Being involved in a car accident is stressful, and the subsequent insurance claims process can be complicated. If you believe you are not at fault for the damage to your vehicle, you have the option to file a claim with the other driver's insurance company. This is called a third-party claim. You will need to obtain the other driver's insurance information, including their insurance card and driver's license, and contact their insurer. The other driver's insurance company may not agree that their driver is fully responsible and may only offer to pay a portion of your damages, or they may refuse to pay you at all. If you are unable to reach a settlement, your next step is to get legal help.

| Characteristics | Values |

|---|---|

| When to report an accident | As soon as possible. |

| Who to report an accident to | The insurance company of the other driver who was at fault. |

| What to do if the other driver doesn't have insurance | File a claim with your own insurance company. |

| What to do if the other driver drove away without stopping | File a claim with your own insurance company. |

| What to do if the other driver's insurance company refuses to pay | Ask for their reason in detail and in writing, then file a claim with your own insurance company. |

| What to do if the other driver's insurance company claims their driver wasn't at fault | Ask for their reason in detail and in writing, then file a claim with your own insurance company. |

| What to do if the other driver's insurance company claims both drivers were at fault | Ask for their reason in detail and in writing, then file a claim with your own insurance company. |

| What to do if the other driver doesn't have enough insurance | File a claim with your own insurance company. |

| What to do if the other driver's insurance company doesn't return your calls or emails | File a claim with your own insurance company. |

| What to do if the other driver's insurance company takes a while to contact you | Be patient, then file a claim with your own insurance company if necessary. |

What You'll Learn

First-party insurance claims vs. third-party insurance claims

When it comes to auto accidents, there are two types of insurance claims that can be filed: first-party claims and third-party claims. Understanding the differences between these two types of claims is crucial if you want to effectively navigate the insurance claims process and receive the compensation you deserve.

First-party insurance claims involve filing a claim directly with your own insurance company for damages or losses covered by your policy. This type of claim typically arises when you are involved in an incident that affects you or your property. For example, if you damage your car by backing into a pole, you would file a first-party claim with your insurance company. They will then review your policy to determine if you have the necessary coverage for them to compensate you for the specific type of loss.

On the other hand, a third-party insurance claim is made when you file a claim with someone else's insurance provider, typically when you are not at fault for the incident. In the context of a car accident, if another driver is at fault, you, as the victim, have the right to file a third-party claim with their insurance company to seek compensation for your accident-related expenses. For instance, if a drunk driver runs a red light and collides with your vehicle, you would file a claim with the drunk driver's insurance company, which is then responsible for your damages.

One key distinction between first-party and third-party claims is the presence or absence of a contract. In a first-party claim, there is a contract between you and your insurance company, which outlines the promises and exclusions of your policy. Common exclusions include injuries resulting from intentional or reckless acts or injuries sustained while driving for a ride-sharing program. In contrast, there is no contract between you and the at-fault driver's insurance company in a third-party claim, which means you may be able to claim damages that your own insurance policy might not cover, such as medical expenses, pain and suffering, mental anguish, and lost wages.

The process of filing a claim is similar for both first-party and third-party claims. It starts by notifying the insurance company of your losses. They will then assign a claim number and appoint a claims adjuster to investigate. You will need to provide details of your damages and losses to the adjuster, who will make a decision on whether to approve, partially approve, or deny your claim. If you disagree with the adjuster's decision, you may consider negotiating further or filing a formal claim in court.

It's important to note that the absence of a contract in third-party claims can make the process more complex and overwhelming. Consulting with an experienced personal injury attorney is highly recommended, as they can guide you through the claims process and ensure you receive fair compensation.

Refinancing Auto Insurance: A Guide to Lowering Your Premiums

You may want to see also

The other driver's insurance company may dispute liability

When you are involved in a car accident, you may need to report it to the other driver's insurance company. However, the other driver's insurance company may dispute liability. Here are some things to keep in mind if this happens:

- Understand the reason for the denial: Ask the insurance company for a detailed explanation of why your claim was denied and review your policy to identify any areas where you may have grounds to contest the denial.

- Gather evidence: Collect relevant evidence, such as police reports, eyewitness accounts, medical reports, and photographs of the accident scene, to support your claim.

- Contact your insurance company: Discuss the denial with your insurance company and explore the possibility of appealing the decision.

- Seek legal assistance: If necessary, consult with an attorney who specialises in car accidents to guide and represent you in disputing the denial.

- Keep a detailed record: Maintain a thorough record of all conversations with insurance representatives, medical treatments, and expenses incurred due to the accident, as this documentation can be valuable in disputing a claim denial.

- Be proactive in communication: Regularly follow up with your insurance company and the other driver's insurance company to keep the lines of communication open and prevent misunderstandings.

- Understand the appeals process: Familiarise yourself with the insurance company's appeals process and follow it carefully, as it may involve submitting additional documentation or undergoing further assessments.

- Consider alternative dispute resolution: If direct negotiation fails to resolve the issue, consider mediation or arbitration as less adversarial and costly options than litigation.

