Many people are curious about the insurance options available for their Total Wireless phones. With the rise of mobile device usage, it's important to understand the coverage and protection one can get for their phones. Total Wireless, a popular mobile network provider, offers various insurance plans to ensure customers can protect their devices from accidental damage, theft, and other unforeseen circumstances. This introduction aims to explore the insurance options provided by Total Wireless, helping consumers make informed decisions about safeguarding their phones.

What You'll Learn

- Coverage and Plans: Insurance options for Total Wireless phones, coverage details, and plan comparisons

- Device Protection: Protecting phones from damage with insurance, coverage for repairs or replacements

- Network Reliability: Total Wireless network reliability, insurance benefits for uninterrupted service

- Customer Support: Insurance claims process, customer support for Total Wireless phone insurance

- Cost Comparison: Comparing insurance costs, value of coverage for Total Wireless phones

Coverage and Plans: Insurance options for Total Wireless phones, coverage details, and plan comparisons

Total Wireless, a popular mobile network operator, offers a range of plans and devices to its customers, but when it comes to insuring these phones, the options might not be as straightforward as one would hope. While Total Wireless provides a limited warranty for its devices, it does not offer traditional insurance coverage directly through the carrier. This means that if your phone is damaged or lost, you'll need to explore alternative insurance solutions.

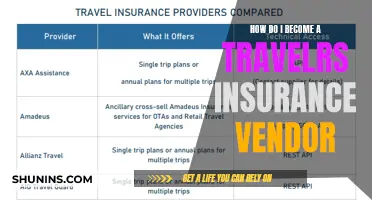

One approach is to consider third-party insurance providers that specialize in mobile device coverage. These companies often work with various carriers, including Total Wireless, to provide extended warranty and insurance plans. When researching these options, it's essential to understand the different types of coverage available. Basic protection plans might include screen repair or replacement, water damage coverage, and theft insurance. More comprehensive policies could offer global coverage, accidental damage insurance, and even trade-in benefits.

Before purchasing any insurance plan, carefully review the terms and conditions to ensure you understand the coverage limits, exclusions, and any potential deductibles. Some policies might require you to file a claim within a specific timeframe, so it's crucial to act promptly if you encounter an issue with your phone. Additionally, compare the costs of different insurance providers to find the best value for your budget.

Another strategy is to consider the built-in warranty offered by Total Wireless. While it may not provide extensive coverage, it can serve as a temporary solution until you decide on a more comprehensive insurance plan. Total Wireless' warranty typically covers manufacturing defects and may include certain repair or replacement options within a specified period. Keep in mind that this warranty might not cover accidental damage or loss, so you'll still need to explore additional insurance options for more extensive protection.

In summary, insuring your Total Wireless phone goes beyond the carrier's limited warranty. Exploring third-party insurance providers and understanding the various coverage options available can help you make an informed decision. By comparing plans and considering your specific needs, you can ensure that your investment in a Total Wireless device is protected against potential risks and damages.

Insurance: Security or Not?

You may want to see also

Device Protection: Protecting phones from damage with insurance, coverage for repairs or replacements

Device Protection: Safeguarding Your Phones with Insurance

In today's fast-paced world, our smartphones have become indispensable tools, often serving as our primary means of communication, information access, and personal expression. However, the constant use and exposure to various environments make them susceptible to damage, from accidental drops and spills to liquid accidents and screen cracks. This is where device protection insurance comes into play, offering a safety net for your valuable phones.

When considering insurance for your Total Wireless phone, it's essential to understand the coverage options available. Many insurance providers offer plans specifically tailored for mobile devices, providing comprehensive protection against various risks. These plans typically include coverage for repairs or replacements due to accidental damage, theft, or malfunction. By enrolling in such insurance, you gain peace of mind, knowing that your phone is protected against unforeseen circumstances.

The process of filing a claim for phone insurance is generally straightforward. If your device sustains damage, you can initiate the claim by contacting your insurance provider and providing the necessary details. This may involve submitting photos or videos of the damaged phone, along with a description of the incident. The insurance company will then assess the claim, and if approved, they will guide you through the repair or replacement process, ensuring minimal inconvenience to you.

