AAA and Farmers are two of the largest insurance companies in the country, with a wide range of coverages and discounts available to their customers. While AAA is better known for its roadside assistance and membership benefits, Farmers has long been one of the most popular insurance carriers, offering a wide range of highly customizable coverage types and numerous discount opportunities. AAA received a score of 88 out of 100, while Farmers scored 85 out of 100. So, which insurance company is better?

| Characteristics | Values |

|---|---|

| Overall Rating | AAA is better than Farmers overall. AAA received 3.4 out of 5 stars, whereas Farmers received 3.0 out of 5 stars. |

| Types of Insurance | Farmers beats AAA. |

| Cost | AAA beats Farmers. |

| Discounts | Farmers beats AAA. |

| NAIC Rating | Farmers beats AAA. |

| J.D. Power Rating | AAA ties with Farmers. |

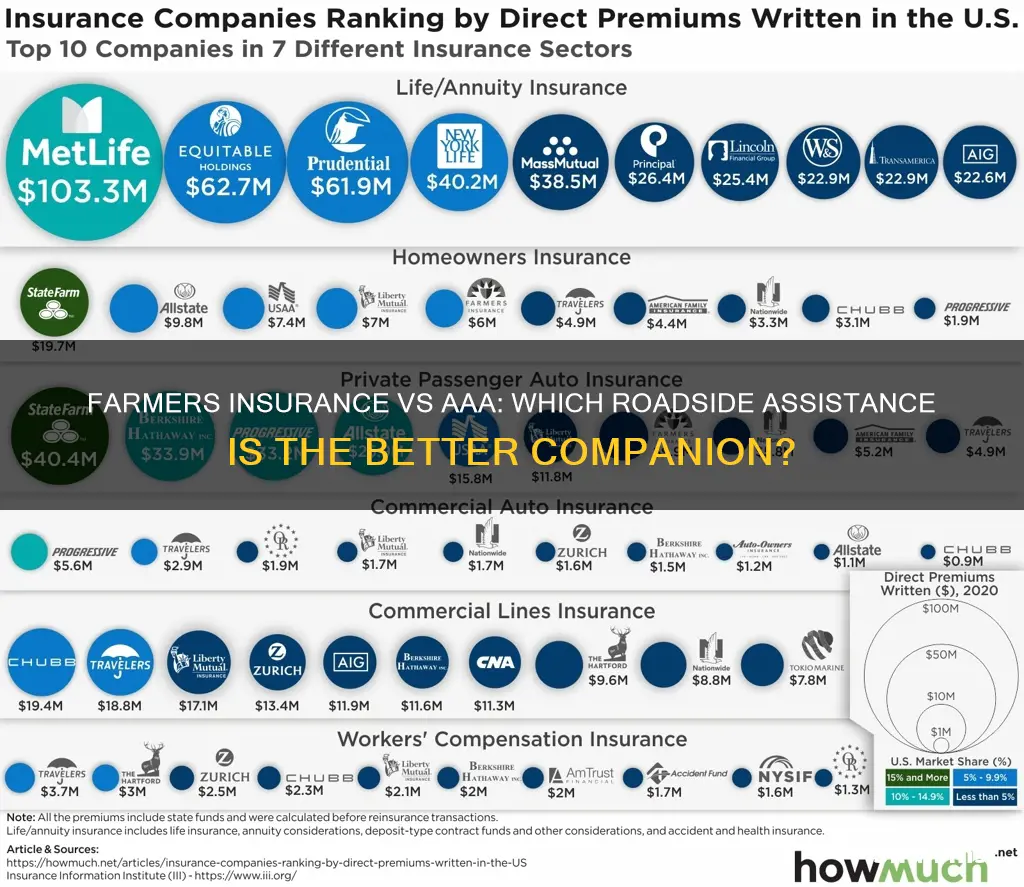

| Market Share | Farmers beats AAA. |

| Customer Satisfaction | AAA has higher customer satisfaction scores. |

| Customer Complaints | Farmers has fewer customer complaints. |

| Financial Stability | AAA has better financial stability. |

Customer satisfaction

AAA Customer Satisfaction

AAA has received mixed reviews for customer satisfaction. WalletHub gives AAA a rating of 3.4 out of 5, while the average user rating on the site is 2.3 out of 5. WalletHub notes that AAA has received more complaints than the average car insurance provider of its size. Customer complaints tend to focus on poor customer service and delayed claim payments.

J.D. Power gives AAA a rating of 3 out of 5 for overall customer satisfaction. The company's customer satisfaction score in The Zebra's 2022 Customer Satisfaction Survey was 4.2 out of 5, ranking it 13th out of 15. AAA's customer satisfaction score in the survey was higher among younger drivers.

