Auto insurance policies are often filled with legal jargon, making them confusing to understand. However, it is important to know how to read your auto insurance policy to ensure you have adequate coverage in case of an accident. The basic components of a personal auto policy are the declarations page and the policy form. The declarations page is typically the first page of the policy and contains basic information about your policy, such as the policy number, term, policyholder address, named insured, coverages, policy limits/deductible, and premium. The policy form goes into more depth about conditions, exclusions, and the overall agreement between you and the insurance company. It is important to understand the limits of your auto insurance coverage to ensure you have sufficient protection in the event of a claim.

| Characteristics | Values |

|---|---|

| Purpose | To outline what is covered and what is not covered by your auto insurance policy |

| Components | Declarations page, policy form, insurance ID card, verification of insurance, insurance agreement, conditions, exclusions, endorsements |

| Information Included | Personal information, insured drivers, insured vehicles, schedule of coverages, policy period, discounts, surcharges |

| Policy Limits/Deductible | Maximum amount each coverage will pay and any required deductible to be paid out of pocket |

| Premium | Amount to be paid over the course of the policy term |

| Conditions | Rules, provisions, obligations, codes of conduct to adhere to; documentation required when filing a claim; time frame for filing a claim; terms for cancellation |

| Exclusions | Perils that are not covered, e.g. intentional damage, government action, using vehicle for racing, catastrophic events |

| Endorsements | Additional specific coverages, e.g. for modified vehicles, rental car coverage, roadside assistance |

| Types of Coverage | Liability, medical payments, personal injury protection (PIP), uninsured/underinsured motorist, comprehensive, collision |

What You'll Learn

Understanding the declarations page

The declarations page, or "dec page", is the first page or pages of your auto insurance policy. It provides a summary of your policy and includes details on the coverage, limits, and deductibles you've purchased. It's a concise summary of vital policy information, and it's important to review it periodically to ensure accuracy. Here's a breakdown of the information typically included on the declarations page:

- Policy number: This is your unique policy number, which you'll need when filing an insurance claim or contacting your insurer for support.

- Policy effective date: The date your policy becomes effective and your coverage begins.

- Agent information: Contact information for your insurance agent, if you purchased your policy through an agent.

- Policyholder details: Your name, address, and phone number.

- Covered drivers: A list of all drivers officially covered under the policy, including the policyholder and any additional drivers.

- Vehicle details: Information about the covered vehicle(s), including the year, make, model, vehicle identification number (VIN), and average mileage.

- Coverage details: The types of coverage included in the policy, such as bodily injury and property damage liability, comprehensive, collision, etc. This section also includes coverage limits, deductibles, premiums, and any policy add-ons or endorsements.

- Policy period: The expiration date of your coverage, typically six or twelve months from the start date.

- Loss payee: Any party with a vested interest in the vehicle, such as a lender if you lease or finance your vehicle.

- Discounts: Some declarations pages list any discounts that have been applied to your policy.

Your insurance company will typically send you the declarations page via mail, email, or fax as soon as you purchase your policy. Many insurers also allow you to access your declarations page online or through a mobile app. It's important to keep this page handy for future reference and to understand your coverage.

U.S. Auto Insurance: Adding a Driver Made Easy

You may want to see also

Understanding the insuring agreement

An insuring agreement is a legal contract between an insurance company and an insured party. This contract allows the risk of a significant financial loss or burden to be transferred from the insured to the insurer. In exchange, the insured agrees to pay a small, guaranteed payment called a premium.

The insuring agreement is the actual binding contract that governs whether or not coverage is provided in the event of a loss. It defines what is covered and how it is covered. It is usually contained in a coverage form from which a policy is constructed. Insuring agreements often outline a broad scope of coverage, which is then narrowed by exclusions and definitions.

The insuring agreement is one of the three main components of an insurance policy, the other two being conditions and exclusions. The insured must understand these three parts of their insurance policy so that they are not faced with any surprises if an event requires an insurance claim.

The insuring agreement is where the insurance company promises to provide coverage in exchange for the premium paid by the insured. It also explains the specifics of what is covered in the policy. This is where you will find any perils (causes of loss) that are explicitly covered.

The insuring agreement is also where you will find any perils that are not covered. These exclusions can differ by state and from one driver to another. Typical insurance policy exclusions include:

- Intentional damage or bodily injury

- Government action or confiscation

- Using a vehicle for prearranged racing events

- Catastrophic events: war, nuclear accidents, etc.

- Using your vehicle for delivery/ride-share purposes

Mississippi Valley Credit Union: GAP Insurance Offerings

You may want to see also

Understanding policy exclusions

Insurance exclusions are provisions in an insurance policy that waive coverage for certain types of risks or events. In other words, they are instances where your insurance company will not provide coverage. Exclusions are typically listed in your auto insurance policy and may vary depending on your coverage level. However, some exclusions are never covered, even by the best auto insurance companies.

Liability Exclusions

Your liability coverage never pays you. By definition, liability coverage pays others for damages caused by you. If you only carry liability insurance, you and your vehicle will not be covered in the event of an accident.

