Life insurance is an important consideration when it comes to estate planning. It can provide financial support and security for loved ones after your death, but it's also important to understand how it fits into your estate and the potential tax implications. Term life insurance, which is the focus of this discussion, offers a cost-effective way to provide a lump sum to dependents, making it a popular choice for young, healthy individuals with families.

When it comes to estates, life insurance proceeds typically bypass the estate and go directly to the named beneficiaries. However, if there are no beneficiaries or if the beneficiaries die before the insured, the proceeds may become part of the estate assets. In such cases, the distribution of the death benefit will follow the instructions in the will or state laws, potentially incurring taxes if the estate exceeds certain thresholds.

To avoid probate and potential taxation issues, it is advisable to remove term life insurance policies from your estate by transferring ownership to a separate entity, often a trust. This strategy helps maximize the impact of your assets on your loved ones after your death. Additionally, careful consideration of beneficiaries is crucial to ensure your wishes are fulfilled and taxes are minimized.

| Characteristics | Values |

|---|---|

| Taxation | Term life insurance proceeds are not typically taxable for beneficiaries. However, if the estate exceeds certain tax thresholds, proceeds may incur taxes. |

| Probate | Term life insurance proceeds usually bypass the probate process if there are named beneficiaries. If there are no beneficiaries, the proceeds may become part of the estate assets and go through probate. |

| Payout | Term life insurance guarantees a payout to beneficiaries if the insured person dies during the specified term. There is no payout if the policy expires before the insured person's death. |

| Cost | Term life insurance is usually the least costly type of life insurance available because it offers a death benefit for a restricted time and doesn't have a cash value component. |

| Renewal | Term life insurance policies can usually be renewed for an additional term, but the premiums will be recalculated based on the insured person's age at the time of renewal. |

| Coverage | Term life insurance provides substantial coverage at a low cost, making it ideal for people who want protection at a lower price. |

| Age Limit | Insurance companies set a maximum age limit for term life insurance policies, typically between 80 and 90 years old. |

| Ownership | Death benefits from term life insurance are generally included in the estate of the owner of the policy, regardless of who is paying the premiums or who is named as the beneficiary. |

| Beneficiaries | Term life insurance allows for the designation of primary and contingent beneficiaries, ensuring that the payout goes to the intended recipients. |

| Cash Value | Term life insurance has no cash value component and thus, no savings or investment benefits. |

| Application Process | Term life insurance companies may require a medical exam and inquire about driving records, health, medications, smoking status, occupation, hobbies, and family history. |

What You'll Learn

Life insurance proceeds and beneficiaries

Life insurance is an important part of financial planning, especially for those who want to ensure their loved ones are provided for after their death. When purchasing life insurance, it is crucial to understand how it works and how your beneficiaries can receive the proceeds of your policy.

Choosing a beneficiary

When buying life insurance, you will need to designate one or more beneficiaries. These are the people or entities that will receive the death benefit from your policy when you pass away. A beneficiary can be a legal guardian of a minor, a charitable organization, or any other person or entity. You can choose to name a single beneficiary or a primary beneficiary and one or more contingent beneficiaries. A contingent beneficiary will receive the death benefit if the primary beneficiary dies or is unable to be located. It is also possible to split the benefit among multiple beneficiaries.

Keeping beneficiary information up to date

It is important to keep your beneficiary designations up to date, especially if your life circumstances change (e.g. marriage, divorce, birth of children). You may change the beneficiaries on a life insurance policy at any time, although the process may vary depending on your employer or financial institution. An easy way to remember to update your beneficiaries is to do so during your employer's annual benefits enrollment or set a date each year to review your accounts and policies.

Payout options

There are several ways a beneficiary may receive a life insurance payout, including lump-sum payments, installment payments, annuities, and retained asset accounts. Lump-sum payments are the most common and traditional method, but modern policies offer more flexibility with options such as installment payments or annuities, where the proceeds and interest are paid out over the life of the beneficiary. Checkbook controls and retained asset accounts are other options that allow the beneficiary to access the funds.

Taxes and probate

Life insurance proceeds are generally not taxable for the beneficiary, but any interest received is taxable and should be reported. If the policy was transferred to the beneficiary for cash or other valuable consideration, the exclusion for proceeds may be limited.

