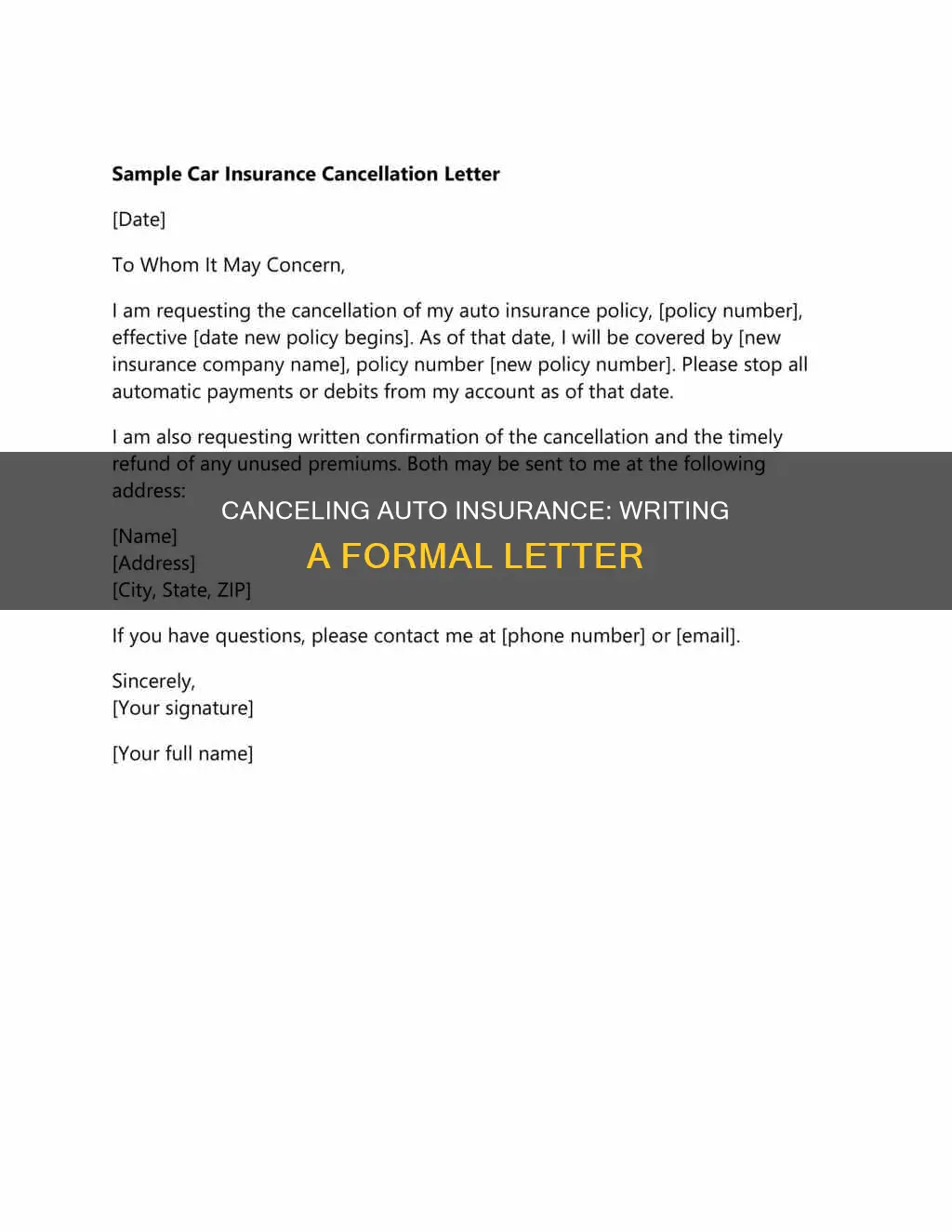

Writing a letter to cancel your auto insurance is a straightforward process, but it's important to follow some key steps to ensure your request is effective. Firstly, it's essential to have another policy in place before initiating the cancellation to avoid any lapse in coverage, which could impact future rates and claims. Then, gather all the necessary information, including personal and policy details, such as policy numbers, effective dates, and contact information. Contact your insurer to understand their specific cancellation process, as some may prefer a phone call or email, while others require a written letter. If a letter is needed, compose a concise and polite letter, including all the relevant information, and send it via certified mail to ensure proof of receipt. Finally, ask for written confirmation of the cancellation and a refund of any unused premiums.

