The cost of car insurance varies significantly from state to state. While the national average cost of car insurance is $1,543 per year, residents of Maine pay an average of $949, whereas residents of Louisiana pay an average of $2,734. This is because insurance companies consider many factors when setting car insurance rates, including age, driving history, type of vehicle, location, and local laws and population density. For example, urban areas tend to have higher insurance rates than rural areas due to increased congestion and higher rates of car break-ins, theft, and vandalism. Additionally, states with a history of severe weather, such as hurricanes or flooding, tend to have higher insurance rates to account for weather-related claims.

| Characteristics | Values |

|---|---|

| States with the cheapest car insurance | Maine, Idaho, Ohio, North Carolina, Iowa, Vermont, Hawaii, Tennessee, Indiana, Wisconsin |

| States with the most expensive car insurance | New York, Florida, Louisiana, Pennsylvania, Maryland, Michigan, Nevada, Delaware, Kentucky, Missouri |

| Average annual car insurance cost in North Carolina | $1,673 |

| Average annual car insurance cost in Massachusetts | N/A |

What You'll Learn

No-fault states vs. fault states

No-fault states and fault states have different ways of handling insurance claims after a car accident. In a no-fault state, each driver's insurance company covers their own medical expenses and lost wages after an accident, regardless of who is at fault. This system limits the ability to sue the other driver, except in cases of severe injury or significant damage. No-fault insurance is often called Personal Injury Protection (PIP).

On the other hand, in a fault state (also called a tort state), the driver found to be at fault in an accident is responsible for covering the damages and injuries of the other party. This system allows the injured party to sue the at-fault driver for compensation beyond what insurance covers. The at-fault driver's insurance should pay for the other driver's medical bills and vehicle repairs.

There are currently 12 no-fault states in the US, including Kentucky, New Jersey, and Pennsylvania, which offer a choice of no-fault or some ability to sue.

In terms of cost, no-fault states generally have higher insurance costs compared to fault states. This is because claims are paid regardless of fault, which can encourage fraud and exaggerated injuries, leading to insurance companies charging more.

Insuring Your Child's Partner

You may want to see also

Population density

North Carolina has a relatively high population density, ranking as the 15th most densely populated state in the US. The state's total surface area is 53,819 square miles, with an average of 196 people per square mile. The population density of North Carolina was 209 in 2018.

In contrast, Massachusetts is a highly urbanized state with a higher population density than North Carolina. As of 2020, Massachusetts had a population of 7.02 million people and a total area of 10,555 square miles, resulting in a population density of 665 people per square mile.

The higher population density in Massachusetts likely contributes to higher auto insurance rates in the state compared to North Carolina. Urban areas tend to have higher rates of accidents, theft, and vandalism, which are risk factors considered by insurance companies when setting rates.

Student Discounts: Farmer Auto Insurance Savings

You may want to see also

Weather

North Carolina experiences a temperate climate with hot summers and mild winters. The state is susceptible to severe weather conditions, including hurricanes, tropical storms, heavy rainfall, and flooding. These weather events can impact car insurance rates in the state.

For instance, in Raleigh, North Carolina, the weather varies from sunny to cloudy days, with occasional showers and thunderstorms. The temperatures range from highs of 82°F to 85°F and lows of 55°F to 64°F. The winds are generally light and variable, with speeds of 5 to 10 mph.

On the other hand, Massachusetts, including cities like Boston, experiences a different climate. The state has a humid continental climate with cold, snowy winters and mild to warm summers. Winters can be harsh, with frequent snowstorms and blizzards, while summers are typically pleasant with occasional heatwaves.

The variation in weather patterns between North Carolina and Massachusetts can influence auto insurance rates in these states. Severe weather conditions in North Carolina, such as hurricanes and flooding, may result in higher insurance premiums compared to Massachusetts, where winters are the primary source of weather-related concerns.

Additionally, population density and urban versus rural settings also play a role in insurance rates. North Carolina has a mix of urban and rural areas, while Massachusetts is predominantly urban, with higher population density. This can further impact insurance rates, as urban areas tend to have higher accident rates and vehicle-related crimes, leading to increased insurance costs.

Ho4 Home Insurance: Your Secret Weapon for Auto Accident Coverage

You may want to see also

Number of uninsured drivers

While the most recent data is from 2022, North Carolina and Massachusetts have both historically been among the US states with the lowest numbers of uninsured drivers.

In 2022, about 14% of US motorists were uninsured, or about one in seven drivers. This is an increase from 2017, when 11.6% of US motorists were uninsured. The percentage of uninsured drivers varies from state to state, ranging from 5.9% in Wyoming to 25.2% in the District of Columbia.

In 2015, North Carolina and Massachusetts were among the states with the lowest number of uninsured drivers, with North Carolina's rate of uninsured drivers at 6.5%. However, while Massachusetts had one of the lowest recorded numbers of uninsured drivers, it saw the largest percentage point increase over a 10-year period.

North Carolina law requires every driver to carry a minimum amount of insurance to ensure victims of car accidents can be compensated. Unfortunately, some North Carolina drivers choose to drive without insurance or with insufficient insurance, leading to underinsured drivers. Underinsured drivers may not have high enough insurance policy limits to cover all the costs of damages for injured parties.

