California is home to more than 27 million licensed drivers, many of whom are seeing their auto insurance premiums go up. In fact, according to an article in abc10, all across the state, drivers are facing higher premiums. But why is auto insurance so expensive in California? Well, there are several factors that contribute to this. Firstly, the cost of repairing today's cars is higher due to the advanced technology they use. Additionally, insurance companies have complained about rising costs, and the state has been slow to approve their requests to raise rates. Moreover, the frequency of accidents has almost doubled since the pandemic, according to insurance expert Karl Susman. Other factors that influence insurance rates include a person's driving record, the type and age of their vehicle, their geographic location, and inflation. While auto insurance in California may be expensive compared to what drivers were previously paying, it is important to note that California is one of the most consumer-friendly states when it comes to car insurance. Insurers are banned from using a driver's gender or credit score to price insurance premiums, which means drivers with poor credit may not necessarily pay more for a policy.

| Characteristics | Values |

|---|---|

| Average cost of full coverage insurance per year | $1,622 |

| Average cost of minimum coverage insurance per year | $462 |

| Cheapest full coverage insurance provider | Auto Club of SoCal |

| Cheapest minimum coverage insurance provider | Geico |

| Number of licensed drivers in California | 27 million |

| Number of auto insurance providers in California | More than 130 |

What You'll Learn

- California's high insurance costs are due to inflation, rising vehicle repair costs, and increased accidents

- California's insurance costs are influenced by geographic location and risk factors, with some areas deemed relatively unsafe

- The type and age of a vehicle impact insurance rates, with luxury and sports cars commanding higher premiums

- California's insurance rates are affected by personal factors like age, driving history, and marital status

- California's insurance market is regulated, with insurers required to offer discounts and sell insurance to good drivers

California's high insurance costs are due to inflation, rising vehicle repair costs, and increased accidents

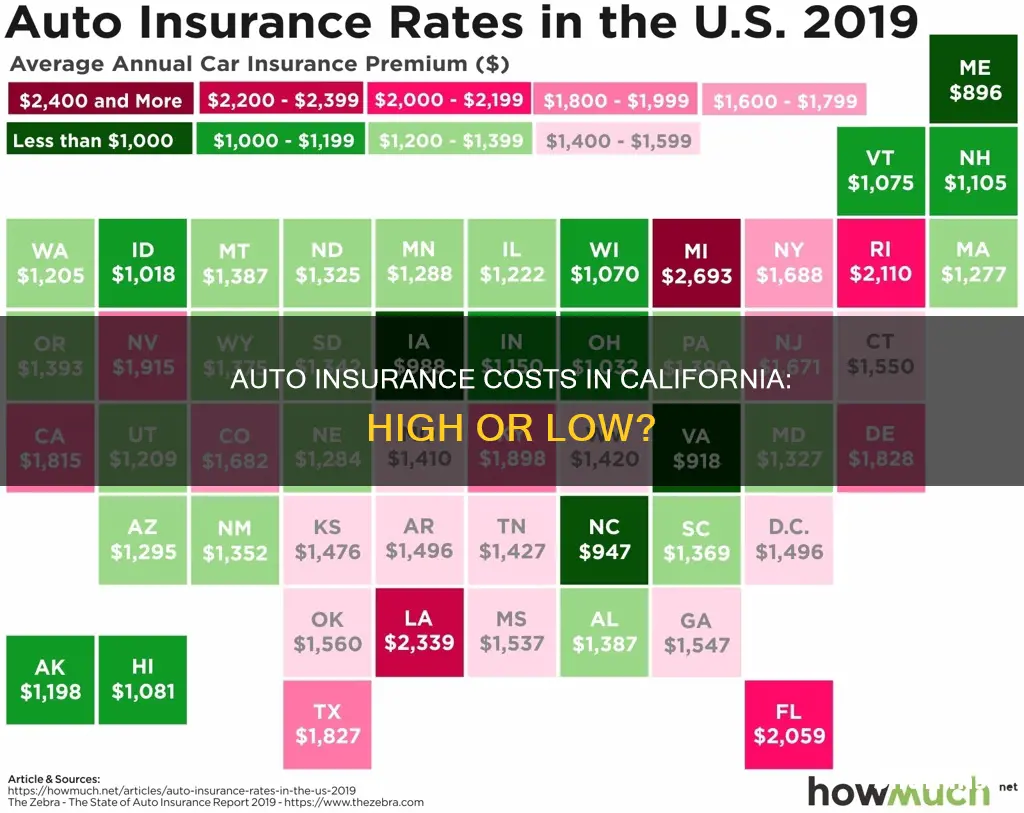

California is known for its high car insurance rates, with residents paying about $1,429 per year on average for car insurance. This is largely due to inflation, rising vehicle repair costs, and increased accidents.

