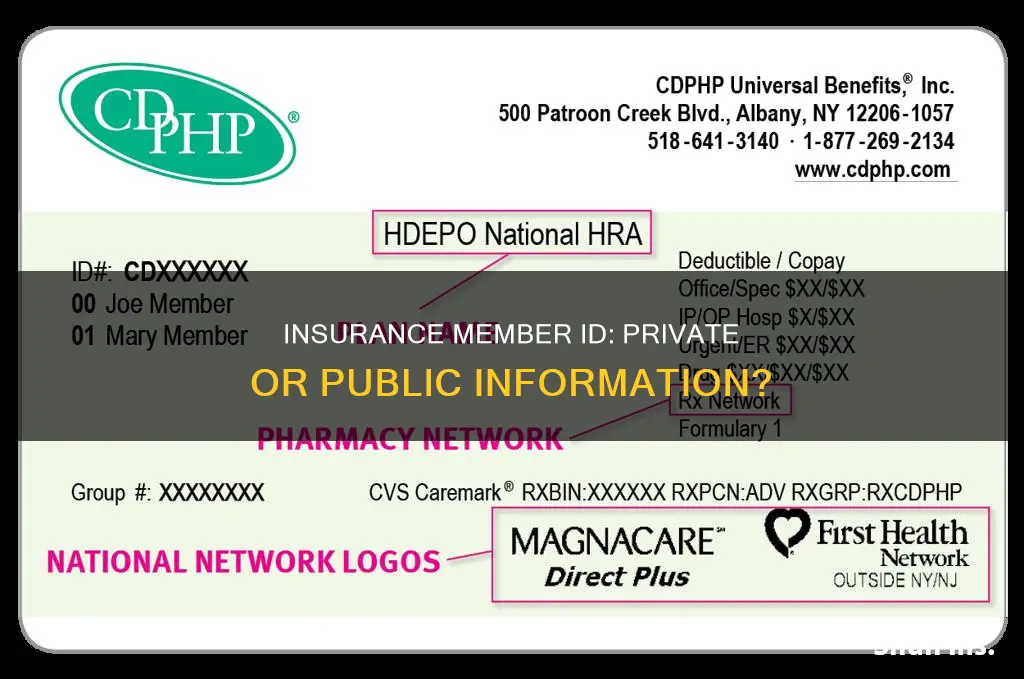

Your insurance member ID is a unique identifier assigned to you by your insurance company. It is used to track your medical claims and ensure that you receive the benefits and coverage that you are entitled to. While it is not explicitly stated that your insurance member ID is private, it is important to keep your member ID card safe and confidential, and you should not share your insurance card number with anyone else. This number is linked to your personal information and medical history and should be treated in the same way as a credit card.

| Characteristics | Values |

|---|---|

| Purpose | Proof of insurance |

| Use | To demonstrate to doctors, dentists, eye doctors, and pharmacists that you have insurance |

| Information | Name, policy number, insurance company, type of insurance plan, benefits, where to submit the claim, ID number(s), coverage type, type of insurance plan, codes and details for pharmacy needs, list of phone numbers for support, copay information |

| Privacy | Should be treated as a credit card, kept confidential, and not shared with anyone except your physician's office or pharmacy |

What You'll Learn

What is a member ID?

A member ID is a unique identification code assigned to an individual by a company or organisation. In the context of insurance, a member ID is a number that demonstrates that an individual is a member of a specific insurance plan. It is often referred to as a subscriber ID or patient ID.

In the case of health insurance, a member ID card is provided to the insured individual, which includes their member ID number. This card serves as proof of insurance and helps providers verify coverage and process claims. It typically includes personal information such as the individual's name and may also include their policy number, group plan number, and benefit details.

The member ID number is used by healthcare providers to confirm coverage for treatment or medicine. It is often required when seeking care, filling prescriptions, or contacting customer service. The member ID card may also contain various codes and acronyms that provide additional information about the insured individual's benefits and coverage.

It is important to keep the member ID card safe and accessible when seeking medical services, as it plays a crucial role in ensuring proper billing and access to insurance benefits.

Magellan Insurance: Is It Private or Publicly Available?

You may want to see also

What is a member ID used for?

A member ID is used to identify you as a member of a health plan. It contains important information about you and your benefits. It is also your way of demonstrating to doctors, dentists, eye doctors, and pharmacists that you have insurance.

When you enrol in a health insurance plan, you will receive a member ID card in the mail. This card identifies you as a member of a health plan and shows important information about you and your benefits. It is also your way of demonstrating to doctors, dentists, eye doctors, and pharmacists that you have insurance.

