Water service line insurance, also known as water line insurance, is a specialized coverage designed to protect homeowners and property owners from financial losses caused by water damage to their service lines. These lines, which connect a property's water supply to the main municipal water source, can be susceptible to damage from freezing, burst pipes, and other water-related issues. Understanding the necessity of such insurance is crucial for homeowners, as it can provide financial security and peace of mind, ensuring that unexpected water-related incidents do not lead to significant out-of-pocket expenses. This paragraph aims to explore the importance of considering water service line insurance as a proactive measure to safeguard one's home and financial well-being.

| Characteristics | Values |

|---|---|

| Definition | Water service line insurance is a type of coverage that protects homeowners or property owners from financial losses caused by water damage to their service lines, such as water lines, sewers, and drains. |

| Necessity | It is considered necessary for homeowners, especially in areas prone to water-related disasters or with older plumbing systems, as it provides financial protection against potential costly repairs. |

| Coverage | Typically covers damage caused by sudden and accidental water line breaks, leaks, and related issues, including burst pipes, water main breaks, and sewer backups. |

| Benefits | Offers peace of mind, financial security, and protection against potentially high repair costs, especially in cases where water damage is extensive or caused by natural disasters. |

| Exclusions | May have exclusions for pre-existing conditions, regular maintenance issues, or damage caused by neglect or lack of maintenance. |

| Cost | Premiums can vary depending on factors like location, property value, age of the plumbing system, and coverage limits. |

| Availability | Available through various insurance providers, often as an add-on to homeowners' or property insurance policies. |

| Claims Process | Involves filing a claim with the insurance company, providing documentation of the water damage, and following the claims procedure to receive compensation for covered losses. |

| Regional Variations | Coverage and requirements may vary by region, so it's essential to review policies specific to your area. |

| Additional Considerations | Some policies may offer additional benefits like temporary living expenses or coverage for alternative living arrangements during repairs. |

What You'll Learn

- Cost-Benefit Analysis: Evaluate insurance costs against potential water damage repair expenses

- Coverage Gaps: Understand what your homeowner's insurance covers and what it doesn't

- Risk Assessment: Identify areas prone to water damage and potential risks

- Legal Requirements: Check local regulations mandating water line insurance

- Professional Advice: Consult insurance agents for tailored coverage recommendations

Cost-Benefit Analysis: Evaluate insurance costs against potential water damage repair expenses

Water service line insurance, often overlooked by homeowners, is a specialized coverage designed to protect against financial losses associated with water damage to the water supply lines connecting a property to the main municipal water source. While it might seem like an unnecessary expense, conducting a cost-benefit analysis can help homeowners make an informed decision about its necessity.

Understanding the Costs:

The primary cost associated with water service line insurance is the premium, which varies depending on factors such as the age of the home, the type of water service line (e.g., copper, plastic), and the location's risk of water damage. These premiums can range from a few hundred to over a thousand dollars annually. Additionally, there might be deductibles, which are the amount the policyholder pays out of pocket before the insurance coverage kicks in.

Potential Repair Expenses:

Water damage to service lines can be costly. Common issues include leaks, bursts, and corrosion, which may lead to extensive repairs or even replacement of the entire line. For instance, replacing a copper water service line can cost anywhere from $2,000 to $5,000 or more, depending on the length and the complexity of the installation. Plastic lines might be cheaper to replace, but they can still incur significant costs, especially if the damage is extensive.

Benefits of Insurance:

Insurance provides financial protection against these potential repair expenses. It covers the costs associated with fixing or replacing the water service line, ensuring that homeowners are not left with a substantial bill. Moreover, having insurance can provide peace of mind, knowing that unexpected water-related incidents won't lead to financial hardship.

Evaluating the Decision:

When considering whether water service line insurance is necessary, a cost-benefit analysis is essential. Weigh the annual insurance premium against the potential repair costs. If the risk of water damage is high in your area, and the potential repair expenses are likely to exceed the insurance premium, then the insurance could be a valuable investment. However, if the risk is low and the repair costs are relatively modest, the insurance might not be as critical.

