Updating the distance driven on your car insurance is important to ensure you are paying the correct amount. The number of miles you drive annually can impact your insurance rate, as the more you drive, the more likely you are to get into an accident. Some insurers offer discounts to drivers who log a lower-than-average number of miles per year. It is important to note that providing incorrect mileage information may be considered fraud, and it could invalidate your insurance policy if you go over your annual mileage. Therefore, it is crucial to keep your insurer updated on your mileage to avoid any issues.

| Characteristics | Values |

|---|---|

| Impact of updating insurance with distance driven | Updating the distance driven with the insurance company can help lower premiums or qualify for a low-mileage discount |

| Average miles driven per year | Americans drive an average of more than 13,000 miles per year as per the Department of Transportation's Federal Highway Administration (FHWA) website |

| Mileage and insurance premiums | The number of miles driven in a year predicts the risk of filing a claim. For example, a Verisk analysis found that vehicles driven less than 3,000 miles annually are involved in 40% fewer claims |

| Mileage reporting methods | Insurers can ask for an estimate when the policy is taken out. They can also track mileage through pay-as-you-drive or usage-based insurance programs |

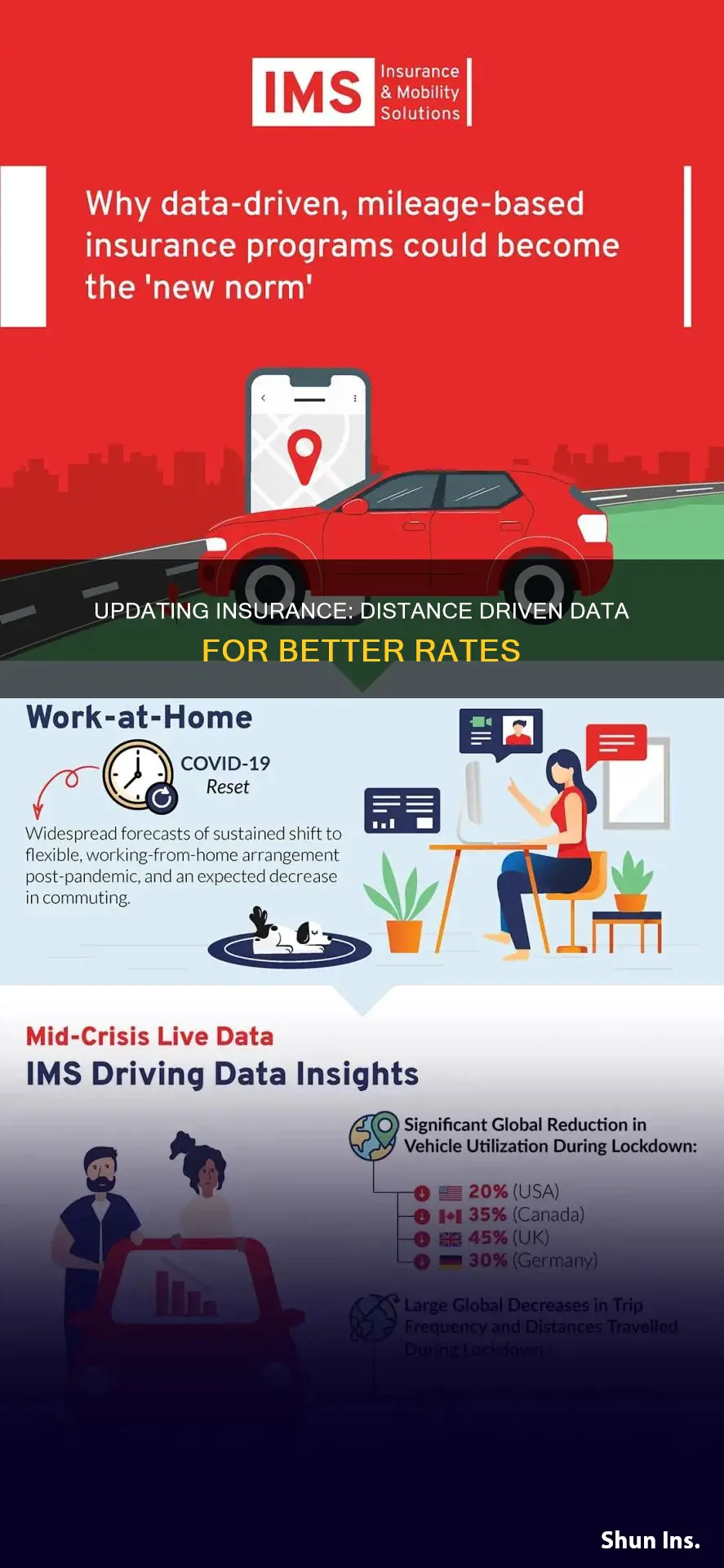

| Work-from-home impact | Updating the insurance policy to reflect the new work-from-home commute mileage can lead to significant savings |

What You'll Learn

How to update your insurance provider about your new work-from-home status

Working from home can have many benefits, including reducing the number of miles driven to and from work. Updating your insurance provider about your new work-from-home status can help lower your premiums or help you qualify for a low-mileage discount.

