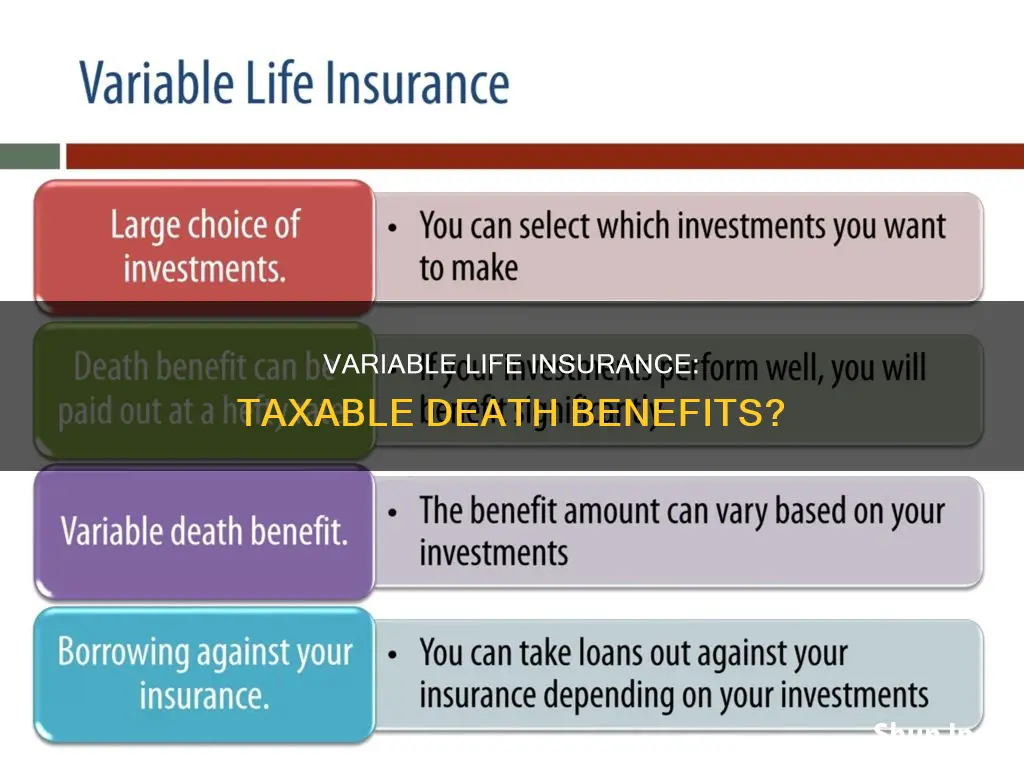

Variable life insurance is a form of permanent life insurance that offers a death benefit to the policyholder's beneficiaries. The cash value of a variable life insurance policy can be invested, offering the potential for greater returns than other types of permanent life insurance. The death benefit is typically not subject to federal income tax. However, there are certain situations where the death benefit may be taxable. For example, if the beneficiary chooses to delay the payout or take it in installments, the interest accrued may be taxed. Understanding the tax implications of variable life insurance is crucial for policyholders and their beneficiaries.

Explore related products

What You'll Learn

- Are life insurance death benefits taxable if you receive them in instalments?

- Are life insurance death benefits taxable if they go into a taxable estate?

- Are life insurance death benefits taxable if they are considered a gift?

- Are life insurance death benefits taxable if you surrender the policy?

- Are life insurance death benefits taxable if you take out a loan?

Are life insurance death benefits taxable if you receive them in instalments?

Life insurance death benefits are generally not taxable, but there are a few exceptions to this rule. One such exception is when the death benefit is paid out in instalments. In this case, any interest that accrues on the unpaid portion of the benefit is considered taxable income. The principal death benefit itself remains untaxed.

Variable universal life insurance is a type of insurance that functions as both insurance and an investment. It offers a variable death benefit, which is based on the performance of an investment account. While the variable death benefit is not taxable to the beneficiary, any gains from investments are eligible for deferred tax as long as they remain within the account until the death benefit is claimed.

It is important to note that the tax implications of life insurance can be complex and may vary depending on the specific circumstances and the type of policy involved. Other factors that can affect the tax status of life insurance benefits include the beneficiary, the structure of the policy, and the presence of any outstanding loans or withdrawals against the policy. Seeking advice from a financial professional or tax advisor can help individuals understand the specific tax implications of their life insurance policies.

Life Insurance Medical Exam: Does a Nurse Visit Your Home?

You may want to see also

Are life insurance death benefits taxable if they go into a taxable estate?

Life insurance death benefits are generally not taxable. However, there are certain circumstances where the proceeds may be subject to taxation. One such scenario is when the beneficiary of the policy is an estate, rather than an individual or entity. In such cases, the death benefit may be included in the taxable estate for estate tax purposes.

