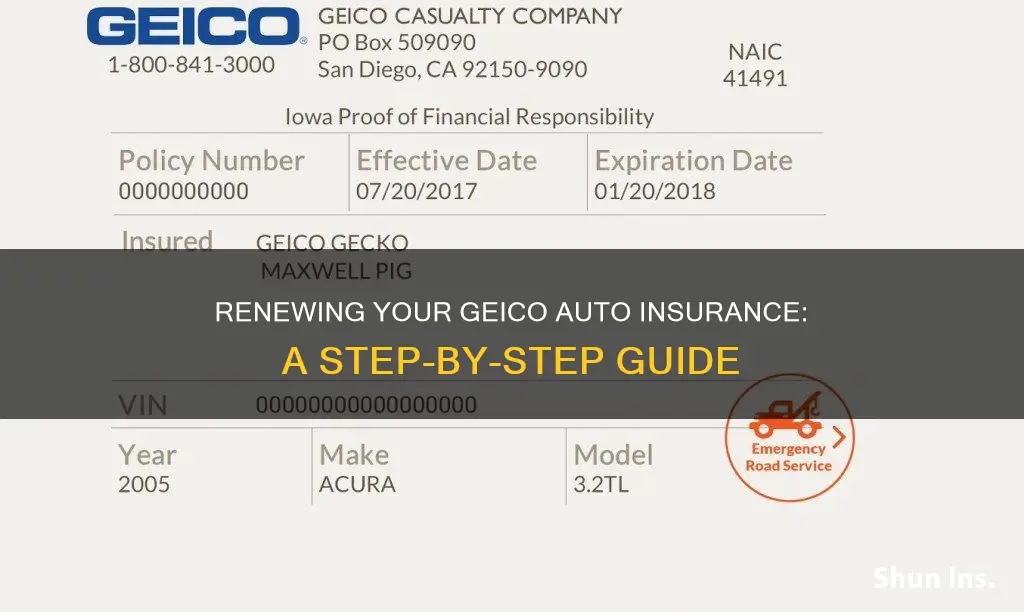

If you're looking to renew your GEICO auto insurance, it's important to know that the process is straightforward. GEICO makes it easy for customers to manage their policies, and there is no cancellation fee. All you need to do is call GEICO's customer support line at 1-800-841-1587 and speak with a licensed agent. You can also say cancel insurance policy and then auto if prompted by the interactive voice response system. It's a good idea to have your GEICO policy number ready, as you may be asked to provide it. Remember, you can cancel your policy at any time, and if you've paid your premium in advance, you may be eligible for a prorated refund.

| Characteristics | Values |

|---|---|

| Phone number | 1-800-841-1587 |

| Interactive voice response system | Say "cancel insurance policy" and then "auto" |

| Cancellation fee | No fee, but customers in North Carolina may be subject to a Short Rate premium calculation |

| Cancellation date | Can be immediate or set for a future date |

| Refunds | Pro-rated refunds for unused payments |

| Power of Attorney | Only the policyholder or someone with legal Power of Attorney can cancel the policy |

What You'll Learn

Cancelling GEICO auto insurance by phone

If you want to cancel your GEICO auto insurance policy, you can do so by calling their customer support. GEICO does not allow customers to cancel their policies online or through the GEICO mobile app.

- Get your GEICO policy number ready.

- Call GEICO at 1-800-841-1587.

- When prompted by the Interactive Voice Response (IVR) system, say "cancel insurance policy" and then "auto".

- You may be asked to provide your GEICO policy number, so have that ready.

- You will then be connected to a customer service agent, who will guide you through the cancellation process.

Before the cancellation is finalised, you must settle any outstanding balance on your account. If you have already paid your entire premium for the policy period in full, GEICO will refund the unused portion.

Please note that GEICO only charges a cancellation fee for customers in North Carolina. For customers in this state, a portion of their unused premiums will be refunded after deducting a fee.

U.S. Auto Insurance: Understanding Automatic Renewal

You may want to see also

Cancelling GEICO auto insurance online

- Get your GEICO policy number ready.

- Call GEICO at 1-800-841-1587.

- When prompted by the interactive voice response system, say "cancel insurance policy" and then "auto".

- You will then be connected to a customer service agent, who will guide you through the cancellation process.

Before the cancellation is finalised, you must pay off any remaining balance on your account. If you have already paid your entire premium for the policy period in full, GEICO will refund the unused portion. Note that GEICO only charges a cancellation fee for customers in North Carolina, where customers may get a portion of their unused premiums refunded minus a fee.

There are a few things to consider before cancelling your GEICO auto insurance policy. For instance, if you are going through certain life changes, such as moving or replacing your current vehicle, GEICO can simply update the mailing address or vehicle information on your policy. GEICO also allows military members to suspend their policy temporarily if their vehicle will be left unused and in storage for more than 30 days.