Farmers Customer Satisfaction

Farmers has also received mixed reviews for customer satisfaction. WalletHub gives Farmers a rating of 3 out of 5, while The Zebra gives Farmers a rating of 4 out of 5. Farmers has received fewer customer complaints than average, according to The Zebra. However, Farmers earned below-average customer satisfaction scores in the J.D. Power 2023 U.S. Auto Insurance Study.

AAA vs Farmers

Both AAA and Farmers have received mixed reviews for customer satisfaction, with some sources giving them average ratings, and others ranking them lower. While AAA has received more complaints than average for a company of its size, Farmers has received fewer complaints than average.

The Six-Month Insurance Premium Shift: What Farmers Need to Know

You may want to see also

Cost

When it comes to cost, Farmers Insurance is generally the cheaper option compared to AAA. However, it's important to note that rates can vary depending on factors such as age, driving history, vehicle choice, credit score, and location. Here's a more detailed breakdown of the cost comparison between Farmers and AAA:

Average Rates

Farmers Insurance offers lower average rates than AAA. According to The Zebra, Farmers' average monthly rate is $131, while AAA's is $151. Insurify reports that Farmers' average monthly rate for liability-only insurance is $110, while AAA's is $89. For full coverage, Farmers' average rate is $249, compared to AAA's $142.

Rates by Credit Score

Farmers Insurance typically offers better rates than AAA across all credit tiers. Drivers with excellent credit scores (800 and above) can expect to save nearly $1,500 annually by choosing Farmers over AAA.

Rates for High-Risk Drivers

Farmers Insurance is often a better choice than AAA for high-risk drivers with an at-fault crash, speeding ticket, reckless driving violation, or DUI on their record. Each insurance company prices policies differently after a violation, so it's advisable to shop around and compare quotes.

Rates by Age

Farmers Insurance is generally more affordable for teen drivers, offering average yearly savings of $3,738 compared to AAA. For retired drivers aged 65 and above, Farmers also provides lower average rates, with a monthly cost of around $143 compared to AAA's $238.

Rates for Different Coverage Types

Farmers Insurance tends to be more affordable than AAA for both state minimum liability-only coverage and full coverage policies. For state minimum liability-only coverage, Farmers' average rate is $126, while AAA's is $169. For full coverage, Farmers' average rate is about $200 per month, compared to AAA's $314.

Discounts

While AAA offers a wider range of discounts than Farmers, with 33 compared to 28, Farmers still provides a significant number of discount options. Some of the unique discounts offered by Farmers include safe driving, multi-car, and bundling discounts.

Additional Costs

It's worth noting that AAA requires membership to purchase insurance policies, and the cost of membership varies depending on the chosen plan. AAA offers three membership plans: Classic, Plus, and Premier, with annual costs ranging from $64.99 to $124.99. These plans include benefits such as roadside assistance, travel planning, and discounts.

The Evolution of Farmers Insurance: A Legacy of Protection and Service

You may want to see also

Discounts

AAA Discounts

AAA offers a range of discounts for its members across different categories, including automotive, personal services, entertainment, and travel. Here are some examples of AAA discounts:

- Automotive Discounts: Discounts on fuel at Shell, auto parts and accessories, and CARFAX Vehicle History Reports.

- Personal Services Discounts: Discounts on eye exams, lenses, and non-prescription sunglasses.

- Entertainment Discounts: Discounts on tickets, books, and streaming services.

- Travel Discounts: Discounts on car rentals, airport parking, hotels, and luggage.

Additionally, AAA offers exclusive member savings through its Discounts & Rewards program. Members can save at over 100,000 partner locations on various products and services, including electronics, dining, and travel. AAA also provides insurance discounts for members, companion policies (home or auto), and mature policyholders.

Farmers Discounts

Farmers Insurance provides a wide range of discounts for auto, home, and business insurance policies. Here are some examples of Farmers discounts:

- Auto Insurance Discounts: Discounts for bundling policies, safe driving, good students, distant students, alternative fuel vehicles, anti-lock brakes, anti-theft devices, and more.

- Home Insurance Discounts: Discounts for bundling policies, UL-approved roofing materials, fortified homes, green certifications, and claim-free history.

- Business Insurance Discounts: Discounts for corporations, vehicle safety technology, and multiple policies.

Farmers also offers discounts for specific groups, including military personnel, first responders, union members, and certain professional groups such as educators, healthcare workers, and law enforcement officers.