Auto Insurance Premiums: The Cost of Adding Drivers

You may want to see also

No-fault states

In the US, there are around a dozen "no-fault" states, where drivers must carry personal injury protection (PIP) insurance. In these states, your own insurance covers your damages, regardless of who caused the accident. This coverage includes medical expenses, lost income (up to a certain dollar limit), the cost of replacement services, and funeral costs if someone died as a result of the accident.

The no-fault insurance system simplifies the process of making a claim. You submit your claim to your insurance company, and they pay compensation for certain financial losses related to your injuries, regardless of who caused the accident. This means you don't have to prove to an insurance adjuster that the other driver was at fault.

However, there are some downsides to the no-fault insurance system. You are not guaranteed a settlement, and you are limited in the types of compensation you can collect. For example, "pain and suffering" damages are generally not included in no-fault claims. Additionally, the cost of PIP coverage is usually high, with most states that require it having premium rates above the national average.

In no-fault states, you can still sue the other driver in certain situations. For instance, if the accident caused ""significant" injury, as defined by state law, or if the accident resulted in medical bills above a certain dollar threshold, you may be able to pursue a claim outside of the no-fault system.

The no-fault car insurance states are:

- Florida

- Hawaii

- Kansas

- Massachusetts

- Michigan

- Minnesota

- North Dakota

- New Jersey

- New York

- Pennsylvania

- Utah

Strategies for Becoming an Auto Insurance Sales Agent

You may want to see also

Underinsured drivers

If you've been in an accident caused by an underinsured driver, you may be wondering how to report it and what your options are. Here's a step-by-step guide to help you navigate the process:

Step 1: Understand Underinsured Motorist Coverage

Underinsured motorist coverage is a type of auto insurance that protects you if the driver who caused the accident doesn't have sufficient insurance to cover the damages. This coverage is different from uninsured motorist coverage, which applies when the at-fault driver has no insurance at all. Underinsured motorist coverage typically includes two parts: bodily injury coverage and property damage coverage.

