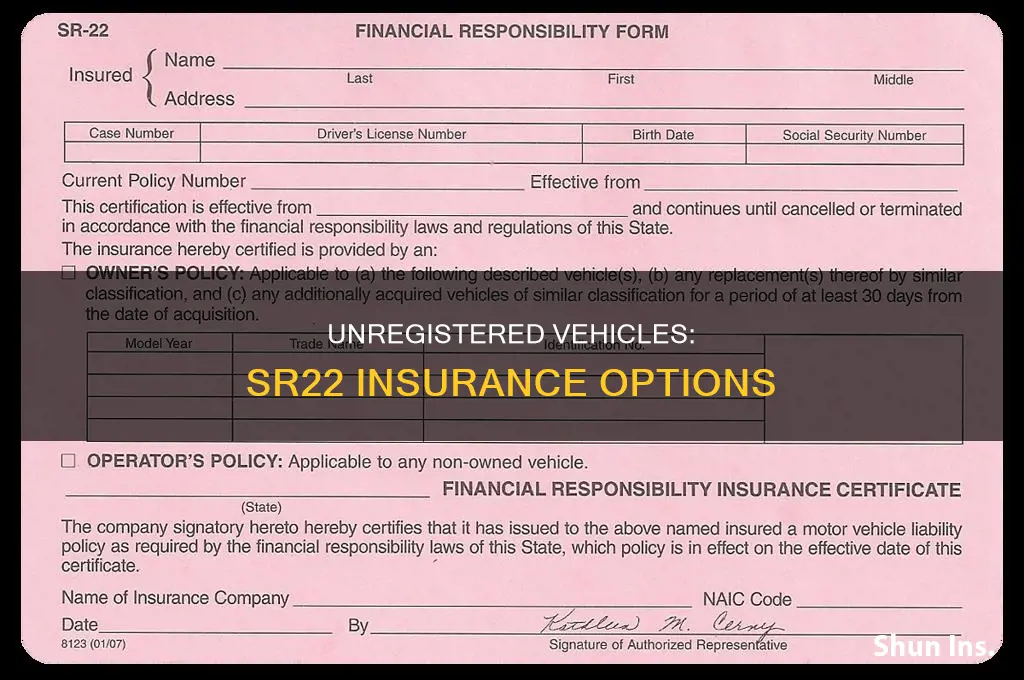

SR-22 insurance is a certificate of financial responsibility that confirms a driver has sufficient car insurance to meet their state's minimum coverage requirements. It is often required after serious driving violations, such as driving under the influence (DUI), driving without insurance, or causing an accident as an uninsured driver. If you don't own a vehicle but are required to carry SR-22 insurance, you can purchase a non-owner SR-22 insurance policy. This type of policy is designed for high-risk drivers who need to meet their state's SR-22 requirements but do not own a car. It provides liability coverage that meets state mandates and can cover costs if the driver gets into an accident in a borrowed or rented vehicle.

| Characteristics | Values |

|---|---|

| What is SR22 insurance? | A "certificate of insurability" for high-risk drivers, filed by insurance companies to certify that the driver is carrying the state minimum coverage required for liability insurance. |

| Who needs SR22 insurance? | Drivers who have committed serious traffic offenses such as DUIs, DWIs, hit-and-runs, or driving without insurance or a valid license. |

| How to get SR22 insurance? | Contact your insurance company to file the SR22 form with your state's Department of Motor Vehicles. |

| Cost of SR22 insurance | The cost of filing an SR22 form is generally $25, though it can vary by state and insurer. |

| Non-owner SR22 insurance | For people who need to meet their state's SR22 requirements but do not own a car. This includes drivers who borrow a car or use a rental. |

| Cost of non-owner SR22 insurance | Ranges from $86 with Auto-Owners to $1,756 with Sentry Insurance, according to a 2022 analysis. |

What You'll Learn

What is non-owner SR22 insurance?

Non-owner SR22 insurance is a type of car insurance for drivers who do not own a vehicle but are required to file an SR22 form with their state. An SR22 form is often required after more serious driving infractions, such as driving without insurance, driving under the influence (DUI), or driving while intoxicated (DWI). It is a form that confirms a driver has sufficient car insurance to meet their state's minimum coverage requirements.

If you are required to carry an SR22 form but don't own a car, you must purchase a non-owner SR22 insurance policy. This type of policy is designed for drivers who don't own a vehicle but are mandated by the state to file an SR22 form as verification of their financial responsibility. Even if you don't own a car, most states still require you to file an SR22 after a major moving violation, such as reckless driving or a DUI.

A non-owner SR22 insurance policy will typically include bodily injury liability and property damage liability coverage. It is important to note that a non-owner policy does not offer physical damage coverage, so if you drive a car and damage it, that won't be covered by your non-owner policy.

To be eligible for a non-owner SR22 insurance policy, you must not own a vehicle, not have access to a vehicle owned by someone in your household, and not be required to have an ignition interlock breath device.

The cost of filing an SR22 form is generally between $15 and $25, although it can vary by state and insurer. The cost of a non-owner SR22 insurance policy also varies but is typically less expensive than a standard car insurance policy.

Leasing a Vehicle: Is Insurance Included?