| Characteristics | Values |

|---|---|

| Length | Short and concise |

| Tone | Polite and firm |

| Content | Full name and address, policy number, effective date of cancellation, reason for cancellation, request for confirmation, request for a refund |

| Format | Business letter |

| Addressee | Addressed to the cancellation department of the insurance company |

| Signature | Signed by the main policyholder |

| Method | Sent by certified mail with return receipt requested |

| Copies | Two copies kept for personal records |

| Mailing address | Verified with the insurer |

| Timing | Sent after finalising a new policy to avoid a coverage gap |

| Confirmation | Written confirmation of cancellation and refund requested |

| Proofreading | Proofread for errors and verified for correct information |

What You'll Learn

Include personal and policy information

When writing a letter to cancel your auto insurance, it is important to include personal and policy information. This is to ensure that your request is clear and can be actioned by the insurance company. Here are some paragraphs detailing what personal and policy information to include:

Personal Information

Your full name and address should be included in the letter. This identifies you as the policyholder and ensures the insurance company knows who is making the request. Be sure to include your contact information, such as your phone number and email address, in case the insurance company needs to get in touch with you regarding the cancellation.

Policy Information

The policy number of the insurance policy you wish to cancel should be included in the letter. Double-check that this number is correct to avoid any confusion. You should also include the name of the insurance company, not your advisor or agent. Additionally, provide the current date of your request and the date you want the cancellation to be effective from. If you have set up automatic payments, be sure to request that these are stopped.

Additional Information

You may also want to include the reason for your cancellation. This is not necessary, but it can be helpful to provide context for your request. You can also request written confirmation of the cancellation and a refund of any unused premiums. Finally, include your signature at the end of the letter to authorise the cancellation.

Underwriters: Auto Insurance Gatekeepers

You may want to see also

State the reason for cancellation

When writing a letter to cancel your auto insurance, it is important to state the reason for your cancellation. This can be done in a simple and concise manner, without going into excessive detail. Here are some examples of reasons you could provide:

"I am writing to request the cancellation of my auto insurance policy as I have sold my car and no longer require this coverage."

"I am relocating to another state, and unfortunately, your company does not offer policies in my new location."

"I believe I am paying too much for my insurance policy, and I have found a more competitive rate with another company."

"I am unhappy with the service provided by your company, particularly in regards to [specific issue(s), such as poor claims handling or unexpected premium increases]."

"I would like to combine my separate policies into a less expensive, bundled policy, which your company does not offer."

Remember to keep the tone of your letter polite and professional, and be sure to include all the other necessary information, such as your personal and policy details, and the effective date of cancellation.

Virginia's Digital Insurance Revolution: Embracing Electronic Auto Insurance Proof

You may want to see also

Request a refund

Requesting a refund is an important part of cancelling your auto insurance policy. Here are some key points to include when writing your letter:

Be clear about the refund amount

Specify the exact amount you are requesting as a refund for any unused premiums. This is especially important if you have paid for your policy in advance. You can also request a check if you prefer.

Include a deadline for the refund

You can include a deadline for the refund to be processed, for example, within 30 days of the receipt of your cancellation notice.

Request confirmation of the refund

Ask for written confirmation of the refund, as well as the cancellation, to ensure you have proof that your request has been received and will be acted upon.

State that the insurer should stop charging your account

If you pay your premiums through automatic payments or debits from your account, be sure to include a statement requesting that these payments be stopped as of the cancellation date.

Enclose a check for any outstanding balance

If there is still a balance due on your account, you can enclose a check with your letter and include the payment amount in your letter.