If you do not name a beneficiary, the payout may be held in probate, which can be a lengthy and complicated process. To avoid this, it is important to designate beneficiaries for your policies and accounts.

SSDI and Life Insurance: Can You Have Both?

You may want to see also

Life insurance and estate planning

Life insurance plays a vital role in estate planning. It ensures that your beneficiaries receive a lump sum payment upon your death. This money can be used to pay off any debts or taxes and can also be a source of financial support for your loved ones. When considering life insurance as part of your estate plan, it is important to understand the different types of life insurance available and how they can impact your estate.

Types of Life Insurance

There are two main types of life insurance: term insurance and whole or universal life insurance. Term insurance is purchased on an annual basis and typically becomes more expensive as the insured person ages. It only provides a death benefit, with no cash value accumulation. Whole or universal life insurance, on the other hand, combines insurance protection with a savings plan. This means that the policyholder can borrow against the cash value of the policy or withdraw it if needed. As a result, premium payments for whole life insurance are generally higher than those for term insurance.

Life Insurance and Estate Taxes

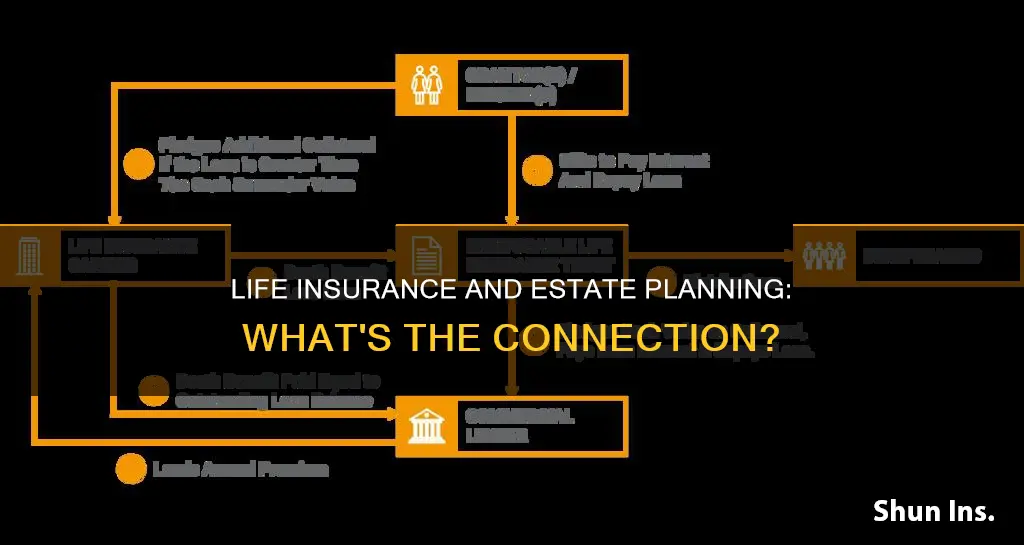

One important consideration when including life insurance in your estate plan is the potential impact on estate taxes. If the death benefit from a life insurance policy is included in your estate, it could increase the value of your estate to a level that triggers federal or state taxation. This, in turn, could result in your beneficiaries receiving less money after taxes. To avoid this, you can transfer ownership of the life insurance policy to a separate entity, such as an irrevocable life insurance trust (ILIT). By doing so, the death benefit is not considered part of your estate, and your beneficiaries can receive the full amount without incurring heavy taxes.

Beneficiary Designations

Another key aspect of life insurance and estate planning is designating beneficiaries. It is important to regularly review and update your beneficiary designations to ensure that the death benefit goes to the intended recipients. If there are no living beneficiaries named on the policy, the death benefit may become part of your estate assets and be subject to probate. By keeping your beneficiary designations up to date, you can help ensure that the life insurance proceeds bypass your estate and go directly to your beneficiaries, providing them with immediate financial support.

Life Insurance and Probate

In addition to estate taxes, life insurance can also be impacted by the probate process, which can be lengthy and costly. By placing your life insurance policy in a trust, you can avoid probate altogether. The trust owns the policy, and the death benefit is distributed according to the trust's bylaws, bypassing the estate entirely. This not only simplifies the distribution of assets but also ensures that your beneficiaries receive the money much faster than if it went through probate.