You may want to see also

How to get non-owner SR22 insurance

An SR-22 is a form that confirms a driver has sufficient car insurance to meet their state's coverage requirements. It is often required after serious driving infractions like driving without insurance or a valid driver's license, or driving under the influence (DUI) or while intoxicated (DWI). If you are required to carry an SR-22 but don't own a car, you must buy a non-owner SR-22 insurance policy.

Check with your insurer

Some insurers don't offer SR-22 filings for non-owner or standard car insurance policies, so it's important to check with your insurer beforehand.

Get quotes from multiple companies

The best way to get cheap SR-22 non-owner insurance quotes is to compare car insurance quotes from multiple companies. Prices vary from company to company, so it's worth shopping around. Get at least three price quotes from national and regional carriers. You can obtain multiple quotes via online comparison tools, on the phone directly from insurers, or through a local insurance agent that represents a single company or multiple insurers.

Ask if the company files SR-22 forms

If you are buying a new auto insurance policy, ask if the company files SR-22 forms before you spend time getting a quote. Even though you'll pay more for coverage attached to an SR-22, you can still save by comparison shopping.

Buy a new policy

If you don't have auto insurance or your current insurer doesn't offer SR-22s, then you'll need to buy a new policy. Since many insurance companies don't offer coverage for SR-22s, it's a good idea to let potential insurers know upfront that you require an SR-22.

File the SR-22 form

Once you have obtained at least the state-mandated coverages as part of your non-owner car insurance policy, the insurance company will file an SR-22 form on your behalf with your state's department of motor vehicles.

Maintain coverage

You must maintain the related insurance coverage for the state-mandated period, which is typically three years but can vary. If you fail to maintain coverage during that time, you'll need to re-file the SR-22 form and the clock will reset, requiring you to carry the form on your policy for a longer period.

Vehicle Insurance Accounting in Tally

You may want to see also

How much does SR22 insurance cost?

The cost of SR22 insurance varies depending on the state and insurer. The cost of filing an SR22 form is generally $25, but it can differ depending on the state and insurer. The cost of a non-owner car insurance policy also varies depending on the insurer, but it is typically less expensive than a standard car insurance policy.

According to WalletHub, non-owner policies with an SR22 cost between $15 and $25, or about 3% more than a standard non-owner policy. The exact cost of a non-owner SR22 policy depends on where you live and how much insurance the court requires you to carry. The Insurance Information Institute reports that an SR-22 certificate requirement can increase your average annual auto insurance premiums by a minimum of 50% to a maximum of 400% above your current rate, depending on the severity of the infraction and the risk assessment by your insurer.

In California, SR22 insurance costs $741 per year on average, plus a filing fee of $15 to $25 for the SR22 form. The cheapest SR22 insurance in California is offered by Mercury, at $796 per year. The average cost of SR22 insurance after a DUI in California is $1,592, meaning rates can nearly triple after a DUI.

Insurance Revoked: DMV Notified?

You may want to see also

What are the liability requirements for drivers in Illinois?

In Illinois, drivers are required to carry liability insurance to register or operate a vehicle. This is to ensure that they can cover the costs of any accidents they may cause, including property damage and injuries to other people. This is known as a "fault"-based insurance system, where the driver deemed responsible for a crash has to pay for the resulting damages.

The minimum liability coverage requirements in the state are:

- $25,000 for bodily injury coverage for each injured person

- $50,000 in total bodily injury coverage per accident

- $20,000 in property damage coverage per accident

Uninsured motorist coverage is also included in liability insurance policies at the legal minimum requirements. This covers any losses incurred in an accident with an at-fault driver who is uninsured.

Drivers in Illinois must carry proof of insurance in their vehicles. Failure to do so, or driving without insurance, can result in stiff penalties, including fines, license suspension, and reinstatement fees.

Transferring Car Insurance: MD to Other States

You may want to see also

How American Auto Insurance can help

If you need SR-22 insurance but don't own a car, American Auto Insurance can help. We specialize in SR-22 insurance and understand that getting back on the road is essential, so we offer instant proof of coverage and file your forms electronically. We also offer an easy application process that doesn't require a credit check.

Here's how to get non-owner SR-22 insurance:

- Receive notification from your state that you need this type of insurance.

- Ensure you meet the standard prerequisites: you don't currently own a vehicle, you don't live with someone who owns a vehicle you can access, you don't need an ignition interlock device, and you have a current and valid driver's license.

- Complete the SR-22 form and ensure that the insurance policy you want meets your state's minimum requirements.

- Have your insurance company file this form with your state to prove that you have the minimum required coverage.

At American Auto Insurance, we can deliver all your state's requirements and even include roadside assistance. We understand that being able to drive is important, so we offer locations throughout the state to help you in person, over the phone, or online. We'll also help you reinstate your driver's license and car registration if needed.

Insuring Vehicles: What About the Driver?

You may want to see also

Frequently asked questions

An SR-22 form is a document that confirms a driver has sufficient car insurance to meet their state's minimum coverage requirements. It is often required after serious driving infractions like driving without insurance or a valid driver's license.

Non-owner SR-22 insurance is a type of car insurance for individuals who do not own a car but need car insurance to drive a vehicle. This usually involves high-risk drivers, such as those with serious moving violations, who want to be able to drive a vehicle.

To get non-owner SR-22 insurance, you must first meet certain conditions, including having a valid driver's license and not owning a vehicle. You can then shop for a non-owner policy and inform the insurance company that you need to file a non-owner SR-22.