Inflation

Inflation has impacted the cost of car insurance across the United States, and California is no exception. As the costs of goods and services rise, so do the costs of insurance claims and payouts. This has led to insurance companies requesting rate increases to keep up with the rising costs.

Rising Vehicle Repair Costs

The technology in today's cars makes them more expensive to repair. Modern vehicles are equipped with advanced features such as cameras, sensors, and LiDAR systems, which require specialized technicians to repair or replace. As a result, insurance companies have to pay out more for auto repair claims, which is reflected in higher insurance rates for California drivers.

Increased Accidents

There has been an increase in the frequency of accidents in California, with some sources citing a near doubling of accident rates compared to pre-pandemic levels. This has led to a higher number of insurance claims and payouts, contributing to the rise in insurance costs.

In addition to these factors, California's dense population, high healthcare costs, severe weather risks, and high rates of theft and vandalism also contribute to the state's high insurance premiums. The combination of these factors makes it challenging for California drivers to find affordable car insurance.

Out-of-State Auto Insurance: Understanding Your Coverage When Crossing State Lines

You may want to see also

California's insurance costs are influenced by geographic location and risk factors, with some areas deemed relatively unsafe

California's auto insurance costs are influenced by several factors, including geographic location and risk factors. The state has seen a significant increase in insurance rates, causing concern among its over 27 million licensed drivers.

Geographic location plays a significant role in insurance costs, with carriers assessing the safety of an area based on accidents and vehicle-associated crime. Living in a state, city, or even a specific zip code deemed relatively unsafe can drive up premiums. This perception of risk can lead to higher insurance rates for residents of these areas.

The impact of geographic location on insurance costs is so significant that moving to a safer neighbourhood can sometimes be enough to lower premiums. However, this is not always feasible, and drivers in unsafe areas may need to explore other options to reduce their insurance costs.

In addition to geographic location, other factors influencing insurance costs in California include a person's driving record, the type and age of their vehicle, inflation, theft rates, climate change, and household changes. These factors collectively contribute to the overall cost of auto insurance in the state, making it challenging for some residents to find affordable coverage.

While California faces challenges with rising insurance costs, it is important to note that the state has implemented regulations, such as Proposition 103, to protect consumers from excessive rate increases. These regulations require hearings for personal insurance rate increase requests above 7% if challenged by the public. Despite these efforts, the rising cost of auto insurance remains a concern for many Californians.

Gap Insurance: Finance Fee or Not?

You may want to see also

The type and age of a vehicle impact insurance rates, with luxury and sports cars commanding higher premiums

The type and age of a vehicle have a significant impact on auto insurance rates in California. While a driver's record is the most influential factor in determining insurance premiums, the vehicle itself also plays a crucial role.

Luxury cars and sports cars typically command higher insurance premiums. This is because luxury vehicles are often more expensive to repair, especially with the advanced technology featured in modern cars. A minor accident that damages a bumper today could lead to costly repairs to replace cameras, sensors, and other high-tech components. As a result, insurance companies will charge more to insure these types of vehicles.

Sports cars, on the other hand, are associated with fast and risky driving. The increased risk of accidents and expensive claims leads to higher insurance rates for sports car owners.

The age of a vehicle is also a factor. Newer cars may benefit from additional policy add-ons, such as new car replacement coverage, which protects their value in the event of a total loss. Older cars, on the other hand, may not require as much coverage. For example, an older car with a lower market value might not need comprehensive and collision coverage, as the cost of insuring it could exceed its actual cash value.

In addition to the type and age of the vehicle, other factors such as safety features, safety records, and the make and model can also influence insurance rates. The cost of insurance can vary depending on whether the car is new or used, with new cars often requiring full auto insurance coverage to protect the owner's financial investment.

