GAP insurance covers the gap between what you owe on a vehicle and what it's worth if it's damaged or written off in an accident. It's not a state requirement like liability insurance, so you have to actively seek it out and add it to your current insurance coverage. If you're leasing a vehicle, your lease agreement may require that you have GAP insurance in case of a total loss.

To find out whether you have GAP insurance, check your existing car insurance policy and the terms of your loan or lease. You can also contact your car insurance provider or the dealership you bought the car from.

| Characteristics | Values |

|---|---|

| Is GAP insurance a state requirement? | No, it is not a state requirement. |

| When is GAP insurance required? | GAP insurance is required when leasing a vehicle. |

| How to check if you have GAP insurance? | Check with your car insurance company, auto lender, or financial documents. |

| Where to purchase GAP insurance? | Purchase GAP insurance from your insurance provider, an online insurer, or a dealership. |

What You'll Learn

Check your insurance statement

If you're unsure whether you have GAP insurance, it's a good idea to check your insurance statement. Ask yourself if you enquired about GAP insurance when you bought your vehicle's insurance policy. If you didn't ask about it, then you probably don't have GAP insurance coverage. If you're unsure whether you asked about it or not, you should be able to contact your insurer or review your vehicle purchase agreement to see if you have GAP coverage.

If you're leasing or financing a car, don't automatically assume you have to buy GAP insurance. Some leasing and loan companies will include a GAP Waiver Provision in their policies with borrowers and lessees. The GAP Waiver Provision will cover the difference between the amount you owe and what's paid out by the insurance company.

If you're still unsure whether you have GAP insurance, you can check your financial documents. Look through your online bills, credit card statements, and chequebook to try to find some clues.

Vehicle Storage Insurance: What's Covered?

You may want to see also

Contact your car insurance company

If you're unsure whether you have GAP insurance, the best option is to contact your car insurance company. Ask yourself if you inquired about GAP insurance when you bought your vehicle's insurance policy. If you didn't ask, you probably don't have GAP insurance coverage. If you're unsure whether you asked or not, contact your insurer. They will be able to clarify your coverage for you.

You can look through records such as your recent bills, or you can log in to your account on the company's website. If this fails, you should call to ask about your coverage. If you have an online account, you may be able to find a record of your GAP insurance there. If you can't find any mention of GAP insurance in your online account, this may mean that you don't have it. However, it's always worth double-checking with a quick phone call.

If you're leasing or financing a car, don't automatically assume you have to buy GAP insurance. Some leasing and loan companies will include a GAP Waiver Provision in their policies with borrowers and lessees. The GAP Waiver Provision will cover the difference between the amount you owe and what's paid out by the insurance company. If you're unsure whether your leasing or loan company includes this provision, contact them to find out.

If you've checked with your insurer and you want to purchase GAP insurance, it's relatively easy to do so. You can purchase GAP insurance from your current insurance provider, an online insurer that specializes in GAP coverage, or from a dealership.

Insurance Revoked: Does DMV Know?

You may want to see also

Check with your auto lender

Checking with your auto lender is a crucial step in determining if you have GAP insurance. Here are some detailed instructions on how to go about it:

Contact Your Auto Lender

If you have an auto loan, contact your lender, which could be a bank, credit union, or other financial institution. Ask them directly if GAP insurance was included in your loan agreement. It's possible that they automatically included GAP coverage in your loan contract without you specifically requesting it. By reaching out to them, you can clarify whether GAP insurance is part of your loan package.

Review Your Loan Documents

Thoroughly review the documents related to your auto loan. Look for any mention of GAP insurance or a GAP waiver clause. Sometimes, lenders include GAP insurance as part of the financing package, and it might be listed in the contract or loan agreement. Go through the paperwork carefully to see if there is any indication of GAP coverage.

Understand Automatic Inclusion of GAP Insurance

In some cases, auto lenders automatically include GAP insurance in loan agreements, especially if you financed a significant portion of the vehicle's cost. This is more common when you finance through a dealership, but it can also occur with banks or credit unions. If you're unsure, contact your lender to clarify their policies and whether GAP insurance was automatically included in your loan.

Inquire About Optional GAP Insurance

If you didn't initially purchase GAP insurance but are interested in doing so, ask your auto lender if they offer it as an optional add-on to your loan. Some lenders provide GAP insurance as an additional service for an extra fee. Find out if your lender offers this option and the associated costs and benefits.

Compare Costs and Coverage

If your auto lender offers GAP insurance, be sure to compare their rates and coverage with those of other providers, such as insurance companies. Dealerships and lenders often charge higher rates for GAP insurance than traditional insurers. By comparing costs and coverage, you can make an informed decision about the best option for your needs.

Insurance Companies: Vehicle Value Determinants

You may want to see also

Review your lease agreement

Be sure to check for different wording, too, as gap insurance can be referred to as Guaranteed Asset Protection, Auto Loan Lease Coverage, Loan or Lease Gap Coverage, or New Vehicle Protection. If you are unsure, contact the leasing company directly and ask them to clarify whether gap insurance is included in your lease.

If gap insurance is not included in your lease agreement, you may want to consider buying it anyway. Even if you are not the owner of the car, you are financially responsible for it per your lease agreement. Not having this coverage can leave you financially unprotected if your car is in an accident, stolen, or declared a total loss.

Vehicle Theft Deterrent: Insurance Discount?

You may want to see also

Check your financial documents

If you are unsure whether you have GAP insurance, it is a good idea to check your financial documents. This is because GAP insurance is not a state requirement and you need to seek it out or ask for it to be added to your car insurance coverage.

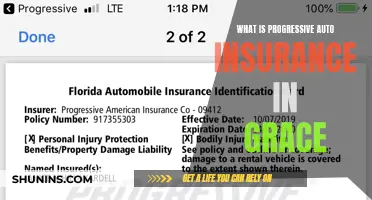

Firstly, check your existing car insurance policy. Car insurance documents generally have a page that lists the coverages on your policy, including optional coverages like auto collision coverage and comprehensive car insurance coverage. Look for GAP coverage in this list. You can also check your recent bills or log in to your account on the company's website. If this doesn't work, call your insurance company to ask about your coverage.

Secondly, check with your auto lender. If you didn't buy GAP insurance from your insurance company, you may have purchased it from the dealership, bank, or credit union that supplied you with a loan or lease. It can be easy to overlook GAP insurance from these sources as it is sometimes included in your contract automatically. Check your sale documents, as well as the documents from your lender, as either of them might have included GAP coverage.

Finally, if you do not have GAP insurance through your dealership, lender, or car insurance company, you probably do not have GAP cover. However, as a last resort, you can look through your financial records, such as your online bills, credit card statements, and checkbook, to try to find some clues.

If you realise you don't have GAP coverage, you can check out WalletHub's recommendations on when GAP insurance is worth it and where to buy it.

Lower Vehicle Insurance: Discounts and Deductibles

You may want to see also

Frequently asked questions

Check your existing car insurance policy and the terms of your loan or lease. You can also contact your car insurance provider or the car dealership where you bought the car.

GAP insurance covers the "gap" between what you owe and what your insurance company pays if your car is stolen or damaged.

Unlike liability insurance, GAP insurance is not a state requirement. However, if you lease a vehicle, your lease agreement may require you to have GAP insurance in case of a total loss.

You can purchase GAP insurance from your car insurance provider, an online insurer that specializes in GAP coverage, or from a dealership.

GAP insurance is beneficial for lessees and drivers who still owe money on their auto loans. If your loan is paid off, you likely don't need GAP insurance.