Firstly, it is important to understand how your insurance company calculates your rates. Some companies base their rates on the number of miles logged by the average driver, taking into account where you drive rather than how much you drive. This is because some places have higher accident rates than others, and most accidents happen within 5 to 10 miles of a driver's home. However, most companies consider the number of miles you drive to be one of the most important factors in determining your rates.

When you update your insurance provider about your new work-from-home status, it is essential to provide an accurate picture of your annual mileage. This can be done by giving an estimate of your expected mileage when you apply for insurance or by updating your policy to reflect any changes in your driving habits. Some companies may also track your mileage directly through pay-as-you-drive or usage-based insurance programs.

To update your insurance provider about your new work-from-home status, you may need to contact them directly by phone or email. It is worth noting that some companies may consider it a form of fraud to under-report your mileage, so it is important to provide accurate and up-to-date information. By keeping your insurance company informed about your current driving behaviour, you can ensure that your rates accurately reflect your mileage and potentially save money on your premiums.

Understanding MPY-0016-S Auto Insurance Endorsement and Its Benefits

You may want to see also

Why you shouldn't under-report your mileage

Under-reporting your mileage to insurance companies is a form of soft fraud and can cause the auto insurance industry billions of dollars in losses every year. While it may be tempting to under-report your mileage to reduce your premium, there are several reasons why you shouldn't do this.

Firstly, insurance companies have many ways to determine your mileage, even without your knowledge. They can access state or national databases, DMV records, or mileage recorded by repair shops and car dealers. They can also use Smartcar's mileage verification solution, which allows them to access a car's odometer reading directly. This technology communicates with 3G and 4G telematics modems built into vehicles, providing accurate and reliable information.

Secondly, under-reporting your mileage can lead to incorrect pricing and underwriting of insurance policies. Insurance companies use annual mileage to calculate your insurance price, and if they have inaccurate data, they may be undercharging you. This can result in financial losses for the insurance company, which may lead to higher premiums for all customers.

Thirdly, if your insurer discovers that you have been under-reporting your mileage, they may view this as fraud and invalidate your policy. This means they may not pay out if you need to make a claim. Additionally, they may charge you an "adjustment fee" to update your details, which can be costly.

Finally, under-reporting your mileage can increase your risk of getting into an accident. Insurance companies use mileage to assess the risk of a policyholder having an accident. If they do not have accurate data, they may not be able to provide the appropriate level of coverage, leaving you underinsured.

In conclusion, while it may be tempting to under-report your mileage to reduce your insurance premium, doing so can have several negative consequences. It is important to be honest and accurate when reporting your mileage to insurance companies to avoid financial losses, policy invalidation, and increased risk of accidents.

Papa John's Auto Insurance: Are Delivery Drivers Covered?

You may want to see also

How your insurance rates are determined

Insurance companies set prices to match the cost of future claims. They do this by looking at your personal risk factors, such as the type of car you drive, your age, gender, and location. They also consider how much they spend on all claims, and how likely you are to be involved in an accident.

Your driving record is one of the most important factors in determining your insurance rates. The more miles you drive, the more likely you are to be involved in an accident. This is why some insurers offer discounts to drivers who log a lower-than-average number of miles per year. Your insurance company may also take into account where you drive, as some places have higher accident rates than others.

Your age is also a significant factor in determining your insurance rates. Younger, less experienced drivers are statistically more likely to drive dangerously and be involved in fatal accidents, so teens and young adults typically pay the highest rates for auto insurance. Insurance rates usually decrease once you turn 25 and continue to drop as you get older, with drivers over 55 paying lower rates. However, at age 75, premiums typically begin to rise again.

The type of car you drive also affects your insurance rates. The cost of your car is a major factor, as well as the likelihood of theft, the cost of repairs, its engine size, and its overall safety record. Additionally, if your car is financed, lenders typically require you to carry more than the minimum required amount of insurance.