One of the key advantages of device protection insurance is the cost-effectiveness of repairs. Without insurance, fixing a damaged phone can be expensive, especially for high-end models. Insurance plans often have negotiated rates with repair centers, allowing them to offer more affordable solutions. This ensures that you can get your phone back to full functionality without incurring substantial out-of-pocket expenses.

Moreover, insurance coverage for phones extends beyond accidental damage. Many policies include protection against theft, providing benefits in case your device is lost or stolen. This is particularly valuable in urban areas where theft is a concern. Additionally, some insurance providers offer global coverage, ensuring your phone is protected even when you travel internationally.

In summary, device protection insurance is a valuable investment for anyone who relies on their smartphone for daily tasks. It provides a safety net, ensuring that your phone is safeguarded against various risks. With insurance, you can enjoy the benefits of your device without the constant worry of potential damage or loss. Remember, when choosing an insurance plan, review the terms and conditions to ensure it aligns with your specific needs and provides comprehensive coverage for your Total Wireless phone.

Inheritance: Insurance Income or Not?

You may want to see also

Network Reliability: Total Wireless network reliability, insurance benefits for uninterrupted service

Total Wireless, a popular mobile network operator, offers a range of plans and services to its customers, and understanding their network reliability and insurance options is essential for making informed choices. When it comes to network reliability, Total Wireless has made significant strides in recent years, aiming to provide its users with a seamless and dependable experience. The company has invested in its infrastructure, including 4G LTE and 5G networks, to ensure faster speeds and better coverage across the country. This has resulted in improved call quality, faster data speeds, and reduced instances of dropped connections, making Total Wireless a reliable choice for many consumers.

The network's reliability is further enhanced by its focus on network optimization and continuous monitoring. Total Wireless employs advanced technologies to manage network traffic efficiently, ensuring that users can stay connected even during peak hours. Additionally, the company's proactive approach to addressing network issues means that customers are less likely to experience disruptions, making it a trusted partner for those seeking uninterrupted communication.

In terms of insurance, Total Wireless offers protection plans that provide customers with peace of mind. These plans typically include coverage for device damage, theft, and accidental loss. When a customer purchases a device through Total Wireless, they can opt for an extended warranty or insurance plan, which offers benefits such as device replacement or repair if the phone is damaged or stolen. This insurance coverage can be particularly valuable, especially for those who rely heavily on their phones for work or personal reasons, ensuring that they can quickly get back to using their devices without significant financial burden.

Furthermore, Total Wireless' insurance benefits can provide uninterrupted service in the event of a device malfunction or loss. If a customer's phone is damaged beyond repair or stolen, the insurance plan can cover the cost of a replacement, allowing the user to continue their activities without a significant lapse in connectivity. This is especially important for professionals who need to stay connected for work or individuals who rely on their phones for essential daily tasks.

In summary, Total Wireless has demonstrated a strong commitment to network reliability, ensuring its customers can enjoy a consistent and dependable mobile experience. The company's insurance options further enhance the overall value proposition, providing financial protection and uninterrupted service in case of device-related issues. By offering these insurance benefits, Total Wireless ensures that its customers can stay connected and productive, even when unexpected events occur. This combination of reliable network performance and comprehensive insurance coverage makes Total Wireless an attractive choice for those seeking a trusted mobile network provider.

Insurance Hierarchy: Primary Policy Priority

You may want to see also

Customer Support: Insurance claims process, customer support for Total Wireless phone insurance

The insurance coverage for Total Wireless phones is an essential aspect of owning a device, offering peace of mind and protection against unforeseen circumstances. If you're a Total Wireless customer and have purchased insurance, understanding the claims process is crucial for a seamless experience. Here's a comprehensive guide to help you navigate the insurance claims process and access the support you need.

When it comes to making an insurance claim, the first step is to contact Total Wireless' customer support team. They are dedicated to assisting customers with their insurance-related inquiries. You can reach out via phone, email, or through their online chat service. Provide your personal details, including your name, account number, and the reason for the claim. Be prepared to explain the situation and any relevant information about the device's condition. The support team will guide you through the next steps and may ask for additional documentation.

