Auto and home insurance payroll deduction is a convenient way to manage your insurance payments. It involves having your insurance premiums automatically deducted from your paycheck, ensuring timely payments without the hassle of manual billing. This method is particularly beneficial for busy individuals or families who want to streamline their finances. While it works best for those with stable paychecks, it may not be suitable for those with fluctuating incomes. Before enrolling, it's important to understand the implications of insufficient funds and job changes. Additionally, payroll deduction for auto insurance is a relatively new option, and not all insurance providers offer it. However, it can be a simple and safe way to pay your bills if you find an insurer that accommodates this payment method and your income is relatively stable.

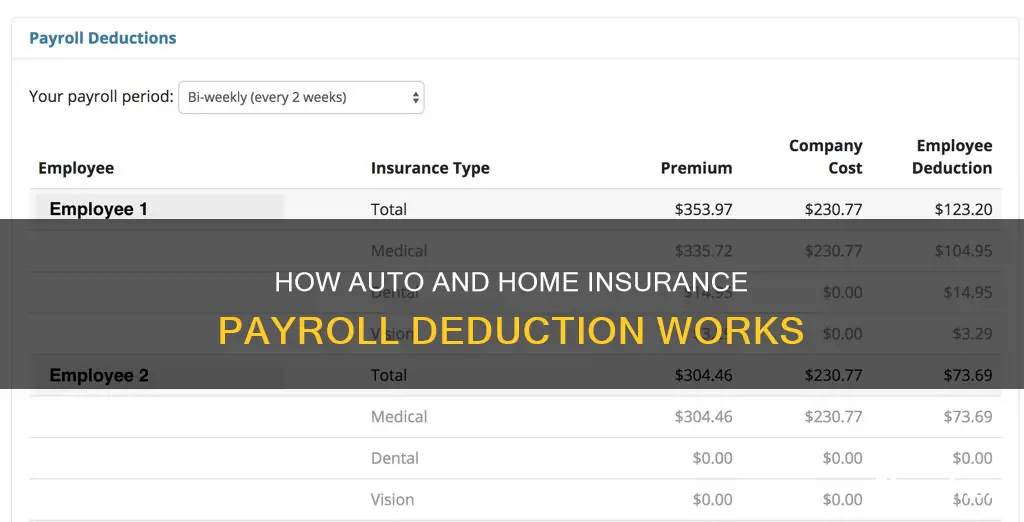

| Characteristics | Values |

|---|---|

| Availability | Auto and home insurance payroll deduction is available through some insurance providers and employers. |

| Eligibility | Employees whose employer participates in the program, who are on active payroll status, and who reside in an eligible state. |

| Benefits | Convenience, savings on service fees and insurance discounts, no risk of late payments, and no need for checks, stamps, or banking fees. |

| Payment Process | Deductions are based on payroll frequency and are spread evenly through the deduction period (usually 48 weeks from the policy effective date). |

| Discount Application | The discount is applied immediately to new policies enrolled in the program and to current policies upon receiving a signed authorization form. |

| Payment Changes | Premium deduction changes may occur due to policy alterations, a renewing policy, or a missed scheduled deduction. |

| Payment Flexibility | Alternate schedules may not be available, but customers can pay in full online if desired. |

| Retirement or Job Change | Payment plans automatically update to monthly direct bill payment unless otherwise directed by the customer. |

| Leave of Absence | Customers should contact the insurance provider to make payment arrangements for leaves of absence to avoid being placed on a monthly bill payment plan. |

What You'll Learn

- Payroll deduction is a safe, simple and convenient way to pay insurance premiums

- It saves money and ensures timely payments, but it's not for everyone

- It's a relatively new option for auto insurance, which may be unavailable with certain providers

- It's offered to employees who purchase auto insurance through their employer

- Private insurers are beginning to offer payroll deduction as a payment method

Payroll deduction is a safe, simple and convenient way to pay insurance premiums

Payroll deduction is a safe, simple, and convenient way to pay insurance premiums. It is a relatively new option for paying auto insurance premiums, and not all insurance providers offer this payment method. However, it is becoming an increasingly popular trend, with more private insurers offering payroll deduction as a payment option.

Payroll deduction is a great option for busy individuals and families who may struggle to stay on top of their bills due to a lack of time or money. It is a simple and automatic payment method that ensures the bill is never forgotten or missed. The money is deducted from your paycheck before it even hits your bank account, making it easier to part with the funds.

Additionally, payroll deduction is a safe option as it eliminates the risk of late payments, which can affect your credit score and result in additional fees. With payroll deduction, you also save on check, stamp, and banking fees associated with other payment methods.

To enroll in a payroll deduction program, you must first ensure that your employer participates in such a program and that you are on active payroll status. You will then need to complete and submit a Payroll Deduction Authorization Form, which authorizes your employer to deduct insurance premiums from your paycheck.

It is important to note that payroll deduction may not be suitable for everyone. It works best for those with stable paychecks, as the premium is usually deducted all at once. If your paychecks vary widely from week to week, you may find it challenging to budget for the payment.

Overall, payroll deduction is a convenient and efficient way to pay your insurance premiums, saving you time and providing peace of mind.

Health Insurance: Auto Injury Coverage

You may want to see also

It saves money and ensures timely payments, but it's not for everyone

Paying for auto and home insurance through payroll deduction saves money and ensures timely payments. However, it is not for everyone.