In conclusion, while the decision to purchase water service line insurance should not be made lightly, a thorough cost-benefit analysis can guide homeowners in making an informed choice. It ensures that they are prepared for potential water-related emergencies and can help avoid financial strain in the long run.

Protect Your Moto Z3: Top Insurance Sources Revealed

You may want to see also

Coverage Gaps: Understand what your homeowner's insurance covers and what it doesn't

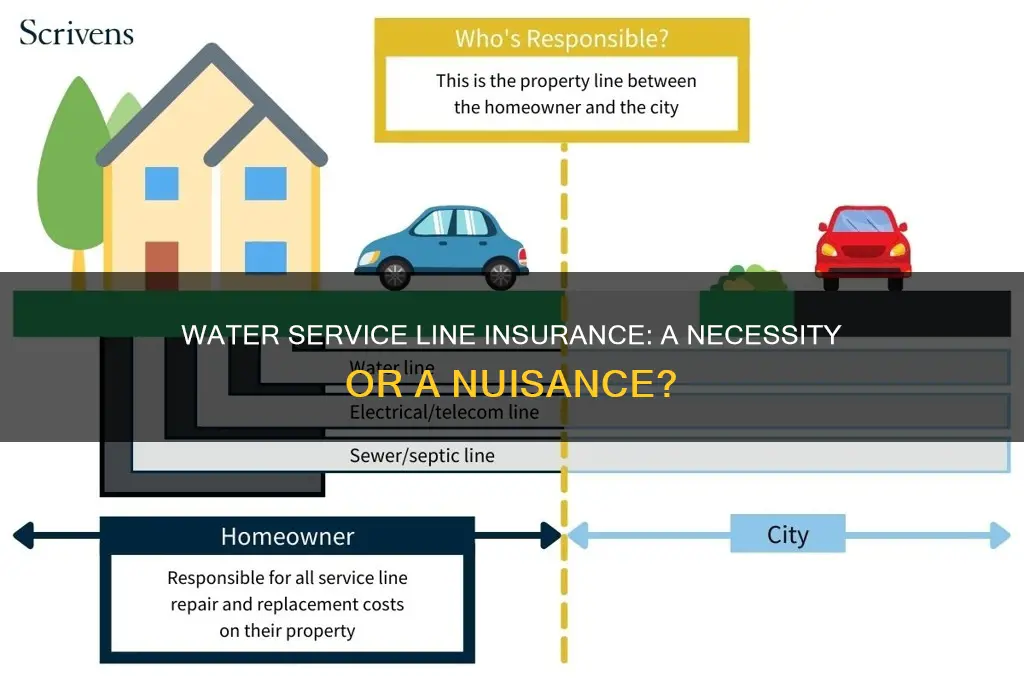

Water service lines, which connect your home to the main water supply, are essential for your daily water needs. However, they can be vulnerable to damage from various sources, including freezing temperatures, burst pipes, and natural disasters. This is where water service line insurance comes into play, offering financial protection against unexpected repairs or replacements. But before you decide whether this insurance is necessary, it's crucial to understand the coverage gaps in your standard homeowners insurance policy.

Standard homeowners insurance typically covers damage to your home's structure and personal belongings from events like fire, theft, and vandalism. However, it generally excludes damage caused by water service line issues. For instance, if a burst pipe floods your basement, your homeowners insurance might cover the damage to your home's structure and belongings, but it won't pay for the repair or replacement of the damaged water service line itself. This is a significant coverage gap that many homeowners might not be aware of.

To bridge this gap, water service line insurance provides additional coverage specifically for the water service lines that connect your home to the main supply. This insurance can cover the cost of repairing or replacing these lines due to various covered causes, such as freezing, burst pipes, or natural disasters. By having this specialized insurance, you can ensure that you're financially protected against the potentially high costs associated with water service line damage.

