If you've been in a car accident, you'll likely have to deal with an insurance claims adjuster who will review the facts and offer you a settlement amount. It's important to remember that the adjuster works for the insurance company and will try to settle the case as cheaply as possible. The first settlement offer is typically low, so it's crucial to review the claim and reject it if it doesn't adequately cover your damages and injuries. To determine if the offer is too low, calculate the total value of your car accident claim by adding up medical bills, treatment costs, repair costs, and any other out-of-pocket expenses. You can then negotiate with the insurance company by writing a claim letter detailing the facts of the case, your injuries, and the value of your desired settlement.

| Characteristics | Values |

|---|---|

| First step | Calculate how much your car accident claim is worth. |

| Calculation factors | Medical bills, treatment costs, repair costs, and any out-of-pocket costs. |

| Next steps | Negotiate with your car insurance company. |

| Negotiation tips | Reject the first offer, write an insurance claim letter, decide on a range that you feel would be fair compensation, let the insurance adjuster make the first offer, start at the high end of your range and explain any extenuating circumstances. |

| Alternative options | File a Property Arbitration claim in the appropriate county, contact a car accident attorney, hire a public insurance adjuster, or sue the insurance company in a court of law. |

What You'll Learn

- Understand the reasons for estimate differences between shops

- Calculate the value of your claim before accepting an offer

- Reject the first offer and negotiate a settlement

- Consult an attorney before negotiating with your insurance provider

- Don't accept a payout before an auto body expert assesses the damage

Understand the reasons for estimate differences between shops

Understanding the reasons for estimate differences between shops is crucial when dealing with auto insurance. Here are some key factors that contribute to these differences:

Experience and Time: The experience level of the estimator plays a significant role in the thoroughness of the repair assessment. A seasoned estimator will typically provide a more comprehensive evaluation than a novice. Additionally, time constraints can impact the accuracy of an estimate. A rushed estimator may not have the opportunity to conduct a detailed inspection, potentially missing crucial elements.

Estimate Discrepancies: Differences in estimates between shops can be attributed to their unique processes and policies. Each shop follows its own set of guidelines, which can lead to variations in the estimated repair costs. It's important to recognize that an estimate is not a final price but rather a preliminary assessment based on visible damage.

Repair Policies and Parts: Repair shops may differ in their repair processes, including the time taken for repairs and the use of aftermarket or OEM (Original Equipment Manufacturer) parts. High-quality shops, for instance, may mandate the removal of lamps, mirrors, and door handles before painting, adding to the labour time. OEM parts, sourced directly from the manufacturer, are often recommended for specific vehicle issues but may be more expensive than aftermarket parts.

Supplemental Damage and Betterment: Hidden damages that are not initially visible can lead to supplemental estimates during the repair process, increasing the final repair bill. In some cases, betterment may be a factor, where the insurance company accounts for improvements made to the vehicle during repairs, such as replacing an old tire with a new one.

It's important to remember that choosing a repair shop should not be based solely on the lowest estimate. Instead, customers should understand the reasons for the differences in estimates and select a shop that provides a comprehensive assessment, ensuring all necessary repairs are addressed.

