Navigating the world of insurance can be complex, and understanding the type of coverage you have is crucial for making informed decisions. This guide will provide a comprehensive overview of how to determine the specific insurance you possess, ensuring you are aware of your protection and can take the necessary steps to manage and potentially enhance your coverage. By following these steps, you'll gain clarity on your insurance types, from health and life to property and liability, and be better equipped to address any concerns or changes in your insurance needs.

What You'll Learn

- Identify Coverage Types: Understand health, life, property, and liability insurance

- Review Policy Documents: Carefully read your insurance policy to know the details

- Check Policy Exclusions: Be aware of what is not covered by your insurance

- Understand Deductibles and Limits: Know your financial responsibility and coverage limits

- Consult with an Agent: Seek professional advice to ensure you have the right coverage

Identify Coverage Types: Understand health, life, property, and liability insurance

To identify the types of insurance you have, it's essential to understand the different coverage categories and how they apply to your specific needs. Here's a breakdown of the primary coverage types:

Health Insurance: This type of insurance is designed to cover medical expenses and provide access to healthcare services. It typically includes coverage for doctor visits, hospital stays, prescription drugs, and preventive care. Health insurance plans can be obtained through employers, purchased individually, or accessed through government-run programs. Understanding your health insurance policy is crucial as it determines your access to healthcare and the financial protection it offers during medical emergencies or routine check-ups.

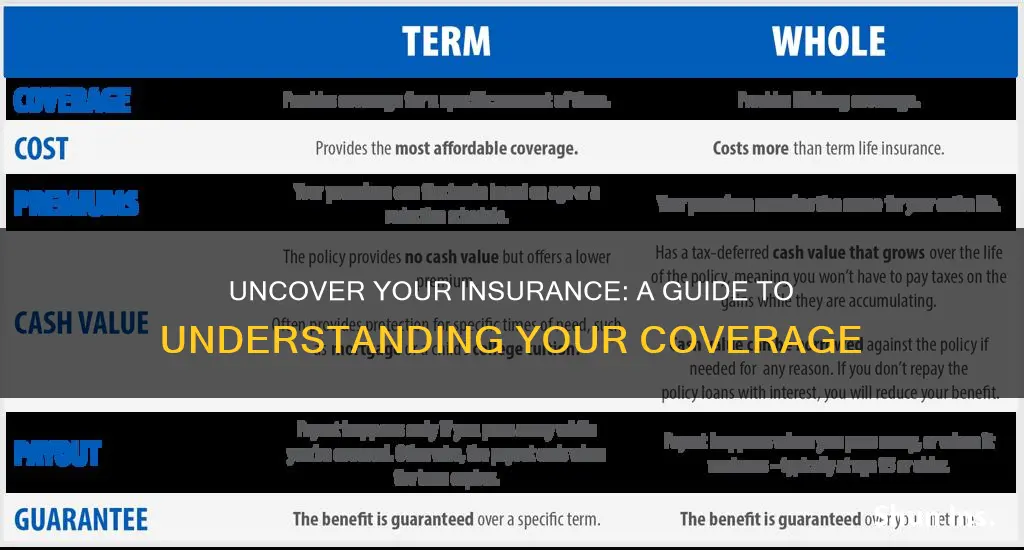

Life Insurance: Life insurance provides financial protection for your loved ones in the event of your passing. It ensures that your family can maintain their standard of living, cover funeral expenses, and potentially pay for children's education or other long-term financial goals. There are two main types: term life insurance, which provides coverage for a specified period, and permanent life insurance, which offers lifelong coverage and may also accumulate cash value over time.

Property Insurance: Also known as homeowner's or renter's insurance, this coverage protects your physical assets. It includes coverage for your home, personal belongings, and sometimes additional living expenses if you need to relocate due to a covered loss. Property insurance policies typically cover damage from natural disasters like fires, theft, vandalism, or severe weather events. Understanding your policy is vital to ensure you're adequately protected and can make a claim in the event of a loss.

Liability Insurance: This type of insurance protects you against claims made by others for bodily injury or property damage that you may cause accidentally. It includes auto insurance, which covers injuries and damage resulting from car accidents, and umbrella insurance, which provides additional liability coverage beyond the limits of your other policies. Liability insurance is essential for protecting your assets and financial well-being, as it can help cover legal fees and settlements in the event of a lawsuit.

By identifying and understanding these coverage types, you can ensure that you have the appropriate insurance in place to protect yourself, your loved ones, and your assets. It's a proactive step towards financial security and peace of mind.

