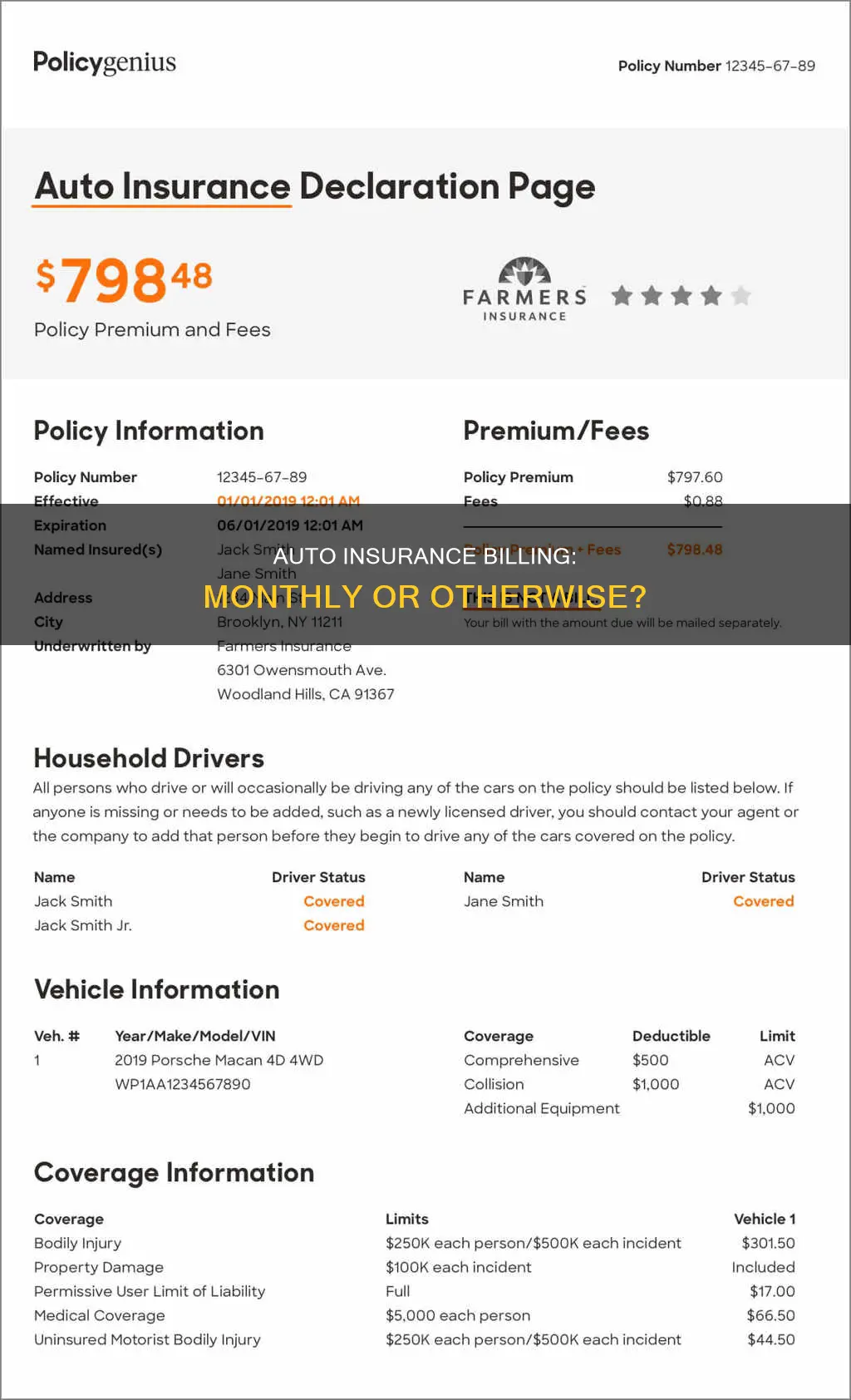

Auto insurance is usually billed monthly, semi-annually, or annually, depending on the provider. Most car insurance companies write their policies for six months, but some also offer 12-month plans. Monthly payment plans are ideal for drivers who cannot afford a lump-sum payment once a year. However, most companies charge an installment fee for this convenience, as it requires more work to process 12 payments instead of one. On the other hand, paying annually is almost always the least expensive option, and many companies offer a discount for paying in full. Ultimately, the choice of payment plan depends on the policyholder's comfort level and financial circumstances.