Understanding the limitations of your homeowners insurance is the first step in making an informed decision about water service line insurance. It's essential to review your policy documents and discuss any concerns with your insurance provider. They can help you identify potential coverage gaps and guide you on whether adding water service line insurance to your policy is beneficial. Being proactive in this regard can save you from financial hardship in the event of a water-related emergency.

In summary, while homeowners insurance provides comprehensive coverage for your home and belongings, it may not include water service line damage. Water service line insurance fills this gap, offering financial protection for the critical component that connects your home to the water supply. Assessing your specific needs and consulting with insurance professionals will help you make the right choice to safeguard your home and financial well-being.

Uninsured Americans: Pre-Obamacare Era

You may want to see also

Risk Assessment: Identify areas prone to water damage and potential risks

Water damage can be a costly and devastating issue for homeowners and businesses, often leading to extensive repairs and potential health hazards. Identifying areas prone to water damage is a critical step in risk assessment and can significantly impact the effectiveness of any mitigation strategy. Here's a detailed guide on how to approach this task:

Understanding the Risks: Begin by familiarizing yourself with the various sources of water damage. Common causes include plumbing leaks, burst pipes, heavy rainfall, flooding, and natural disasters like hurricanes or earthquakes. Each of these events presents unique challenges and potential risks. For instance, a burst water service line can lead to immediate and severe water damage, especially in colder climates where pipes may freeze and burst. Understanding these risks is fundamental to identifying vulnerable areas.

Assess the Building's Structure: Conduct a thorough inspection of the building's infrastructure. Focus on the plumbing system, as it is a primary source of water-related risks. Check for signs of wear and tear, such as corroded pipes, loose connections, or outdated fixtures. Identify areas where water lines are exposed, especially in crawl spaces, basements, or utility closets. These areas are more susceptible to damage during heavy storms or flooding. Additionally, examine the roof and gutters for potential leaks or blockages that could lead to water accumulation and subsequent damage.

Identify Vulnerable Locations: Different parts of a building may be more prone to water damage. For example, kitchens and bathrooms are naturally more susceptible due to the presence of sinks, showers, and appliances that generate moisture. Basements and lower levels are also at higher risk due to their proximity to the ground and potential exposure to water seepage. Pay attention to areas with poor ventilation, as this can exacerbate moisture-related issues. Identify any existing water damage, such as discolored walls or ceilings, which may indicate previous leaks or flooding.

Environmental Factors: Consider the surrounding environment and its potential impact on water damage. Areas prone to heavy rainfall or snowmelt may experience increased water runoff, leading to flooding risks. Coastal regions are particularly vulnerable to storm surges and high tides, which can cause extensive water damage. Additionally, the presence of nearby water bodies, such as rivers or lakes, should be noted, as they can contribute to flooding during heavy precipitation.

Risk Mitigation and Prevention: Once the vulnerable areas are identified, develop strategies to minimize the risks. This may include installing water sensors and leak detection systems, regular maintenance of plumbing and roofing, and implementing proper drainage systems. Educating occupants or employees about water conservation and the importance of reporting leaks promptly can also reduce potential damage. By proactively assessing and managing these risks, individuals and businesses can significantly reduce the likelihood and impact of water-related incidents.

The Safeguarding of Savings: Understanding the Deposit Insurance Bill

You may want to see also

Legal Requirements: Check local regulations mandating water line insurance

Water service line insurance is a specialized coverage that protects homeowners and property owners from financial losses associated with water damage caused by sudden and accidental pipe bursts or leaks. While it is not a mandatory requirement in all areas, it is essential to understand the legal obligations and regulations that may apply to your specific location. Checking local laws and ordinances is crucial to ensure compliance and avoid potential legal issues.

Many regions have recognized the importance of water line insurance and have enacted legislation to protect property owners. These laws often require insurance coverage for water service lines, especially in areas prone to freezing temperatures or where water damage can lead to significant financial losses. For instance, in some states, local governments mandate that homeowners' insurance policies include coverage for water service lines, ensuring that property owners are financially protected in the event of a covered water-related incident.

