Negotiating with an insurance adjuster can be a tricky process, but it's important to remember that you have the right to a fair settlement. Here are some tips to help you navigate the negotiation process and get the best possible outcome:

- Determine the value of your vehicle: Before negotiating, it's crucial to independently assess the worth of your vehicle. Consider factors such as the year of manufacturing, the value of similar vehicles online, and use resources like Kelley Blue Book and NADA Guides. This information will be essential in supporting your case for a higher settlement.

- Get a written estimate: Obtaining a written estimate from a qualified mechanic or body shop can provide concrete evidence that your vehicle is worth more than the insurance adjuster's initial appraisal.

- Use online tools: Take advantage of online tools and resources to determine the ballpark value of your vehicle. Print out the results to bring to the negotiation as additional evidence.

- Find comparable vehicles: Location can impact vehicle values, so find cars for sale in your area with similar make, model, and mileage to your vehicle. Present these listings during the negotiation to support your claim for a higher settlement.

- Request your Certified Collateral Corporation (CCC) report: The CCC report is an itemized list of your vehicle's features used by adjusters to determine its market value. Review this report thoroughly and ensure that all features and trim levels are listed accurately.

- Negotiate with the adjuster: If you believe the appraisal from the insurance company is too low, don't hesitate to negotiate. Be polite but firm, and provide evidence to support your claim for a higher settlement.

- Consider hiring an attorney: If negotiations with the adjuster are unsuccessful and you still believe you have a strong case, you may want to consult an attorney. They can provide legal expertise and help relieve the stress of total loss negotiations. However, keep in mind the added cost of hiring an attorney and carefully consider if it aligns with your goals.

- Obtain a written settlement agreement: Once you reach a settlement, it's crucial to get the terms in writing to ensure both parties understand and agree to the expectations and financial obligations.

Remember, insurance adjusters may try to minimize compensation, so it's important to be well-informed, organized, and persistent in your negotiations. Don't be afraid to ask for a higher settlement if you have evidence to support your claim.

| Characteristics | Values |

|---|---|

| Determine the vehicle's worth | Make, model, body style, mileage, manufacturing year, value of similar vehicles for sale online, value on Kelley Blue Book and Edmunds, estimates from qualified mechanics |

| Get an estimate | In-depth estimate from a qualified mechanic or expert witness detailing all necessary repairs |

| Review the adjuster's offer | Carefully look over the details of your claim and consider how compensation is related to your vehicle's value and damage |

| Get legal help if necessary | Hire an attorney to fight for the settlement amount you think you should have |

| Get everything in writing | Get a written settlement agreement to confirm the terms and verify that everyone agrees |

| Understand your policy | Know the coverage limits and the method your insurer uses to determine the actual cash value (ACV) of vehicles |

| Determine the actual cash value (ACV) | Research the value of your car prior to the accident using online valuation tools |

| Gather documents | Collect your vehicle's service history, receipts for any upgrades or repairs, and evidence of your car's condition before the accident |

| Prepare your counteroffer | If you believe the offer is too low, prepare a counteroffer supported by your research and documentation |

| Consider hiring a professional | Consult with an attorney or a public adjuster if negotiations are going nowhere |

What You'll Learn

Research your car's value and prepare a counteroffer

Researching your car's value is crucial when preparing a counteroffer to an insurance adjuster. Start by determining your car's actual cash value (ACV) or fair market value, which is the amount the vehicle was worth before the accident. You can use online valuation tools like Kelley Blue Book (KBB) and the National Automobile Dealers Association's (NADA) guide to get an estimate. Consider factors such as your car's make, model, year of manufacturing, mileage, condition, and any customized features or upgrades.

Next, gather evidence to support your counteroffer. Collect documentation such as your vehicle's service history, receipts for repairs or upgrades, and evidence of its condition before the accident. You can also obtain multiple repair estimates from reputable mechanics or body shops to show the actual costs of repairing your vehicle. Additionally, research the pricing of similar vehicles in your local market and find comparable cars for sale in your area with similar features, mileage, and options.