Gap Insurance: Trade-In Benefits

You may want to see also

Reasons for cancelling GEICO auto insurance

GEICO offers a range of insurance options and provides a simple cancellation process for its customers. However, there may be reasons why a customer would want to cancel their GEICO auto insurance policy. Here are some common reasons for cancelling:

- Moving to a different state: While GEICO offers insurance across all 50 states and DC, a customer may prefer to switch to a different provider with more tailored or cost-effective coverage for their new location.

- Change in marital status: A change in marital status can impact insurance rates and coverage needs. Customers may seek alternative insurance options that better accommodate their new circumstances.

- Vehicle changes: If a customer has sold their vehicle, had it totaled, or it becomes inoperable, they may no longer require insurance. GEICO does offer coverage for rental vehicles for a short period, but customers may opt to cancel if they don't plan to drive again soon.

- Combining policies: Customers may prefer the convenience and potential cost savings of combining their auto insurance with other types of insurance policies, such as homeowners or renters insurance, under a single provider.

- Affordability: GEICO offers various discounts and adjustments to policies, but customers may still find the cost of their auto insurance unaffordable and choose to switch to a cheaper provider.

- Finding a cheaper rate: Customers may discover more affordable rates with comparable coverage, deductibles, and benefits from another insurance company. Despite GEICO's range of discounts, some individuals may find better value elsewhere.

These reasons highlight some of the common motivations for cancelling GEICO auto insurance. It's important to carefully consider one's needs and explore all available options before making a decision to cancel any insurance policy.

Gap Insurance: Collision Coverage?

You may want to see also

Steps to cancelling GEICO auto insurance

GEICO offers auto insurance across all 50 states and in DC. However, if you need to cancel your GEICO auto insurance policy, the process is relatively straightforward. Here are the steps you need to take:

- Get your GEICO policy number ready: You will need this when speaking to a customer service agent.

- Call GEICO: Dial 1-800-841-1587 to reach GEICO's customer service line.

- Follow the Interactive Voice Response (IVR) prompts: When prompted, say "cancel insurance policy" and then "auto" to indicate you are cancelling your car insurance policy.

- Speak to a customer service agent: A licensed agent will guide you through the cancellation process. They may ask you for your GEICO policy number, so have it ready.

- Pay off any remaining balance: Before the cancellation is finalized, ensure you pay off any outstanding balance on your account. If you have already paid your premium in full for the policy period, GEICO will refund the unused portion.

- Consider your reasons for cancelling: Before you confirm the cancellation, GEICO recommends considering whether there are any life changes that may impact your policy, such as moving to another state, changing your marital status, selling your vehicle, or combining policies with another company. They may be able to update your policy to reflect these changes.

- Obtain a new policy before cancelling: If you are switching to another insurance carrier, it is essential to obtain a new policy before cancelling your current GEICO policy. This prevents a lapse in coverage, which could lead to higher premiums in the future.

- Cancel previous insurance: If you are switching from another insurance provider, you may need to cancel your previous insurance policy. GEICO provides a "Cancel Previous Insurance Letter" that you can fill out and mail to your previous insurer.

Please note that GEICO does not allow customers to cancel their policies online or through the mobile app. Additionally, North Carolina policies may be subject to a Short Rate premium calculation upon cancellation, resulting in a cancellation fee.

AAA Auto Insurance: Exploring the Turo Coverage Conundrum

You may want to see also

GEICO auto insurance refunds

To be eligible for a GEICO auto insurance refund, you must first cancel your policy. GEICO does not charge a cancellation fee, except for customers in North Carolina, where customers may get a refund on their unused premiums minus a fee.

To cancel your GEICO insurance policy, you must call GEICO to speak directly with a customer service agent. You cannot cancel your policy online or through the GEICO mobile app. You may cancel your policy at any time, and the cancellation can take effect immediately or be set for a future date.

- Have your GEICO policy number ready.

- Call GEICO at 1-800-841-1587.

- When prompted by the interactive voice response system, say "cancel insurance policy" and then "auto".

- You will then be connected to a customer service agent, who will guide you through the cancellation process.

Before the cancellation is complete, you must pay off any remaining balance on your account. If you've already paid your entire premium for the policy period in full, GEICO will refund the unused portion. After your cancellation request has been processed, GEICO will send any refund that is owed to you. However, some companies may deduct an early cancellation penalty, so be sure to review your policy paperwork to see if this applies to you.

Auto Insurance's Long Memory: Unraveling the Wreck History

You may want to see also

Frequently asked questions

To renew your GEICO auto insurance, you must call GEICO's customer support line at 1 (800) 841-1587. You will be asked to provide your policy number and personal identification details.

No, you cannot renew your GEICO auto insurance online. You must contact GEICO's customer support line by phone.

Yes, you can renew your GEICO auto insurance policy at any time.