When considering the legal requirements, it is imperative to research and consult the local authorities or insurance regulators in your area. They can provide specific information regarding water line insurance mandates and any related guidelines. This step is vital as regulations can vary widely between different municipalities and counties. By staying informed about these local laws, you can ensure that you meet all the necessary legal obligations and adequately protect your property.

In some cases, the insurance requirements may be tied to building codes and standards. Local authorities might enforce regulations that mandate water line insurance as a condition for obtaining building permits or for maintaining compliance with safety standards. These codes could be particularly relevant for new construction projects or when making significant renovations to existing structures.

Understanding and adhering to these legal requirements is essential to avoid any legal consequences and to ensure that your property is adequately protected. It is always advisable to consult with legal or insurance professionals who can provide tailored advice based on your specific location and circumstances. They can guide you through the process of verifying local regulations and help you make informed decisions regarding water service line insurance.

Understanding Insurance Billing Procedures Post-Sale: A Guide for Psychotherapy Corporations

You may want to see also

Professional Advice: Consult insurance agents for tailored coverage recommendations

When it comes to protecting your home and its systems from potential water damage, considering water service line insurance is a wise decision. This type of insurance is specifically designed to cover the costs associated with water damage caused by leaks or breaks in the water supply lines that run into your home. While it might seem like a rare occurrence, water line breaks can happen due to various factors, including aging infrastructure, extreme weather events, or even accidental damage. The consequences can be costly, leading to extensive water damage, mold growth, and potential health hazards.

Consulting with insurance agents is a crucial step in ensuring you have the appropriate coverage for your specific needs. These professionals can provide valuable insights and guidance tailored to your situation. They will assess your home's water supply system, considering factors such as the age of the pipes, the type of water service line material, and the overall condition of the plumbing. By understanding these details, insurance agents can recommend the right level of coverage to protect against potential water-related disasters.

During the consultation, insurance agents will explain the different types of water service line insurance policies available. These policies typically include coverage for the repair or replacement of damaged water lines, as well as the associated costs of water removal, drying, and any necessary mold remediation. Some policies may also cover additional living expenses if you need to temporarily relocate due to extensive water damage. It's essential to choose a policy that aligns with your specific risks and financial situation.

Furthermore, insurance agents can help you understand the deductibles and coverage limits associated with these policies. They will ensure that you are aware of any exclusions or specific conditions that may apply. By providing personalized advice, they can help you make an informed decision, ensuring that you are adequately protected without paying for unnecessary coverage.

In summary, seeking professional advice from insurance agents is a proactive approach to safeguarding your home against water-related issues. Their expertise allows them to offer tailored coverage recommendations, ensuring that you are prepared for potential water service line emergencies. Don't leave your home vulnerable to water damage; instead, take the necessary steps to protect your investment by consulting with insurance professionals today.

Rich Folks' Cash: Many Banks, Insured

You may want to see also

Frequently asked questions

Water Service Line Insurance is a specialized coverage designed to protect homeowners and property owners from financial losses caused by water damage to the water service lines connecting a property to the main municipal water supply. These lines can be susceptible to leaks, bursts, and other issues, leading to costly repairs and potential water damage.

Water damage can be extremely expensive and disruptive. Without insurance, homeowners might have to pay for repairs or replacements out of pocket. This insurance provides financial protection, ensuring that any damage to the water service lines is covered, thus saving homeowners from potential financial strain.

This insurance is beneficial for all property owners, especially those in areas prone to extreme weather conditions, such as freezing temperatures, where burst pipes are more common. It is also essential for homeowners with older homes, as older pipes may be more susceptible to leaks and damage.

The policy usually covers the repair or replacement of the water service line and any associated fixtures, such as faucets and valves, in the event of a covered loss. It may also include coverage for water damage to the property caused by the leak, up to a certain limit.

While homeowners' insurance may provide some coverage for water damage, it often excludes damage to the water service lines themselves. Water Service Line Insurance acts as an additional layer of protection, ensuring that both the service line and the associated fixtures are covered, providing comprehensive protection for the homeowner.