By having a solid understanding of your car's value and supporting it with evidence, you will be in a stronger position to negotiate with the insurance adjuster and work towards reaching a fair settlement. Remember, the goal is to demonstrate that your vehicle is worth more than the adjuster's initial offer, so be prepared to provide detailed information and documentation to support your counteroffer.

Navigating the Aftermath: Effective Communication Strategies with Insurance Adjusters Post-Accident

You may want to see also

Determine the comparables in your area

When negotiating with an insurance adjuster after a total loss, it is important to determine the comparables (comps) in your area. Comps are vehicles for sale in your zip code that match your car's year, make, and model. You can find these by visiting used car websites such as Auto Trader and Car Gurus. Print out listings of similar vehicles with similar features and mileage as yours. The closer the example to your own car, the more leverage it will provide in your negotiations.

Additionally, you can use online car valuation sites such as Kelley Blue Book and the National Automobile Dealers Association (NADA) to get a fair resale price for your vehicle. These sites provide commonly recognized value estimates that can be used as a reference point in your negotiations.

By gathering information on comparable vehicles in your area and utilizing online valuation tools, you can arm yourself with knowledge and build a strong case for negotiating a higher settlement value for your total loss vehicle.

Unraveling the Path to Becoming an Insurance Adjuster in Louisiana

You may want to see also

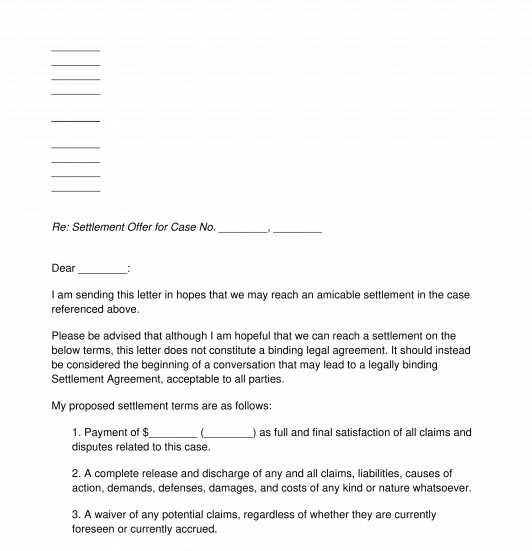

Obtain a written settlement offer

Obtaining a written settlement offer is a crucial step in the negotiation process with an insurance adjuster for a total loss claim. Here are some detailed instructions and considerations to help you through this process:

- Written Estimate: Request a detailed written estimate from the insurance adjuster, outlining the valuation of your vehicle, the calculated settlement amount, and the specific policy provisions or legal basis for the offer. This documentation ensures transparency and provides a reference point for further negotiations if needed.

- Valuation Report: Ask the adjuster to provide a copy of the valuation report used to assess your vehicle's worth. This report should include relevant details such as the Certified Collateral Corporation (CCC) report, which lists your vehicle's features and trim level. Ensure that all your vehicle's features are accurately considered in this report and that the mileage is correct.

- Sales Tax and Payoff Lien Amount: Confirm that the written settlement offer includes the sales tax, which is the responsibility of the insurer to pay. Additionally, if you have an outstanding vehicle loan, request that the payoff lien amount be included in the settlement offer. This amount should be paid directly to the auto financing company.

- Net Settlement Amount: The written offer should clearly state the net settlement amount you will receive from the insurance company. This amount represents the actual cash value of your vehicle after any applicable deductions, such as your deductible.

- Compare with Research: Before accepting the written settlement offer, compare it with your independent research. Use resources like Kelley Blue Book, NADA Guides, or similar websites to determine the estimated value of your vehicle. Consider the make, model, year, condition, mileage, and any customized features or recent repairs. If the settlement offer seems too low or doesn't align with your research, you may need to negotiate further.

- Counteroffer and Documentation: Prepare a counteroffer by calculating a reasonable amount based on your research and the written settlement offer. Support your counteroffer with documentation, including vehicle valuation estimates, used car reports, and receipts for recent repairs or upgrades. A well-documented counteroffer adds credibility to your position and demonstrates your knowledge of the vehicle's value.