Auto Insurance in Utah: What's the Cost?

You may want to see also

Vehicle theft

Auto insurance rates vary drastically from state to state, influenced by factors such as population density, traffic congestion, weather conditions, and crime rates. North Carolina (NC) and Massachusetts (MA) are no exceptions to this, with their respective sets of factors influencing insurance costs. While it is challenging to directly compare insurance rates between NC and MA due to different calculation methods, we can examine vehicle theft rates and related laws in both states to understand this aspect of insurance pricing.

In North Carolina, stealing a motor vehicle or committing vehicle-related crimes is a severe offense that often leads to felony charges and lengthy prison sentences. The state's larceny laws classify these crimes based on the value of the stolen property. If the stolen vehicle is worth $1,000 or less, the crime is a Class 1 misdemeanor, while a value exceeding $1,000 results in a Class H felony. Additionally, under North Carolina law, G.S. § 20-106, possessing, receiving, or transferring a vehicle with the knowledge that it is stolen is also a Class H felony.

Other vehicle-related crimes in the state include larceny of a motor vehicle part, joyriding, larceny of motor fuel, and carjacking, each carrying its own set of penalties.

Massachusetts has also experienced vehicle-related crimes, with a recent report identifying the Honda Accord as the most frequently stolen car model in the state. This is followed by similar fuel-efficient sedans such as the Honda Civic and Toyota Camry. However, car thefts in Massachusetts have been on a downward trend, with a nearly 40% decrease since 2011, according to the report.

The state has laws in place, such as 211 CMR 75.00, which govern the reporting of motor vehicle thefts to prevent fraudulent insurance claims and collaborate with law enforcement to combat vehicle theft.

In summary, while vehicle theft is a factor considered in insurance pricing, a comprehensive comparison of insurance rates between NC and MA would require analyzing various other factors and calculation methods specific to each state.

Auto Repair Shop Insurance: Navigating the Legal Maze

You may want to see also

Frequently asked questions

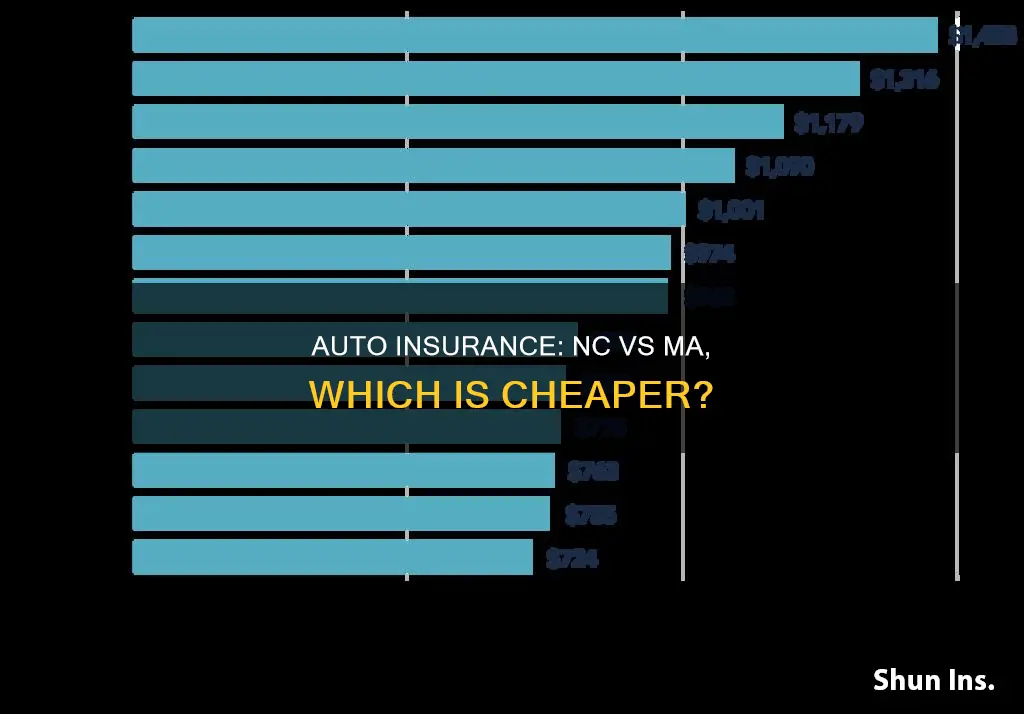

Auto insurance is generally cheaper in North Carolina than in Massachusetts. The average annual rate for car insurance in North Carolina is $1,165, while in Massachusetts, it is influenced by several factors, including age and gender.

The cost of auto insurance in North Carolina is influenced by factors such as driving record, age, marital status, location, and vehicle type. Maintaining a clean driving record, choosing higher deductibles, and comparing quotes from multiple companies can help keep costs low.

The minimum auto insurance requirements in North Carolina include liability coverage for bodily injury and property damage. The specific limits are $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

The cost of auto insurance in Massachusetts is generally higher than in many other states. Massachusetts is not a no-fault state, and factors such as age, gender, driving record, and credit score can influence the cost of auto insurance.