Suspended License? Auto Insurance Options

You may want to see also

Calculate the value of your claim before accepting an offer

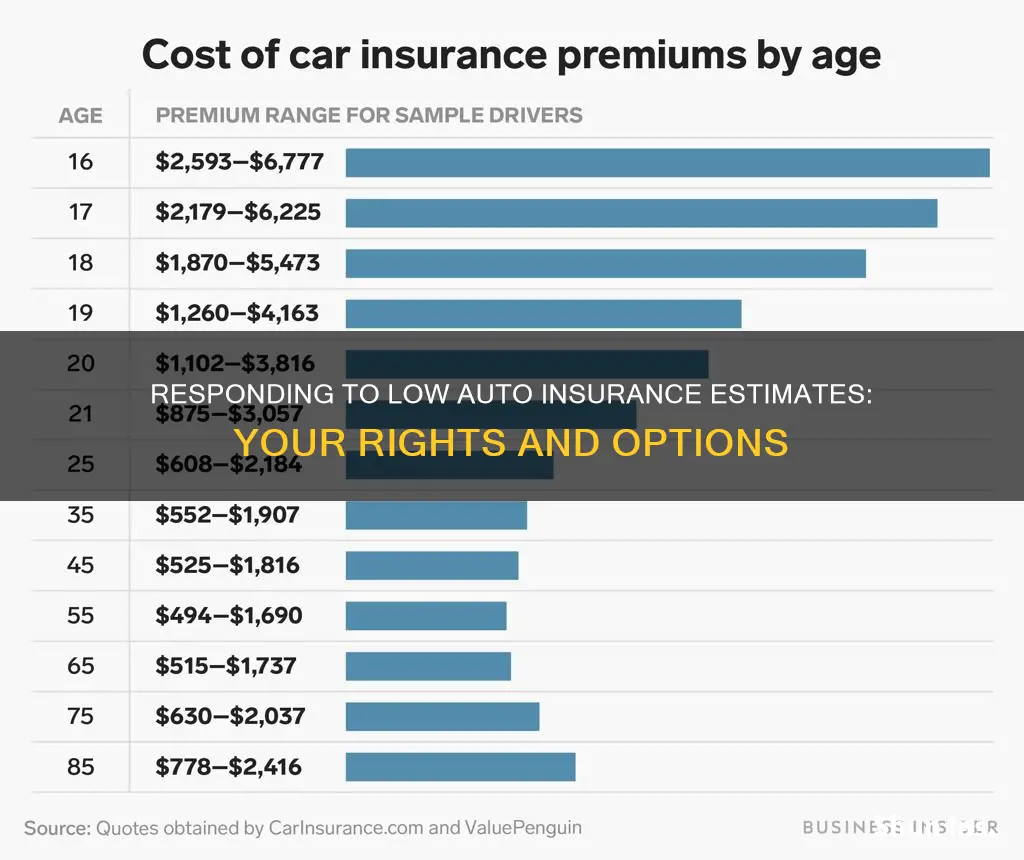

When an insurance company offers you a low estimate, it is important to calculate the value of your claim before accepting the offer. This will help you determine if the settlement offer is fair and if you need to negotiate for a higher amount. Here are some steps to calculate the value of your claim:

- Know your policy details: Understand the coverage provided by your car insurance policy. Check if you have medical coverage and the limits of this coverage. Also, look into collision and comprehensive coverage, as these will impact the damages and injuries you can claim.

- Gather your medical bills and expenses: Calculate the total amount of your medical bills, including any costs related to treatment, prescriptions, and mileage to and from the doctor's office.

- Consider the extent of your treatment: Think about whether you needed extensive treatment, such as physical therapy, and if the accident prevented you from performing your normal duties at work or at home.

- Evaluate vehicle repairs: Ensure that the settlement offer includes the cost of repairing your vehicle to restore it to its pre-accident condition.

- Determine fault and contributing factors: Consider who was at fault in the accident and how much you may have contributed to the damage and injuries. Insurance companies may try to overstate your level of fault to reduce their payout, so be aware of this possibility.

- Account for future costs: Take into account any future costs associated with your claim, such as lost wages due to missed work or ongoing medical expenses for permanent injuries.

By following these steps, you can gain a clearer understanding of the value of your claim and be better equipped to negotiate with the insurance company. Remember to ask the claims adjuster about the factors they considered when determining your initial settlement offer, as this can help you identify areas of disagreement and strengthen your case for a higher settlement amount.

Safeco Auto Insurance in Florida: What You Need to Know

You may want to see also

Reject the first offer and negotiate a settlement

Rejecting the first offer and negotiating a settlement is a common approach to dealing with a low estimate from an auto insurance company. Here are some steps to guide you through this process:

Understand Your Policy and Calculate Your Claim's Value:

Know your auto insurance policy inside out. Understand the coverage you have, including medical, collision, and comprehensive coverage. Calculate the total value of your claim, including medical bills, treatment costs, repair costs, rental car expenses, and any other out-of-pocket expenses incurred due to the accident.

Reject the Initial Offer:

Don't blindly accept the first offer made by the insurance adjuster. It is likely to be on the lower end, as adjusters aim to settle cases cheaply for their employer, the insurance company. Reject the offer by writing a formal insurance claim letter. Outline the facts of the case, your injuries, and the value of your claim.

Establish a Fair Compensation Range:

Before entering negotiations, decide on a range that you believe would be a fair settlement for your claim. Consider all the costs you have incurred and will incur in the future due to the accident.

Let the Adjuster Make the First Offer:

During negotiations, let the insurance adjuster make the first offer. This will likely be on the lower end of their authorized range. By letting them make the first move, you can gain insight into their negotiation strategy and the range they are working with.

Counter with a Higher Figure and Explain Your Reasons:

Start your counteroffer on the higher end of your fair compensation range. Explain any extenuating circumstances or specific details related to the accident that justify your figure. Be reasonable and focus on getting a fair settlement, rather than asking for an outrageous amount.

Consider Seeking Legal Advice:

If you feel overwhelmed or unsure about handling the negotiation process on your own, consult a car accident attorney. They can provide valuable guidance and represent your interests during the settlement negotiations.

Remember, insurance companies profit by paying out as little as possible on claims, so don't be afraid to advocate for yourself and negotiate for a higher settlement when you believe their initial offer is too low.

Auto Insurance Rates: Most Expensive States

You may want to see also

Consult an attorney before negotiating with your insurance provider

If you've received a lowball offer from your insurance company, you may want to consult an attorney before negotiating further with your insurance provider. While this may seem like an extreme step, there are several benefits to seeking legal advice.