Remember, obtaining a written settlement offer is a critical step in the negotiation process. It provides you with a clear understanding of the insurance company's position and allows you to make informed decisions about your next steps. Don't hesitate to seek legal advice or consult a professional if you feel the offer is unfair or if negotiations stall.

The Integrity Tightrope: Examining the Honesty of Insurance Adjusters

You may want to see also

Negotiate with your insurance adjuster

Negotiating with an insurance adjuster can be a challenging process, but it is possible to do so effectively and secure a fair settlement. Here are some steps to guide you through the negotiation process:

Know Your Vehicle's Value

Begin by determining the worth of your vehicle. This is a crucial step as it forms the basis for your negotiation. You can use various resources, such as Kelley Blue Book, NADA Guides, or online tools, to assess your vehicle's value based on factors such as its make, model, year, condition, and mileage. It is also helpful to review comparable vehicles for sale in your local area with similar features and mileage.

Gather Documentation

Collect relevant documentation that supports your vehicle's value. This includes maintenance records, service history, receipts for upgrades or repairs, and evidence of its condition before the accident. Having comprehensive documentation strengthens your case and makes it easier to negotiate with the adjuster.

Prepare a Counteroffer

If you believe the insurance company's initial offer is too low, prepare a counteroffer. Utilize your research and documentation to support your counteroffer and explain why you believe your vehicle is worth more than their initial valuation. Be polite but firm in your negotiations, and remember that you don't have to accept their first offer.

Seek Legal Advice

If negotiations with the insurance adjuster are not progressing, consider seeking legal advice. An attorney can provide valuable expertise in dealing with insurance settlements and guide you through the process. They can also demand supporting evidence for the insurer's low offer and pursue bad faith claims if unreasonable conduct is evident.

Get Everything in Writing

Once you and the insurance adjuster agree on a settlement, ensure that you get the terms in writing. This helps to validate the agreement and ensures that both parties understand their financial obligations and expectations.

Remember that negotiation is a dialogue, and it is important to remain calm and well-informed throughout the process. By following these steps, you can effectively negotiate with your insurance adjuster and secure a fair settlement for your total loss claim.

The Path to Becoming an Independent Insurance Adjuster: A Comprehensive Guide

You may want to see also

Get legal help if necessary

If you're unsatisfied with the negotiation process and feel that the insurance company is being unfair or unreasonable, it's advisable to seek legal help. Hiring an attorney is typically a last resort, but it can be crucial in fighting for a fair settlement. An attorney can provide expertise in dealing with insurance settlements and guide you through the process. They can also demand supporting evidence for the insurer's low offer and pursue bad faith claims if unreasonable conduct is evident.

When deciding whether to hire an attorney, consider the potential costs and benefits. Attorney fees can be expensive, so ensure that their fees won't outweigh the potential increase in your settlement amount. If the insurer's conduct is unreasonable, an attorney may be able to negotiate a higher settlement or pursue legal action.

If you decide to hire an attorney, it's best to do so before speaking with the insurance company. Allow your attorney to handle all communications regarding your total loss claim. They are familiar with insurance companies' tactics to devalue claims and can ensure you receive a fair payout.

If you're unsure about hiring an attorney, consider seeking a free legal consultation to understand your options and rights. Remember, time is often a factor, as most legal claims have strict time deadlines.

Understanding Your Rights: Communicating with Insurance Adjusters After Water Damage

You may want to see also

Frequently asked questions

Your car is a total loss if it is damaged beyond repair, stolen and not recovered, or if the repair cost is more than the vehicle is worth.

An insurance adjuster, also known as a claims adjuster, investigates your coverage and insurance claim after an accident. They will determine if you have full coverage and may gather statements from those involved. If your vehicle is a total loss, they will assess the cost of repairs and the vehicle's worth.

First, determine your vehicle's worth by considering factors such as its make, model, year, condition, and mileage. Then, gather documentation such as maintenance records and receipts for upgrades. Finally, present your research and documentation to the adjuster and politely request a reassessment.

Hiring an attorney can be beneficial if negotiations with the insurance adjuster are unsuccessful. An attorney can provide expertise, guide you through the process, and fight for a higher settlement amount. However, consider the cost of hiring an attorney and whether the potential increase in the settlement justifies the expense.