Dealing with insurance adjusters can be a stressful and overwhelming process, especially when it comes to negotiating a fair settlement. It's important to understand your rights and know that you can respectfully disagree with an insurance adjuster's decision. Here are some steps to guide you through this challenging process: Firstly, review your insurance policy thoroughly and understand your coverage limits. Gather all relevant records, including communications with the adjuster, medical records, repair estimates, and any other supporting documentation. You have the right to ask the adjuster for their reasoning and request an internal review of your claim if needed. If you're still unsatisfied, consider seeking external assistance, such as hiring an independent appraiser or lawyer to assess your claim's value and guide you through alternative dispute resolution methods like mediation or arbitration. Remember, the adjuster's word is not final, and you have the option to file a complaint or take legal action as a last resort.

| Characteristics | Values |

|---|---|

| When to disagree | When the settlement is insufficient, fault is disputed, the vehicle is undervalued, the claim is denied, the coverage is inadequate, the personal injury compensation is insufficient, or liability is disputed. |

| What to do | Gather evidence, review your policy, be patient and persistent, consider a second opinion, opt for mediation and arbitration, speak with a lawyer, file a complaint, and be prepared for legal action. |

| Understanding your rights | You have the right to dispute the claims adjuster's opinion or evaluation of your claim. |

| Understanding your policy | Review the language and fine print of your insurance policy to make sure you are filing a claim within your coverage limits. |

| Documentation | Collect all documentation related to your claim, including letters, emails, photographs of property damage, and your insurance policy. |

| Asking the adjuster to reconsider | Speak to the claims adjuster directly and ask for their reasoning. |

| Requesting an internal review | Write a letter to the insurance company requesting an internal review of your claim. |

| Filing a complaint | File an official complaint against the insurance company with a relevant regulatory body, such as the Arizona Department of Insurance. |

| Seeking legal advice | Contact an insurance bad faith lawyer for a free consultation to understand and defend your rights. |

What You'll Learn

- Understand your rights: You have the right to dispute the adjuster's opinion or evaluation

- Review your policy: Ensure you are filing a claim within your coverage limits

- Gather evidence: Collect photos, emails, letters, and other relevant documentation

- Ask the adjuster to reconsider: Misunderstandings can occur, so clarify the adjuster's reasoning

- Seek alternative dispute resolution: Mediation and arbitration can help resolve disagreements

Understand your rights: You have the right to dispute the adjuster's opinion or evaluation

Understanding your rights is crucial when dealing with insurance adjusters. While adjusters work for the insurance company and may not have your best interests at heart, you have the legal right to dispute their opinions or evaluations. Here are some steps to help you exercise your rights effectively:

Understand Your Policy and the Adjuster's Decision:

Carefully review your insurance policy, including the fine print and coverage limits. Make sure you understand what is covered and what your rights are under the policy. Also, carefully read any letters or emails from the insurance adjuster detailing their decision. Identify the reason for their decision and evaluate if it aligns with your understanding of your policy.

Collect Evidence and Documentation:

Gather and organise all relevant documentation, including photographs, repair estimates, medical records, correspondence with the adjuster, and your insurance policy. Keep a thorough record of your claim and all interactions with the adjuster. This documentation will be crucial if you need to dispute the adjuster's decision or go through an appeal process.

Ask the Adjuster to Reconsider:

In some cases, a misunderstanding or missing information may have led to the adjuster's decision. Contact the adjuster directly and ask for their reasoning. Provide any additional information or evidence that may support your case. If this doesn't resolve the issue, you can request an internal review of your claim from the insurance company. They are obligated to grant this request and assign someone to review the facts of your case.

Seek Legal Assistance:

If you still disagree with the adjuster's decision after the internal review, consider contacting an attorney or a public insurance adjuster. They can review your case, advise you on your rights, and help you navigate the dispute process. A lawyer can communicate and negotiate with the insurance adjuster on your behalf, working to reverse or modify their determination.

File a Complaint or Initiate Alternative Dispute Resolution:

If the issue remains unresolved, you may file an official complaint against the insurance company. In some states, you can file a complaint with the state's department of insurance, which may provide leverage in negotiations. Additionally, you can explore alternative dispute resolution methods, such as mediation or arbitration, to resolve disagreements without litigation.

Remember, you have the right to dispute the insurance adjuster's opinion or evaluation. Stay patient and persistent, and don't settle for less than what you believe is fair.

ACA Profits: Unraveling the Risk Adjustment Factor

You may want to see also

Review your policy: Ensure you are filing a claim within your coverage limits

When dealing with an insurance adjuster, it's important to know your rights and understand your insurance policy. Reviewing your policy will help you determine if you are filing a claim within your coverage limits. Here are some key points to consider:

- Understand your policy limits and coverage: Familiarize yourself with the specific details of your insurance policy, including coverage limits, exclusions, and endorsements. Know what types of incidents or damages are covered and what your financial limits are. This will help you assess if your claim is valid and reasonable within the terms of your policy.

