Starting a medical insurance company is a complex and challenging endeavor that requires a deep understanding of the healthcare industry, regulatory compliance, and financial management. This process involves several key steps, including market research to identify the specific needs and gaps in the insurance market, developing a comprehensive business plan, and securing the necessary capital and resources. It also entails navigating the intricate regulatory landscape, which varies by region and country, to ensure compliance with local laws and standards. Additionally, building a strong team of experts in healthcare, finance, and operations is crucial for success. This introduction sets the stage for a detailed exploration of the strategic and operational considerations involved in launching a medical insurance company.

What You'll Learn

- Regulatory Compliance: Navigate legal requirements for insurance business

- Market Analysis: Identify target audience and assess industry trends

- Product Design: Craft comprehensive coverage plans with competitive pricing

- Underwriting Process: Develop risk assessment methods for policy acceptance

- Distribution Channels: Establish partnerships for sales and marketing

Regulatory Compliance: Navigate legal requirements for insurance business

When embarking on the journey of establishing a medical insurance company, understanding and adhering to regulatory compliance is paramount. The insurance industry is heavily regulated to protect consumers and ensure fair practices, making it crucial to navigate these legal requirements carefully. Here's a comprehensive guide to help you understand the regulatory landscape:

- Licensing and Registration: The first step is to obtain the necessary licenses and registrations from the relevant regulatory authorities. Each country or region has its own insurance regulatory body. For instance, in the United States, you would need to work with the state insurance departments, while in the UK, the Financial Conduct Authority (FCA) governs insurance companies. Research and identify the specific licenses required for your medical insurance business, such as health insurance licenses, and ensure you meet all the eligibility criteria. This process often involves submitting detailed applications, providing business plans, and demonstrating financial stability.

- Compliance with Insurance Laws: Insurance businesses are subject to various laws and regulations, which may include the Insurance Regulatory Act, Consumer Protection Act, and Anti-Trust Laws. Familiarize yourself with these laws to ensure your company's operations are in full compliance. For instance, you must adhere to regulations regarding policy terms, premium pricing, claims handling, and customer information privacy. Stay updated on any changes in legislation to avoid legal pitfalls.

- Reporting and Disclosure: Insurance companies are required to submit regular reports to regulatory authorities. These reports may include financial statements, market share data, and customer satisfaction metrics. Ensure you have robust accounting and reporting systems in place to facilitate these submissions. Transparency and accurate reporting are essential to maintaining trust and compliance.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Financial institutions, including insurance companies, must implement robust AML and KYC procedures. These regulations aim to prevent financial crimes and ensure the legitimacy of business transactions. Develop policies and procedures to verify customer identities, monitor transactions for suspicious activities, and report any potential illegal activities to the relevant authorities.

- Data Privacy and Security: With sensitive customer data, medical insurance companies must comply with data protection regulations. Implement robust data security measures to protect customer information from breaches and unauthorized access. Stay informed about privacy laws, such as the General Data Protection Regulation (GDPR) in Europe, and ensure your company's data handling practices meet these standards.

Navigating the regulatory landscape is an ongoing process, requiring constant vigilance and adaptation. It is advisable to seek legal and compliance expertise to ensure your medical insurance company operates within the boundaries of the law, providing a solid foundation for your business's success and sustainability.

Navigating Medical Insurance: Can I Include My Partner?

You may want to see also

Market Analysis: Identify target audience and assess industry trends

To begin your market analysis for starting a medical insurance company, it's crucial to identify your target audience. This involves understanding the demographics, health needs, and behaviors of potential policyholders. For instance, are you targeting young adults who are more likely to opt for basic coverage, or are you focusing on older individuals who may require more comprehensive plans? Understanding your target market will help you tailor your products and marketing strategies accordingly.

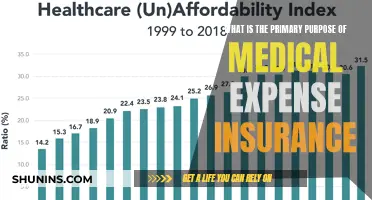

Industry trends play a significant role in shaping the medical insurance sector. One of the key trends is the increasing demand for personalized health plans. Consumers are becoming more health-conscious and are seeking insurance that aligns with their specific needs, such as coverage for chronic conditions or wellness programs. Additionally, the rise of telemedicine and digital health platforms is transforming how people access healthcare, and insurance companies are adapting by offering more flexible and tech-driven solutions.