The member ID card is used to verify your coverage. It contains a variety of codes and acronyms that help the provider determine your insurance benefits. The card includes information such as:

- Your ID number(s): This is a unique number assigned to you, and it is often displayed prominently on the card.

- Type of coverage: The card will indicate the type of coverage you have, such as medical, pharmacy, dental, or vision.

- The type of insurance plan: The card may include acronyms like HMO, PPO, POS, or EPO, indicating the structure of your plan and the providers you can see.

- Pharmacy needs: Codes starting with "Rx" relate to pharmacies and help direct prescription claims to the correct insurance provider.

- Contact information: The card may include phone numbers and addresses for support and assistance with your insurance plan and benefits.

- Copay information: Some cards may list the copay amounts you can expect to pay for primary care, specialist visits, emergency room visits, or prescription medications.

It is important to always present your member ID card when receiving services to ensure that your health plan can process your claim and help cover the cost of care.

How Private Garages Reduce Insurance Premiums

You may want to see also

Who can see my member ID?

Your member ID card is for your eyes only. Treat it as you would a credit card. It is proof that you have health insurance and contains a wealth of personal information about your healthcare coverage. It is important to keep your card safe and confidential.

Your member ID card may be used by:

- Doctors

- Dentists

- Opticians

- Pharmacists

- Healthcare providers

These people will use the information on your card to:

- Confirm they are part of your plan's network

- Bill your health plan for your care

- Verify your coverage

- File claims for healthcare services

- Arrange payment for services

If you have downloaded a mobile app for your health insurance plan, you may be able to share your member ID card on your smartphone or tablet.

Wealth Management Funds: Are Your Investments Insured?

You may want to see also

How do I keep my member ID safe?

Your member ID card is important as it demonstrates to healthcare providers that you have insurance. It also contains personal information, so it's important to keep it safe. Here are some tips on how to keep your member ID safe:

- Keep your physical card in a secure place when you don't need to carry it with you.

- If you have a digital copy of your card, ensure your device is secure.

- Only share your member ID details with trusted individuals and organisations when necessary.

- If you believe your member ID has been compromised, contact your insurance provider immediately.

- It is also a good idea to familiarise yourself with the different parts of your member ID card, so you know exactly what information it contains and can better protect your personal details.

Most insurance companies allow you to present your card in physical or digital form. However, in some cases, having only a digital copy may cause issues. For example, if you are taken to the ER in an ambulance, doctors will check for your physical insurance card. If they do not find it, you may receive bills that you will have to retroactively sort out with the hospital and insurance company, which can be time-consuming. Additionally, some clinics' IT systems may require them to scan an actual card, and they may refuse to treat you or bill your insurance if they cannot do so. Therefore, it is generally a good idea to carry a physical card with you, just in case.

Private Insurance: How Many Americans Are Enrolled?

You may want to see also

What happens if I lose my member ID?

A member ID card is an important piece of documentation that proves you have health insurance. It contains personal information such as your name and policy number, as well as details about your insurance plan, including the type of coverage, copay information, and contact information for your insurance provider.

If you lose your member ID card, the first thing you should do is contact your insurance provider. They will be able to help you replace your card. You may be able to request a new card by calling the number on your previous card, or by accessing your online account. Some insurance providers also offer mobile apps that allow you to access a digital version of your member ID card.

It is important to treat your member ID card with the same level of care as you would a credit card. Your member ID card contains sensitive information that could potentially be used for fraud or identity theft if it falls into the wrong hands. Therefore, it is recommended to keep your card secure and only allow trusted individuals, such as your physician or pharmacist, to handle it.

Additionally, be cautious about providing your member ID information over the phone. Do not disclose personal information, such as your member ID number, credit card details, or other sensitive data, unless you initiated the phone call. By following these precautions, you can help protect yourself from potential fraud or identity theft.

In summary, losing your member ID card can be inconvenient, but it is not the end of the world. Contact your insurance provider to request a replacement card, and consider taking advantage of digital alternatives or mobile apps that provide secure access to your member ID information. Remember to treat your member ID card and its associated details with care to prevent unauthorized use or fraud.

ConnectiCare Private Insurance: What You Need to Know

You may want to see also

Frequently asked questions

A member ID is a unique identifier assigned to you by your insurance company. It is used to track your medical claims and ensure that you receive the benefits and coverage that you are entitled to.

Yes, your insurance member ID is private and should be kept confidential. Treat your member ID card as you would a credit card.

Never provide your member ID number or personal information on a phone call that you did not initiate. Do not let anyone except your physician's office or pharmacy handle your member ID card.