The insurance claims process typically involves an assessment of the device's damage or loss. Total Wireless may require you to ship your device to their authorized repair center or provide a detailed description of the issue. In some cases, they might request photos or videos to support your claim. It's essential to follow their instructions carefully to ensure a smooth process. Once the assessment is complete, the insurance provider will decide on the course of action, which could include repairs, replacements, or refunds based on the terms of your policy.

Customer support plays a vital role in resolving insurance claims efficiently. Total Wireless aims to provide prompt assistance and keep customers informed throughout the process. They may offer temporary device solutions or financial assistance while your claim is being processed. It's advisable to keep all relevant receipts and documentation related to the purchase and insurance coverage for future reference. The support team can also help with any policy-related questions, ensuring you understand your coverage and the benefits you're entitled to.

Remember, the key to a successful insurance claim is prompt action and clear communication. Total Wireless' customer support team is there to assist you, so don't hesitate to reach out with any concerns. By following the outlined steps and staying informed, you can efficiently navigate the insurance claims process and receive the necessary support for your Total Wireless phone.

Switching Your AIA Insurance Giro Account: A Step-by-Step Guide

You may want to see also

Cost Comparison: Comparing insurance costs, value of coverage for Total Wireless phones

When it comes to insuring your Total Wireless phone, it's important to understand the various options available and how they compare in terms of cost and coverage. Many people opt for insurance to protect their devices, especially since Total Wireless offers a range of phones at different price points. Here's a breakdown of the insurance costs and the value of coverage you can expect.

First, let's consider the different insurance plans offered by Total Wireless. They typically provide two main options: the manufacturer's warranty and third-party insurance. The manufacturer's warranty often covers defects and issues with the phone for a limited time, usually around 12-18 months. However, it generally doesn't cover accidental damage, water damage, or theft. This warranty is usually included with the purchase of the phone and is free, but it may not provide the comprehensive protection you need.

Third-party insurance, on the other hand, can be purchased separately and offers more extensive coverage. These plans often include protection against accidental damage, water damage, theft, and even screen repair. The cost of this insurance varies depending on the plan and the device's value. Typically, you can expect to pay a monthly fee, which can range from $5 to $15 or more, depending on the coverage level and the insurance provider.

Now, let's compare the costs. If you choose the manufacturer's warranty, you won't incur any additional expenses, as it's included in the phone's purchase price. However, this coverage might not be sufficient if you're looking for comprehensive protection. On the other hand, third-party insurance will require an investment, with the monthly fee adding up over time. For instance, a plan covering accidental damage and theft might cost around $10 per month, while a more comprehensive plan could be $15 or more.

The value of the coverage is an essential factor in your decision-making process. Total Wireless phones, especially those in the higher price range, can be expensive to replace or repair. With third-party insurance, you can ensure that your device is protected against unforeseen events, providing peace of mind. The coverage can save you from significant financial burdens, especially if the phone is damaged or stolen. It's a wise investment, especially for those who want to keep their devices in good working condition without the worry of unexpected costs.

In summary, while the manufacturer's warranty is a basic option, third-party insurance provides more comprehensive coverage for your Total Wireless phone. The cost comparison shows that insurance plans do come with an additional expense, but the value of the protection they offer is significant. It's a personal choice, but considering the potential risks and the phone's value, insurance can be a smart decision to safeguard your investment.

United MileagePlus Explorer: Understanding Rental Insurance Benefits and Changes

You may want to see also

Frequently asked questions

Total Wireless offers a device protection plan called Total Protect, which provides insurance coverage for your phone. This plan covers accidental damage, mechanical breakdowns, and theft, ensuring that your device is protected from unforeseen events.

Enrolling in Total Protect is straightforward. You can choose this option when purchasing your phone or enroll online through the Total Wireless website. The plan typically includes a monthly fee, and you can select the level of coverage that suits your needs, such as accidental damage only or a comprehensive plan.

The Total Protect plan covers various issues, including physical damage caused by accidents, mechanical failures, and liquid damage. It also provides protection against theft and loss. However, it's important to review the specific terms and conditions, as certain exclusions may apply, such as damage caused by user negligence or natural disasters.