Assess the competitive landscape to understand the strengths and weaknesses of existing players in the market. Identify the gaps in their offerings that your company can fill. For example, are there specific demographics or regions underserved by current insurance providers? Understanding these gaps will help you position your company effectively and develop unique selling propositions.

Demographic analysis is essential to pinpointing your target audience. Consider factors such as age, income, geographic location, and lifestyle choices. For instance, younger individuals might prefer lower-cost, basic plans, while older adults may require more extensive coverage. Income levels can influence the type of insurance one can afford, and geographic location can impact the availability and cost of healthcare services.

Staying abreast of industry trends is vital for long-term success. Keep track of regulatory changes, technological advancements, and shifts in consumer behavior. For instance, the implementation of new healthcare policies or changes in government subsidies can significantly impact the insurance market. Additionally, monitor the latest innovations in telemedicine and digital health, as these trends are likely to influence how insurance companies operate and provide value to their customers.

Hearing Aid Coverage: Navigating Insurance Options for Better Hearing

You may want to see also

Product Design: Craft comprehensive coverage plans with competitive pricing

When designing medical insurance products, the goal is to create comprehensive coverage plans that are both competitive and appealing to potential customers. Here's a structured approach to achieving this:

Understand Market Needs: Begin by conducting thorough market research to identify the gaps in existing coverage options. Analyze the needs and preferences of your target audience. For instance, are there specific demographics or age groups that are underserved by current providers? Understanding these nuances will help you tailor your plans accordingly.

Define Core Benefits: Break down the essential components of medical insurance. This typically includes hospitalization coverage, doctor visits, prescription drugs, preventive care, and emergency services. Decide on the extent of coverage for each category, ensuring that the plans offer a well-rounded benefit package. For instance, you might choose to provide comprehensive coverage for routine check-ups and screenings, while offering more limited coverage for elective procedures.

Pricing Strategy: Competitive pricing is crucial for attracting customers. Develop a pricing model that considers various factors such as the age and health status of the insured, the number of dependents covered, and the chosen level of coverage. You can employ different pricing strategies, such as age-based tiers, family plans, or individual rates. It's essential to strike a balance between profitability and affordability to ensure your plans are accessible to a wide range of consumers.

Customization and Flexibility: Allow customers to customize their plans to suit their specific needs. This could include adding or removing specific benefits, choosing different deductibles and co-pays, or selecting optional add-ons like vision or dental coverage. Flexibility in plan design can significantly enhance customer satisfaction and loyalty.

Regular Review and Updates: Medical insurance regulations and healthcare trends evolve rapidly. Therefore, it's essential to periodically review and update your coverage plans. Stay informed about changes in medical costs, healthcare provider networks, and industry best practices. Regularly assess the competitiveness of your pricing and benefits to ensure your company remains attractive to both customers and healthcare providers.

Unraveling Valley Medical's Insurance: A Comprehensive Guide to Coverage

You may want to see also

Underwriting Process: Develop risk assessment methods for policy acceptance

The underwriting process is a critical aspect of starting a medical insurance company, as it involves assessing and managing the risks associated with providing coverage to policyholders. Developing effective risk assessment methods is essential to ensure the financial stability and success of your insurance venture. Here's a detailed guide on how to approach this:

Risk Assessment Framework: Begin by establishing a comprehensive risk assessment framework that covers various aspects of healthcare and medical insurance. This framework should include both traditional and emerging risk factors. Traditional risks might include age, gender, medical history, and lifestyle choices, while emerging risks could encompass genetic predispositions, environmental factors, and the rapid evolution of medical technology. Create a structured system to evaluate these factors, ensuring that your underwriting process is thorough and consistent.

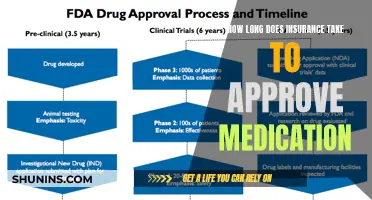

Data Collection and Analysis: Gather relevant data from multiple sources to inform your risk assessment. This includes medical records, demographic information, lifestyle surveys, and even genetic testing data (if applicable). Develop algorithms and models to analyze this data, identifying patterns and correlations that may indicate higher or lower risks. For instance, you might use statistical models to predict the likelihood of certain diseases based on age, family history, and lifestyle factors.