Unlocking Flexibility: Converting Term Insurance to an IUL Policy

You may want to see also

Review Policy Documents: Carefully read your insurance policy to know the details

Reviewing your insurance policy documents is a crucial step in understanding the coverage you have and ensuring you're adequately protected. Here's a detailed guide on how to approach this process:

Understanding the Policy Documents:

Insurance policies can be complex, so it's essential to take the time to thoroughly review them. Start by reading the entire document, as it will provide an overview of the policy's purpose, coverage types, and any specific conditions or exclusions. Pay close attention to the following sections:

- Policy Summary or Declarations Page: This page typically provides a concise summary of your insurance coverage, including the policy number, coverage types, limits, and premiums. It's a quick reference point to understand the basics of your policy.

- Coverage Details: Dive into the policy's coverage sections to understand what is insured and the specific terms and conditions. This includes property, liability, health, or any other coverage you have. Look for details like coverage limits, deductibles, and any applicable exclusions or limitations.

- Exclusions and Limitations: Insurance policies often have specific clauses that outline what is not covered. These sections are crucial to understanding the gaps in your coverage. Be aware of any exclusions related to natural disasters, pre-existing conditions, or specific activities.

Key Steps to Review the Policy:

- Read Thoroughly: Start by reading the entire policy from cover to cover. This might seem tedious, but it ensures you grasp the overall structure and key components.

- Identify Coverage Types: Determine the different types of insurance you have, such as health, auto, home, or life insurance. Each type will have its own policy document, so locate and review these separately.

- Check for Updates: Insurance policies can change over time. Review the policy renewal date and any recent updates or amendments made to the terms and conditions.

- Compare with Your Needs: Evaluate your policy against your current insurance needs and potential risks. Ensure that the coverage limits and types align with your requirements and consider any recent life changes that might impact your insurance.

- Ask for Clarification: If you come across unfamiliar terms or concepts, don't hesitate to seek clarification from your insurance provider or a trusted insurance professional. They can explain complex clauses and ensure you understand your coverage.

By carefully reviewing your policy documents, you can gain a comprehensive understanding of your insurance coverage, identify any gaps, and make informed decisions about your insurance needs. It empowers you to take control of your insurance and ensure you have the right protection in place.

Unveiling the Mystery: How Insurance Companies Discover DUI Incidents

You may want to see also

Check Policy Exclusions: Be aware of what is not covered by your insurance

When it comes to understanding your insurance coverage, it's crucial to delve into the details, especially when it comes to policy exclusions. These exclusions are the specific events, circumstances, or risks that your insurance policy does not cover. Being aware of these can help you make informed decisions and ensure you're adequately protected. Here's a step-by-step guide on how to check and understand your policy exclusions:

- Obtain Your Policy Documents: Start by gathering all the documents related to your insurance policy. This typically includes the insurance contract or agreement, any addenda or riders, and a summary of coverage. These documents are your primary source of information about what is covered and what isn't.

- Review the Policy Language: Carefully read through the policy documents. Insurance policies often use complex language, so it's essential to understand the terms and conditions. Look for sections that specifically mention 'exclusions' or 'what is not covered'. These sections will outline the risks or events that the insurance company does not guarantee.

- Identify Common Exclusions: Different types of insurance policies have varying common exclusions. For example, in health insurance, you might find exclusions for pre-existing conditions, cosmetic surgeries, or certain types of elective procedures. In property insurance, common exclusions could include earthquakes, floods, or damage caused by acts of war. Understanding these industry-specific exclusions is vital.

- Check for Customized Exclusions: Every insurance policy is unique, and insurance providers often offer customized coverage based on your needs. Therefore, some policies may have additional exclusions tailored to your circumstances. These could be related to your occupation, hobbies, or specific lifestyle factors. It's important to review these customized exclusions to ensure you're aware of any gaps in your coverage.

- Seek Clarification: If you come across any terms or exclusions that are unclear, don't hesitate to contact your insurance provider. They should be able to explain the policy in simpler terms and clarify any doubts. Understanding the exclusions is as important as knowing what is covered, as it helps you make better decisions regarding additional coverage or risk mitigation.

By thoroughly checking policy exclusions, you can ensure that you're not caught off guard by unexpected events that your insurance might not cover. This proactive approach to understanding your insurance will help you make the most of your policy and provide better protection for yourself and your assets.

Switching HMO Insurance: What You Need to Know

You may want to see also

Understand Deductibles and Limits: Know your financial responsibility and coverage limits

Understanding the details of your insurance policy is crucial to ensuring you have adequate coverage and are aware of your financial responsibilities. One of the key aspects to grasp is the concept of deductibles and limits, which directly impact your out-of-pocket expenses and the extent of your insurance coverage.

