damage. You may also need to provide your insurance company with an invoice for the repair or replacement. Some auto glass companies can handle this process for you, so be sure to ask if they can process your insurance claim.

What You'll Learn

What information to include on the invoice

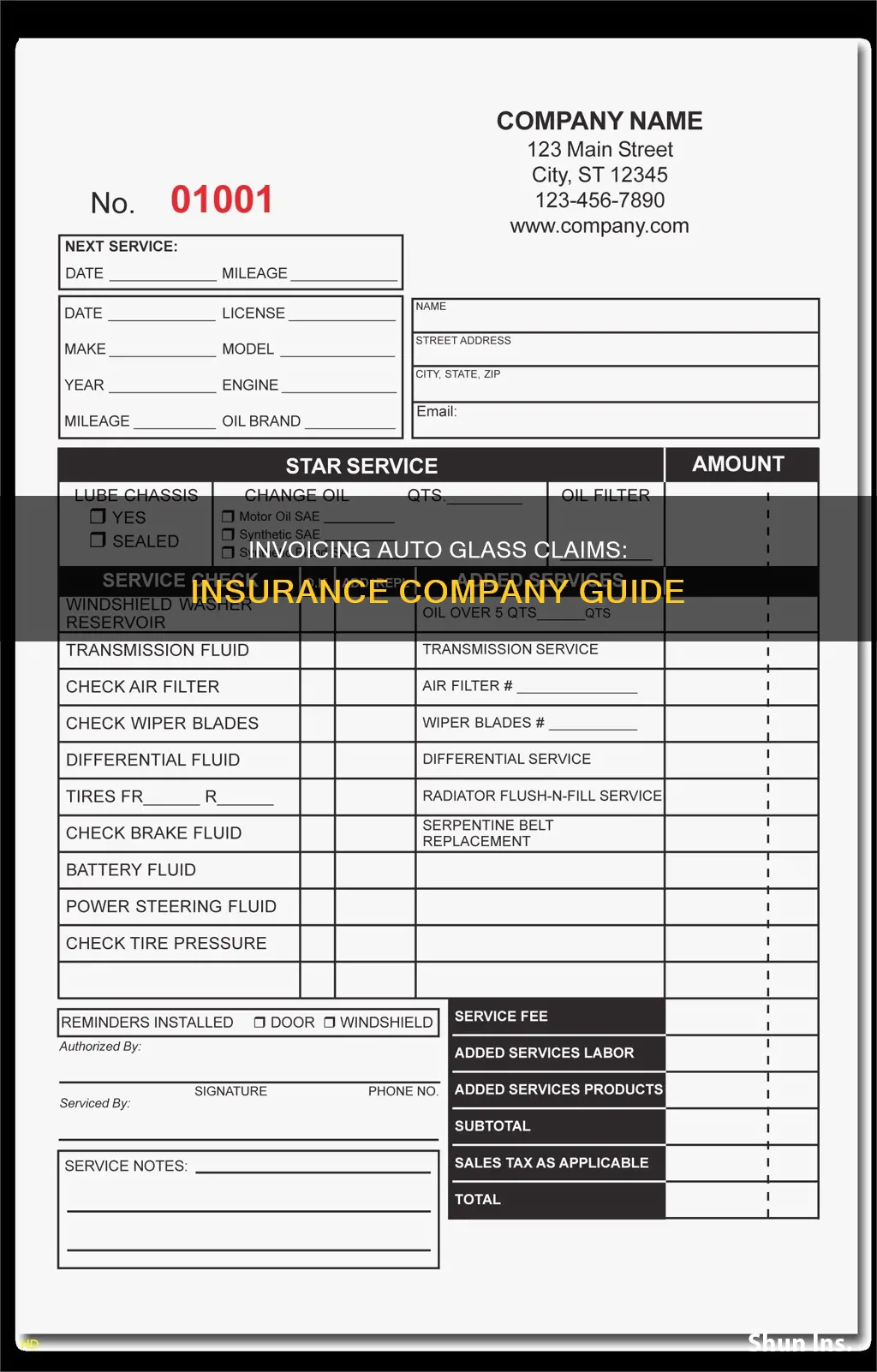

When invoicing an insurance company for auto glass repair or replacement, it is important to include all the relevant information to ensure a smooth and efficient billing process. Here is a detailed list of what to include on the invoice:

Policyholder Information:

Start by providing the full name and contact information of the policyholder, including their address, phone number, and email address. This information helps the insurance company identify the customer and contact them if needed.

Insured Vehicle Information:

Clearly state the details of the insured vehicle, such as the make, model, year, vehicle identification number (VIN), and license plate number. Including this information accurately links the invoice to the specific vehicle and its associated insurance policy.