When it comes to insurance rates, the vehicle's age can work in the owner's favour. As a car gets older, it may be advisable to re-evaluate the insurance coverage. Dropping comprehensive and collision coverage for older, less valuable vehicles can help lower insurance costs.

In summary, while a driver's record is the most significant factor in determining insurance rates, the type and age of the vehicle being insured also have a notable impact. Luxury and sports cars typically command higher premiums due to repair costs and risk factors, respectively. Older vehicles may require less coverage, and their owners may benefit from reduced insurance rates.

Amica Auto Insurance: Is It Available in Connecticut?

You may want to see also

California's insurance rates are affected by personal factors like age, driving history, and marital status

California's auto insurance rates are some of the most expensive in the US, and there has been a recent spike in insurance costs. Several personal factors affect insurance rates, including age, driving history, and marital status.

Age is a significant factor in determining insurance rates, with younger drivers deemed to be at a higher risk of accidents. Insurance companies tend to charge more to insure drivers under the age of 25.

An individual's driving history also plays a crucial role in insurance rates. A clean driving record can result in lower insurance premiums, while accidents and traffic violations can increase costs. In California, accidents remain on an individual's record for at least three years, and the presence of violations can extend this period to over ten years. The type of accident and the number of violations will influence the duration of this record. For instance, a DUI conviction or a collision with injuries and police involvement will result in a lengthier record.

Marital status is another factor that insurance companies consider when determining rates. Married drivers are often viewed as more financially stable and safer, leading to lower insurance costs. On average, a married driver pays $96 less per year than a single, widowed, or divorced driver. This is because married couples are more likely to be homeowners, bundle their policies, cover multiple vehicles, and insure more than one driver on a single policy.

IID Devices: How Auto Insurance Rates are Impacted

You may want to see also

California's insurance market is regulated, with insurers required to offer discounts and sell insurance to good drivers

California's insurance market is highly regulated, with insurers required by law to offer discounts to good drivers and sell them insurance. This regulation, Proposition 103, passed in 1988, mandates that insurance premiums must be based on a driver's record, experience, and miles driven annually. Good drivers in California are defined as those who have held a license for a minimum of three years, have one or fewer points on their record, have not been to traffic school more than once, have had no at-fault accidents resulting in death or injury, and have had no DUI-related convictions for the past ten years. These good drivers are legally entitled to a 20% discount on their insurance premiums, which is the highest in the country. California is one of only four states that require insurers to sell insurance to good drivers.

The regulation of insurance rates in California has been a point of contention for insurance companies, who argue that the state's cumbersome rules hinder their ability to do business. The process of requesting rate increases is particularly scrutinized, with any increase above 7% requiring a hearing if a member of the public challenges it. This has resulted in a backlog of requests and a delay in approvals, causing frustration for both insurers and consumers.

The California Department of Insurance is responsible for reviewing and approving rate increase requests, and they have approved 111 rate increases as of 2023, with 58 of those from requests filed in the same year. The department is also investigating complaints from drivers about higher premiums, delayed quotes, and questionable insurer behavior.

The insurance market in California is facing challenges, with rising costs and increasing difficulties for drivers to obtain affordable coverage. The state's regulations, while intended to protect consumers, have also contributed to the complexity and delays in the insurance process.

Despite the challenges, California's regulated insurance market aims to balance the interests of insurers and consumers. The requirement to offer discounts and sell insurance to good drivers is a key aspect of this balance, ensuring that safe drivers are rewarded with lower premiums and accessible coverage.

Getting Auto Insurance as a Visitor in the US

You may want to see also

Frequently asked questions

Auto insurance rates in California have been increasing due to rising costs of car repairs, inflation, and an increase in accidents.

Your location plays a major role in how much you pay for auto insurance. Living in certain states, cities, or zip codes may increase your premium because the carrier thinks the area is relatively unsafe due to accidents and vehicle-associated crime.

Your driving record significantly impacts your auto insurance. Generally, coverage is cheapest for those with a history of safe driving. If your driving record changes, the premium for your auto insurance is likely to increase.

You can find cheap auto insurance in California by shopping around and comparing prices from different insurers. There is no law that says you have to stay with your current insurer.