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For example, if you have a health insurance policy with a $500 deductible, you will need to pay the first $500 of covered medical expenses yourself before the insurance company starts covering the costs. This is a common feature in health, auto, and homeowners' insurance policies. Knowing your deductible is essential because it determines how much you'll pay upfront in any given claim.

On the other hand, coverage limits refer to the maximum amount your insurance company will pay for a specific type of claim or event. These limits can vary widely depending on the policy and the insurance provider. For instance, in auto insurance, there might be a limit on the amount the company will pay for property damage or medical expenses in a single accident. Understanding these limits is vital as it helps you recognize the maximum financial protection your policy offers.

To ensure you are well-informed, carefully review your insurance policy documents. These documents will outline the specific deductibles and coverage limits for each type of insurance you hold. If you're unsure about any terms, don't hesitate to contact your insurance provider for clarification. They can explain the intricacies of your policy and help you navigate any complex aspects. Additionally, consider asking about any potential changes or updates to your policy to stay informed and ensure your coverage remains appropriate.

By comprehending your deductibles and coverage limits, you can make more informed decisions about your insurance needs and be better prepared for any financial responsibilities that may arise. It empowers you to take control of your insurance coverage and ensures you are not caught off guard by unexpected expenses.

Aetna's Short-Term Insurance Plans: Exploring the Pros and Cons

You may want to see also

Consult with an Agent: Seek professional advice to ensure you have the right coverage

If you're unsure about the type of insurance you have, consulting with an insurance agent is a crucial step to ensure you're adequately protected. These professionals are trained to understand your unique needs and can provide tailored advice. Here's why seeking their expertise is essential:

Insurance agents have an in-depth understanding of the various insurance products available. They can explain the different types of coverage, such as health, life, auto, home, and more. By assessing your current situation, they can identify the gaps in your existing policies and recommend appropriate solutions. For instance, they might suggest adding a rider to your health insurance to cover a specific medical condition or recommend a new auto insurance policy with better coverage for your vehicle.

A qualified agent will take the time to ask relevant questions to understand your personal and financial circumstances. They will consider factors like your age, health status, income, assets, and lifestyle to determine the most suitable insurance options. For example, an agent might inquire about your travel plans to recommend appropriate travel insurance or assess your home's value to suggest adequate property coverage. This personalized approach ensures that the advice given is tailored to your specific needs.

Insurance agents can also help you navigate the often complex world of insurance jargon and policy documents. They will explain the terms and conditions of your policies in a way that is easy to understand, ensuring you know exactly what you're covered for. This clarity is vital to making informed decisions and avoiding potential issues with claims.

Furthermore, agents can provide valuable insights into the claims process and help you understand your rights as an insured party. They can guide you through the often-daunting task of filing a claim, ensuring you have all the necessary documentation and that your claim is processed efficiently. This support can be invaluable during challenging times, providing peace of mind and ensuring a smoother experience.

In summary, consulting with an insurance agent is a proactive step towards securing the right insurance coverage. Their expertise, personalized approach, and ability to simplify complex insurance concepts make them an invaluable resource. By seeking their advice, you can make informed decisions, ensure adequate protection, and have the confidence that your insurance needs are being met.

IRS's Affordable Insurance Rule: How They Determine Cost

You may want to see also

Frequently asked questions

To find out the specifics of your insurance coverage, start by reviewing any documents or policies you've received from your insurance provider. Look for terms like "auto insurance," "health insurance," "homeowner's insurance," or "life insurance" to identify the type of policy. If you're unsure, contact your insurance company directly and ask for a copy of your policy details. They can provide you with a comprehensive breakdown of your coverage.

In the case of multiple insurance policies, it's essential to review each one separately. Contact the respective insurance providers for each policy and request a summary or a copy of the policy. This will help you understand the coverage, benefits, and any specific terms associated with each policy. You can also ask the insurance agents or brokers to assist in consolidating your policies and explaining the different types of coverage.

Yes, many insurance companies and third-party websites offer tools to help you identify your insurance types. These resources often require you to provide personal details and policy information. For example, you can visit the website of your insurance company and use their online search tools or customer support chat to inquire about your policy types. Some financial advisors or insurance brokers also provide online resources to help clients understand their insurance coverage.

If you're unsure about the coverage and want to switch insurance providers, it's crucial to assess your needs and compare different policies. Start by identifying the specific coverage you require, such as health, life, or property insurance. Then, research and compare various insurance companies' offerings. Consider factors like coverage limits, premiums, customer reviews, and the company's reputation. You can also seek advice from independent insurance brokers who can provide personalized recommendations based on your requirements.