Medical Payments Exclusions

Medical payments coverage covers death and bodily injury to those in your vehicle. However, there are certain exclusions that apply to medical payments. For example, if you have an employee who is injured while working, losses should be covered under worker's compensation and not your personal auto insurance policy.

Damage to Your Vehicle

Your insurance won't cover certain damages to your vehicle, even if you carry collision and comprehensive coverage. Some of the damages your insurance won't cover include normal wear and tear, damage resulting from pre-arranged racing, non-permanent electronics, and any intentional damage.

Other Types of Exclusions

- Police seizure or lawful repossession: If your car is confiscated or repossessed by the government, losses or damages are not covered by insurance.

- Illegal activity: If you have an accident while engaged in illegal activity, you may not be covered by your insurance policy.

- Unapproved vehicle modifications: If you modify your vehicle without informing your insurance company, these modifications will not be covered under a typical policy.

- Personal possessions: Any of your personal possessions damaged in an accident are unlikely to be covered by your auto insurance policy. However, they may be covered by a homeowners or renters policy.

- Death, injury, or damage sustained in nuclear accidents, war, or other catastrophic events are not covered by car insurance.

- Named driver exclusion: The named driver exclusion removes particular drivers from your policy, meaning they will not be covered. This is usually done to save money on premiums if the excluded driver has a poor driving record or offences such as DUIs.

- Driving outside of the US: Most insurance policies sold by American insurance companies are only valid in the United States. You may need to add coverage that extends to other countries.

- Loan vs. vehicle value: As your car depreciates, you may owe more on your vehicle than it is currently worth. Even with full coverage, if your vehicle is a total loss, your insurance may only cover the current worth, leaving you with the difference. Gap insurance can help make up the difference.

- Commonly excluded vehicles: Vehicles with fewer than four wheels, vehicles whose primary use is for racing, and business vehicles are not likely to be covered by a standard insurance policy.

Get Your Florida Auto Insurance License: A Guide

You may want to see also

Understanding liability limits

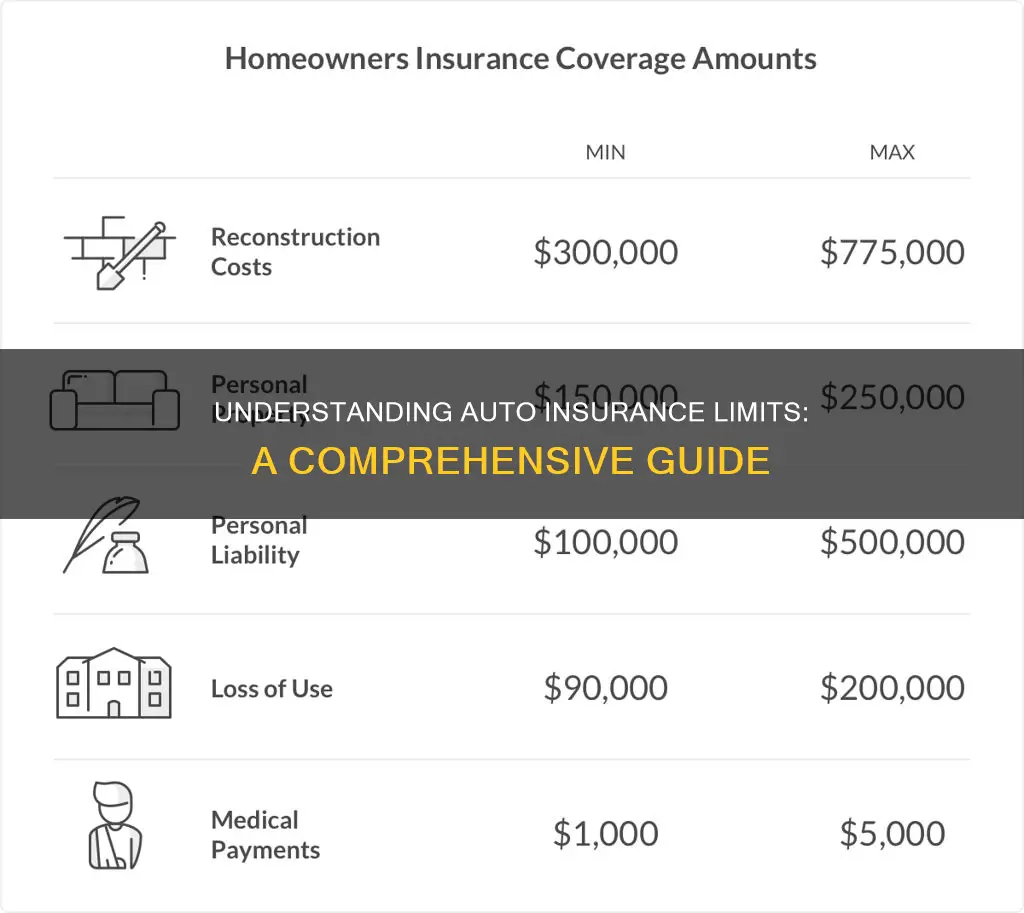

Liability limits refer to the maximum amount your insurance company will pay out for a covered claim. In the context of auto insurance, liability insurance covers the costs of damages if you are at fault in a car accident and hurt someone or damage their property. This includes medical expenses and repairs to the other person's vehicle or property. Understanding your liability limits is essential to ensure you have adequate coverage in the event of an accident.