Farmers Insurance and LoJack Discounts: Unlocking the Benefits

You may want to see also

Types of insurance

There are several types of insurance policies available to consumers, each with its own unique benefits and coverage options. Here are some of the most common types of insurance:

- Homeowner's Insurance: This type of insurance provides coverage for your home and personal property in the event of a covered loss, such as fire, theft, or vandalism. It also includes liability coverage for accidental damage to others' property or injuries that occur on your property.

- Renter's Insurance: Renter's insurance covers your personal belongings, such as electronics and clothing, in the event of a covered loss like fire or theft. It also provides liability coverage for accidental damage to others' property or injuries that occur within your rented space.

- Auto Insurance: Auto insurance covers damage to your vehicle and medical bills for you and your passengers in the event of an accident. It also includes liability coverage if you're at fault for the accident.

- Life Insurance: Life insurance provides financial protection for your beneficiaries in the event of your death. It offers various options, including different time frames and coverage amounts.

- Health Insurance: Health insurance helps cover the rising costs of medical care and prescriptions, protecting you from incurring debilitating bills due to accidents or illnesses.

- Disability Insurance: This type of insurance provides financial protection if you become disabled and unable to work. It supplements a portion of your lost income to help cover expenses like rent, mortgage, or loan payments.

- Long-term Care Insurance: Long-term care insurance assists with expenses related to in-home care, adult day care, or nursing home stays. It's often purchased by adults in their 50s or 60s to prepare for potential future needs.

- Personal Liability Umbrella Insurance: This type of insurance provides additional coverage beyond what is included in underlying policies like auto or homeowner's insurance. It offers larger amounts of coverage for specific situations and broader ranges of coverage for exclusions in the underlying policies.

These are just a few examples of the many types of insurance available. Each type of insurance is designed to provide financial protection and peace of mind for individuals and their loved ones.

Rickie Fowler's Participation in the Farmers Insurance Open: What We Know

You may want to see also

Geographical coverage

AAA is a not-for-profit motor club that offers insurance coverage through different regional insurance clubs, including CSAA and Auto Club of Southern California. AAA membership is required to obtain coverage and is available in plans ranging from Classic to Plus and Premier. The company offers insurance in all 50 states.

Farmers Insurance is a national insurer that offers auto, home, renters, flood, earthquake, life, and business insurance. It provides coverage in all 50 states and offers a range of insurance products, including home, vehicle, life, business, pet, motorcycle, and umbrella insurance.

Both AAA and Farmers have their own unique geographical coverage, with AAA being a membership-based service and Farmers being a more traditional insurance provider. AAA's coverage is dependent on the regional insurance clubs that it partners with, while Farmers operates as a national insurer with a wider reach.

AAA Geographical Coverage:

AAA offers insurance coverage through its regional clubs, with the following being some of the key areas:

- CSAA: This club provides coverage in several states, including California, Utah, and Nevada.

- Auto Club of Southern California: This club offers coverage in Southern California, serving a large population.

- AAA Northern California, Nevada, and Utah: This club covers the northern part of California, Nevada, and Utah, providing a wide range of services.

- AAA Arizona: This club provides insurance services to residents of Arizona, offering a range of benefits.

- AAA Montana: With a focus on Montana, this club ensures that residents have access to AAA's services and benefits.

Each of these regional clubs has its own unique coverage area, and members can access services and benefits based on their location. AAA's coverage is tailored to specific regions, ensuring that members receive localized support and assistance.

Farmers Geographical Coverage:

Farmers Insurance, as a national insurer, has a broader geographical reach. Here are some key aspects of their coverage:

- All 50 States: Farmers offers insurance coverage across the United States, making it accessible to a wide range of customers.

- International Presence: In addition to its extensive domestic coverage, Farmers also has a presence in other countries. For example, it offers Mexico insurance for those traveling or living in Mexico.

- Online and Local Presence: Farmers provides both online and local services, allowing customers to access their insurance information and manage their policies from anywhere. They also have local agents available for personalized support.

Farmers' geographical coverage is more extensive due to its nature as a national insurer. This allows them to provide services to a wider range of customers across the United States.

Unraveling the Complexities of Pain and Suffering in Farmers Insurance Claims

You may want to see also

Frequently asked questions

Farmers Insurance is generally cheaper than AAA. However, the cost of insurance depends on a variety of factors, including age, driving history, and location.

According to WalletHub, AAA beats Farmers Insurance in terms of customer satisfaction. However, Farmers Insurance offers more discount options, which may be important for some customers.

AAA membership includes emergency roadside assistance, travel deals, shopping discounts, and financial benefits such as free identity theft monitoring.

Farmers Insurance offers a wide range of insurance products, including car, home, renters, flood, earthquake, life, and business insurance.