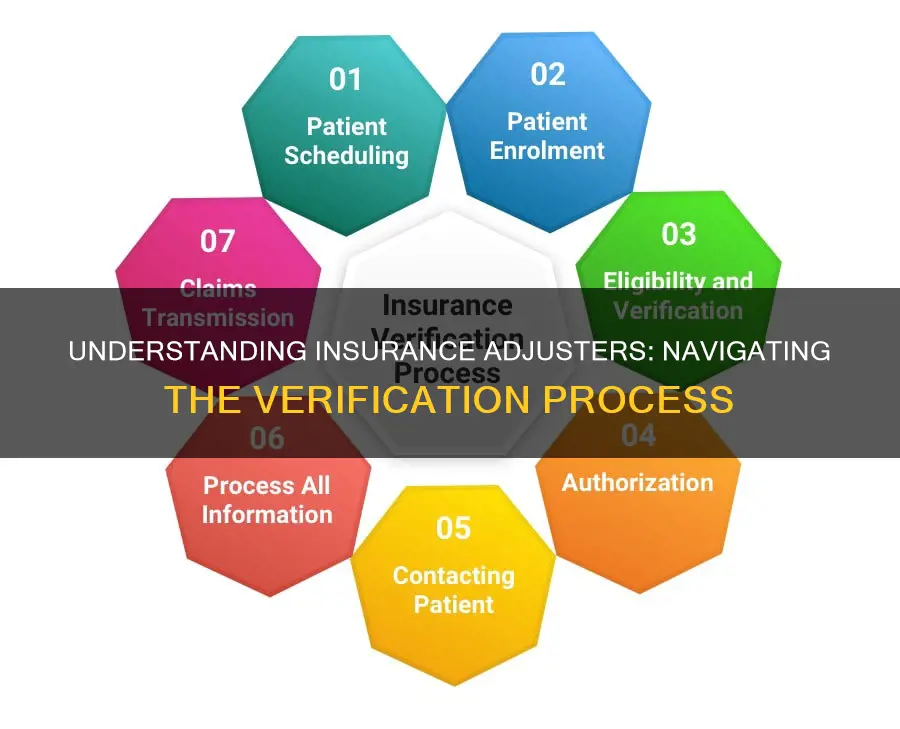

Verifying insurance benefits is a crucial step in the claims process, and it's important to know what to do when calling an insurance adjuster. The first step is to collect the patient's insurance information, including their name, date of birth, insurance company, policy number, and group ID number. It's also important to ask about secondary insurance and get the same details for that insurer if the patient has additional policies. The next step is to contact the insurance company before the patient's initial visit, usually by phone, to confirm the details of the patient's policy and benefits. It's recommended to initiate contact at least 72 hours in advance to allow enough time for this process. During the call, it's important to confirm that the conversation is HIPAA-compliant and to ask questions about the patient's coverage, including copay, deductible, and any additional documentation or coverage limitations. Proper insurance verification helps minimize claim denials, maximize cash flow, and increase patient satisfaction by providing clear information about their coverage.

| Characteristics | Values |

|---|---|

| First step | Collect the patient's insurance information |

| Second step | Contact the insurance company before the patient's initial visit |

| Third step | Gather all the crucial benefits information and record it in your EMR |

| Bonus step | Reverify every month |

What You'll Learn

- Collect the patient's insurance information, including their name, date of birth, insurance company, policy number, and group ID number

- Contact the insurance company before the patient's initial visit to confirm details

- Ask the right questions when speaking with insurance reps, such as policy expiration and copay

- Determine if insurance authorization is required before the patient's appointment

- Reverify insurance information regularly, as plans can change at any time

Collect the patient's insurance information, including their name, date of birth, insurance company, policy number, and group ID number

Collecting a patient's insurance information is the first step in verifying their insurance benefits. This process is crucial to ensure that the patient's insurance plan covers the services provided and is within your network. It also helps to minimize claim denials, maximize cash flow, and increase patient satisfaction by providing clear information about their coverage.

- Obtain the patient's name and date of birth. This information is essential for accurate identification and verification.

- Record the name of the insurance company. Knowing the specific insurance provider is crucial for contacting and communicating with the insurer.

- Identify the primary insurance plan holder and their relationship to the patient. This information helps to establish the patient's dependency or connection to the insurance policy.