Payroll deduction is a convenient way to pay for insurance, as it is often automatic and ensures that payments are never missed or forgotten. It is also a safe way to pay, as the money is deducted before it hits your bank account, making it easier to part with the funds. Additionally, payroll deduction can save money on service fees, late payment fees, and banking fees.

However, payroll deduction for insurance is not always an option. It is a relatively new method of payment and may be unavailable through certain insurance providers. It is most commonly offered to employees who purchase insurance through their employer, although private insurers are beginning to offer this payment method as well.

Even if payroll deduction is offered by your insurance provider, it may not be the best option for you. Payroll deduction works well for customers with stable paychecks, as the premium is generally deducted all at once. If your paychecks vary widely from week to week, you may have trouble budgeting for the payment.

Before enrolling in payroll deduction for insurance, it is important to understand the potential consequences of failing to make enough money to cover the premium. While many insurers will attempt to resubmit the charge during the next pay period, it would be within the company's rights to cancel your policy for lack of payment. Therefore, payroll deduction can save money and ensure timely payments, but it is not the best option for everyone.

Auto Insurance Deductible Reimbursement: Understanding Your Options

You may want to see also

It's a relatively new option for auto insurance, which may be unavailable with certain providers

Paying for auto insurance through payroll deduction is a relatively new option, and it may be unavailable with certain providers. This method of payment is becoming a trend, and private insurers are beginning to offer it.

Payroll deduction for auto insurance is usually offered to employees who purchase auto insurance through their employer. However, it is worth noting that not all employers offer this option. Before enrolling in payroll deduction for auto insurance, it is important to understand the potential consequences of failing to make enough money to cover the premium. While some insurers may attempt to resubmit the charge during the next pay period, others may simply cancel the policy for lack of payment. Therefore, it is crucial to review the company's policies in advance.

Payroll deduction can be a convenient option for busy individuals or families who want to ensure they stay on top of their bills. It allows payments to be deducted automatically from their paychecks before the money even reaches their bank account, making it easier to part with the funds. This method also ensures that payments are never missed or forgotten.

However, payroll deduction may not be suitable for everyone. It works best for those with stable paychecks from week to week. For individuals with unsteady or varying paychecks, budgeting for the premium deduction may be challenging. Additionally, it is important to consider what happens if one changes jobs or retires. Even if the insurance is sponsored by the employer, regulations allow individuals to continue their coverage for a certain period. Still, a change in billing method will be necessary if they are no longer receiving paychecks.

Felons Selling Auto Insurance in Texas: Legal?

You may want to see also

It's offered to employees who purchase auto insurance through their employer

Many employers offer payroll deduction as a payment method for employees who purchase auto insurance through their employer. This is often done in conjunction with a group insurance program, where employees can get quality home insurance at a discounted rate.

Payroll deduction for auto insurance is a convenient way to pay your premiums, as it is taken directly from your paycheck. This means you don't have to worry about writing cheques or making online payments, and you can save money on service fees and late payment fees. Additionally, the pre-tax nature of payroll deductions can lower your taxable income and the amount of money owed to the government.

To enrol in a payroll deduction program, you will need to fill out and submit a Payroll Deduction Authorization Form to your employer. This form authorises your employer to deduct insurance premiums from your paycheck. The deductions will be based on the frequency of your payroll and will usually be spread evenly over the deduction period.

It is important to note that payroll deduction for auto insurance may not be available in all states, and eligibility criteria may apply. Additionally, if you leave your employer, the payroll deduction will stop, and you will need to arrange a different payment method for your insurance premiums.

Switching Auto Insurance: Anytime Changes

You may want to see also

Private insurers are beginning to offer payroll deduction as a payment method

Payroll deduction is a convenient way to pay for insurance, as it saves the policyholder time and money. There are no checks, stamps, or banking fees to worry about, and no risk of late payment. It can also save money on service fees and offer discounts on auto and home insurance.

Some employers are offering payroll deduction as an optional extra benefit to their employees, while others are providing it as a standard part of their benefits package. For example, MetLife offers payroll deduction as a payment option for its auto and home insurance policies, while Electric Insurance Company offers a Payroll Deduction Program that provides discounts on top of an employee's existing benefits.

Payroll deduction is a useful tool for states and employers to reduce the cost of employees' premium contributions, either for individual or group insurance. By reducing the effective price of insurance, more people may be encouraged to take out policies, increasing compliance with any insurance mandates.

However, the take-up of payroll deduction for insurance premiums has been relatively low, even where it is mandated by employers. This may be due to a lack of awareness or understanding of the benefits, or a reluctance to have money deducted from wages, particularly for lower-wage workers. There may also be complexities and uncertainties around the legal and administrative requirements of setting up payroll deduction, especially for smaller employers.

Gap Insurance: VW Loan Standard?

You may want to see also

Frequently asked questions

Auto home insurance payroll deduction is when your insurance premium is automatically deducted from your paycheck.

To set up auto home insurance payroll deduction, you need to contact your insurance company and request a Payroll Deduction Authorization Form. Once you have filled out and signed the form, send it back to your insurance company and they will process your request.

Auto home insurance payroll deduction is a convenient way to pay your insurance premium, as you don't need to worry about remembering to make a payment each month. It can also save you money on service fees and provide discounts on top of any employee discounts you may already receive.

Auto home insurance payroll deduction may not be suitable for those with unsteady paychecks as the premium is generally deducted all at once. If you fail to make enough money to cover the premium, your insurance policy may be cancelled for lack of payment.