Underwriting Guidelines: Based on your risk assessment framework and data analysis, create detailed underwriting guidelines. These guidelines should outline the criteria for policy acceptance, including acceptable risk profiles and any exclusions or limitations. For example, you may decide to offer comprehensive coverage to individuals with no significant medical history, while charging higher premiums for those with pre-existing conditions. Ensure that your guidelines are transparent and fair, providing clear expectations for both the insurer and the policyholder.

Risk Mitigation Strategies: Develop strategies to mitigate identified risks. This could involve recommending specific lifestyle changes, providing access to preventive care, or offering incentives for policyholders to engage in healthy behaviors. For instance, you might partner with wellness programs or fitness centers to encourage policyholders to adopt healthier habits, potentially reducing the risk of certain diseases. Additionally, consider implementing risk-based pricing, where premiums are adjusted based on the assessed risk of the individual.

Continuous Monitoring and Adaptation: Underwriting is not a one-time process; it requires continuous monitoring and adaptation. Regularly review and update your risk assessment methods to stay current with medical advancements, changing demographics, and evolving healthcare trends. This ensures that your insurance company remains competitive and financially stable over time.

Breast Augmentation: Uncovering Insurance Coverage and Costs

You may want to see also

Distribution Channels: Establish partnerships for sales and marketing

When starting a medical insurance company, establishing effective distribution channels is crucial for sales and marketing success. Here's a detailed guide on how to build partnerships and optimize your sales and marketing efforts:

Identify Target Markets and Partners:

- Target Market Analysis: Begin by thoroughly understanding your target market. Identify demographics, healthcare needs, and existing insurance gaps. This knowledge will help you tailor your products and partner with the right entities.

- Partner Selection: Seek partnerships with organizations that share your target market. This could include:

- Healthcare Providers: Hospitals, clinics, and doctors' offices can act as valuable distribution channels. Offer them competitive commissions or incentives for referring patients to your insurance plans.

- Employers: If your target market includes employees, partner with employers who offer group health insurance. You can provide customized plans and streamline the enrollment process.

- Community Organizations: Local community centers, senior citizen groups, and non-profits can be excellent outlets for outreach and education.

Develop Compelling Value Propositions:

- Unique Selling Points: Clearly articulate what sets your medical insurance company apart. Highlight features like lower premiums, comprehensive coverage, specialized care networks, or innovative digital tools.

- Targeted Marketing Materials: Create marketing collateral that resonates with your target audience. Use language and visuals that address their specific needs and concerns.

Build Relationships and Communication Channels:

- Personal Connections: Foster strong relationships with potential partners. Attend industry events, network, and build trust.

- Communication Platforms: Establish clear communication channels with partners. Utilize email, phone, and dedicated portals for efficient collaboration and information exchange.

Implement Incentivizing Strategies:

- Commission Structures: Offer competitive commissions to healthcare providers and employers based on successful referrals and enrollments.

- Referral Programs: Implement structured referral programs that reward both providers and patients for successful referrals.

- Co-Marketing Initiatives: Collaborate on co-marketing campaigns, such as joint webinars, workshops, or educational materials, to reach a wider audience.

Leverage Technology:

- Digital Platforms: Utilize online platforms for sales, policy management, and customer service. Make it easy for partners and customers to access information and complete transactions.

- Data Analytics: Leverage data analytics to track sales performance, identify successful partnerships, and optimize marketing efforts.

Continuous Evaluation and Adaptation:

- Performance Monitoring: Regularly evaluate the effectiveness of your distribution channels and partnerships. Analyze sales data, partner feedback, and customer satisfaction.

- Adapt and Innovate: Be prepared to adapt your strategies based on market feedback and changing trends. Continuously seek new partnerships and explore innovative ways to reach your target audience.

Navigating Insurance and Medicaid: Marketplace Coverage Explained

You may want to see also

Frequently asked questions

The initial phase involves extensive market research and analysis. You need to understand the healthcare industry, identify target demographics, and study existing insurance providers to gauge competition and potential gaps in the market. This research will help you define your unique value proposition and tailor your services accordingly.

Securing funding is crucial for any startup. You can explore various funding options such as personal savings, loans from financial institutions, or attracting investors. Preparing a comprehensive business plan, showcasing market potential, and highlighting your unique features will be essential in attracting investors or securing loans.

Starting a medical insurance company requires compliance with strict regulations. You'll need to research and understand the specific laws and guidelines set by your country's healthcare authority. This includes obtaining licenses, meeting capital requirements, and ensuring your company adheres to privacy and security standards, especially regarding sensitive patient data. Consulting legal and industry experts can provide valuable guidance throughout this process.