- Collect the patient's policy number and group ID number (if applicable). These numbers are unique identifiers for the patient's specific insurance plan and group coverage (if they are part of a group plan through their employer or another organization).

- Gather the insurance company's contact information, including their phone number and address. Having this information allows you to reach out to the insurer directly to verify coverage and benefits.

It is important to collect this information as early as possible, preferably during the patient's initial intake or registration. This gives you ample time to complete the verification process and avoid any delays or issues with insurance coverage.

Additionally, it is a good practice to periodically reverify the patient's insurance information, especially if a significant amount of time has passed since their last visit. This ensures that you have the most up-to-date information and can provide accurate guidance to the patient regarding their coverage.

Navigating Roof Repair Conversations with Insurance Adjusters: A Homeowner's Guide

You may want to see also

Contact the insurance company before the patient's initial visit to confirm details

Contacting the insurance company before the patient's initial visit is a crucial step in the insurance verification process. Here are some detailed instructions and considerations to keep in mind when confirming the details with the insurance company:

- Start the verification process early: It is recommended to initiate contact with the insurance company at least 72 hours before the patient's initial visit. This allows ample time to gather all the necessary information and ensure a smooth verification process.

- Collect the patient's insurance information: Before contacting the insurance company, ensure you have the patient's name, date of birth, name of the insurance company, name of the primary insurance plan holder and their relationship to the patient, policy number, group ID number (if applicable), and the insurance company's phone number and address.

- Reach out to the insurance company by phone: Call the insurance provider's phone number and speak to a representative. Confirm that you are speaking to an authorized representative who can verify the patient's insurance details.

- Confirm HIPAA compliance: Ensure that the conversation with the insurance representative is HIPAA-compliant for secure transmission of patient information.

- Provide patient information: Share the patient's insurance information, including their name, date of birth, and policy number, so that the representative can locate the correct policy.

- Ask relevant questions: Go beyond confirming basic information. Ask about the policy's active status, expiration date, copay, deductible, insurance authorization requirements, additional documentation, coverage limitations, and whether the therapist is considered an in-network or out-of-network provider.

- Utilize online resources: If phone calls are inconvenient, some insurance companies offer online eligibility-checking resources or portals. However, be cautious as these resources may contain outdated information.

- Automate the process: Consider using digital solutions or automatic verification services that integrate with your electronic medical records (EMR) system to save time and streamline the verification process.

- Document the interaction: Keep a record of the conversation, including the name of the representative, and any relevant details discussed. This ensures that you have accurate information and can refer back to it if needed.

- Reverify insurance information regularly: Insurance plans can change, so it is a good idea to reverify the patient's insurance information on a regular basis, preferably monthly.

Unraveling the Path to Becoming a Crop Insurance Adjuster

You may want to see also

Ask the right questions when speaking with insurance reps, such as policy expiration and copay

When speaking with insurance representatives, it is important to ask the right questions to ensure you are getting the full benefits you are entitled to. Here are some crucial questions to ask:

Confirming Policy Details

- Ask the insurance representative to confirm all the information you have provided, including the patient's name, date of birth, insurance company, policy number, group number (if applicable), and the relationship of the policyholder to the patient.

- Verify the policy is active and ask about its expiration date.

- Inquire about any secondary insurance coverage and if there is an excess policy in place.

Understanding Financial Obligations

- Ask about the patient's copay and deductible, if applicable.

- Find out if there are any additional costs, such as coinsurance.

- Inquire about pre-authorization requirements for specific treatments, prescriptions, or tests.

Understanding Coverage Limitations

- Ask if there are any coverage limitations or documentation requirements you should be aware of.

- Clarify if the therapist or service provider is considered in-network or out-of-network.

Additional Questions

- Inquire about the claims address to ensure proper submission of claims forms.

- Ask about the number of therapy visits or services covered under the policy.

- Request information on any unusual coverage limits or additional documentation requirements specific to the payer.

Remember to document all communication with the insurance company and follow up with a written confirmation of any verbal agreements. It is also advisable to consult with a lawyer to ensure you are fully aware of your rights and entitlements under the policy.

