Life insurance is a crucial financial product that provides financial security to families after the death of a loved one. However, selling life insurance is not an easy task, and being a life insurance agent comes with its own set of challenges and benefits. In this article, we will explore the pros and cons of being a life insurance agent to help you decide if it is a good career path.

| Characteristics | Values |

|---|---|

| Salary | The salary of a life insurance agent depends on several factors, such as location, experience, and company size. The average annual salary ranges from $62,000 to $76,000, with some agents earning over $100,000. |

| Work Hours | Life insurance agents may need to work long hours, including evenings and weekends, to meet sales targets and clients' availability. |

| Work Environment | The work environment can be high-pressure due to sales targets and quotas. The nature of the job, dealing with mortality, can also be emotionally challenging. |

| Job Security | Life insurance is an essential product, providing financial security to families, so there is a constant demand for agents. |

| Flexibility | Life insurance agents often have flexible schedules and the ability to work remotely, allowing them to choose their own work hours. |

| Entry Requirements | Minimal entry barriers exist as a college degree is not always required, and training programs are provided by employers. However, a license to sell insurance is necessary. |

| Career Growth | There are diverse career opportunities within the life insurance industry, offering the potential for career growth and advancement. |

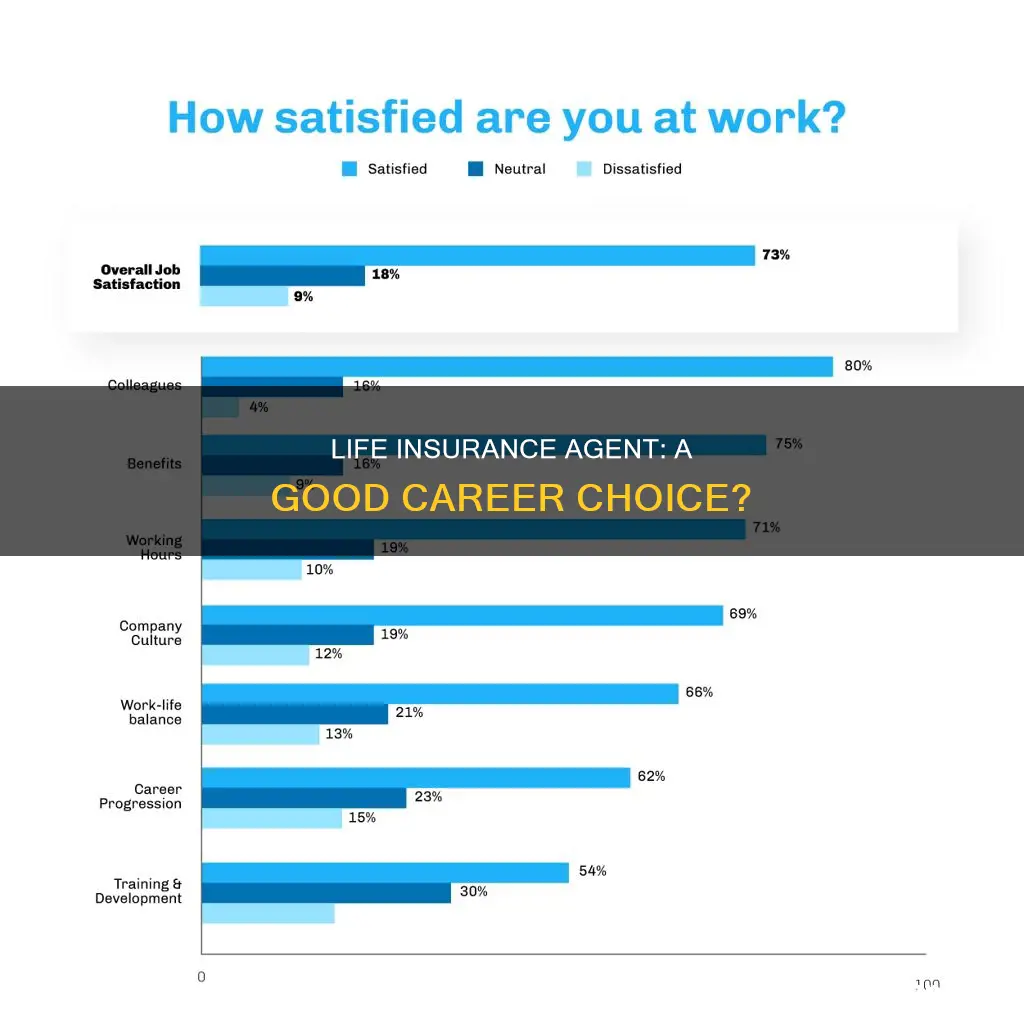

| Job Satisfaction | The job can be rewarding as agents help families secure their financial future and provide support during difficult times. |

| Commission Structure | Life insurance agents are typically paid through commissions, which can provide high earning potential but also financial instability if sales targets are not met. |

What You'll Learn

High earning potential

Life insurance agents have the potential to earn a high salary. This is because they are paid mostly through commissions, which are among the highest in the insurance industry. Agents receive front-loaded commissions of 40% to 115% of the policy's first-year premiums, although this figure drops steeply in subsequent years. Whole life insurance plans offer the highest commission rates, followed by universal life insurance, and then term life insurance plans.