Other factors that may influence your insurance rates include your location, driving history, credit score, and gender. Urban drivers tend to pay higher insurance prices due to higher rates of vandalism, theft, and accidents. A history of moving violations, such as speeding or reckless driving, can also result in higher insurance costs. In some states, insurance companies also consider gender when setting insurance premiums, with women usually paying less than men due to lower accident rates.

Auto Insurance: Lost Keys Covered?

You may want to see also

How to save money by updating your insurance with your new address

Moving to a new address can be a great opportunity to save money on your car insurance. The number of miles you drive annually is a significant factor in determining your insurance premium, as it predicts the risk of you filing a claim. By updating your insurance policy with your new address, you can ensure that your insurer has an accurate picture of your mileage, which may result in lower premiums. Here are some ways you can save money by updating your insurance with your new address:

- Lower Mileage, Lower Premiums: If your new address is closer to your workplace or frequently visited locations, the overall distance you drive is likely to decrease. Updating your insurance policy to reflect this change can result in lower premiums. For example, if you previously commuted 80 miles round trip to work and now only commute 8 miles, you can expect to pay lower premiums as your risk of getting into an accident decreases with fewer miles driven.

- Work-from-Home Advantage: If your new address allows you to work from home, you can further reduce your mileage. Many insurance companies offer discounts for drivers who log a lower-than-average number of miles per year. Updating your policy to reflect your new work-from-home status can help you qualify for these low-mileage discounts and save money.

- Accurate Data, Accurate Rates: Providing your insurer with your new address and updated mileage ensures they have accurate data to set your rates. Inaccurate or outdated mileage information may result in overpaying for your insurance. By giving them the latest details, you can benefit from rates that truly reflect your driving behaviour and potentially lower your insurance costs.

- Avoid Under-Reporting: While it may be tempting to under-report your mileage to reduce your premium, this can be considered fraud. Instead, by updating your policy with your new address and accurate mileage, you maintain honesty and transparency with your insurer. This not only prevents potential legal issues but also ensures you are paying a fair rate based on your actual driving habits.

To update your insurance policy with your new address and mileage, simply contact your insurance company. You can call or email them to provide your updated information, and they will adjust your policy accordingly. It is a quick and easy process that can lead to significant savings on your car insurance.

Auto Insurance and Mileage: The Tracking Technology Twist

You may want to see also

How to update your insurance with your new mileage

When you buy car insurance, you usually have to report your estimated annual mileage to your insurer. This is because the number of miles you drive is one of the most important factors in determining what you pay for auto insurance. If you go over your estimated mileage, your insurance company may charge you an "adjustment fee" to update your details, and your premium may increase.

There are several ways to report your vehicle's mileage to your insurer, but they won't necessarily have the same result. Some insurers have drivers put a tracking device in their car that automatically records mileage data and transmits it to an insurance app installed on the driver's smartphone. In other cases, a device plugged into a port in your car (such as below the steering wheel) automatically records data, including mileage. Some insurers tap into state or national databases to confirm vehicle mileage, while others verify mileage through pay-as-you-drive or usage-based insurance programs. Repair shops also record mileage when you take your car in for oil changes or repairs.

If you are driving less than expected, you should update your insurer, as they may lower your insurance price or offer you a refund. Some insurers offer a discount to drivers who log a lower-than-average number of miles per year, so keeping your mileage updated ensures you can still qualify for the discount.

If you go over your estimated annual mileage, you should also update your insurer. If you do not, your insurance could be invalidated, and your insurer may not pay out if you need to make a claim. While it may be tempting to under-report your mileage to get a lower rate, this could be considered fraud, and you may be undercharged.

California Casualty Auto Insurance: Comprehensive Coverage for Kia Owners

You may want to see also

Frequently asked questions

Insurance companies use annual mileage to calculate the price of your car insurance. The more miles you drive, the more likely you are to get into an accident and make a claim. Therefore, drivers with lower annual mileage generally get cheaper car insurance.

You can update your insurance company with your new mileage by calling or emailing them. Some insurance companies also allow you to update your mileage online by editing your vehicle information.

If you don't update your insurance company with your new mileage, your policy could be invalidated. This means that they won't pay out if you need to make a claim. Additionally, you may be charged a lump sum to cover the difference between your current policy price and what you would have been charged if your mileage was correct.

Under-reporting your mileage may be considered fraud by your insurance company. Additionally, if you are driving more miles than you have reported, you may be missing out on lower rates or discounts offered to drivers with lower mileage.