| Characteristics | Values |

|---|---|

| How often is auto insurance billed? | Monthly, semi-annually (twice a year), or annually |

| Payment plans | Once-per-term, monthly payment plans |

| Pros of monthly payments | More affordable, flexible, and manageable |

| Cons of monthly payments | More expensive in the long run due to installment fees |

| Pros of annual payments | Least expensive option, fewer payments to keep track of, fewer chances of late fees or cancellation |

| Cons of annual payments | Requires a large lump sum of money upfront |

What You'll Learn

Auto insurance is billed monthly, semi-annually, or annually

Auto insurance is billed in different ways, depending on the provider and the policyholder's preference. The three most common billing cycles for auto insurance are monthly, semi-annually (every six months), or annually.

Monthly payments are a convenient option for those who cannot afford to pay a lump sum once or twice a year. This billing cycle allows policyholders to spread the cost of their premium over 12 instalments, making it easier to budget. Many insurance companies offer online portals where customers can manage and pay their monthly premiums. Additionally, monthly payments offer more flexibility, as any changes made to the policy, such as removing a driver, will result in a lower cost from the following month. However, monthly payments may incur an additional fee, as it requires more manual processing by the insurance company to keep the policy active each month.

Semi-annual payments are offered by most major auto insurance companies. This billing cycle requires the policyholder to pay their premium twice a year, at the beginning of each new six-month term. This provides an opportunity to review and make changes to the policy at the renewal point. While semi-annual payments are more infrequent than monthly ones, they may be a more feasible option for those who can budget and save for this larger expense.

Annual payments involve paying the entire premium for the year upfront. This billing cycle often comes with a discount, as it saves the insurance company time and money by only requiring one payment processing step. Paying annually can provide peace of mind, as you won't need to worry about making monthly payments or incurring late fees. It is also a good option for those who have fluctuating or seasonal income, receive annual bonuses, or prefer to make fewer payments.

Ultimately, the choice of billing cycle depends on the policyholder's financial situation and preferences and the options provided by their insurance company.

Getting Auto Insurance: First-Time Buyer's Guide

You may want to see also

Paying annually can be cheaper

Auto insurance is usually billed monthly, every six months, or annually, depending on the provider. While paying monthly premiums is convenient for many, paying annually can often be the cheaper option.

Discounts for Annual Payments

Many insurance companies offer a discount for paying annually. This is because processing a single annual payment is less work for the insurance company than processing 12 monthly payments. This discount can lead to significant savings. For example, in 2021, drivers who paid premiums in full saved about 4.7% on average.

Avoid Monthly Installment Fees

Most companies charge an installment fee for the convenience of paying in monthly installments. This is because it takes more work for the company to process 12 payments instead of one. By paying annually, you can avoid these fees.

Peace of Mind

Paying annually can also give you peace of mind. You won't have to worry about missing a monthly due date or incurring late payment fees, and your insurance won't be canceled due to non-payment. This can be especially helpful for people who have trouble keeping up with monthly payments or who have fluctuating or seasonal income.

Better for Your Budget

While paying a large lump sum annually may be daunting, it can actually be better for your budget. By paying annually, you can spread the cost of your premium over the year and set aside a smaller amount each month. This can be easier to manage than a large monthly payment.

Save Your Money for Other Things

If you pay annually, you can invest the money you would have spent on monthly payments or use it for other large expenses. This is a good option if you receive an annual bonus or tax refund, as you can use this money to pay your annual premium in full.

Shop Around for the Best Deal

The amount of savings you'll get from paying annually depends on the insurance company. Be sure to find out how much of a discount each company offers for paying annually, as this may factor into your decision about which company to choose.

Switching Auto Insurance: How Often Is Too Often?