Life insurance agents can also earn passive income through policy renewals, as they continue to earn a commission for as long as the policy is in force. This means that even after the initial sale, life insurance agents can continue to earn a commission of around 5% to 10% of the premiums paid.

The earning potential for life insurance agents is further enhanced by the high demand for life insurance products. Life insurance plays a crucial role in providing financial security for families after the death of a loved one, helping them to pay off debts and meet daily living expenses. As a result, there is a high volume of people seeking coverage, which translates into ample opportunities for life insurance agents to sell policies.

The U.S. Bureau of Labor Statistics reports a wide range of salaries for insurance sales agents, with the lowest 10% earning an estimated $29,970 to $34,000 annually, while the highest 10% earn over $126,000 to $134,000. The median salary falls between $50,000 and $59,000 per year.

However, it is important to note that life insurance agents typically work on a commission-only basis, which can lead to financial instability, especially when starting out. It can be challenging to find good leads, and the sales process is difficult due to the nature of the product. As a result, many new agents experience burnout and quit within the first year.

Despite these challenges, life insurance agents who persevere and establish a solid client base can reap the financial rewards that come with the high earning potential of the profession.

Life Insurance and the American Bar Association: What's Offered?

You may want to see also

Minimal entry barriers

The only educational requirement for becoming a life insurance agent is a high school diploma or GED. Some states require a pre-licensing class with a minimum number of hours, while others only require passing an exam. These requirements are relatively easy to meet, with exams described as being "as easy as a fifth-grade spelling test".

The vast majority of life insurance companies have no formal education requirements for becoming an agent. While many prefer college graduates, this general rule is often overlooked in favour of the "right" candidates. Previous experience in the insurance industry is also not required, as most medium and large insurance carriers have internal training programs.

Renewing Life Insurance Licenses: Oklahoma's Guide

You may want to see also

Diverse professional opportunities

The life insurance sector offers a range of career opportunities that suit different skills and qualifications. Here are some diverse professional opportunities within the life insurance sector:

Information Technology

The life insurance industry, like any other, relies on technology to function. This includes software and applications for data management, policy management, and customer relationship management. As such, there is a demand for IT professionals who can develop and maintain these systems.

Marketing and Advertising

Life insurance companies invest in marketing and advertising campaigns to promote their products and services. Professionals in these roles are responsible for creating and executing strategies to reach target audiences and differentiate their brand from competitors. This includes digital marketing, social media management, content creation, and market research.

Financial Analysis

Financial analysts in the life insurance sector evaluate a company's financial projects and processes to ensure sound decision-making. They hold business or other related degrees and often have previous experience in the financial industry.

Risk Management

Risk managers help life insurance companies minimise their financial risks by implementing processes for underwriters to follow and managing the company's investments. They work closely with underwriters and actuaries to assess and mitigate potential risks.

Customer Service

Customer service representatives are the frontline support for life insurance clients. They answer questions, address complaints, and provide information about coverage. They play a crucial role in ensuring customer satisfaction and maintaining the company's reputation.

The life insurance sector offers a variety of career paths that go beyond sales and underwriting. These roles provide opportunities for professionals with diverse skill sets and interests to build successful careers in the industry.

Graded Life Insurance: Understanding the Policy and Its Benefits

You may want to see also

High-pressure work environment

A career in life insurance sales can be a demanding and high-pressure job. The role often entails working long hours, with 90% of new life insurance agents quitting within the first year due to burnout. This figure rises to 95% within the first five years.

The high-pressure environment is largely due to the commission-based pay structure, which can be financially unstable. Life insurance agents are under constant pressure to meet sales targets and quotas, with their income dependent on the number of successful sales. This means that to earn more, agents must push themselves harder, often working evenings and weekends to make sales.

The pressure is further compounded by the difficulty in finding leads. Life insurance is a challenging product to sell as it involves discussing a person's mortality, and it does not provide instant gratification like other impulse purchases. Agents often have to rely on their own network to find leads, and even then, there is a high chance that these leads have already been contacted by multiple agents.

The high-pressure sales environment can lead to unethical practices and aggressive sales tactics. Some companies may push agents to sell high-commission policies, which can be overpriced and of questionable value. This adds to the pressure and stress faced by agents, who are already struggling to meet their sales targets.