Keep a copy for your records

As with any important correspondence, it is always a good idea to keep a copy of your letter for your own records. This can be useful if there are any disputes or issues later on.

"I am requesting a refund of the unused portion of my policy premium, totalling $ [amount]. Please send the refund within 30 days of receiving this notice. I also request written confirmation of the refund and cancellation. Please stop all automatic payments or debits from my account as of the cancellation date. If there is any outstanding balance on my account, I have enclosed a check for $ [amount]. Please find attached a copy of this letter for your reference."

Georgia Auto Insurance: Why So Expensive?

You may want to see also

Ask for confirmation

When writing a letter to cancel your auto insurance, it is important to ask for confirmation from your insurance company that your policy has been cancelled. This ensures that you have proof of the cancellation and the effective date it took place, which can be useful if, for example, a future premium is taken from your bank account and you need to request a refund.

You can ask for confirmation in several ways. Firstly, you should state in your letter that you are requesting confirmation. For example, you could write: "I would appreciate it if you could send me written confirmation that my request has been processed and my policy will be cancelled on [date]." This gives your insurer a clear instruction to send you confirmation.

Secondly, you can ask for confirmation by sending your letter via certified mail, which provides proof that your letter was received by the insurer. This is a useful way to ensure that your request has been dealt with and that the cancellation will take place.

Thirdly, you could follow up with the insurance company after sending your letter. You could do this by calling or emailing to confirm that your letter has been received and that your policy will be cancelled as requested. This could be a good opportunity to confirm any other details, such as the effective date of the cancellation and any refund you are owed.

Finally, it is a good idea to keep a copy of your letter for your own records. This will allow you to refer back to the details of your request, including the date you sent it, what you asked for, and any confirmation you received. This can be useful if there are any issues or discrepancies in the future.

Asking for confirmation is an important step when cancelling your auto insurance policy to ensure that the process is smooth and that you have proof of the cancellation if needed.

Switching Auto Insurance After a Claim

You may want to see also

Send by certified mail

Sending your auto insurance cancellation letter by certified mail is a good idea for several reasons. Firstly, it provides you with proof that the insurer received the paperwork. This is important because it safeguards your interests and gives you hard copy evidence of your cancellation request. Secondly, some insurance companies require a letter of cancellation to be sent by certified mail. Therefore, it is a good idea to check with your insurance company beforehand to see if they have any specific delivery requirements.

- Verify the mailing address: Before sending off your cancellation request, make sure you have the correct mailing address. Sending it to the wrong address could delay your policy cancellation.

- Keep a copy for your records: Always keep a copy of your letter for your reference. This can be useful if you need to prove that you sent the cancellation request.

- Include "cancellations" in the address: Insurance companies are often large operations with many departments. Including "cancellations" in the address will help ensure your letter goes to the right place.

- Use the correct format: Use proper business letter format for your letter. This includes the date, the name and address of the insurance company, the appropriate department name and contact person, your name and address as the insured, your phone number, and the coverage period.

- Be polite and firm: Write in a polite, yet firm tone. Thank the insurance company for their services and clearly state your intention to cancel your policy.

- Provide all the necessary information: Include the date you would like your policy to be cancelled, a request for a refund of unused premiums, a statement that you no longer authorize the insurer to withdraw funds from your account for premiums, and a request for written confirmation that your request will be executed by the desired date.

- Proofread and sign: Once you have finished writing your letter, carefully proofread it for any errors. Then, sign the letter by hand.

Auto Insurance and Adult Children: What You Need to Know

You may want to see also

Frequently asked questions

Your letter should include your name and address, the insurance company's name and address, your policy number, the date you would like your policy to be cancelled, and a request for a refund of any unused premiums.

You should send your letter by certified mail and keep a copy of the letter and the note proving it was received for your records.

It is not necessary to provide a detailed reason for cancelling your auto insurance, but it can be helpful to include a brief explanation in your letter.