Unraveling the Path to Becoming a Property Insurance Adjuster

You may want to see also

Determine if insurance authorization is required before the patient's appointment

Verifying whether insurance authorization is required before a patient's appointment is crucial to ensure the patient receives the necessary care without delays or unexpected costs. Here are some steps to determine if insurance authorization is needed:

- Collect Patient Information: Obtain the patient's insurance information, including their name, date of birth, insurance company name, policy number, group ID (if applicable), and insurance company contact details. Also, ask about secondary insurance and collect similar details if the patient has multiple policies.

- Contact the Insurance Company: Reach out to the insurance company at least 72 hours before the patient's initial visit. Verify that you are speaking with a representative who can confirm patient insurance details and is authorized to discuss HIPAA-compliant information. Provide the patient's information and ask if prior authorization is required for the specific treatment or procedure.

- Understand Insurance Requirements: Ask the insurance representative about any necessary insurance authorization, additional documentation, or coverage limitations. Inquire about the specific services that require authorization and the process for obtaining it.

- Review Patient's Plan: Check the patient's insurance plan documents, including their Summary of Benefits and Coverage, to understand the specific requirements for prior authorization. Different plans have varying rules, so it is essential to review the patient's particular policy.

- Communicate with the Patient: Keep the patient informed about the insurance authorization process and any requirements or limitations. Let them know about their copay, deductible, and other relevant financial information to avoid surprises.

- Verify Regularly: Insurance information can change, and patients might forget to update their details. Therefore, it is advisable to reverify insurance information before each patient encounter or at regular intervals, such as monthly.

By following these steps, you can determine whether insurance authorization is required before the patient's appointment, helping to streamline their care and avoid potential issues with coverage.

Navigating the Path to Becoming a Disaster Relief Insurance Adjuster

You may want to see also

Reverify insurance information regularly, as plans can change at any time

Reverifying Insurance Information

It is important to reverify insurance information regularly as plans can change at any time. Patients can lose insurance or switch plans at any time, and they may not always remember to inform you of these changes. Therefore, it is recommended to collect the patient's insurance information before each encounter or encourage them to submit it through your practice's patient portal.

- Collect the patient's insurance information: Obtain the patient's name, date of birth, insurance company name, policy number, group ID number (if applicable), insurance ID, and the name of the primary insurance plan holder and their relationship to the patient.

- Contact the insurance company: Reach out to the insurance company by phone or through their online portal. If calling, confirm that you are speaking with an authorized representative and that the conversation is HIPAA-compliant. Provide the patient's insurance information and ask any relevant questions to confirm their coverage and benefits.

- Ask the right questions: Confirm the patient's policy details, including the policyholder's name and their relationship to the patient. Verify if the policy is active and its expiration date. Ask about the patient's copay, deductible, and any additional documentation or coverage limitations.

- Record the information: Ensure that all the collected and confirmed information is accurately recorded in the patient's file. This includes scanning and saving a copy of the patient's insurance card and photo ID.

- Inform the patient: After verifying their insurance information, inform the patient about their coverage and what their plan does and does not cover. This helps set clear expectations and increases patient satisfaction by preventing unexpected costs.

- Repeat the process regularly: Aim to reverify insurance information on a regular basis, such as monthly or before each patient encounter. This helps ensure that you always have the most up-to-date information and can provide accurate billing and treatment plans.

Remember that insurance verification is crucial to minimizing claim denials, maximizing cash flow, and improving patient satisfaction. By taking the time to reverify insurance information, you can avoid disruptions in patient care and billing processes.

Understanding Your Rights: Discussing Accidents with Insurance Adjusters

You may want to see also

Frequently asked questions

To verify a patient's insurance, you will need to collect the following information: the patient's name and date of birth; the name of the insurance company; the name of the primary insurance plan holder and their relationship to the patient; the patient's policy number and group ID number (if applicable); and the insurance company's phone number and address.

The most common way to contact insurance companies is over the phone. You will need to confirm that you are speaking with a representative on the provider services line, as some payers have lines exclusively for hospital admissions or referrals. Alternatively, many insurers have online portals where you can enter the patient's data to verify their coverage and benefits.

You should ask the insurance representative to confirm the patient's policy and group number, the name of the policyholder, and the relationship of the policyholder to the patient. You should also confirm the claims address, the policy's end date, the patient's copay and deductible, and whether there are any coverage limitations or documentation requirements.

It is recommended to reverify insurance information every month, as patients can theoretically lose insurance or switch plans at any time.