Reading Your Liability Limits:

When reviewing your auto insurance policy, you'll typically see your liability limits presented as a series of numbers, such as 100/300/100 or 25/50/25. Here's how to interpret these numbers:

- Bodily Injury Liability Limits per Person: The first number represents the maximum amount your insurance company will pay for injuries to a single person in an accident. For example, if your policy shows 100/300/100, your insurance will cover up to $100,000 per person for medical expenses.

- Bodily Injury Liability Limits per Accident: The second number indicates the total amount your insurer will pay for injuries to all individuals involved in a single accident, except for you or anyone in your household. Using the previous example, the policy will cover up to a total of $300,000 for all injured parties.

- Property Damage Liability Limits per Accident: The third number represents the maximum amount your insurance company will pay for property damage you cause in an accident. This includes repairs to other vehicles, buildings, or any other property damaged. Continuing with the example, a policy with limits of 100/300/100 will cover up to $100,000 in property damage.

It's important to note that these liability limits apply per accident and are subject to the overall maximum limit specified in your policy. If the costs of an accident exceed your liability limits, you may be held personally responsible for the remaining expenses.

Combined Single Limit:

In some cases, insurance companies offer an alternative called "combined single limit" liability. This provides a single, larger liability limit that covers both bodily injury and property damage combined. This type of coverage offers more flexibility and, in some cases, may provide more financial protection than split limit coverage. However, it generally comes at a higher cost.

State Requirements and Recommendations:

Nearly every state has minimum liability coverage requirements, and it's essential to ensure your policy meets or exceeds these requirements. While minimum coverage is a starting point, it's recommended to consider higher liability limits to adequately protect your assets in the event of a serious accident. Medical bills and vehicle repairs can be costly, and having sufficient liability coverage can help prevent financial strain if you are found at fault.

Reviewing and Adjusting Your Policy:

Understanding your auto insurance policy is crucial, and it's important to periodically review your coverage limits. If you find that your liability limits are insufficient, you can contact your insurance provider to discuss adjusting your policy. Additionally, consider shopping around and comparing rates from different insurance companies to find the best coverage for your needs.

Commercial Auto Insurance: More Expensive?

You may want to see also

Understanding insurance endorsements

Insurance endorsements, also known as riders, are additions or modifications to your insurance policy that alter your coverage to meet your specific needs. They are a way to customise your policy and ensure it suits your unique circumstances. Endorsements can be added when purchasing a new policy, during your coverage period, or when renewing your policy. They are typically purchased separately from your standard coverages and can enhance the protection and terms of your initial policy.

There are several types of insurance endorsements:

- Optional coverage: Endorsements can add extra coverage to your policy, such as rental reimbursement, roadside assistance, or key replacement.

- Exclusion endorsement: These restrict your policy by excluding specific drivers or situations from coverage.

- Changes to policy details: Endorsements can be used to make changes to your policy details, such as your name, address, or vehicle information.

- Vehicle parts: If you have made upgrades or modifications to your vehicle, you may need an endorsement to ensure these are covered by your policy.

- New, financed, or leased vehicles: Certain endorsements are required when financing or leasing a vehicle, such as full coverage or gap insurance.

- Specialty car insurance: This includes antique or classic car coverage, import vehicles, or rideshare insurance for drivers working for companies like Uber or Lyft.

When purchasing a new policy or renewing an existing one, it is important to review the base coverage and identify any gaps or areas where additional protection is needed. Endorsements allow you to fill these gaps and create a policy that truly fits your needs. They give you control over your coverage and provide peace of mind by ensuring you have the right protection in place.

When considering endorsements, it is essential to compare the options and costs from different insurance providers. Endorsements may come at an extra cost, be included in a package, or even decrease your premium in some cases. By understanding the different types of endorsements available and assessing your specific needs, you can make informed decisions about which endorsements to add to your policy.

Insuring Your Car: You, Your Fiancé

You may want to see also

Frequently asked questions

The declarations page is the first page of your auto insurance policy. It contains basic information about your policy, such as the name and contact information of your insurance company, the policy number, the policy term, the policyholder address, the named insured, coverages, policy limits/deductible, and the premium.

The insurance policy form goes into more depth than the declarations page, outlining various coverages, the insuring agreement, conditions, exclusions, and endorsements for your policy.

The conditions of an insurance policy refer to the legal agreement between the insured and the insurer. It lists any rules, provisions, obligations, or codes of conduct that the insured must adhere to. If the insured is in breach of any of these conditions, coverage or claims may be denied.

Auto insurance policy exclusions refer to the perils that are not covered by the policy. Typical exclusions include intentional damage or bodily injury, government action or confiscation, using a vehicle for pre-arranged racing events, catastrophic events, and using the vehicle for delivery or ride-sharing purposes.