In conclusion, life insurance is a crucial component of estate planning. By understanding the different types of life insurance, the impact on estate taxes, the importance of beneficiary designations, and the role of trusts, you can effectively utilize life insurance to support your legacy and provide for your loved ones after your passing.

Lumico Life Insurance: AmBest's Top-Rated Coverage Options

You may want to see also

Life insurance, death, and taxes

Life insurance is a crucial aspect of financial planning, providing financial security for loved ones and supporting your legacy after death. But what happens to your life insurance policy when you pass away? Is it part of your estate, and how are the proceeds taxed? These are important questions to consider when planning your estate.

Whether or not life insurance becomes part of your estate depends on the beneficiaries named in the policy. Typically, life insurance proceeds bypass the estate and go directly to the named beneficiaries. However, if there are no beneficiaries or the named beneficiaries have predeceased the insured, the proceeds may become part of the estate assets.

Life Insurance and Taxes

When life insurance proceeds go directly to named beneficiaries, they are usually tax-free and do not incur income taxes for the beneficiaries. However, if the proceeds become part of the estate, they may be subject to estate taxes if the estate exceeds certain tax thresholds.

To avoid estate taxes, it is generally advisable to remove your life insurance policy from your estate by transferring ownership to a separate entity, often a trust. An irrevocable life insurance trust (ILIT) is commonly used for this purpose, as it keeps the insurance policy and its payout separate from the estate, reducing the taxable value of the estate.

Additionally, careful consideration should be given to beneficiary designations. In some cases, naming your spouse as the owner and beneficiary of the policy, while listing your children as secondary beneficiaries, can help avoid taxation issues.

Types of Life Insurance

There are two main types of life insurance: term insurance and whole or universal life insurance. Term insurance provides coverage for a specified term, such as 10 or 20 years, and has no value other than the guaranteed death benefit. Whole or universal life insurance, on the other hand, combines insurance protection with a savings plan, allowing the policyholder to build cash value that can be borrowed or withdrawn.

Life insurance plays a vital role in estate planning, providing financial support for loved ones and helping to preserve your legacy. By understanding how life insurance interacts with your estate and taxes, you can make informed decisions to ensure your wishes are carried out and maximize the benefits for your beneficiaries.

Life Insurance Options for People with PTSD

You may want to see also

Life insurance and probate

Life insurance is generally seen as a "safe" investment, one that won't result in surprising taxes or unforeseen deductions. However, when it comes to an estate, it's important to understand how best to use your life insurance policy to achieve your goals.

An up-to-date life insurance policy does not have to go through probate. Because a beneficiary is designated within the policy, the life insurance is paid out directly to the beneficiary upon the death of the policy owner.

However, if the beneficiary listed on the policy is deceased, unable to be located, or if there is no listed beneficiary, the policy must go through probate so that the court can determine who can legally claim the benefit. If the beneficiary is a minor, the court may need to appoint a guardian, a process that would require probate even if the policy itself does not.

When a life insurance policy has to go through probate, there are administrative challenges. But there are bigger reasons to keep that policy out of the probate process. As we described in the probate steps above, debts and taxes must be paid before assets are distributed to heirs. So if a life insurance policy goes through the probate process, it will be used first to pay any remaining debts or taxes before the remainder gets distributed to any intended beneficiary.

Conversely, the funds in a life insurance policy that flows directly to a designated beneficiary are not readily available to estate creditors — a good reason to make sure a policy doesn't go through probate.

How to avoid probate through beneficiary designations

To avoid probate, it's important to properly designate beneficiaries. Here are some guidelines:

- A beneficiary must be alive. One of the most common mistakes people make is failing to update a beneficiary designation on a life insurance policy after the death of a spouse.

- A beneficiary must be over the age of 18. If the listed beneficiary is a minor, the court would need to name a guardian to manage the benefits until the beneficiary reaches the age of majority. There is a way to get around this — by naming a trust created for the minor as the beneficiary of the policy.