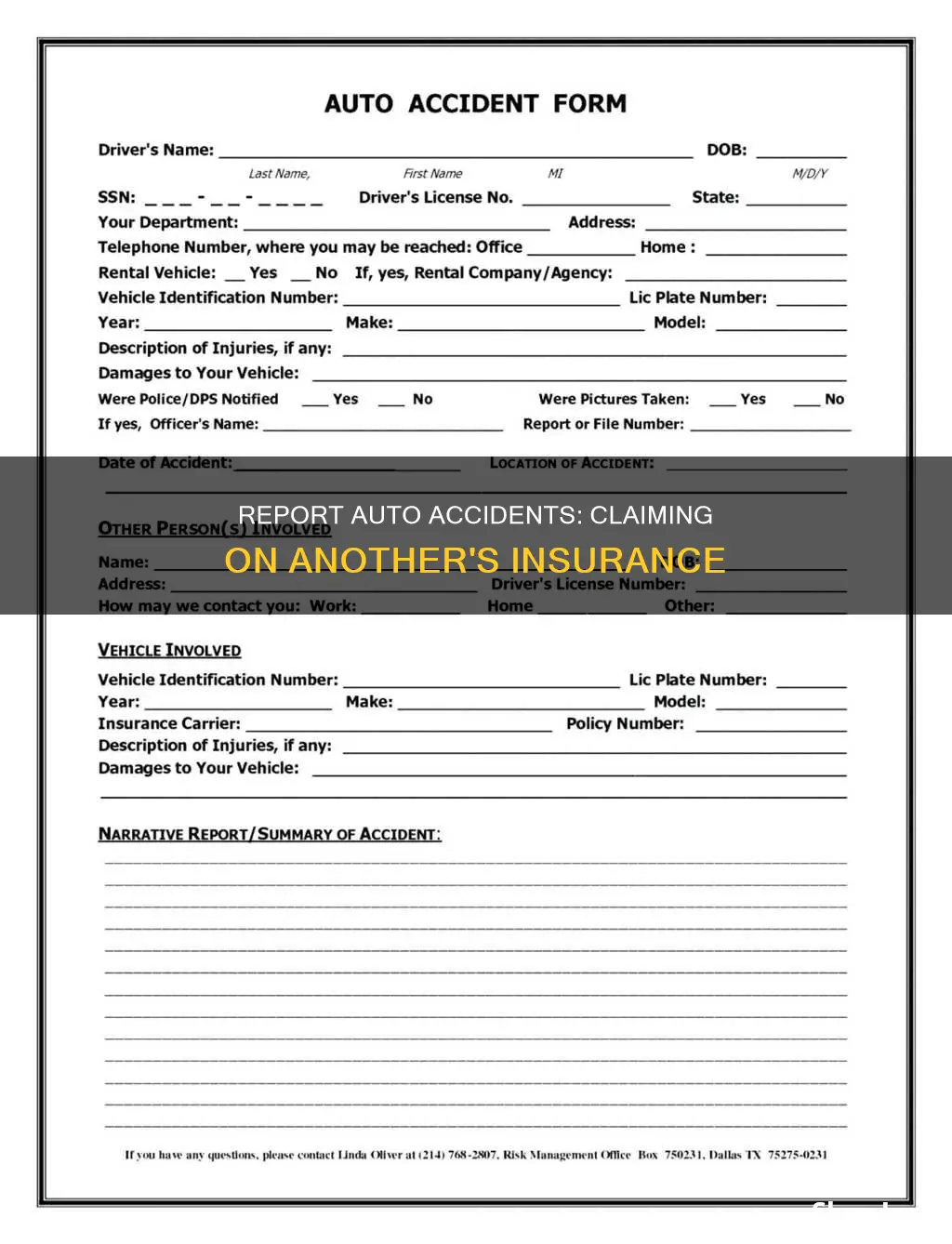

Step 2: Exchange Information at the Scene

If you're involved in an accident, the first step is to ensure everyone's safety. Once you've confirmed that you and your passengers are okay, exchange information with the other driver. Take photos of the damage, and get their insurance information by taking a picture of their insurance card and driver's license. Additionally, get their name, phone number, insurance company name, and policy number.

Step 3: File a Claim with the Other Driver's Insurance

When you get home, file a claim with the other driver's insurance company. Let your own insurance company know about the accident as well. If the police responded to the accident, obtain a copy of the police report and send it to the other driver's insurance company. They will investigate the accident to determine their driver's fault.

Step 4: Understand Potential Challenges

Keep in mind that the other driver's insurance company might deny your claim or only agree to pay a portion of your damages. They may argue that their driver is not at fault or that their driver doesn't have enough insurance to cover all your costs. This is where underinsured motorist coverage comes into play.

Step 5: Contact Your Own Insurance Company

If the other driver's insurance company refuses to pay or doesn't provide sufficient coverage, contact your own insurance company. If you have underinsured motorist coverage, it will cover the additional costs, including medical bills and repairs or replacement of your vehicle, up to the limit of your policy.

Step 6: Understand Your Coverage Limits

The amount of coverage provided by underinsured motorist protection varies by state and your specific policy. In some states, only underinsured motorist bodily injury coverage is available, while others offer both bodily injury and property damage coverage. Check with your state's department of motor vehicles or your insurance agent to understand the specific coverage available to you.

Remember, it's important to remain calm and collected at the scene of the accident, exchange all necessary information, and contact your insurance company as soon as possible. By following these steps, you can effectively report an accident involving an underinsured driver and ensure you receive the coverage you need.

Auto-Renewal: Haven Insurance's Seamless Solution

You may want to see also

Getting legal help

- Dealing with insurance companies: Insurance companies may try to lowball you with a minimum compensation offer or deny your claim altogether. A lawyer can help you negotiate a fair settlement and guide you through the claims process.

- Gathering evidence: To build a strong case, you need to gather evidence such as police reports, witness statements, photos, and proof of damages. A lawyer can help you collect and preserve this evidence, which is crucial for your claim or lawsuit.

- Understanding your rights: The laws regarding car accidents vary from state to state. A lawyer can explain your rights and options, so you can make informed decisions about your case.

- Maximising your settlement: If you have sustained significant injuries or losses, you deserve to be fully compensated. A lawyer can help you assess the extent of your losses and fight for a settlement that covers all your expenses, including medical bills, vehicle repairs, pain and suffering, and emotional trauma.

- No-fault states: In some states with no-fault insurance laws, you must first make injury claims through your own insurance before suing the other driver. A lawyer can help you navigate the specific rules and requirements in your state.

- Underinsured or uninsured drivers: If the other driver doesn't have enough insurance or is uninsured, you may need to turn to your own insurance or take legal action to recover your damages. A lawyer can advise you on the best course of action and protect your rights.

- Complex situations: If there are disputed facts, multiple parties involved, or significant injuries and losses, a lawyer can help you navigate the complexities and ensure your interests are protected.

Remember, the aftermath of a car accident can be chaotic and stressful. Taking prompt action, gathering the right documentation, and seeking legal help when needed can put you in a stronger position to protect your rights and obtain the compensation you deserve.

Smart Ways to Get DD Discount on GEICO Auto Insurance

You may want to see also

Frequently asked questions

You should stop immediately and move only if it is safe to do so. Call 911 if there are injuries and notify the police. Obtain names, addresses, telephone numbers, and driver's license numbers from all drivers, as well as license plate and vehicle identification numbers. Also, get the names, addresses, and telephone numbers of other passengers and any witnesses. If possible, take photographs of the damage and the accident scene.

If the other driver doesn't have insurance, ask for their name, phone number, insurance company name, and policy number. If they drove away, you may need to use your own insurance to cover the costs of repairs and medical bills.

The other driver's insurance company will process the claim, but there is no guarantee they will pay. They might investigate the accident to determine fault. If they accept responsibility, they may provide you with a rental vehicle or alternative transportation while your vehicle is being repaired.