Policy Number and Details:

Reference the insurance policy number associated with the claim. Also, include the start and end dates of the policy coverage period, as this information is crucial for validating the policy's active status at the time of the incident.

Date of Invoice:

Clearly state the date on which the auto glass damage occurred. If there is a police report or incident report associated with the damage, you can reference the report number or provide a copy of the report with the invoice.

Description of Services:

Provide a detailed description of the auto glass damage, including the location of the damage on the vehicle (e.g., front windshield, rear window, driver's side door glass, etc.), the extent of the damage (cracks, chips, shatter, etc.), and any relevant measurements. You may also include photos or diagrams to illustrate the damage.

Repair or Replacement Details:

Describe the repair or replacement work performed, including any parts or materials used. If there were multiple options for repair or replacement, explain why the chosen method was necessary or the most appropriate.

Cost Breakdown:

Provide an itemized list of all charges, including labour, parts, materials, and any other applicable fees or taxes. Break down each expense category to ensure transparency in the billing process.

Invoice Date and Payment Terms:

Clearly state the date of the invoice and the due date for payment. Additionally, include any accepted methods of payment, such as credit card, cheque, or bank transfer, along with the payment currency.

Vendor Information:

Include the name, address, and contact information of the auto glass repair or replacement shop. Provide a contact person's name, if available, to direct any questions or correspondence regarding the invoice.

Policyholder Signature:

If required by the insurance company, include a signature line for the policyholder to authorize the repairs and the associated charges. This serves as approval from the customer for the work performed and the resulting invoice.

Additional Notes:

Use this section to include any other relevant information or supporting documentation that may be helpful for the insurance company's review.

Remember to review the invoice for accuracy and completeness before submitting it to the insurance company. Keeping detailed records of all invoices and supporting documentation is essential for efficient claims processing and any potential future references or disputes.

Auto Insurance: Is It Tax Deductible?

You may want to see also

How to submit the invoice

If you need to submit an invoice to an insurance company for auto glass repair or replacement, the process will depend on the company you're dealing with and the country in which you're based. Here is a step-by-step guide on how to submit the invoice:

Step 1: Check Your Insurance Coverage

Before submitting an invoice, ensure that your insurance policy covers auto glass repair or replacement. Review your policy documents or contact your insurance provider to confirm. It's important to understand your deductible (the amount you must pay before insurance covers the rest) and whether auto glass is included in your comprehensive coverage or requires separate fees.

Step 2: Choose a Repair Company

Select a reputable auto glass repair company that is experienced in dealing with insurance claims. Companies like Autoglass® in the UK or Delta Kits in the US work closely with major insurance providers and can handle the insurance claim process for you.

Step 3: Provide Necessary Information

When booking your repair or replacement, you'll typically only need to provide your surname and postcode/zip code to confirm your insurance details. The repair company will then coordinate directly with your insurance provider.

Step 4: Understand the Billing Process

In some cases, you may need to submit the invoice yourself for reimbursement from your insurance company. This process can vary depending on the insurance company and country. In the US, for example, insurance companies often subcontract auto glass claims to Third-Party Administrators (TPAs). You can either submit the invoice to the TPA or hire a company to handle the claim for you.

Step 5: Submit the Invoice

Submit the invoice to the appropriate party, either the insurance company directly or the designated TPA. You can usually do this online, by fax, or through an Electronic Data Interchange (EDI). Keep in mind that payment processing times may vary, typically ranging from 6 to 30 days.

Step 6: Follow Up as Needed

After submitting the invoice, you may need to follow up with the insurance company or TPA to ensure timely payment processing. Keep track of the expected payment date and contact them if you haven't received the payment by then.

Remember to review the specific requirements and processes of your insurance company, as they may differ from the general guidelines provided above.

Insuring Old Vehicles in Florida

You may want to see also

Whether to submit the invoice directly to the insurance company or via a third-party

When it comes to submitting an invoice for auto glass repair to an insurance company, there are two main options: doing it directly or using a third-party administrator (TPA). Here's a detailed overview of the considerations for each option:

Submitting the Invoice Directly to the Insurance Company:

This option involves interacting directly with the insurance company and handling the paperwork yourself. Most insurance companies offer multiple ways to file a claim, including online portals, mobile apps, phone calls, or in-person visits. It is essential to review your insurance coverage to understand if auto glass repair is included in your policy. Comprehensive coverage typically includes repairs for damages not caused by vehicle collisions, such as animal collisions, fires, vandalism, or storm damage. After confirming coverage, contact your insurance agent to receive instructions on providing the necessary documentation and filing your claim. They can also advise on time limitations for submitting claims and bills, and whether you need damage estimates. Once the repair is complete, submit the receipt along with your name, policy number, phone number, and the date of the damage to your insurance company.