- Review your deductible: Your deductible is the amount you need to pay out of pocket before your insurance coverage kicks in. Confirm your deductible amount and factor it into your claim. In some cases, it may not be worth filing a claim if the damages are only slightly above your deductible, as it could result in increased premiums or negative impacts on your policy.

- Assess the scope of damages: Evaluate the extent of the damages you are claiming. Compare this to your coverage limits and deductible to determine if filing a claim is the best course of action. If the damages are minimal or fall below your deductible, you may want to consider covering the costs yourself to avoid potential negative consequences on your policy.

- Check for specific damage exclusions: Some insurance policies may have exclusions for certain types of damages. Carefully review your policy to ensure that the damages you are claiming are not specifically excluded from coverage. Filing a claim for excluded damages could lead to increased premiums or negative impacts on your policy.

- Be timely: Most insurance policies have time limits for filing claims. Check your policy to understand the timeframe within which you need to file your claim. Acting promptly can help ensure your claim is processed efficiently and increase your chances of receiving the desired outcome.

- Seek clarification: If you are unsure about any aspect of your policy or coverage, don't hesitate to contact your insurance provider or agent. They can provide clarification and guide you through the claims process. It's important to have a comprehensive understanding of your policy before proceeding with any dispute or negotiation.

The Distinct Roles of Insurance Adjusters and Lawyers: Unraveling the Similarities and Differences

You may want to see also

Gather evidence: Collect photos, emails, letters, and other relevant documentation

When preparing for mediation, it is important to gather all relevant evidence and documentation to support your case. This includes:

- Photographs of any property damage or accident scenes.

- Copies of your insurance policy and letters from the adjuster.

- All correspondence with the insurance company, including emails, letters, and direct messages.

- Medical records and bills related to any injuries sustained.

- Repair estimates for any damages to your property or vehicle.

- Police reports, if applicable.

It is crucial to organise and review these documents before the mediation process begins. This will help you understand the strengths and weaknesses of your case and identify any additional information or evidence that may be needed. It is also advisable to seek the assistance of an attorney who can guide you in gathering the necessary evidence and presenting it effectively during mediation.

Pursuing a Career in Insurance Adjusting: Navigating the 9-Month Educational Path in California

You may want to see also

Ask the adjuster to reconsider: Misunderstandings can occur, so clarify the adjuster's reasoning

When dealing with an insurance adjuster, it's important to remember that they work for the insurance company and not for you. Their primary goal is to minimise the compensation paid out by the company, and they will use various tactics to achieve this. However, you have the right to dispute their assessment and ask them to reconsider.

Misunderstandings can occur, and there may be a simple explanation for the adjuster's decision. Ask the adjuster for their reasoning, as this may allow you to clear up any issues that resulted in a diminished or denied claim. For instance, you may have forgotten to give them a critical piece of information or enough supporting evidence.

If a conversation with the adjuster does not resolve the issue, you can write a letter to the insurance company requesting an internal review of your claim. They must grant you this right and assign someone to review the facts of your case and determine whether the adjuster made a mistake. If the internal review does not reverse the adjuster's decision, you can file an official complaint against the insurance company.

Before contacting the adjuster, it's a good idea to review your insurance policy to ensure you are filing a claim within your coverage limits. You might have assumed coverage for a certain type of loss or natural disaster when, in fact, your policy never included this. Reading your policy will help you understand whether the adjuster's decision makes sense based on the terms of your contract.

It's also important to remember that insurance adjusters handle a high volume of claims and have a lot on their plate. Taking the high road and treating the adjuster with kindness and respect can go a long way. If you feel they are acting unreasonably, allow a day or two to pass before communicating with them again. Reflect on your previous approach and consider whether there is anything you could have done differently. Then, raise your concerns and explain how their actions made you feel.