According to US tax laws, if the estate is the beneficiary of the insurance proceeds or if the insured person had certain economic ownership rights, known as "incidents of ownership", in the policy at the time of their death or within three years of their death, the death benefit will be included in the taxable estate. Incidents of ownership include rights to change beneficiaries, assign or revoke the policy, pledge the policy as security for a loan, borrow against the policy's cash surrender value, or surrender or cancel the policy.

To avoid this, it is important to ensure that the estate is not designated as the beneficiary of the policy. Additionally, transferring ownership of the policy to another person or entity or creating an irrevocable life insurance trust (ILIT) can help remove the proceeds from the taxable estate. However, it is crucial to act early as the three-year rule applies to both ownership transfers and the establishment of an ILIT.

It is worth noting that while the death benefit itself is typically tax-free, any interest earned on the benefit if it is paid out in installments may be subject to taxation.

Life Insurance: Covering Husbands, Wives, and Their Families

You may want to see also

Are life insurance death benefits taxable if they are considered a gift?

Life insurance death benefits are typically not taxable. However, there are certain circumstances where the proceeds may be taxed. If the beneficiary of the policy is the estate of the insured, the death benefit may be subject to estate taxes. In 2024, the federal estate tax ranges from 18% to 40% for estates over $13.61 million. Additionally, twelve states and the District of Columbia impose an estate tax, with exemption limits ranging from $1 million to $13.61 million.

If the beneficiary of the policy receives the death benefit in installments, any interest accrued on the unpaid portion will be taxable. This is because the principal death benefit is not taxed, but any interest earned is considered taxable income.

If the owner of the policy is different from the insured, the payout to the beneficiary could be considered a taxable gift. This is because the proceeds of the policy may be included in the taxable estate of the owner, and subject to estate taxes. To avoid this, the owner of the policy can transfer ownership to another person or entity, or to an irrevocable life insurance trust (ILIT). However, if the transfer is made within three years of the death of the insured, the proceeds will still be treated as part of the estate of the original owner. Additionally, the value of the policy beyond what was paid for it will be considered a taxable gift.

Variable universal life insurance is a type of permanent life insurance that combines insurance and investment. The death benefit includes a variable amount based on the performance of the investment account, in addition to a guaranteed death benefit. The gains from the investments are eligible for deferred tax as long as they remain in the account until the death benefit is claimed.

Misdemeanor and Life Insurance: Can You Get Licensed?

You may want to see also

Explore related products

Are life insurance death benefits taxable if you surrender the policy?

Life insurance death benefits are typically not taxable, but there are some situations where taxes may be incurred.

If you surrender a life insurance policy, you will receive the cash surrender value, which is the policy's cash value minus any fees. While the principal is not taxed, any cash value accrued will be taxed as income.

- You receive more funds than the policy's cost basis.

- You have outstanding policy loans that exceed the policy's cost basis. The insurance company will deduct the loan amount and any interest from the cash surrender value, and you will owe income tax on the lower surrender value if it exceeds the amount paid in premiums.

It is important to note that there are ways to access the cash value of your life insurance policy without surrendering it, such as borrowing against the cash value or withdrawing from it directly. However, these options may also have tax implications, so it is essential to carefully consider your options and consult with a tax expert and financial advisor before making any decisions.

Life Insurance Exam: Arizona's Classroom Time Requirement

You may want to see also

Are life insurance death benefits taxable if you take out a loan?

Life insurance death benefits are generally not taxable. However, there are certain situations in which they may be taxable.

When a Life Insurance Death Benefit May Be Taxable

If you are a life insurance beneficiary who chooses to receive interest on the death benefit, any interest paid to you may be taxed. This typically occurs when a beneficiary delays the payout or opts for installments instead of a lump sum.

In the case of employer-paid group life insurance, if the death benefit exceeds $50,000, the amount above $50,000 is taxed as income.

If the beneficiary of a life insurance policy is an estate, the death benefit may be subject to estate taxes, which include both federal and state estate taxes.

If you have a policy with cash value, such as whole life insurance, and you take out a loan against it, the loan itself is not taxable as long as the policy remains in force. However, if the policy terminates before the loan is repaid, you may be taxed on the amount of the loan that exceeds your policy basis. The policy basis refers to the portion of the premium that you have paid.

In summary, while life insurance death benefits are typically tax-free, certain situations, such as receiving interest on the benefit or including the benefit as part of an estate, may trigger tax liability. Taking out a loan against the cash value of a life insurance policy generally does not result in taxation as long as the policy remains active.

Best Canadian Life Insurance: Top-Rated Companies and Plans

You may want to see also

Frequently asked questions

If you receive the death benefit in instalments, any interest that accrues is taxable. However, the principal death benefit is still not taxed.

If you are the beneficiary of a life insurance policy, the payout is typically tax-free. However, there are some exceptions. For example, if the beneficiary is an estate, the death benefit may be subject to estate taxes.

Borrowing against the cash value of a variable life insurance policy is generally not taxable. However, if the policy is surrendered or lapses before the loan is repaid, the outstanding loan amount may be considered a withdrawal and may be subject to federal income taxes.