Using a Third-Party Administrator (TPA):

The majority of insurance companies subcontract their auto glass claims to TPAs. These are independent companies that handle the claims process on behalf of the insurance provider. Examples of TPAs include Harmon Solutions Group, Gerber National, Lynx Services, and Safelite Solutions Network. Using a TPA can be more convenient as they will work directly with a network of glass shops, allowing you to go straight to the repair shop without dealing with the insurance company directly. To initiate the process, contact the TPA and provide basic information about the damage, your vehicle, and insurance policy. They will then guide you through their specific claims process. If you choose to work with a TPA, your business will need to carry a certain amount of general business liability insurance, typically at least $500,000. Additionally, you can hire a company to handle the claims for you or register with multiple TPAs and submit claims directly.

Factors to Consider:

When deciding between submitting the invoice directly or using a TPA, consider the level of convenience and control you prefer. Direct submission may require more time and effort to navigate the insurance company's processes, but it gives you direct communication and potentially more control over the claim. On the other hand, TPAs streamline the process by handling the paperwork and coordinating with their network of glass shops, but you may have less flexibility in choosing your preferred repair shop or negotiating prices. It is worth noting that some insurance companies may require you to obtain multiple estimates, and if your chosen shop is not the lowest bidder, you may be responsible for the difference in cost.

Taxi Auto Insurance: Blurring the Lines Between Business and Personal Use

You may want to see also

The expected wait time for payment

It's important to note that if your vehicle is leased or your company has an account with the auto glass repair company, they may invoice the leasing company or your company directly for the work, and you won't be responsible for the payment. However, if you prefer to pay yourself or if your insurance doesn't cover glass damage, you can usually arrange this directly with the repair company.

To expedite the payment process, it's recommended to provide as much documentation as possible and cooperate with the adjuster handling your claim. The adjuster will investigate the claim, determine the fault, and provide an estimate for the repairs. You should also be proactive in communicating with your insurance company and adjuster to stay updated on the claim's progress.

Additionally, the state in which you live may have specific laws regulating the timeframe for insurance companies to settle and pay claims. For example, California requires insurers to accept or reject a claim within 40 days and then issue payment within 30 days of a settlement, while Texas allows 30 days to accept or reject and five days to issue payment. Knowing your state's laws can help you understand the expected wait time and take action if there are undue delays.

Gap Insurance: Protecting Your Car Loan in NC

You may want to see also

How to handle billing for customers who don't want out-of-pocket expenses

When it comes to handling billing for customers who don't want to pay out-of-pocket expenses, there are a few key strategies you can employ:

Understand the reasons for non-payment

There are various reasons why customers might not pay their invoices on time or at all. It could be due to financial difficulties, dissatisfaction with the product or service, or simply because they prioritise other bills or debts. Understanding the underlying reasons can help you develop effective solutions.

Communicate openly

Open communication is key. Ask your customers about their financial situation, their level of satisfaction with your product or service, or any other reasons that might be preventing them from making payments. This approach can help you get to the root of the problem and work together to find a solution.

Send regular invoices and payment reminders

Ensure that you send invoices promptly and follow up with payment reminders as needed. Sometimes, customers may delay payment because they have simply forgotten about the invoice deadline. Sending regular reminders can help keep your customers informed and reduce the chances of late or missed payments.

Offer flexible payment options

Consider offering flexible payment options, such as payment plans or accepting online payments through popular apps. By accommodating your customers' financial needs and preferences, you make it easier for them to stay on top of their payments.

Set clear payment policies

Be transparent about your payment policies from the outset. Outline deposit schedules, late fees, and other relevant details in a written contract. This helps set clear expectations and reduces the risk of misunderstandings or disputes down the line.

Consider using a factoring service or collection agency

If you have sent multiple payment reminders and followed up, but the customer still hasn't paid, you may need to consider alternative options. You can engage a factoring service, which will advance you money against your accounts receivable. Alternatively, a collection agency can help you recover unpaid invoices, although this option may come with additional costs and risks to your customer relationships.

Remember to always maintain a polite, professional, and non-threatening tone in all your communications with customers regarding payments. By handling these situations tactfully and effectively, you can improve your cash flow and maintain positive relationships with your customers.

Auto Insurance After Divorce

You may want to see also

Frequently asked questions

You can either provide the customer with an invoice that they can submit to their insurance company for reimbursement or you can take care of the paperwork yourself. If you choose the latter, you can either hire a company to handle the claims for you or register with Third-Party Administrators (TPAs) and submit claims directly.

All you need to do is provide your installer with your insurance company and policy number, and they'll talk to your insurance company for you.

The auto glass company will need your surname and postcode to confirm your insurance details.

You can still get your auto glass repaired or replaced, but you will have to pay for it yourself.