- A beneficiary designation cannot be changed through a will. For instance, if Joe named his sister as his life insurance beneficiary and later wrote a will stating that all of his assets should go to his girlfriend, the proceeds of the life insurance policy will still go to his sister because beneficiary designations are completely separate from wills.

- Designating a contingent (alternate) beneficiary provides protection. Listing a second option reduces the possibility of a policy having to go through probate because the intended beneficiary is unavailable due to death, minor status, or failure to be reached.

- Updating policies after divorce helps prevent unintended consequences. If a divorced individual fails to change their beneficiary designation prior to their death, the proceeds of their life insurance policy could end up going to their ex-spouse. In some states, divorce triggers an automatic revocation of the ex-spouse as a designated beneficiary on a life insurance policy. If that revocation occurs and the owner of the policy does not update the designation, the policy will be left without a beneficiary, and the policy proceeds may have to go through probate.

If the owner of a life insurance policy dies and there is no available beneficiary to receive the death benefit, the policy must go through probate as part of the deceased's estate. As part of the decedent's estate, these funds become subject to payment of taxes and debts, if they remain, or for distribution to heirs.

Some states exempt a portion of the life insurance benefit from debt or tax collection, but the amounts are generally quite low.

Critical Illness Coverage: Symetra Life Insurance Benefits Explored

You may want to see also

Life insurance and trusts

Trusts are a critical component of estate planning, helping to protect assets and the financial future of loved ones. Life insurance trusts are commonly used by individuals with a high net worth, as well as parents who want to structure benefit payments to their children.

A life insurance trust is a legal agreement that allows a third party, known as a trustee, to manage the death benefit from a life insurance policy. The trustee ensures that the policy's death benefit is distributed to beneficiaries according to the rules set out in the trust agreement.

There are two types of life insurance trusts:

Irrevocable Life Insurance Trusts (ILIT)

Irrevocable life insurance trusts cannot be changed or cancelled once created. This means that any assets placed within the trust will remain within it, including the cash value of a whole life policy. Despite these restrictions, irrevocable trusts are a common choice among high-net-worth individuals whose estates exceed the federal estate tax threshold. Since the policy is owned by the trust and not the insured, the proceeds are not subject to federal estate tax.

Revocable Life Insurance Trusts

Revocable life insurance trusts can be modified or cancelled. These trusts are useful for parents who want to control how their children receive their inheritance. For example, instead of giving a 16-year-old child a lump sum, a trust can disburse the funds in instalments over time. Revocable trusts are also a good option for those with a special-needs child, as the trust can hold funds for the child and define when and how the money is spent.

Funding a Life Insurance Trust

Funding a life insurance trust involves transferring ownership of a life insurance policy to the trust. This can be done by purchasing a new policy and naming the trust as the owner and beneficiary, or by transferring an existing policy to the trust. While it is technically possible to create a life insurance trust with either a term or whole life policy, whole life insurance is more commonly used. This is because it has a clearly defined and guaranteed death benefit. Term policies may expire, leaving the trust unfunded, while universal policies may vary in value over time, making it difficult to anticipate how much funding the trust will have.

Tax Implications of Life Insurance Trusts

Life insurance trusts can have significant tax implications during the grantor's lifetime and after their death. During the grantor's lifetime, the trust may be subject to income tax on the earnings of the life insurance policy. If the grantor transfers assets to the trust, those transfers may be subject to gift tax. After the grantor's death, the death benefit of the policy may be subject to estate tax. However, if the trust is properly structured, the death benefit can be excluded from the grantor's estate for tax purposes, reducing tax liabilities.

DACA Recipients: Life Insurance Options and Eligibility

You may want to see also

Frequently asked questions

Term life insurance provides a death benefit for a specified period of time that pays the policyholder's beneficiaries. Once the term expires, the policyholder can either renew it for another term, possibly convert it to permanent coverage, or allow the term life insurance policy to lapse.

When you buy a term life insurance policy, the insurance company determines the premium based on the policy's value and factors such as age, gender, and health. If you die during the policy term, the insurer will pay the policy's face value to your beneficiaries.

Term life insurance is attractive to young people with children as they can obtain substantial coverage for a low cost. These policies are also well-suited for people with growing families, as they can maintain the coverage needed until their children reach adulthood and become self-sufficient.