The demanding nature of the job, coupled with the challenges of prospecting and inconsistent income, can lead to discouragement and burnout among life insurance agents. It is important for individuals to carefully consider the high-pressure nature of the job before pursuing a career in life insurance sales.

Life Insurance and Sunsuper: What's the Deal?

You may want to see also

Difficulty in finding leads

Finding good leads is one of the biggest challenges in a career selling life insurance. It is the most important element of a successful sales career, but in a highly saturated market, it is also the most difficult. Agents often compete for a few qualified prospects, and it is crucial to catch the attention of these potential buyers before other agents do.

Company-Provided Leads

Some life insurance agencies use the promise of leads to entice new agents. While the idea of not having to prospect for business on your own is alluring, the reality is that company leads are often old and have been worked to death. When an agent quits, the company reclaims their leads and often redistributes them to the next batch of new agents. By the time you get your hands on a company lead, it may have already been called by several other agents.

The benefit of using company leads is that you don't have to spend money to access them, and it saves you time that you would otherwise spend searching for leads. However, you pay for these leads in the form of lower commissions. These leads are also not exclusive, so there is a strong likelihood that they have already been contacted by several other agents.

Third-Party Leads

You can also buy sales leads from third-party lead generation companies. You have two options: shared leads, which are cheaper but sold to multiple agents, or exclusive leads, which are more expensive but give you less competition.

The biggest drawback of third-party leads is the level of risk. Since you pay for the leads upfront, the only way to get your money back is to close sales. If you fail to do so, you may end up with negative earnings.

Other Ways to Find Leads

- Social media: You can use professional networking platforms such as LinkedIn to access prospective buyers, but you must be adept at using it. A great LinkedIn profile can help you build a reputation as a trusted industry expert and attract clients.

- Website and SEO: Having a website that details your profile and describes the products you sell is another way to build trust with buyers. Coupled with sound SEO practices, your website can rank higher in search engines. However, this method can be time-consuming and may require expert help.

- Referrals: A satisfied customer may refer your business to another person. Referrals entail very little cost, and these clients are generally an easy close. However, you cannot rely solely on referrals as they don't come very often.

- Lead aggregators: Aggregators purchase leads and then resell them, and these leads are usually less expensive, allowing you to buy large lists. However, the main drawbacks are that they are often not delivered in real-time and have a high share rate, meaning the prospects may already have bought a policy or been contacted by several other agents.

- Cold calling: This is one of the oldest and cheapest forms of generating leads, but it requires impeccable sales skills, plenty of time, and effort.

Warm, Cold, and Hot Leads

Life insurance leads can be categorized into three types: cold, warm, and hot. Cold leads are prospective customers who don't know much about or seem interested in the products you're selling. Warm leads have opted into your mailing list or replied to a cold email, and they often show intent to buy insurance. Hot leads are clients who are ready to buy life insurance and prepared to talk to an agent and make a purchase.

Tips for Success

Your success as a life insurance agent depends primarily on the type of relationship you establish with customers. Here are some strategies to help you build strong professional relationships:

- Practice good customer service: Understand your client's unique needs and consistently provide quality service.

- Identify clients' needs: Empathize with your clients and identify what kind of protection they need.

- Play the long game: Focus on establishing relationships instead of trying to sell policies right away. By being patient, you are more likely to secure long-term customers who may refer you to other potential clients.

- Leave a professional impression: Know how to dress and communicate in a professional manner, and choose an appropriate place to meet clients to establish professionalism.

Huntington Bank: Life Insurance Options and Benefits

You may want to see also

Frequently asked questions

There are several disadvantages to being a life insurance agent. Life insurance agents often work on a commission-only basis, which can lead to financial instability, especially when starting out. The product is also difficult to sell, as people are reluctant to discuss their mortality. The work can be monotonous and the sales targets can be very challenging, leading to high levels of burnout and attrition.

There is a lot of flexibility in the role, with the potential for high earnings. It can be an easy industry to enter, with minimal barriers to entry and a high demand for agents. The work can be rewarding, as you are helping families secure their financial future.

The earning potential varies depending on location and experience. The average annual salary for life insurance agents is estimated to be between $62,000 and $77,000. However, the lowest 10% of insurance sales agents made only $29,970 in 2021, while the highest 10% earned more than $126,000.

If you are interested in insurance sales, there are other types of insurance you can sell, such as home, health, and auto insurance. Alternatively, you could consider a fee-only wealth management role.

To be a successful life insurance agent, you need strong customer service skills, the ability to relate to diverse clientele, and a professional manner. You also need to be resilient, as rejection is an inevitable part of the job.