The Art of Damage Assessment: Unraveling the Insurance Adjuster's Process

You may want to see also

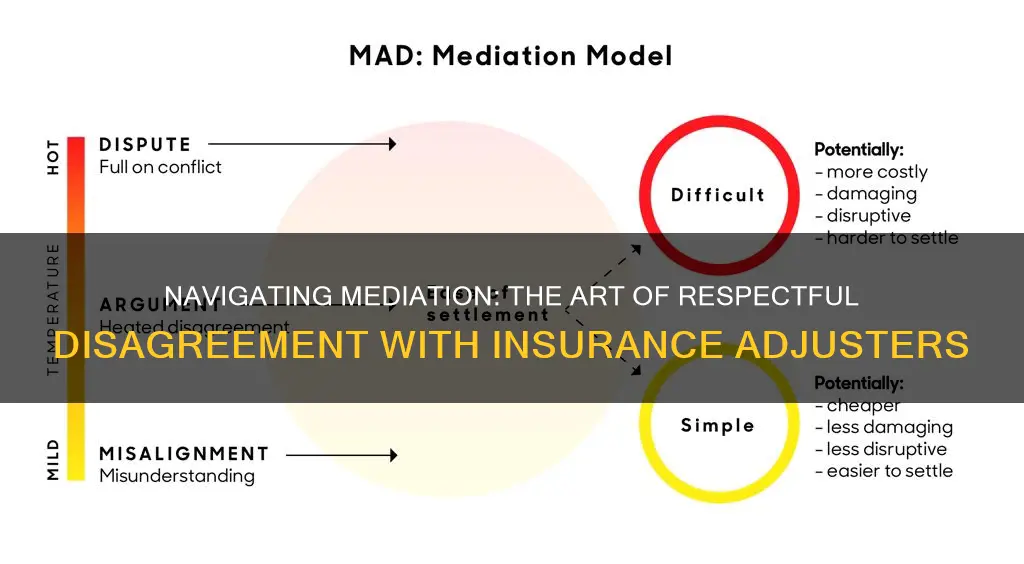

Seek alternative dispute resolution: Mediation and arbitration can help resolve disagreements

When faced with an insurance dispute, it is important to understand your rights and know that you can respectfully disagree with an insurance adjuster's evaluation. While insurance adjusters evaluate damages and determine compensation, their word is not final, and you have the right to challenge their assessment.

Mediation and Arbitration as Alternative Dispute Resolution (ADR) Methods

Mediation and arbitration are alternative dispute resolution (ADR) methods that can help resolve disagreements outside of the courtroom. These processes are particularly useful when insureds and insurers cannot agree but wish to avoid litigation. While both methods involve a neutral third party, they differ in the level of control given to the disputing parties and the formality of the process.

Mediation

Mediation is a voluntary, non-binding process where a neutral third party, known as a mediator, assists the disputing parties in reaching a mutually satisfactory resolution. The mediator facilitates communication, helps identify common ground and areas of disagreement, and guides negotiations. The process is less formal, flexible, and adaptable to the needs of the parties, allowing for creative solutions. It is also generally less expensive and faster than litigation.

Arbitration

Arbitration is a more formal process than mediation and is similar to a court case. It involves both sides presenting their arguments and evidence before a neutral third party, known as an arbitrator, who then renders a decision. Arbitration can be binding or non-binding, and voluntary or involuntary. With binding arbitration, the decision is final and legally enforceable. Arbitration tends to be faster and less expensive than litigation, but it may not offer the same level of control over the outcome as mediation.

Benefits of Mediation and Arbitration in Insurance Disputes

Mediation and arbitration offer several advantages over traditional litigation in resolving insurance disputes:

- Cost-effectiveness: These processes typically involve fewer legal fees and administrative costs compared to litigation.

- Time efficiency: Disputes can often be resolved faster through mediation or arbitration, which can take months or even years in litigation.

- Confidentiality: Mediation and arbitration sessions are usually private and confidential, helping preserve the reputations of the parties involved.

- Relationship preservation: These ADR methods foster cooperation and communication, helping to maintain business relationships between the parties.

- Creative solutions: The flexible nature of mediation, in particular, allows for creative and customized solutions that may not be possible through litigation.

Choosing Between Mediation and Arbitration

The choice between mediation and arbitration depends on the specific circumstances and the relationship between the disputing parties. If both parties believe they can work together and find a resolution collaboratively, mediation may be the better option. On the other hand, if an agreement seems unlikely, arbitration may be more suitable, as it provides a more definitive outcome with the assistance of a trained, impartial arbitrator.

Understanding Adjusted Income: A Guide to Estimating for Insurance Purposes

You may want to see also

Frequently asked questions

First, understand that you have the right to dispute the insurance adjuster's decision. Next, review your insurance policy and gather all relevant documents, including letters, emails, and other communications. Then, ask the adjuster for their reasoning and try to resolve the issue through discussion. If this doesn't work, you can request an internal review of your claim from the insurance company.

If the internal review does not reverse the adjuster's decision, you can file an official complaint against the insurance company. This process varies depending on your location. For example, in Arizona, the complaint would be filed with the Arizona Department of Insurance.

If you have just received notification of the adjuster's decision, contact a lawyer promptly to review your options. If it has been a while since the decision, you should still contact a lawyer, who will assess your available options. A lawyer can communicate with the adjuster, hire an independent appraiser, or take legal action.

Mediation and arbitration are alternative dispute resolution methods that can be used to resolve disagreements. Mediation involves a facilitated negotiation where a mediator helps both sides work things out informally. Arbitration involves presenting evidence to a group of arbitrators who make a binding or non-binding decision.