You may want to see also

Monthly payments are more manageable for some

While paying auto insurance annually is the cheapest option, it requires a large sum of money upfront, which can be difficult for some. Monthly payments, on the other hand, are more manageable for those who live from paycheck to paycheck or those who cannot afford a lump-sum payment. This way, they can spread the cost of the premium over time and set aside a smaller, more manageable amount of money each month.

Monthly payments are also beneficial for those who want to remove a driver from their policy, as they can do so at any point and see a lower cost from the following month. This flexibility is not available with annual payments. Additionally, with monthly payments, individuals can know the exact due date of their car insurance bill and set up automatic payments to reduce the risk of forgetting to make a payment.

For those who have the money to pay an annual premium but want to invest the extra funds or use it for another large expense, monthly payments might be a better choice. It is also a good option for those who have fluctuating or seasonal incomes, annual bonuses, or tax refunds.

However, it is important to note that most companies charge an installment fee for monthly payments since it requires more work to process multiple payments instead of just one. Therefore, individuals should carefully consider their financial situation and decide which payment option suits them best.

Auto Insurance in California: Monthly Costs Explained

You may want to see also

Discounts are available for paying annually

Auto insurance is usually billed monthly, every six months, or annually, depending on the provider. Most car insurance companies write policies for six months, but some also offer 12-month plans.

While paying monthly premiums is a more manageable option for some, paying annually can result in significant discounts. Insurance companies save money when they only have to process your payment once or twice a year, so they encourage borrowers to choose this option by offering lower premiums.

For example, Progressive, Farmers, and Allstate offer discounts for paying in full. In 2021, drivers who paid premiums in full saved about 4.7% on average. This means that paying upfront for the entire year could result in notable savings, especially when compared to paying monthly.

In addition to the financial benefits, paying annually can also provide peace of mind. You won't have to worry about missing a due date or incurring late payment fees, and your insurance won't be at risk of being canceled due to non-payment. This option is ideal for those who have difficulty keeping up with monthly bills or prefer to make fewer payments overall.

When deciding whether to pay monthly or annually, it's important to consider your financial situation and comfort level. Paying in full may not be feasible for those who would be left cash-strapped after making a large payment. However, if paying annually is within your budget, you can take advantage of the discounts offered by insurance companies and enjoy the convenience of having one less bill to worry about each month.

Auto Insurance: Which State is Cheapest?

You may want to see also

Monthly payments can be automated

Automatic payments can also help you save money. Some insurance companies offer a discount for those who sign up for autopay. This is because it costs the insurance company more if a policyholder pays their premiums monthly, as it requires manual processing each month to keep the policy active.

You can also set up an Electronic Funds Transfer (EFT) to pay your monthly bill. This is where you authorise your car insurance company to automatically pull the amount from your debit card or bank account each month. While this is an easy way to pay, make sure you have sufficient funds in the account to avoid a lapse in coverage.

Monthly payments are a good option if you can't afford to pay upfront for the full year's insurance premium. They allow you to spread the cost of the premium over time and fit well with most people's monthly budgeting. You can set aside the premium to be paid along with your other monthly bills.

If you expect a major change to your policy before the year is up, such as removing a teenage driver, you can make the change and see immediate savings with a monthly payment plan. This flexibility may be important to you, and it's something you won't get with an annual payment.

Monthly payments might also be a good choice if you have the money to pay an annual premium but want to invest the extra money or use it for another large expense.

The Fine Line Between Non-Owned Auto Insurance and Owner Coverage

You may want to see also

Frequently asked questions

Auto insurance is usually billed a month, six months, or a year in advance, depending on the provider.

Paying auto insurance in full can help you lock in a "pay in full" discount. It also saves you from the hassle of keeping track of monthly bills.

The main disadvantage of paying auto insurance in full is the need for a large lump sum of cash, which can be difficult to budget for.

Paying auto insurance monthly is a more feasible option for those who cannot afford a large lump-sum payment. It also provides flexibility, allowing for immediate savings if a driver is removed from the policy.

Yes, most insurance companies allow policyholders to pay their auto insurance bill early.