Firstly, attorneys have the necessary legal knowledge and expertise to assess your situation and provide advice on your rights and options. They can help you navigate the complex laws and regulations surrounding insurance claims and ensure your interests are protected.

Secondly, attorneys are skilled negotiators who can advocate on your behalf. They understand the tactics used by insurance adjusters and can effectively negotiate to maximize your settlement. Insurance adjusters work for the insurance company and may try to minimize your claim, but an attorney can provide an objective perspective and ensure you receive fair compensation.

Additionally, attorneys have access to resources such as expert witnesses, accident reconstruction specialists, and medical professionals who can strengthen your case. They can also guide you through complicated legal procedures, including filing deadlines, paperwork, and documentation requirements.

When deciding whether to consult an attorney, consider the severity of your injuries, the complexity of your claim, and the potential value of your settlement. If your injuries are serious or your claim is high-value, an attorney can help you receive fair compensation and navigate the challenges of the legal process.

Before engaging an attorney, it is essential to evaluate the extent of your damages and research similar cases and settlements in your area to estimate the value of your claim. This knowledge will empower you during negotiations and help you set realistic expectations.

In conclusion, consulting an attorney before negotiating with your insurance provider can be a strategic decision that levels the playing field and increases your chances of receiving a fair and favourable resolution.

Understanding Auto Insurance Reimbursement: Your Guide to Getting Covered

You may want to see also

Don't accept a payout before an auto body expert assesses the damage

When dealing with a low auto insurance estimate, it's important to remember that insurance companies aim to pay out as little as possible on every claim. This often results in policyholders receiving low-ball estimates. Here's why you shouldn't accept a payout before an auto body expert assesses the damage:

Understand Your Entitlements

Knowing what you're entitled to is crucial. Insurance adjusters may not disclose all the benefits you're entitled to, as it saves the company money. They may also pressure you to use their "preferred" repair shops, citing guarantees and approvals. However, these agreements primarily benefit the insurance company and can result in lower-quality repairs. Cosmetic imperfections and structural integrity issues may arise, affecting the vehicle's ride, stability, and safety.

Selection of Body Shop is Your Right

You have the right to choose the auto collision shop that will repair your vehicle. It is illegal for an insurance company to coerce or force you to use a specific shop, even if it's your own insurance company's recommendation. Visit the body shop, speak to the manager, and ensure they understand that they work for you, not the insurance company. Make sure the shop has the proper equipment, trained technicians, and provides a minimum warranty on their work, including paint jobs.

Get a Comprehensive Damage Assessment

An auto body expert can provide a detailed assessment of the damage to your vehicle. This includes not just the repairs needed but also any supplemental damages found during the repair process. By having an expert assess the damage, you can be sure that all necessary repairs are identified and included in the claim. This helps to avoid future problems resulting from unrepaired damage.

Ensure Safe and Proper Repairs

An auto body expert will ensure that repairs are done properly and safely. They will have the necessary equipment and trained technicians to restore your vehicle to its pre-accident condition. By choosing a reputable shop, you can be confident that your vehicle's electrical and safety systems are functioning correctly, and any structural damage is properly addressed.

Avoid Additional Costs and Delays

Delaying repairs or choosing a subpar repair shop can lead to additional costs and delays. Reputable auto body experts will keep you informed throughout the repair process and address any issues that arise with the insurance company. They can also help ensure that you receive compensation for any out-of-pocket expenses related to the accident, such as rental car costs or mileage expenses.

In summary, don't accept a payout before an auto body expert assesses the damage. By understanding your rights and entitlements, selecting a reputable body shop, and getting a comprehensive damage assessment, you can ensure that your vehicle is properly repaired and that you receive fair compensation for all expenses related to the accident.

Auto Insurance in Ohio: What You Need to Know

You may want to see also

Frequently asked questions

If you receive a low auto insurance estimate, you should first calculate how much your car accident claim is worth. Add up your medical bills, treatment costs, repair costs, and any out-of-pocket expenses. If the estimate you received is lower than the total amount of these costs, you will need to negotiate with your insurance company.

To negotiate a low auto insurance estimate, you should write an insurance claim letter detailing the facts of the case, your injuries, and the value of your desired settlement. After establishing the value of your claim, decide on a range that you consider fair compensation. Let the insurance adjuster make the first offer, which will likely be on the lower end of their range, and then counter with an offer on the higher end of your range.

Some tips for calculating the value of your car accident claim include knowing your car insurance policy inside and out, adding up all your medical and out-of-pocket expenses, considering the extent of your treatment and whether it prevented you from performing normal duties, ensuring that you will receive enough money to restore your car to its pre-accident state, and looking for future costs associated with your claim, such as time off work or permanent injuries.